This week, we examine Ethereum, Ripple, Cardano, Binance Coin, and Solana in greater detail.

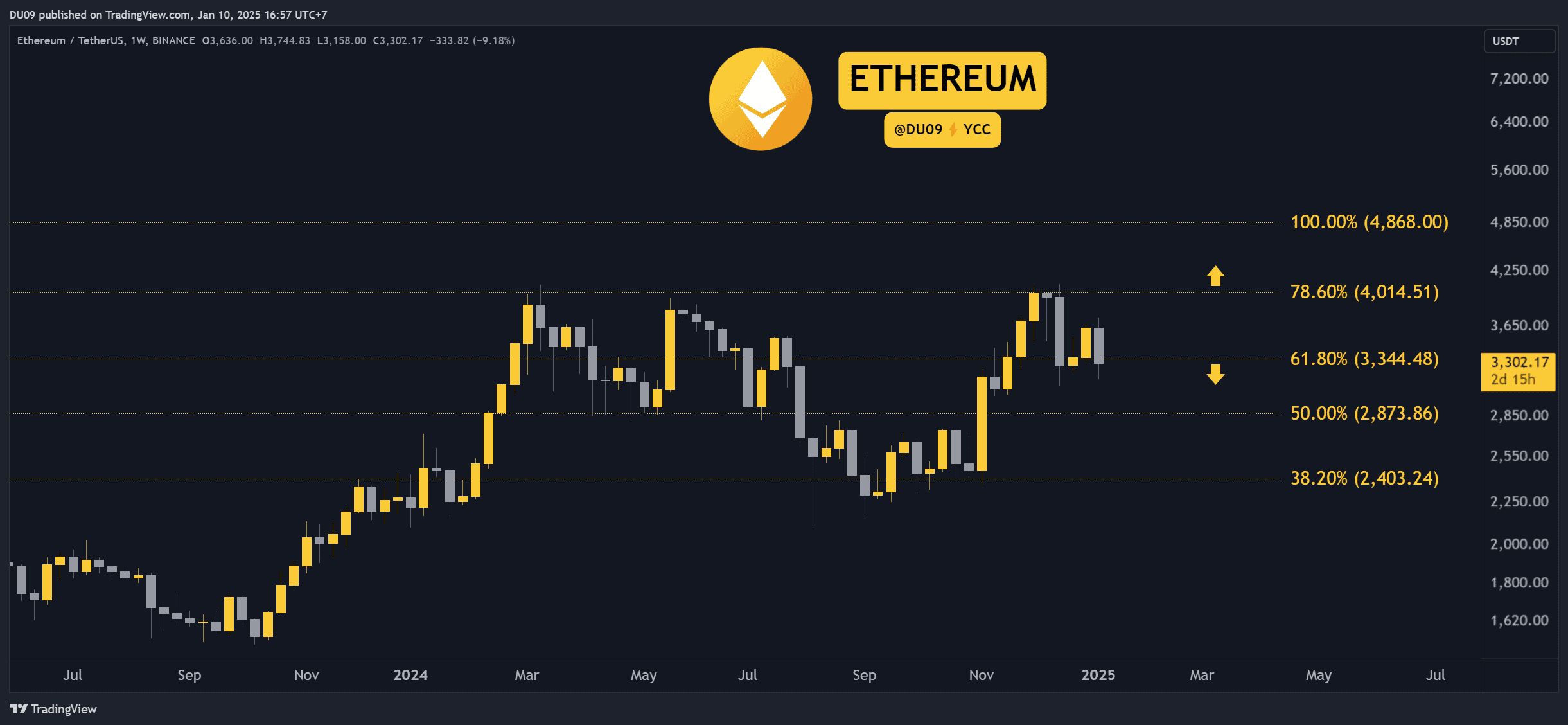

Ethereum (ETH)

This week, Ethereum attempted to surge beyond $3,600 but was halted by robust selling pressure that forced the asset down to the significant support level of $3,200. If buyers maintain their current lackluster performance, there’s a possibility that Ethereum could dip below $3,000. The price ended the week with a 4% decrease.

In simpler terms, the upward trend seems to have stopped, and we’re unsure if the buyers can regain control over the market trends in the near future. The resistance looks weak, which means sellers might continue to push prices down.

Moving forward, if ETH can’t maintain its value above $4,000 and enters a prolonged downtrend, it’s possible we won’t see it return to that price this month. But if the downtrend ends, a strong recovery might be expected in February.

