What to know:

- The U.S. Securities and Exchange Commission’s controversial accounting standard that the crypto industry says chased banks away is about to face the arrival of new agency leadership that hates that policy, Staff Accounting Bulletin No. 121.

- The agency accounting chief behind SAB 121 just announced he’s retiring next week.

- The Federal Deposit Insurance Corp. is also about to be taken over by a chairman who advocates giving digital assets firms an easier time with banks, and he said he favors reversing policies that he think have harmed U.S. crypto efforts.

On the day of the inauguration in the United States, the potential for a toppling first policy domino might be the removal of banking barriers within industries. However, significant actions may not originate from the White House itself.

People in the cryptocurrency sector are likely to celebrate some of the potential executive orders from President-elect Donald Trump upon his inauguration, as these may address cryptocurrencies. However, it’s important to note that such orders might produce more noise than actual action. In fact, President Joe Biden had issued a similar order in 2022, directing the federal government to improve its understanding of cryptocurrencies.

As the White House outlines its plans for cryptocurrency policy, specific actions will be implemented by regulatory bodies like the Securities and Exchange Commission (SEC) and Federal Deposit Insurance Corporation (FDIC). Although these entities operate independently, their upcoming leadership is expected to reflect President Trump’s perspective, even if there are delays in confirming permanent agency heads.

At the Securities and Exchange Commission (SEC), Paul Atkins, a former commissioner, is expected to officially receive his nomination to assume leadership. However, this seasoned conservative SEC official might face delays due to the possible logjam of Senate confirmations, where priority will be given to the most pressing appointees, such as the new Secretary of the Treasury.

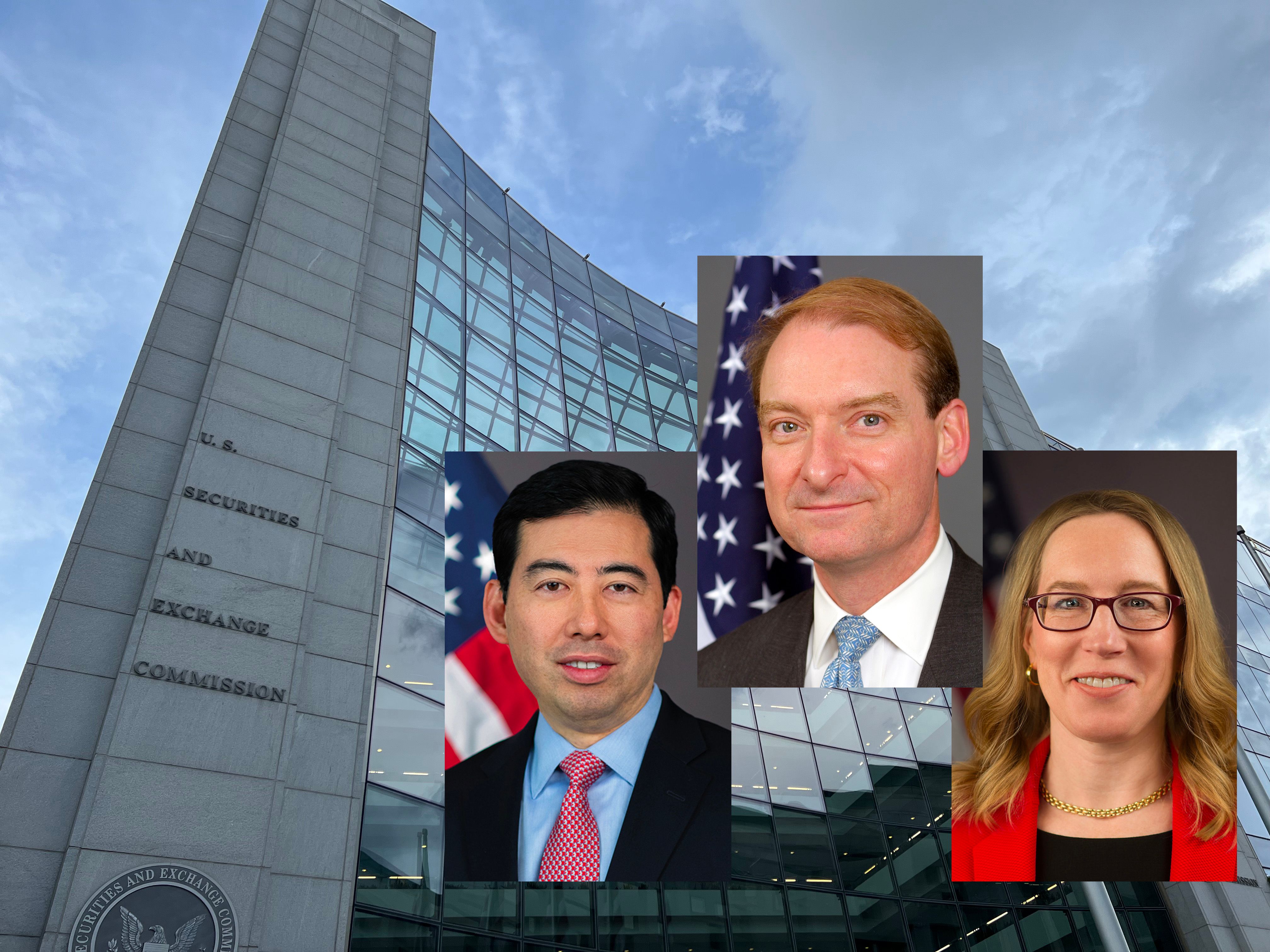

On January 21st, following the inauguration, the commission will comprise only three members: two Republicans and a Democrat. Trump has the power to designate one of the Republican members as the acting chair, similar to how Biden appointed Allison Herren Lee on his first day in office in 2021. Given that both Republican commissioners, Mark Uyeda and Hester Peirce, previously served as advisors to Atkins at the SEC, it’s likely they share similar views with him.

