On March 26, 2025, Hyperliquid, a decentralized trading platform, removed the JELLY token from its listings due to suspected market manipulation. This activity resulted in a significant loss of approximately $10.63 million, leading to an immediate response by its validator network to intervene as an emergency measure.

Hyperliquid Delists JELLY Amid Suspected Market Manipulation

bitcoin.com/zachxbt-exposes-hyperliquid-whales-20m-profits-from-illicit-funds-and-casino-exploits/”>Hyperliquid, a decentralized exchange (DEX) protocol operating on its proprietary layer one (L1) blockchain, removed the JELLY token from trading on Wednesday after detecting suspicious market activity. The platform’s validator set intervened to force-settle JELLY at $0.0095, significantly below its peak of $0.16004, to mitigate further financial damage.

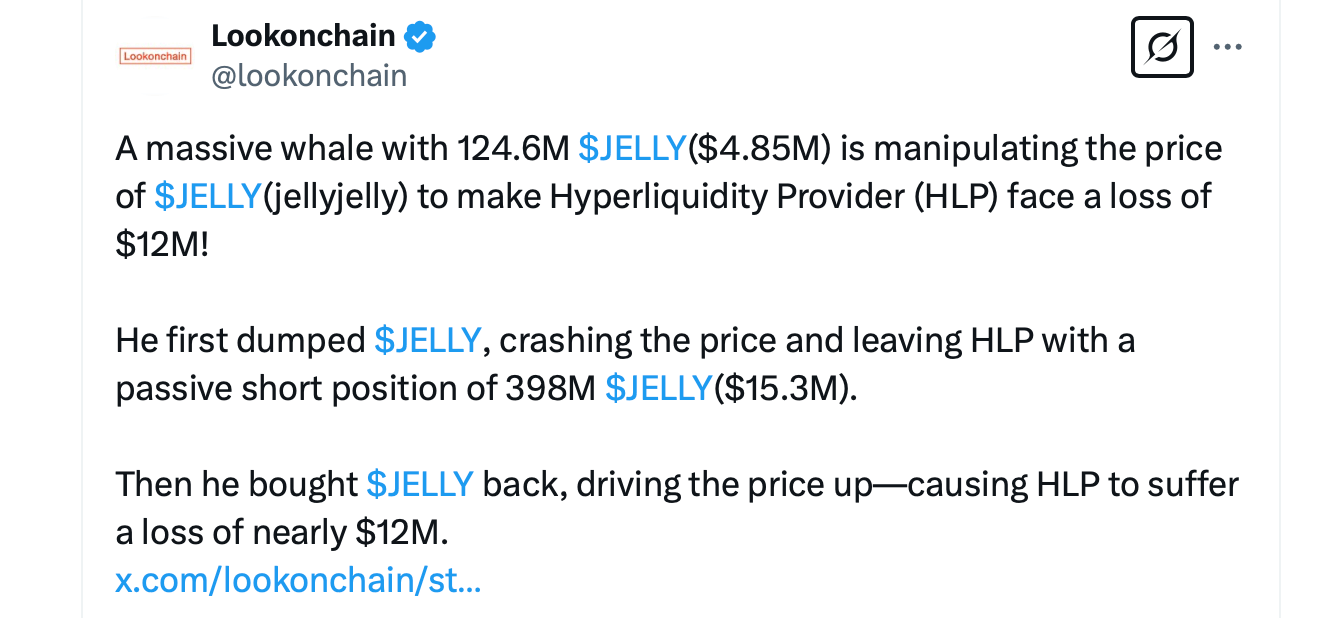

In a rapid span of under an hour, the Solana-linked JELLY token associated with a video-sharing platform skyrocketed by 230%, leading investigators to suspect organized manipulation as the cause. This price surge was set off when a trader established a massive short position for 430 million JELLY tokens and then withdrew their margin, causing over $4.5 million in liquidations. The treasury of Hyperliquid, an automated system, inadvertently took on this position, resulting in an estimated unrealized loss of approximately $10.63 million.

If JELLY’s price had climbed to $0.17, the protocol might have faced a potential liquidation of approximately $240 million, posing a threat to its liquidity reserves. In response, all 16 validators on Hyperliquid, who manage the network, voted in agreement to remove JELLY from listings and limit reimbursements for regular users. The Hyper Foundation, the charitable division of the platform, will repay qualified traders using data from the blockchain, excluding accounts suspected of manipulation.

“After evidence of suspicious market activity, the validator set convened and voted to delist JELLY perps,” Hyperliquid explained on the social media platform X. “All users apart from flagged addresses will be made whole from the Hyper Foundation. This will be done automatically in the coming days based on onchain data. There is no need to open a ticket. Methodology will be shared in detail in a later announcement.”