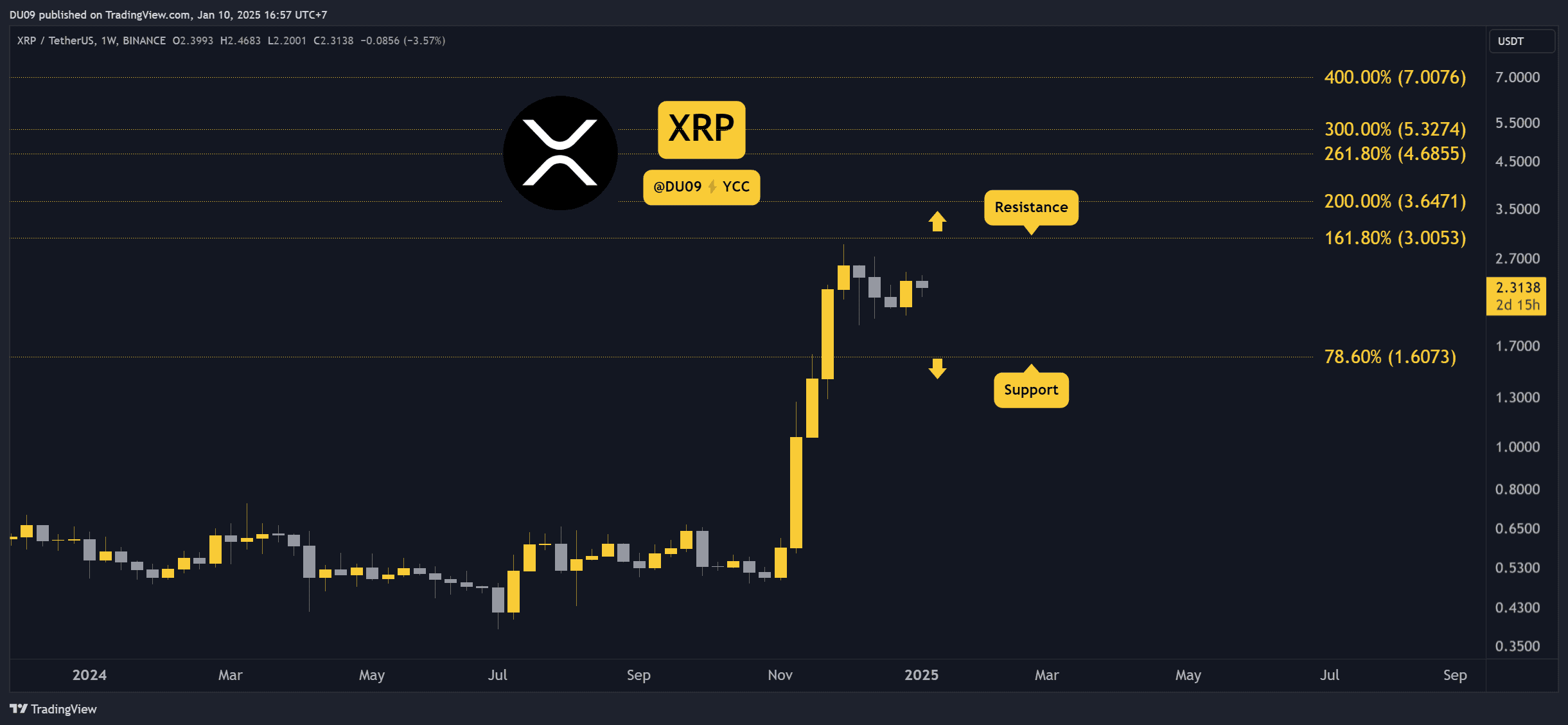

Ripple (XRP)

Ripple ended the week on a downward trend, losing approximately 4%. However, this drop aligns with the broader market trend. Interestingly, XRP exhibits a degree of strength by confining its movement within a channel, ranging from $1.6 to $3. As the price maintains its position within this range, there’s a promising possibility that it could escalate further in the near future.

As a crypto investor, I’ve noticed swift buyer interest whenever the price dipped below $2, propelling XRP up to $2.4 this week. At the moment of writing, the asset hovers around $2.3, a commendable level given that the recent peak reached $2.9.

In the near future, it’s likely that XRP will maintain its upward trend and potentially reach or even surpass its previous peak of $3.3, which was set in early 2018.

