If money flowed any faster into Bitcoin and Ether ETFs, someone might start sandbagging the stock exchange. 📈 Meanwhile, Blackrock and a gaggle of other financial wizards have whipped up an $86 million Bitcoin inflow—just another perfectly ordinary, gravity-defying day in crypto.

Bitcoin, Ether, and the Art of the Reluctant Inflow (With Extra Drama!)

Thursday, June 12: The crypto ETF markets, still damp from yesterday’s optimism, were hit by another storm—of cash. Investors continued to hurl money at bitcoin and ether ETFs with all the reckless glee of a Discworld resident who’s just discovered the concept of “compound interest.” Even the mixed trading activity couldn’t dampen the appetite (nor could the indigestion from all those acronyms).

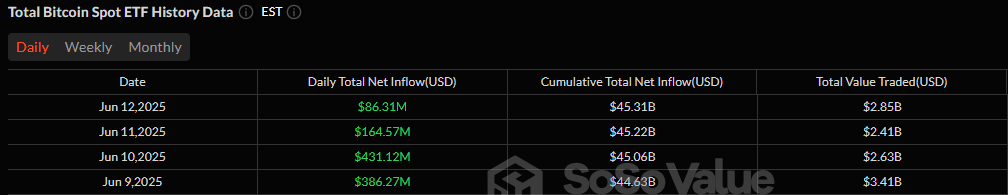

While Bitcoin ETFs managed their fourth consecutive day of inflows, hauling in $86.31 million, the plot was anything but straightforward (think soap opera, but with fewer steamy love triangles and more spreadsheets). Blackrock’s IBIT swaggered in with a $288.33 million inflow, probably tipping its hat as Grayscale’s GBTC snuck in behind with $5.89 million and the faint hope someone might notice.

Of course, there’s always a counterspell. Fidelity’s FBTC pulled off a $197.19 million vanishing act (some say it left a note: “Gone fishing—be back when FOMO returns”), and Ark 21Shares’ ARKB slipped out the back with another $10.73 million. Net result: the day was more bipolar than a wizard’s hat collection. Traded value for bitcoin ETFs jumped to $2.85 billion—not bad for magic beans and moon dust—with net assets sitting on a frankly smug $130.26 billion.

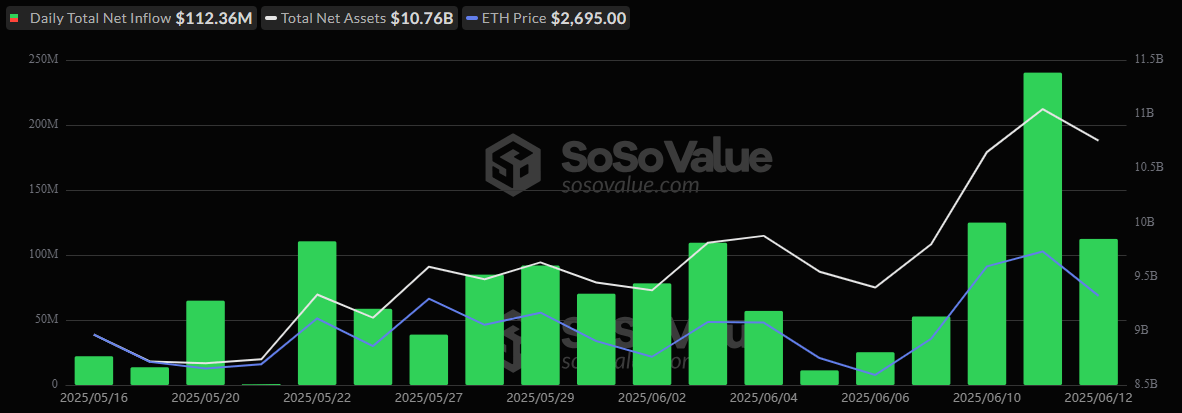

Meanwhile, ether ETFs decided to win at streaks, not content with gravity or realism or basic market physics. For a 19th day in a row (which is, for the record, roughly three centuries in crypto time), they inhaled another $112.36 million, most of it wolfed down by Blackrock’s ETHA at $101.53 million. There are black holes less hungry than this one.

Fidelity’s FETH chimed in, dropping another $10.83 million atop the already-teetering pile. Trading volume ticked up at $503.99 million. Net assets, presumably grinning from ear to ear, climbed to $10.76 billion.

With institutional confidence flying higher than the average wizard at Hogswatch, both bitcoin and ether ETFs are rolling into June with the unstoppable momentum of a runaway luggage trunk. Summer’s looking suspiciously bullish, so keep your hats on and your magical artifacts close—anything could happen, and probably will. 🌞💸

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to watch the South Park Donald Trump PSA free online

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- 50 Goal Sound ID Codes for Blue Lock Rivals

2025-06-13 15:27