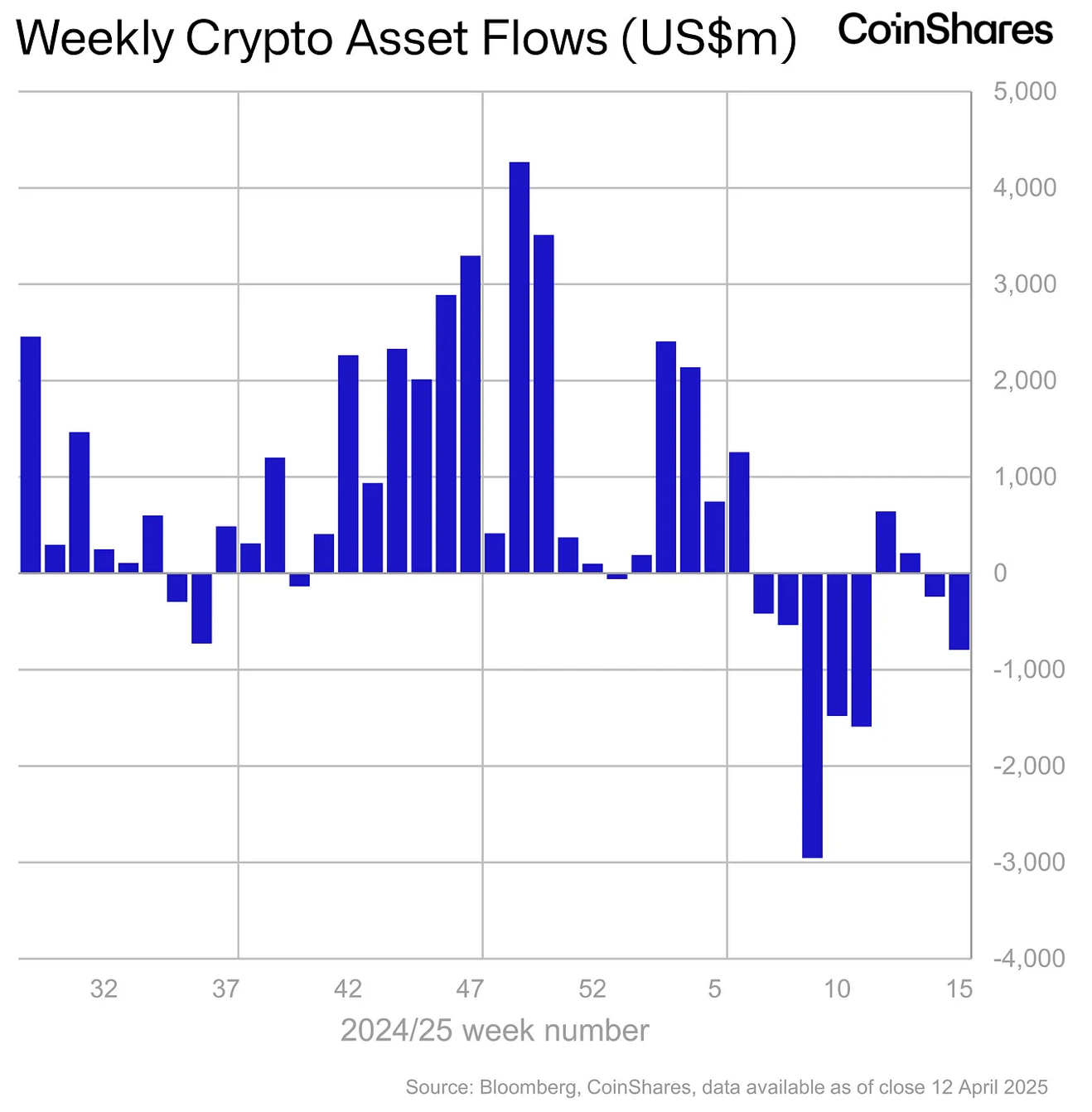

Ah, dear reader, as the eternal wheel of market fate turns inexorably, we find that since the dawn of February, the harrowing total of $7.2 billion has fled the scene. This loss is so monumental, it could put even the most fatalistic Russian novel to shame, erasing the proud year-to-date inflows that now timidly stand at a mere $165 million, like the last vestige of autumn leaves clinging to a branch before winter’s embrace.

Tariffs: The Fickle Fortune’s Bitter Joke

CoinShares’ eminent harbinger of market truths, the insightful James Butterfill, likened the ongoing exodus to a tempestuous sea stirred by President Donald Trump’s tariff decisions—a shadow cast long and dark over the crypto waters. Yet, lo and behold, a faint glimmer of hope appeared late in the week: the price surge breathed life into total assets under management, rising from a pitiful $120 billion on April 8 to a jubilant $130 billion, an 8% recovery that could almost be likened to a phoenix rising, albeit from a rather singed ash.

“President Trump’s temporary retreat from tariffs, which had threatened economic mayhem, facilitated this rebound—even if, amusingly, China was left out of this unexpected festival of relief,” buttered Butterfill with a wry smile on his face.