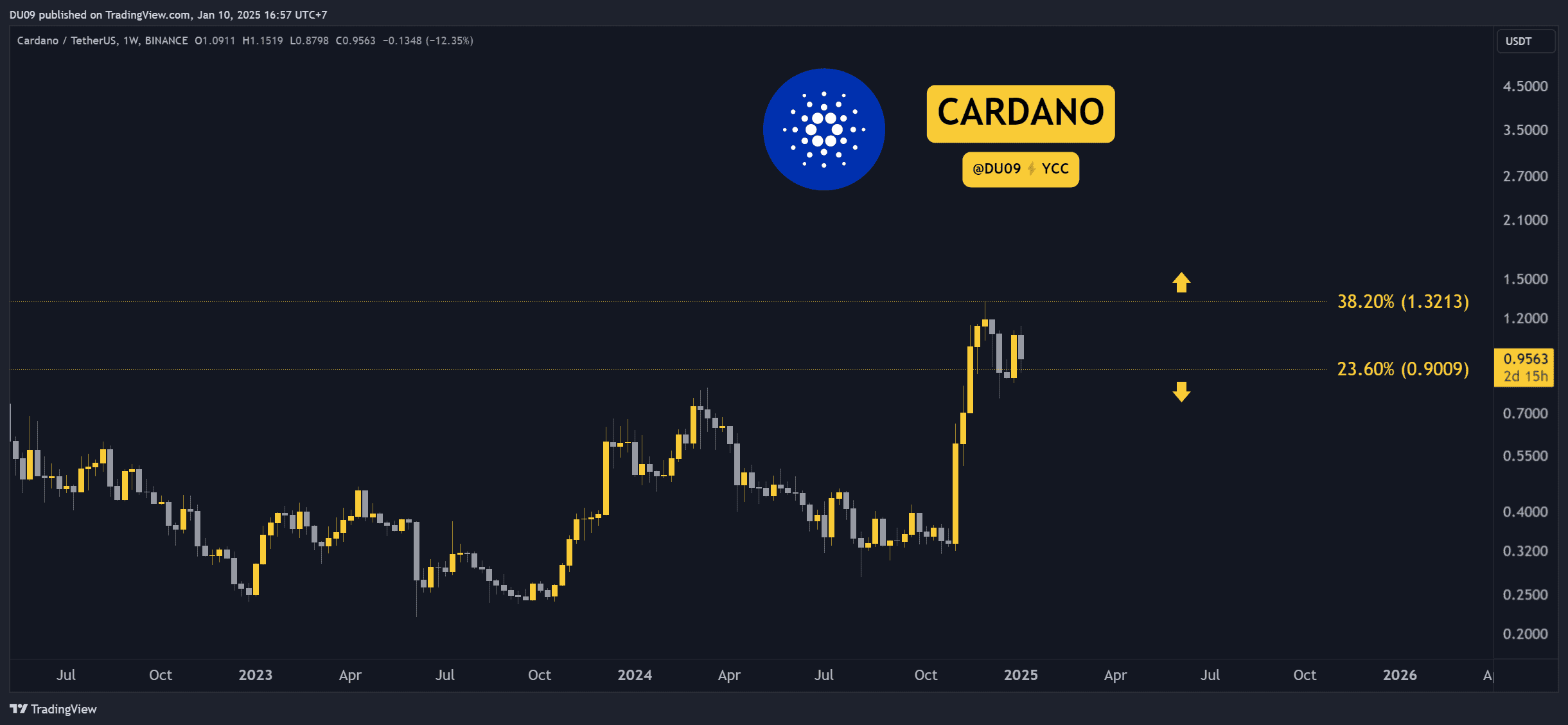

Cardano (ADA)

The behavior of ADA’s price seems to mirror that of XRP, fluctuating between approximately $0.9 and $1.3. Yet, in comparison to XRP and Ethereum, Cardano saw a 9% decrease this week, indicating that sellers were more active and buyers held back on returning.

Looking at the larger picture, Cardano (ADA) hit a new peak in December 2024. This indicates that there’s potential for further growth in 2025 as the general trend remains positive, even though there may be temporary downturns along the way.

Moving forward, for Cardano to reach new heights this year, it needs to overcome its significant resistance at approximately $1.3 and convert that level into a support zone first.

