What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

2025 is set to see the first major U.S. economic event: the release of December’s Consumer Price Index data. This upcoming report, due on a Wednesday, holds considerable importance for the digital assets market, given recent concerns about the Fed’s hawkish stance and bitcoin’s growing link to tech stocks. Additionally, uncertainty surrounding the continued influx of liquidity through stablecoins has sparked debate about the longevity of the price rebound from under $90K. As a result, traders are gearing up for potential market turbulence by buying short-term put options.

Here’s what experts are saying about the upcoming event:

QCP Capital

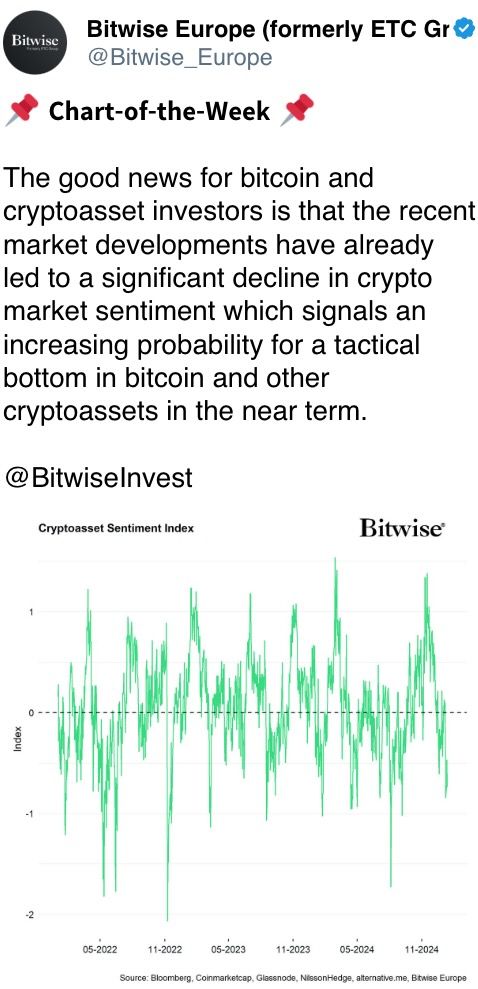

In the world of cryptocurrency, a sense of caution is noticeable in Bitcoin options transactions, as puts (options that allow you to sell BTC) are being rolled below the significant $90k support level. The immediate volatility and price fluctuations remain significant, while the VIX (a measure of market volatility) remains high at 18.68, hinting at continued volatility through January.

Geoffrey Chen, author of the Fidenza Macro blog

In November, a surge in market growth and the resolution of election uncertainties boosted business optimism, leading to improved data. Additionally, the early import of goods and price increases aimed at avoiding tariffs might have increased PMIs as well. Furthermore, oil prices have risen by over 10% from their December levels, which strengthens the stagflation scenario. Unfortunately, this could lead to higher CPI figures tomorrow [Jan. 15] and a more hawkish stance from the FOMC later this month. These unexpected events might lean towards hawkish and stagflationary outcomes, placing additional strain on risk assets.

Markus Thielen, founder of 10x Research

Bitcoin is currently trading in a gradually narrowing channel, and there are significant events looming that could impact its price. There’s growing anticipation for a higher Consumer Price Index (CPI) figure, which means if the actual CPI reading turns out to be lower than expected, it might spark a surge in Bitcoin’s value.

