Today, I delve into the 2025 crypto outlook, as presented by Leo Mindyuk from MLTech. I emphasize essential elements likely to propel the widespread acceptance of these digital assets.

Then, Miguel Kudry from L1 Advisors shares his insights on the topic in Ask and Expert.

–Sarah Morton

You’re currently reading our weekly digest on Cryptocurrency for Financial Advisors, published by CoinDesk. Sign up here and receive it in your inbox every Thursday!

2025 Outlook for Crypto Adoption: Building Bridges to the Mainstream

2025 finds the crypto market brimming with renewed determination. Over the last year, it has experienced significant advancements, hinting at the growing fusion of cryptocurrencies with conventional finance ( TradFi) and a broader embrace of digital assets, notably bitcoin. Yet, the path forward may prove challenging for this burgeoning landscape. As we peer into the 2025 horizon, several elements become apparent as crucial in determining the adoption pattern: clarity from regulators, involvement by institutions, and groundbreaking technological advancements.

1. Regulatory Clarity: Turning Uncertainty Into Institutional Guidelines

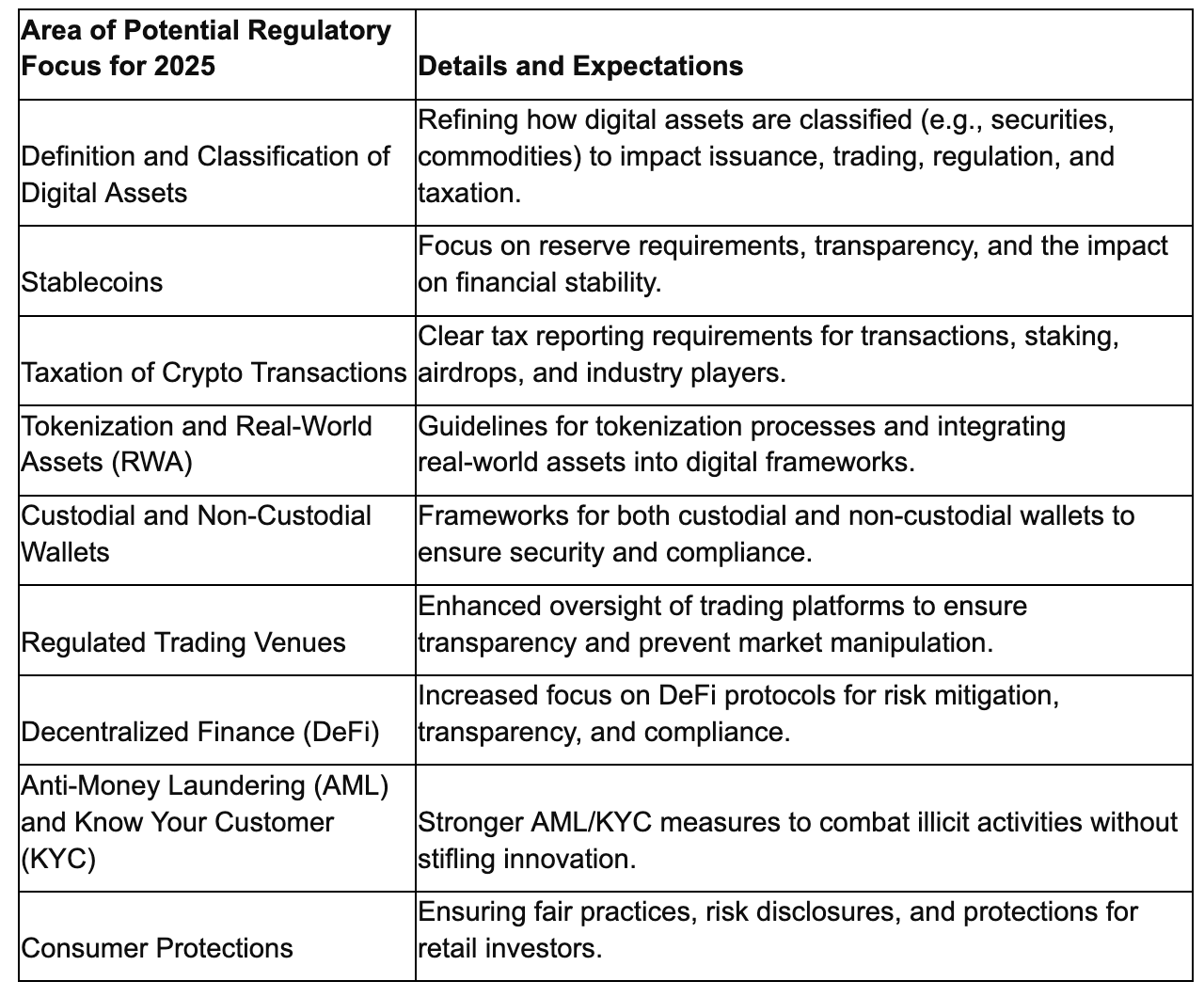

In my recent podcast on CoinDesk, I touched upon the election night results and their impact on crypto markets. It appears that regulatory certainty is becoming a crucial element in the widespread adoption of cryptocurrencies. The market seems to be anticipating that newly elected officials will finally provide the long-sought structure for the digital asset landscape. This year, we should begin seeing some of these expectations materialize. Areas where we might expect more clarity include:

Revising the categorization of digital resources in the United States: The U.S. is planning to provide more precise definitions for what constitutes a digital asset – be it a security, commodity, or a mix of both. This clarification will have immediate effects on how tokens are created, bought and sold, monitored, and taxed.

