Crypto Inflows Soar to $644 Million: A Miracle Cure for the Market’s Bleak Outlook? 🤔

Good heavens, it seems the crypto market has finally awoken from its slumber, and what a glorious sight it is!

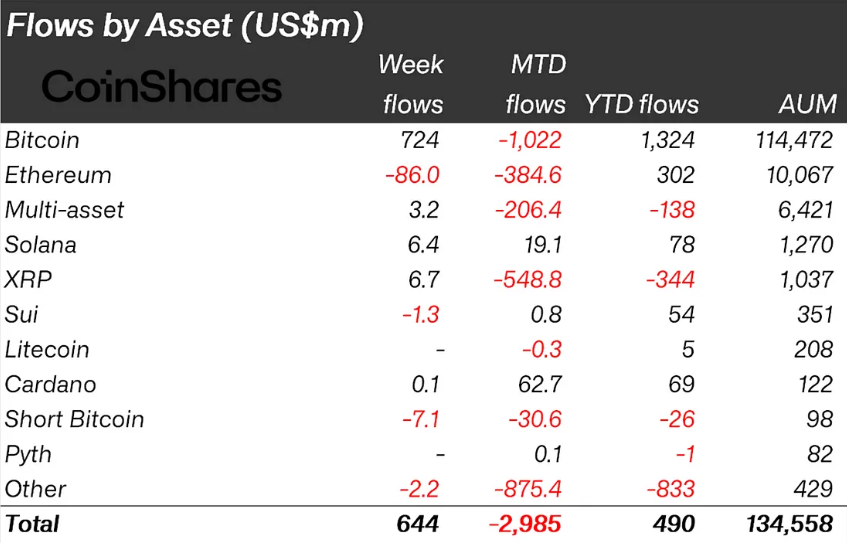

After five consecutive weeks of outflows, the latest data suggests a decisive shift in market confidence, with crypto inflows reaching a staggering $644 million last week. It’s a veritable flood of funds, if I do say so myself!

Crypto Inflows Reach $644 Million, Market Sentiment Recovers

“But what about the altcoins?” Ah, my curious friend, they’re a mixed bag, as one would expect. Ethereum, for instance, faced the heaviest outflows, with a paltry $86 million exiting the asset. On the other hand, Solana recorded a respectable $6.4 million in inflows. It’s a tale of two markets, if you will.

But what’s the takeaway from all this? Simply put, investors are being selective about where they allocate their capital. They’re focusing on projects with perceived strong fundamentals, and Solana, it seems, is one of them. Ah, the eternal conundrum: to invest or not to invest in Ethereum? 🤔

And where, pray tell, are these inflows coming from? Ah, it seems most of last week’s influx originated from the US, with a whopping $632 million entering digital asset investment products. It’s a veritable invasion of the market, if you will.

March Reverses February’s Negative Trend

Now, before I get ahead of myself, let’s take a step back and look at the bigger picture. February was a bit of a rough patch for the market, what with outflows surging and all. But it seems March has brought a welcome change in sentiment, possibly driven by renewed institutional interest and a more stable macroeconomic outlook.

And what about Bitcoin ETFs, you ask? Ah, they’re doing smashingly, thank you for asking! After five consecutive weeks of outflows, they recorded a respectable $744 million in inflows last week. It’s a sign, if you will, that investors are regaining confidence in crypto-based financial products.

“I bet BTC hits $110,000 before it retests $76,500. Why? The Fed is going from QT to QE for treasuries. And tariffs don’t matter cause transitory inflation,” wrote BitMex founder Arthur Hayes.

Now, I know what you’re thinking: “What’s the big deal about Bitcoin hitting $110,000?” Ah, but that’s the thing – it’s not just about the price; it’s about the sentiment. And sentiment, my friends, is a tricky beast to tame.

“Bitcoin rose above $87,000 on Monday, its highest since March 7, after dipping to $76,000 earlier this month. The rally comes as reports suggest upcoming Trump tariffs, set for April 2, will be more targeted and less disruptive than feared,” finance expert Walter Bloomberg observed.

And what about these Trump tariffs, you ask? Ah, it seems they’re not as dire as initially thought. In fact, they might even be a boon for the market. Who knew tariffs could be a good thing? 🤷♂️

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- You Won’t Believe Denzel Washington Starred in a Forgotten ‘Die Hard’ Sequel

2025-03-24 17:44