In a rather dramatic turn of events, the shares of this beleaguered company were temporarily halted from trading on the New York Stock Exchange (NYSEAM) in April, after its stock price plummeted below the astonishingly low threshold of ten cents per share. Quite the fall from grace, wouldn’t you say?

Ah, the little-known Asian food company, DDC Enterprise Limited (NYSEAM: DDC), affectionately dubbed “DayDayCook,” has managed to raise a staggering $528 million to buy bitcoin ( BTC), as revealed in a Tuesday press release. This comes after a glorious four-year streak of financial losses, culminating in a temporary trading suspension in early April, when the firm’s stock took a nosedive below ten cents. Talk about a rollercoaster ride! 🎢

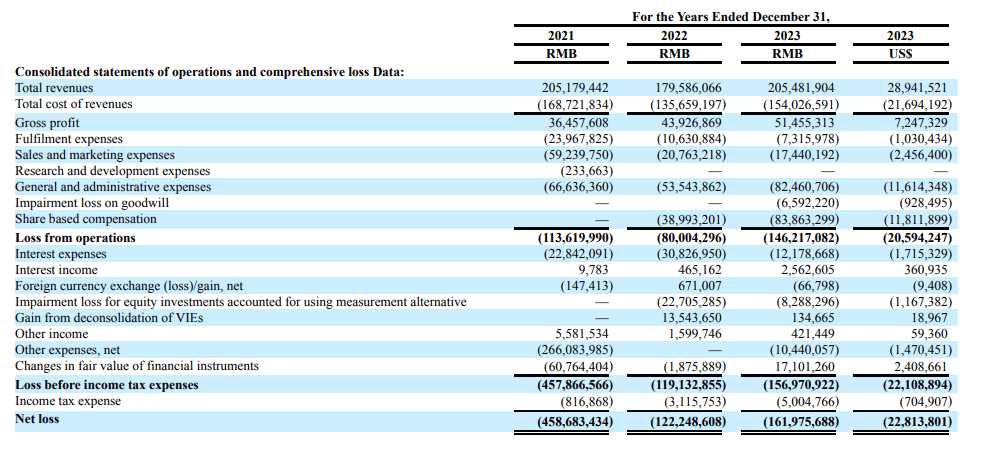

Norma Chu, the founder, chair, and CEO of DDC, claims she launched the company in 2012 out of a fervent passion for food and cooking. The Hong Kong native, now residing in Seattle, took the company public on the New York Stock Exchange American (NYSEAM) in November 2023. However, judging by the firm’s financials, it seems that the culinary dreams have been marred by a rather unfortunate reality. DDC has been bleeding money for at least four consecutive years. Who knew cooking could be so costly? 🍳

In a dramatic twist, the NYSE threatened to delist the company’s stock in 2024 for failing to file its 2023 financials on time. DDC managed to secure an extension and eventually filed the necessary documents, only to have trading of its stock halted in early April 2025 after a market selloff saw its share price decline by almost 95%. DDC’s stock nosedived below ten cents after having debuted at a lofty $212.50 in November 2023. Quite the dramatic arc, wouldn’t you agree? 🎭

But fear not, for Chu was not about to go down without a fight! She orchestrated a reverse 1:25 stock split, where 25 DDC shares were combined into one, resulting in fewer shares but a price just high enough to keep trading alive. A clever maneuver, indeed!

“Last Friday, amid a broad market selloff and trading below $0.10 per share, the NYSE-American halted trading of our shares,” Chu penned in a letter to shareholders. “The board unanimously approved the previously shareholder ratified 1:25 reverse stock split…This action is designed to elevate our share price to a more acceptable trading range.” A valiant effort, if I may say so!

Perhaps the pièce de résistance of that shareholder letter is the announcement of DDC’s new bitcoin treasury strategy. “We’ve developed a strategy to diversify corporate reserves with cryptocurrency through an innovative injection of bitcoin,” the letter reads. “We plan to complete the initial bitcoin injection in the next 30 days.” And just like that, DDC transformed into one of the many struggling public companies pivoting to bitcoin treasuries for survival. Who knew crypto could be the knight in shining armor? 🦸♂️

Chu announced DDC’s first bitcoin purchase on May 23. The company acquired 21 BTC by selling its stock via a share exchange and unveiled a roadmap for acquiring a total of 500 BTC in six months and 5,000 BTC in three years. Tuesday’s announcement is a step in that direction, with DDC revealing a $2 million equity private placement, a $26 million private investment in public equity (or “PIPE,” where shares are sold at a discount), a $200 million equity line, and a $300 million convertible secured note. Proceeds from all of this, totaling up to $528 million, will be used for bitcoin purchases. Quite the financial buffet! 🍽️

we are building the world’s most valuable bitcoin treasury,” Chu declared. A bold statement, indeed!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- Gaming’s Hilarious Roast of “Fake News” and Propaganda

- League of Legends MSI 2025: Full schedule, qualified teams & more

2025-06-18 20:27