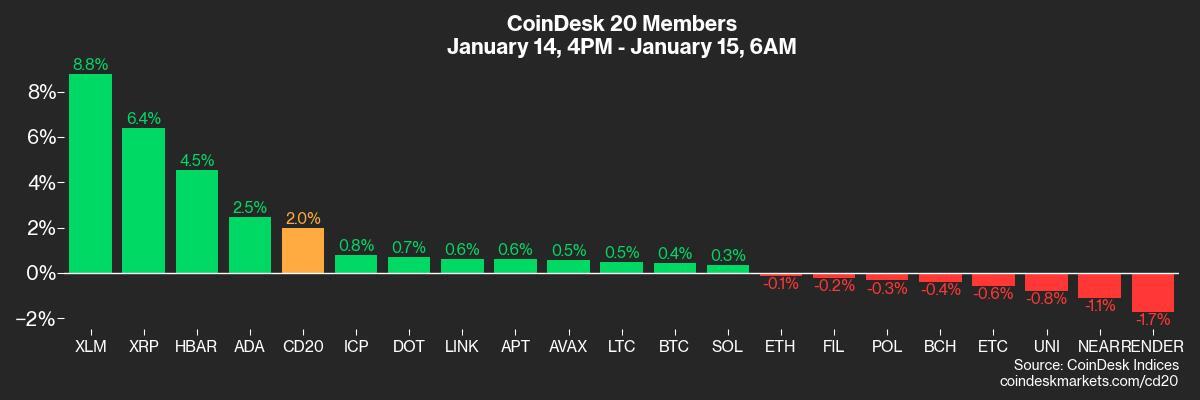

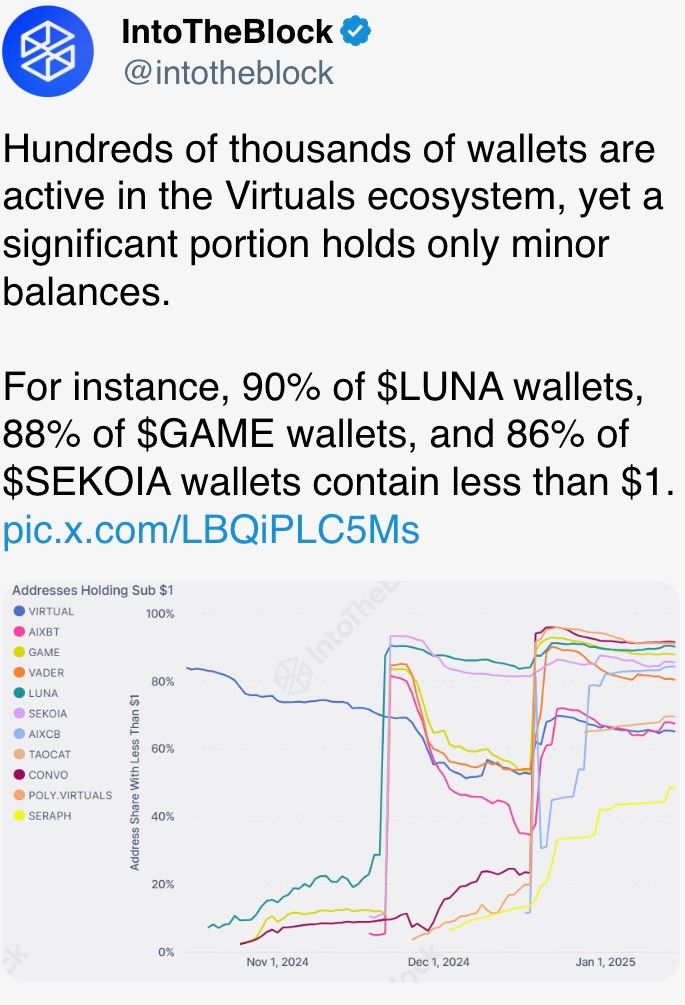

Focus on XRP and AI

As a researcher, I’ve noticed an intriguing trend this morning: XRP has spiked to $2.90, reaching its December peak, a sign that technical analysis predicts further upward momentum. Simultaneously, it appears that market participants specializing in artificial intelligence coins have been actively purchasing dips in specific tokens such as FAI, GRASS, VIRTUAL, Ai16z, and TAO, as suggested by Wintermute’s observations.

If the CPI prompts increased risk-taking in financial markets, these coins might potentially yield larger profits.

Token Talk

By Oliver Knight

- Toshi, a memecoin on layer-2 network Base, has risen by more than 70% in the past 24-hours after it was added to Coinbase’s future listing roadmap. TOSHI‘s market cap has now topped $100 million.

- Non-fungible token (NFT) trading volume fell by 19% in 2024 compared to the previous year, making it the worst performing year since 2020, a DappRadar report shows.

- The Ondo community are bracing for mammoth $2.2 billion token unlock this week as circulating supply is set to jump by 134%. The majority of supply has been allocated to “ecosystem growth,” however $377 million will be distributed to participants of a private sale. Unlocks of this magnitude typically heap pressure on the underlying asset, although a significant increase in short positions could spur a short squeeze, a trend that has been seen since 2023.

- Binance Alpha has posted a new batch of projects that are being considered for listing on the exchange. These include VITA, GRIFT, VITA Aimonica, the latter two are AI agent tokens.

