Ah, dear reader, Coinbase Institutional has unveiled three illustrious trends that are poised to sculpt the crypto market in the latter half of 2025: a more favorable macroeconomic panorama, an upsurge in short-term corporate appetite, and a burgeoning clarity in regulations. Who would have thought?

These delightful dynamics, as they say, could usher in a period of remarkable growth and structural metamorphosis across the digital asset landscape. Quite the spectacle, wouldn’t you agree?

3 Trends Set to Define Crypto Markets in H2 2025

First on our list is the improving macroeconomic outlook, with recession risks seemingly taking a backseat. Coinbase, in its infinite wisdom, has highlighted this trend.

“We could see an economic slowdown or mild recession this year – if not avoid a recession altogether – rather than a severe recession or stagflation scenario,” the report stated. Ah, the optimism!

It appears that the U.S. economic growth outlook is becoming more optimistic, particularly as the Federal Reserve (Fed) is likely to wield its mighty scissors to cut interest rates by late 2025. How generous!

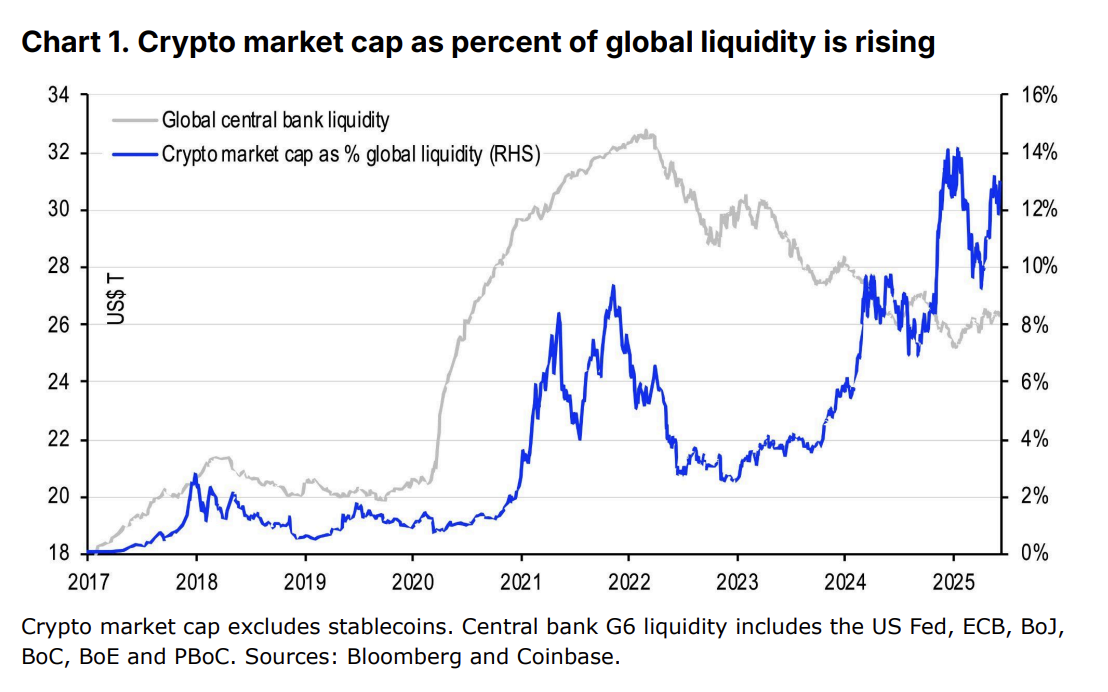

With liquidity metrics like the U.S. M2 money supply swelling and global central bank balance sheets expanding like a well-fed cat, Coinbase posits that “conditions are unlikely to cause asset prices to revert to 2024 levels.” This implies that Bitcoin’s upward trajectory will likely continue, much to the delight of its ardent followers. Controlled inflation and supportive fiscal policies? What a dream!

Next, we have the strong short-term corporate demand, as companies increasingly regard cryptocurrencies as a delightful asset allocation tool. According to Coinbase, around 228 public companies are hoarding a staggering 820,000 BTC globally, with some dabbling in ETH, SOL, and XRP. Quite the treasure trove!