Stablecoins: Given their significant practical applications in the real world and possible influence on financial system stability, they are expected to draw considerable attention from regulatory bodies.

Changes in Taxation of Cryptocurrency Transactions: Lately, there have been significant adjustments, and it’s expected that the reporting of taxes on digital assets, related activities, and key players within the industry will become more transparent.

Discussions and possible actions on supplementary subjects like tokenization involving real-world assets, different types of digital wallets, regulated stock exchanges, decentralized finance (DeFi), adherence to anti-money laundering regulations (AML) and know your customer protocols (KYC), as well as consumer safeguards, will be an ongoing focus.

2. Institutional Participation: ETFs as a Catalyst

2024 witnessed a phenomenal surge in the growth of Cryptocurrency Exchange-Traded Funds (ETFs), as they garnered billions in net investments and saw many high-profile launches. With the introduction of new financial instruments, Crypto ETFs have emerged as a rapidly expanding market sector that has piqued investor curiosity and outshone conventional funds. It is anticipated that we’ll observe an array of related investment products in the near future.

By 2025, the consistent rise in investments and substantial trading activity in Bitcoin and Ethereum ETFs is expected to solidify cryptocurrency as a recognized investment category. This will make it easier for both individual and institutional investors to invest in this sector. This paves the way for more single-asset ETFs, multi-asset ETFs, along with various other types of ETFs such as leveraged, inverse, market-timing, and volatility ETFs. If regulatory approvals come quickly, we might witness the debut of U.S.-based crypto ETFs that generate yield (for example, staking). These innovative products could attract more investors to this asset class and boost investment in passive and actively managed funds.

3. Technological Innovation: The Convergence of Blockchain Scalability and AI

In the year 2025, progress in technology will predominantly revolve around the improvement of Layer-2 blockchain systems for scalability and integration with Artificial Intelligence (AI). Rollups, zero-knowledge proofs, and seamless interoperability will significantly boost transaction speed and user satisfaction for applications based on decentralized networks (dApps) and DeFi. Meanwhile, AI agents working within these decentralized platforms will address a wide range of tasks, optimize them, and communicate with users as well as other agents. This collaboration simplifies interactions in the Web3 environment while ensuring secure, transparent execution of AI-based decisions on blockchain. The combination of these advancements will reduce barriers for newcomers, draw developers and users alike, and speed up mainstream acceptance, making 2025 a critical year for the fusion of blockchain and AI technologies.

Summary

2025 looks promising for cryptocurrency adoption, but it won’t come without hurdles. Key factors supporting growth will be regulatory certainty, involvement from institutions, and technological advancements. It’s not a question of if crypto will become mainstream, but rather at what pace and in what form. As we move forward into this next stage, those who can adapt to the changing environment will play a significant role in determining its future direction.

– Leo Mindyuk, CEO, ML Tech

Ask an Expert

Could you tell me about the significant advancements in the cryptocurrency market during the last year, and explain how these changes have influenced the widespread use of cryptocurrencies?

The most notable advancement in the crypto sphere over the past year was a political transformation, as President-elect Donald Trump emphasized crypto in his agenda. Currently, markets are just starting to consider the effects of the Executive and Legislative bodies, plus financial regulators, who have chosen not to oppose the crypto industry but instead support its growth within the U.S. While bitcoin adoption and the possibility of a national strategic bitcoin reserve are on the horizon, many market players are still uncertain about the broader consequences for financial markets. Some major global financial entities that were initially hesitant are now actively devising their crypto strategies due to the pro-crypto administration.

What might be the potential influence of changing regulations on the crypto market and institutional participation by the year 2025?

The SEC’s strategy of regulating through enforcement has significantly influenced the cryptocurrency market. Changing this approach to a neutral or even supportive stance could prompt financial experts and institutions to proactively investigate ways to cater to their clients who are already involved with cryptocurrencies, given its significant role in recent elections. Furthermore, they will need to modify their services to stay competitive in an environment where traditional financial markets are increasingly being powered by cryptocurrency infrastructure. Financial advisors, in particular, now have more chances to assist their clients by integrating cryptocurrency allocations and existing portfolios into comprehensive financial planning and strategy.

In light of the economic conditions expected in 2025, what advice would be appropriate for financial experts regarding the inclusion of cryptocurrencies within comprehensive investment plans?

2025 is set to be a turning point for cryptocurrencies, evolving from just an investment category into the foundational structure supporting an expanding segment of various investment types. In simpler terms, as more people embrace crypto networks, financial experts will have improved tools to adapt to economic trends, which in turn could speed up the momentum of tokenized assets, strategic investments, and overall acceptance.

– Miguel Kudry, CEO, L1 Advisors

This article’s opinions belong to the writer and may not align with those held by CoinDesk, Inc., its proprietors, or associated entities.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- DAG PREDICTION. DAG cryptocurrency

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2025-01-09 19:20