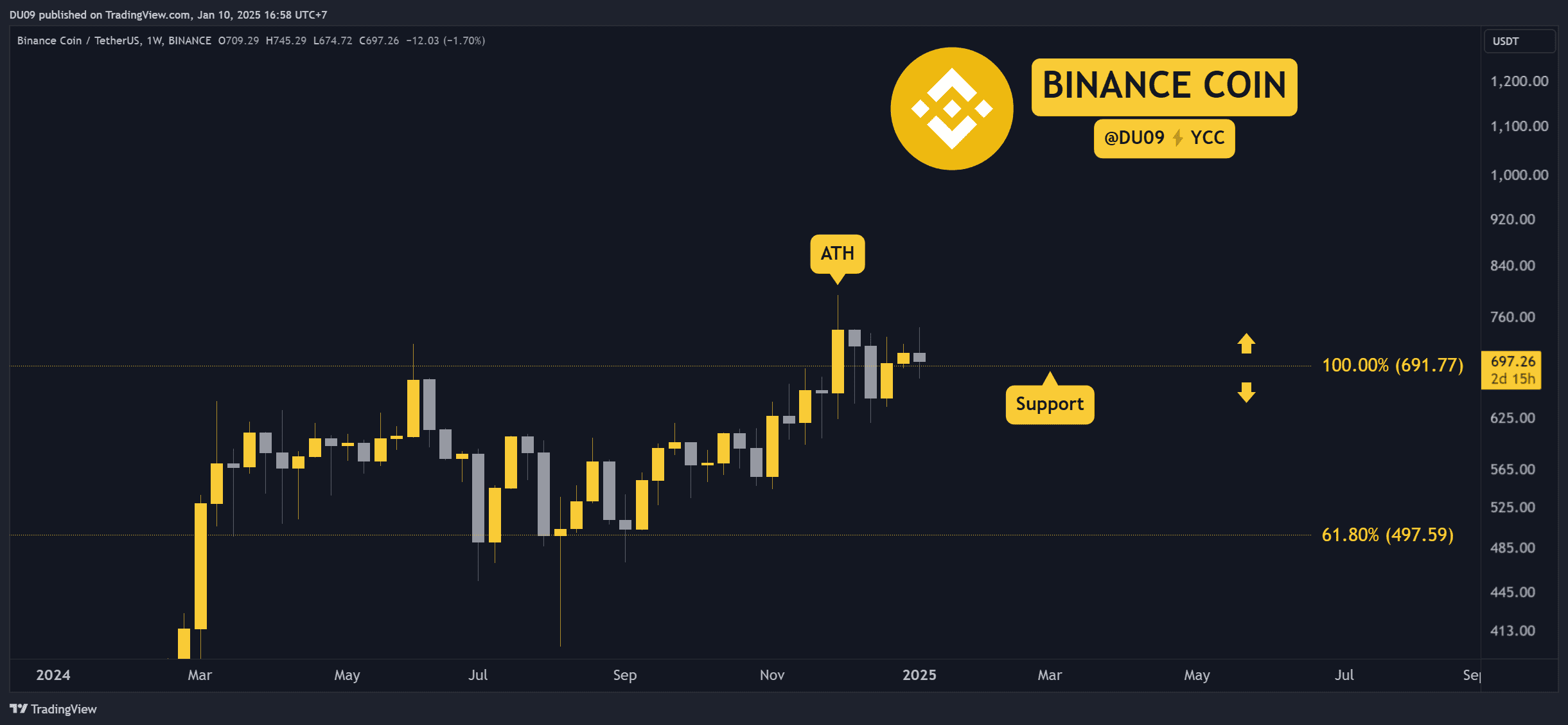

Binance Coin (BNB)

As a researcher, I’ve noticed that Binance Coin has demonstrated remarkable resilience by maintaining its position above the crucial support at $690. If buyers can successfully safeguard this level, the general sentiment remains optimistic, suggesting potential future highs. Interestingly, the current price is mirroring last week’s levels, indicating a possible consolidation or readiness for further growth.

To establish a new peak, the asset needs to surpass its current record of $794, which stands at $750 for now. However, given the uncertainty in the market’s direction, it seems challenging for this milestone to be reached in the near future.

Moving forward, Binance Coin is among the most robust altcoins in the top 10 cryptocurrencies based on market capitalization, as it has reached a new record high during this cycle. Not many altcoins have accomplished that feat, and some, like Ethereum, are yet to attain such a milestone.