Bitcoin: A Tale of Dismal Outflows Amidst his Rejuvenated Ego

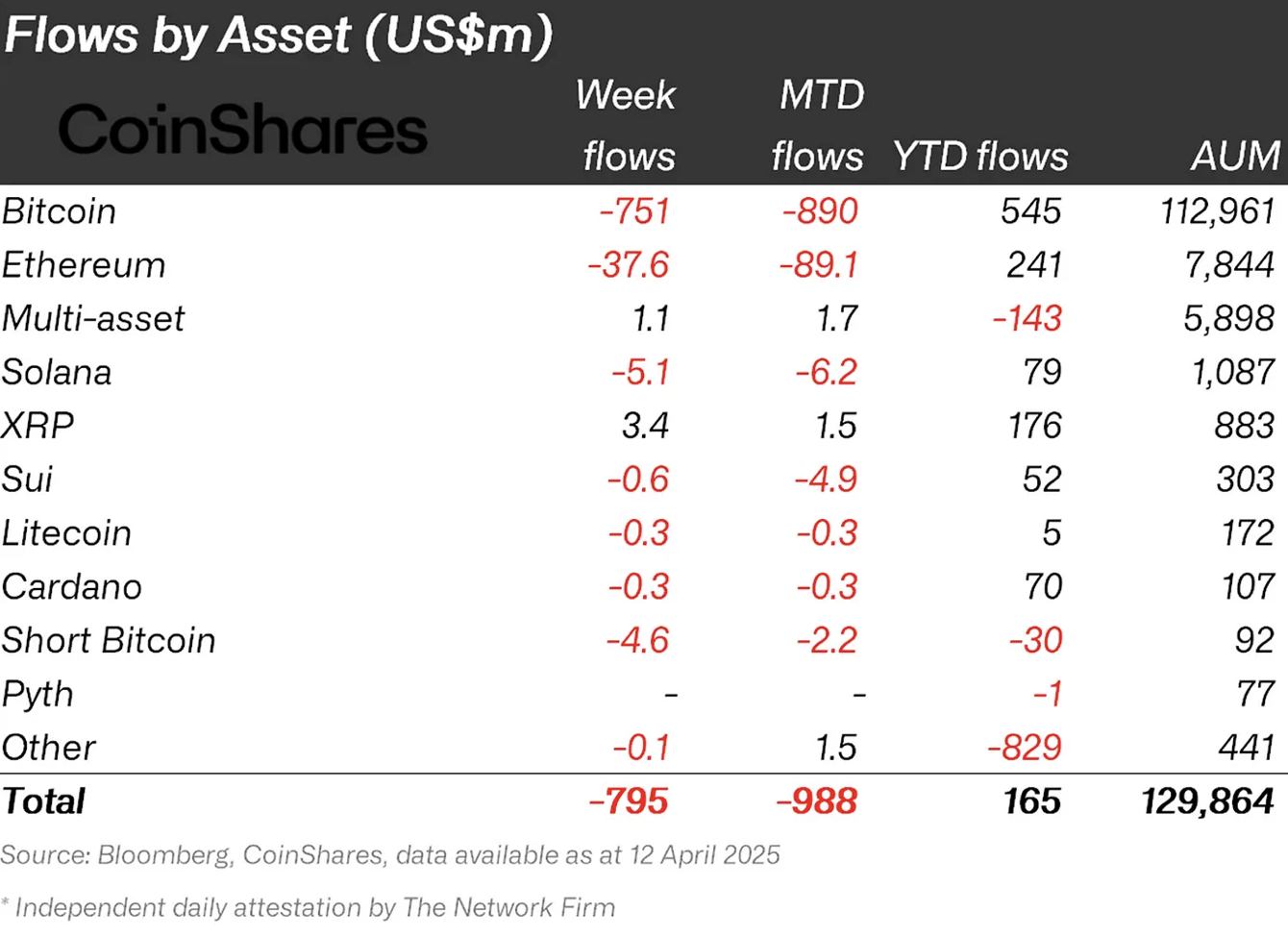

Oh woe unto Bitcoin investment products, for they suffered the harshest of fates, with a staggering $751 million in outflows, making it the martyr of this season’s financial theatrics. Still, as if clinging to life with desperate hands, year-to-date inflows for BTC reside at a respectable $545 million. Remarkably, even the short-Bitcoin products reported a subtle $4.6 million in outflows, indicating that investors perhaps fancy themselves as noble warriors rather than grim harbingers of doom.

This beloved Bitcoin dipped below the tragic threshold of $75,000 early last week, only to rise with the fury of a Russian novel’s hero, reclaiming a trading position above $84,000 by Friday. The GMCI 30 index, much like the wayward sun peeking through clouds, gained 13% as if to say, “Not today, dark times!”

XRP: The Eloquent Survivor Amidst a Sea of Crypto Woe

Ethereum products, alas, suffer similarly, with second-largest global outflows at $37.6 million. U.S. spot ETH ETFs lead this malaise, contributing $82.5 million to the funeral procession, their gains abroad like droplets of rain slipping from thirsty soil.

In this tumult, Solana, Aave, and Sui products also witnessed minor net outflows; however, XRP, that cunning trickster, and its cohorts—Ondo, Algorand, and Avalanche—managed to attract slight inflows, as if laughing in the face of adversity, embodying the sentiment of a grand celebration amidst whispers of misfortune.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- How to watch the South Park Donald Trump PSA free online

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- 50 Goal Sound ID Codes for Blue Lock Rivals

2025-04-14 16:10