It is widely believed that Commissioner Uyeda might be chosen as acting chair, and if he is, there’s a strong possibility he could implement a significant change in the realm of crypto banking right away. His stance on the matter is clear – he advocates for abolishing Staff Accounting Bulletin No. 121 (SAB 121), a rule that essentially requires banks to view their customers’ cryptocurrency assets as their own, thereby affecting their balance sheets and increasing the expensive capital they need to maintain. If Commissioner Uyeda were to take office, he could order the withdrawal of this bulletin, alleviating pressure on large banks that have been cautious when dealing with crypto matters.

Within the agency, Commissioner Peirce publicly voiced her disagreement with SAB 121 by stating, “the SAB fails to recognize the Commission’s part in shaping the legal and regulatory risks that necessitate this accounting approach.” Consequently, if she were to assume control, the directive could be revoked in a similar manner.

121 SAB (Staff Accounting Bulletin) has faced criticism since its release, leading Congress to attempt its removal last year in a broad, bipartisan vote using the Congressional Review Act to overturn the SEC’s decision. However, President Biden used his veto power to preserve the accounting standard.

In September, the SEC’s Chief Accountant, Paul Munter, maintained his stance on SAB 121, emphasizing that banks should reflect their responsibility to secure cryptocurrency assets held for others on their balance sheets. However, it was announced on Tuesday that he would be retiring next week, paving the way for a new accounting chief at the revamped agency.

If the current chair temporarily abides by Atkins’ arrival, it is anticipated that the previous commissioner will take responsibility for rescinding SAB 121 himself. When it was announced last month that Atkins was Trump’s SEC nominee, Representative Mike Flood, a Nebraska Republican who spearheaded the opposition against this accounting standard in the House, expressed enthusiasm on social media platform X about collaborating with him to eliminate SAB 121.

U.S. banking supervisors might soon lift restrictions on crypto assets, allowing them to be integrated more freely within banks. Martin Gruenberg, the current FDIC Chairman, is likely to step down a day before the inauguration, with Travis Hill, the Republican Vice Chairman, taking over in an interim role at least temporarily.

According to Jaret Seiberg, a financial policy expert at TD Cowen, it’s anticipated that Hill will put forth a plan which makes it clear banks can participate in cryptocurrency transactions and defines situations where such activities require prior regulatory approval. Additionally, this proposal may also establish firm timelines for the FDIC to take action.

Last week, Hill expressed multiple opinions favorable towards cryptocurrency, asserting that the agency’s stance has hindered innovation and given the impression that the FDIC is unavailable for business when it comes to institutions exploring blockchain or distributed ledger technology. He further claimed that the FDIC had inadvisably initiated a campaign to cut off banking relationships with crypto companies and those associated with them.

Hill stated that it would have been more effective for the agencies to clearly explain to the public what actions are legally allowed, and how they should be carried out while adhering to safety and soundness standards. Furthermore, he mentioned that if regulatory approvals are necessary, they must be processed promptly, which has not been the case in recent times.

As a crypto investor, I’ve noticed that while the FDIC doesn’t impose strict rules on banks’ involvement with cryptocurrencies, they provide guidance instead, which can be more flexible. However, it’s essential to keep in mind that two other key players are involved in regulating U.S. banks: the Office of the Comptroller (OCC) of the Currency and the Federal Reserve. These entities play an integral role in shaping the landscape for banking operations within the United States.

For over three years now, the Office of the Comptroller of the Currency (OCC) has been managed by Acting Administrator Michael Hsu, who is eagerly waiting for the incoming appointee to take his place. This can happen when the President instructs his Treasury Secretary to designate a “first deputy comptroller.” According to OCC regulations, this individual would automatically assume the role of acting comptroller. Previously, Donald Trump placed Brian Brooks into this temporary position. Brooks, who has worked for crypto companies like Coinbase in the past, swiftly initiated steps to allow cryptocurrency firms easier access to the banking system, such as by proposing a unique method for chartering.

In simple terms, Michael Barr, who is currently the vice chairman for supervision at the Federal Reserve, has announced his resignation effective at the end of February. As the vice chairman in this role, Barr had previously issued warnings to banks under Fed supervision that any involvement with cryptocurrencies needed to be carefully regulated before they could proceed. His departure might present an opportunity for a future vice chair who may advocate for lenders to delve into digital assets.

As key figures from the Securities and Exchange Commission (SEC) and banking regulatory bodies prepare to depart, certain limitations imposed on cryptocurrency banking may be more susceptible to change.

In his message, Seiberg injected some practical insight from Washington, saying, “We must remember, as Mike Tyson wisely puts it, that every person seems to have a strategy until they’re hit with an unexpected challenge.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-15 16:11