Solana (SOL)

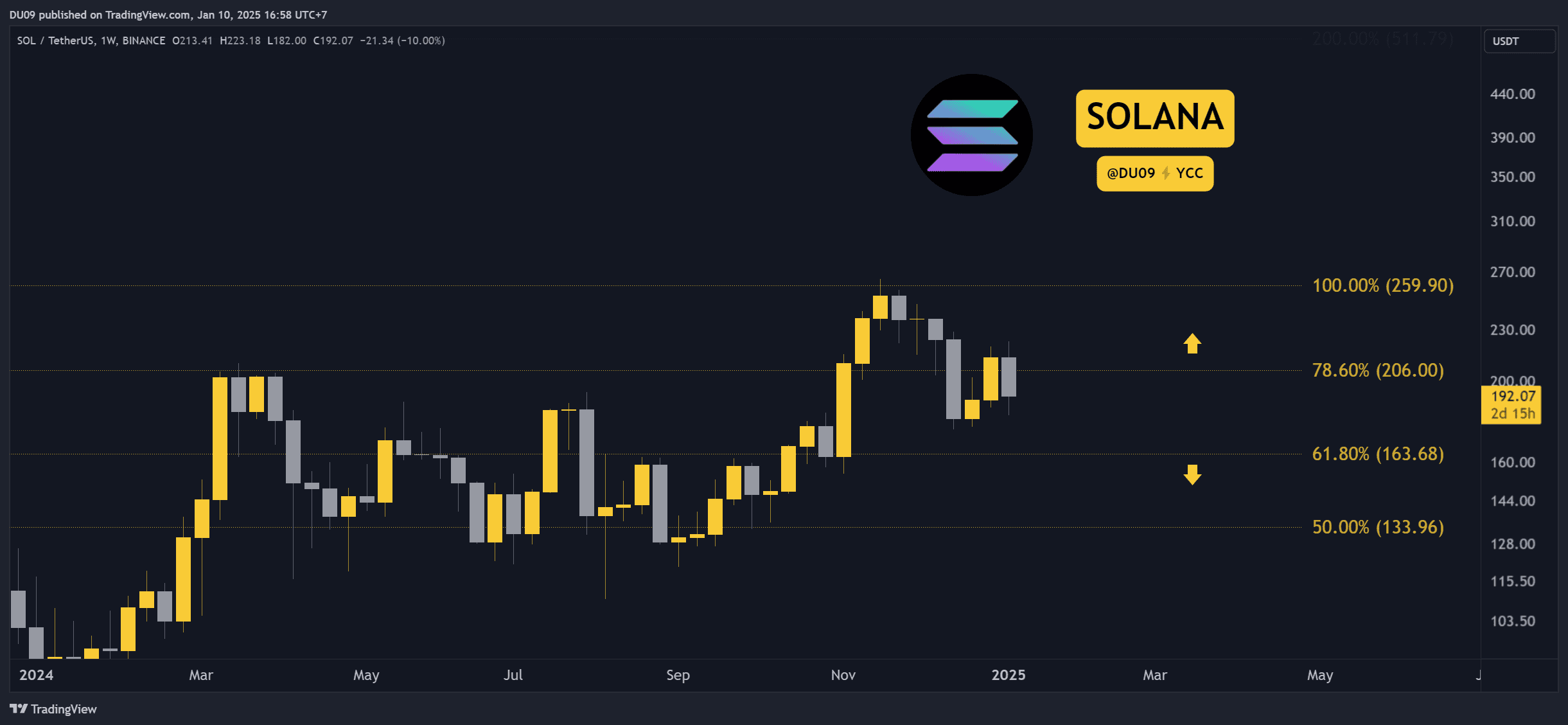

Last week wasn’t smooth sailing for Solana, as its price reached the $206 mark as a potential barrier. Consequently, the value of SOL dipped further, ending the week with a 9% decrease – a position it now shares with Cardano.

As a crypto investor, I find it intriguing to observe Solana (SOL) struggling while coins like Binance Coin (BNB) are thriving, even during these turbulent market conditions. If buyers don’t step in soon, the next significant support for SOL will be at $164. If the market continues to trend bearish in the short term, I fear that we may revisit this level with SOL.

Moving forward, I found myself grappling with challenges in January as Solana struggled to maintain its value above $200. Should this critical mark not be recaptured promptly, the overall sentiment towards this digital currency might dwindle, potentially causing it to descend further until a significant support level is reached.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- DAG PREDICTION. DAG cryptocurrency

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2025-01-10 15:14