So, hold onto your hats, folks! In 2024, while we were all trying to figure out TikTok dances, sanctioned regions collectively received a jaw-dropping $15.8 billion in cryptocurrency. Yep, that’s right, 39% of all those shady crypto transactions happened right under our noses. It’s like the adult version of a high-stakes poker game, but instead of cards, they’re playing with digital currency and sanctions!

The Office of Foreign Assets Control (OFAC) came in with a mere 13 crypto-related designations. Less than 2023, but still a solid second-best for the past seven years! Look at us keeping track of these numbers like we’re prepping for “Dancing with the Stars.”

Iran’s Crypto Adventure!

Flashback to 1979 when the US decided sanctions were the way to go after the hostage crisis. It’s like Iran’s been trying to break up with their financial system ever since, but guess what? They can’t completely quit it. Their currency is more unstable than a soap opera marriage, and with limited bank access, folks are diving headfirst into crypto like it’s a kiddie pool in summer.

In 2024, Iranian services got a significant boost in sanctions-related crypto action, driven by a sprinkle of distrust in the government (thanks, political turmoil!). Turns out, many financial movements don’t revolve around criminal masterminds but rather a bunch of citizens just trying to keep their assets safe from an uninvited government intervention. Hello, red flags! 🚩

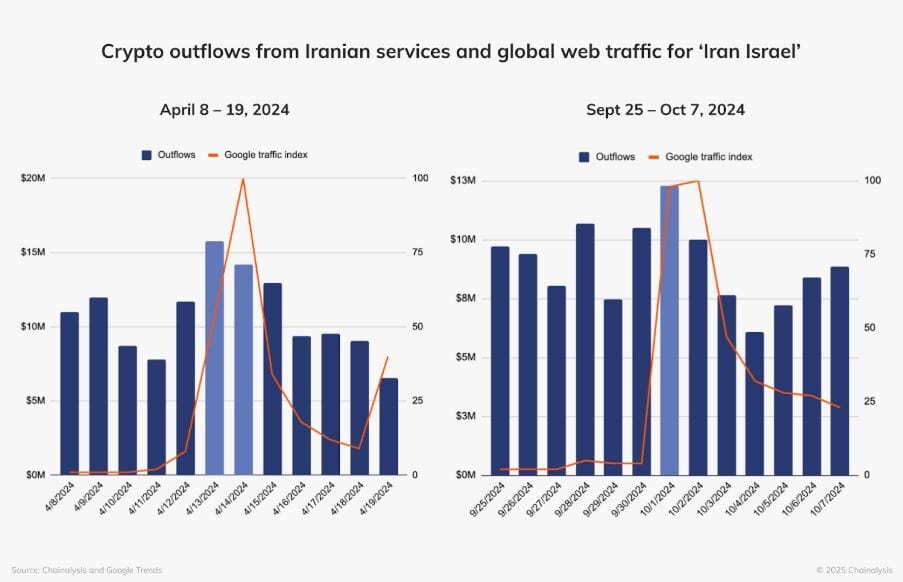

And in a twist worthy of a season finale, during geopolitical crises, cryptocurrency outflows from Iranian exchanges shot up like my caffeine when I see a donut. Google Trends went wild with searches for “Iran Israel” on days when conflict was at its peak, mirroring the roller coaster that is the Iranian Rial. Who needs soap operas when you have this level of drama?

Get this: while all asset types saw outflows, the big star was Bitcoin, which skyrocketed in correlation with rumors of missile strikes. It’s like watching a suspense movie, but with cryptocurrencies instead of cliffhangers!

Guess Who’s Back? No-KYC Exchanges!

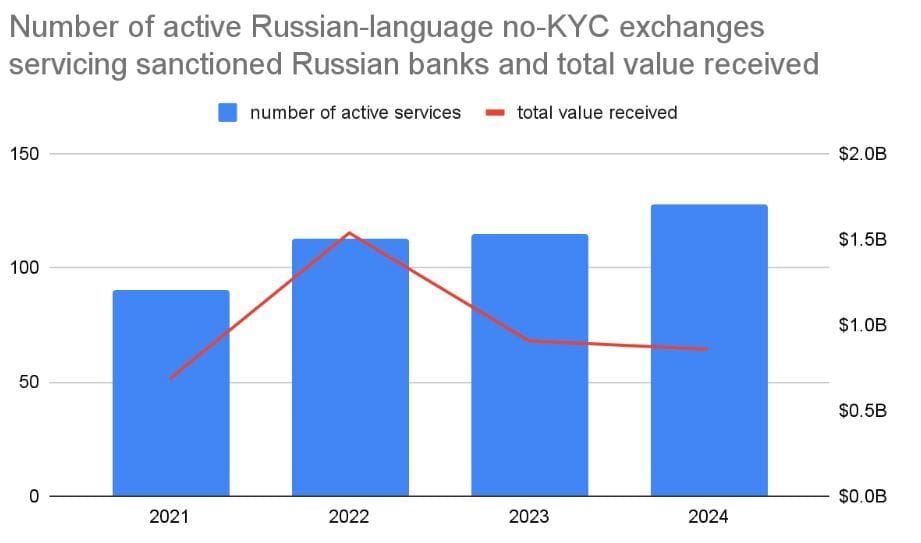

As crypto chaos expanded in Iran, Russia decided to join the party, with no-KYC exchanges popping up like mushrooms after a rainstorm, despite attempts to enforce some rules. Thanks, sanctions! 🍄

Chainalysis reports show that these sketchy exchanges are not just a passing fad; they’re here to stay, and smaller startups are stepping up to keep the party going—even as inflows are taking a nosedive thanks to some tough love from the US and international sanctions.

Many platforms cater to Russian-speaking comrades and deal with sanctioned Russian banks, but good luck figuring out where they’re hiding out! It’s like trying to find Waldo in a “Where’s Waldo?” book—with no map and while blindfolded!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- Gaming’s Hilarious Roast of “Fake News” and Propaganda

- League of Legends MSI 2025: Full schedule, qualified teams & more

2025-02-19 16:09