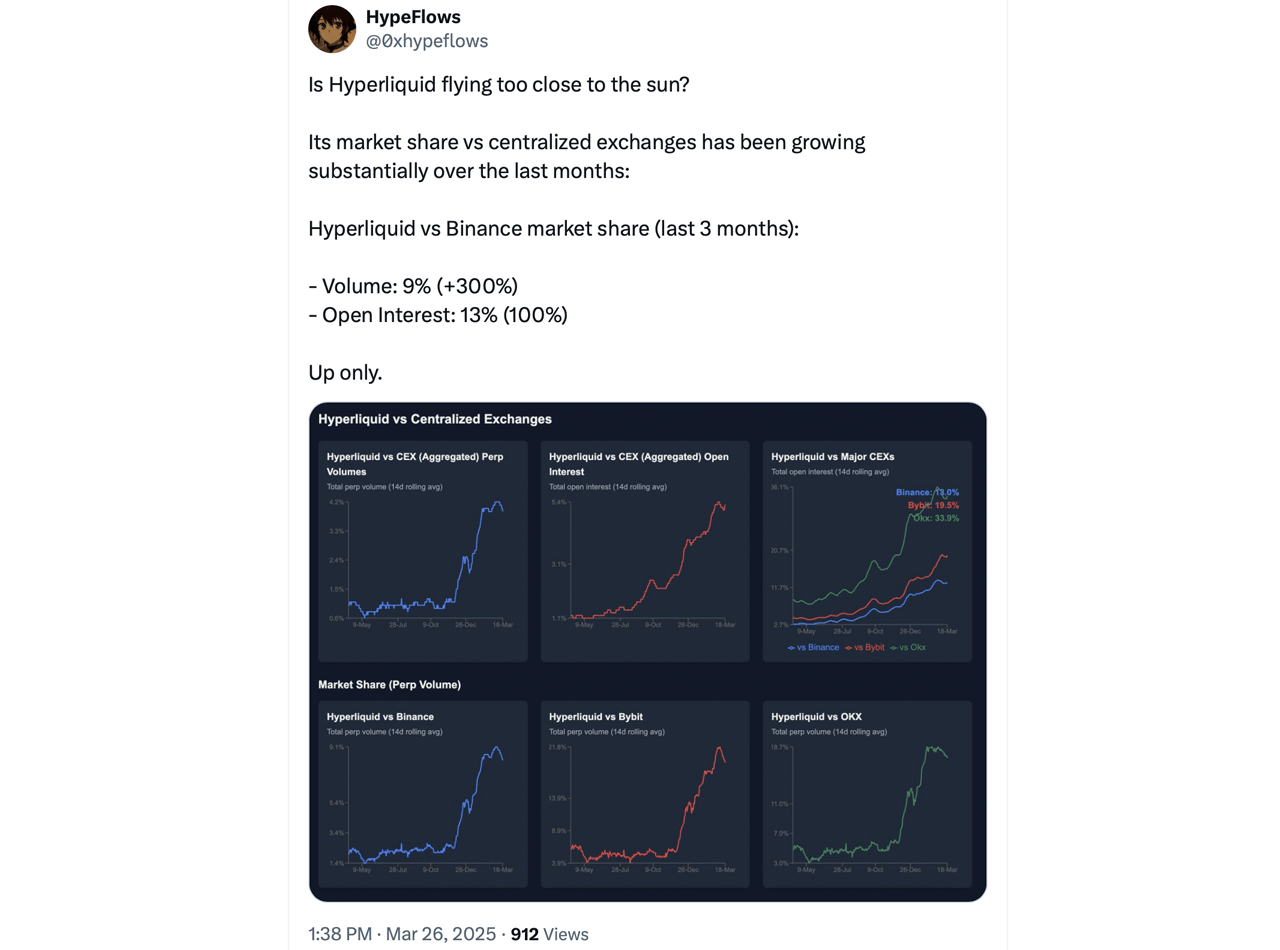

Flagged users, including the whale’s suspected account, will not receive refunds. The controversy has reignited debates about decentralization in DeFi. Critics, including Bitmex co-founder Arthur Hayes, argue Hyperliquid’s validator actions resemble centralized control, undermining its decentralized ethos. The platform’s HYPE token, already down 40% from its 2024 peak, faces renewed volatility amid the fallout.

Hyperliquid’s liquidity pool reported a $700,000 net gain post-incident, signaling short-term resilience. However, the event highlights vulnerabilities in handling volatile, low-market-cap assets and high-leverage trading. “HYPE can’t handle the JELLY,” Hayes wrote on X. “Let’s stop pretending hyperliquid is decentralised. And then stop pretending traders actually give a fu**. Bet you HYPE is back where is started in short order cause degens gonna degen.”

“Hyperliquid may be on track to become FTX 2.0,” Bitget’s CEO Gracy Chen stressed on X. “The way it handled the JELLY incident was immature, unethical, and unprofessional, triggering user losses and casting serious doubts over its integrity. Despite presenting itself as an innovative decentralized exchange with a bold vision, Hyperliquid operates more like an offshore CEX with no KYC/AML, enabling illicit flows and bad actors.”

Chen added:

Establishing the move to shut down the JELLY market and compel trades under advantageous terms might pave the way for a risky pattern. It’s trust, rather than capital, that forms the bedrock of any exchange (be it CEX or DEX), and once trust is eroded, it becomes extremely difficult to restore it.

The removal of JELLY from popular lists underscores the challenging tightrope walk that Decentralized Finance (DeFi) platforms must perform, balancing user safety with decentralization. Even though Hyperliquid acted quickly to prevent a widespread failure, this event acts as a reminder about the importance of governance and risk management in DeFi. Reimbursements should be completed in just a few days.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-03-26 22:01