Per Galaxy Digital, about 20 companies are employing leveraged funding strategies, a concept once pioneered by the illustrious Strategy (formerly MicroStrategy). Updated FASB accounting rules now allow digital assets to be recorded at fair market value, replacing the old loss-only recognition. How progressive!

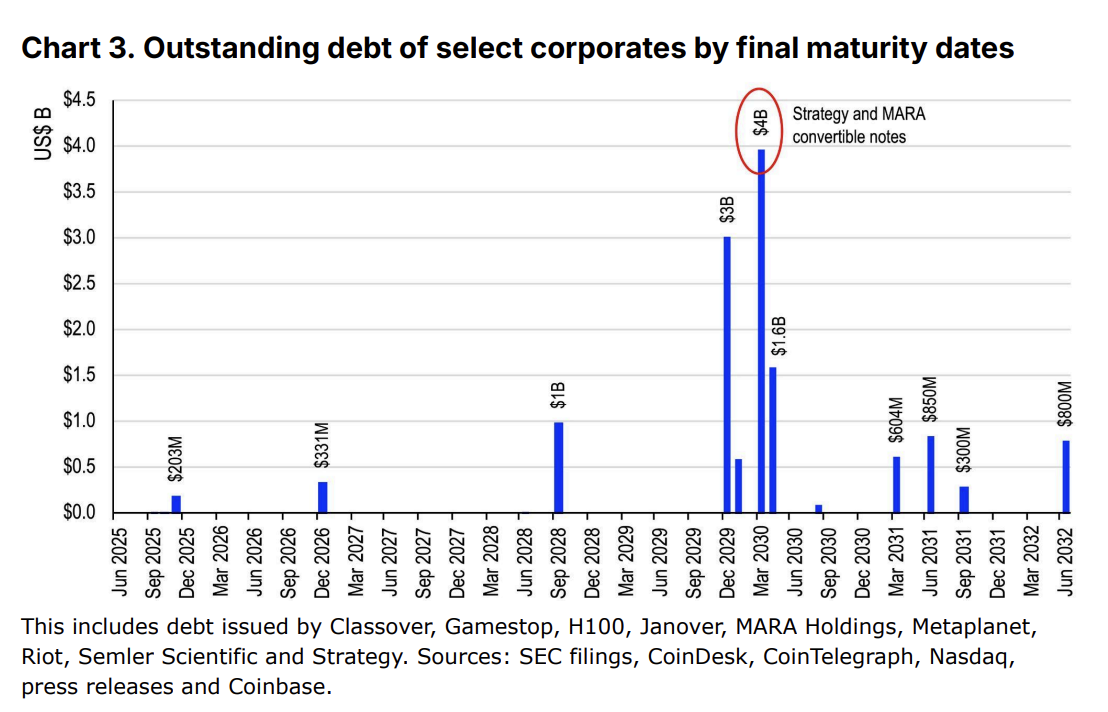

And lo! A new trend emerges: the rise of publicly-traded crypto vehicles (PTCVs), which are solely focused on crypto accumulation through equity and convertible bond issuance. However, this brings its own set of risks: forced selling pressure (thanks to bond debts) and discretionary selling (which could erode market confidence). Oh, the drama!

But fear not, for short-term risks are low, as most debts mature between 2029 and 2030. With reasonable loan-to-value ratios, large firms can refinance without liquidating assets, thus supporting continued crypto accumulation in the second half of 2025. What a relief!

Lastly, we arrive at the third trend: a clearer regulatory roadmap, with significant strides in stablecoin and market structure legislation. Unlike the previous “regulation by enforcement” approach, the White House and Congress are now advancing a comprehensive framework. How refreshing!

Moreover, stablecoin laws, via the STABLE Act and GENIUS Act, are expected to be a breakthrough, establishing reserve requirements, anti-money laundering compliance, and user protections. These bills may even be unified by August 2025. A miracle!

Crypto market structure laws, like the CLARITY Act, aim to clarify the roles of the CFTC and SEC, building on the foundations laid by FIT21. What a time to be alive!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- MrBeast removes controversial AI thumbnail tool after wave of backlash

- Mirren Star Legends Tier List [Global Release] (May 2025)

2025-06-13 15:38