Derivatives Positioning

- XLM has seen a 27% surge in perpetual futures open interest, the highest among major tokens, with cumulative volume delta pointing to net buying pressure. The combination supports an extension of the past 24 hours’ 11% price rise.

- Large positive dealer gamma is seen at $97K, according to Deribit’s options market. Positive gamma means market makers will likely trade against the market direction, arresting price volatility.

- In ETH‘s case, a large negative gamma is seen closer to its going market rate, suggesting potential for increased price turbulence.

- Front-dated risk reversals continue to show bias for BTC, ETH puts.

- Notable block flows include a long BTC straddle, involving $97K options expiring on Jan. 24. The strategy profits from a volatility explosion.

Market Movements:

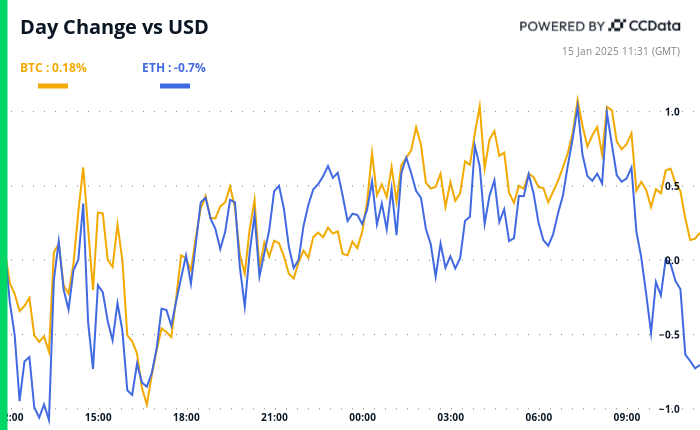

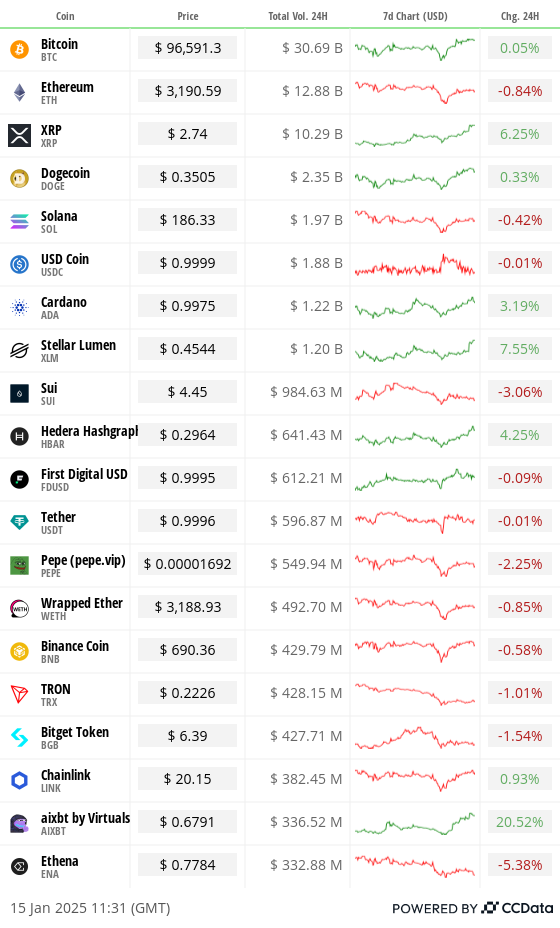

- BTC is up 0.51% from 4 p.m. ET Tuesday to $96,951.13 (24hrs: +0.4%)

- ETH is down 0.24% to $3,207.75 (24hrs: -0.37%)

- CoinDesk 20 is up 1.88% to 3,546.65 (24hrs: +2.35%)

- Ether staking yield is unchanged at 3.12%

- BTC funding rate is at 0.0059% (6.49% annualized) on Binance

- DXY is down 0.23% to 109.02

- Gold is up 1.28% to $2,646.45/oz

- Silver is up 2.16% to $30.78/oz

- Nikkei 225 closed on Tuesday unchanged at 38,444.58

- Hang Seng closed +0.34% at 19,286.07

- FTSE is up 0.74% to 8,262.35

- Euro Stoxx 50 is up 0.34% at 4,997.65

- DJIA closed +0.52% at 42,518.28

- S&P 500 closed +0.11% at 5,842.91

- Nasdaq closed -0.23% at 19,044.39

- S&P/TSX Composite Index closed +0.21% at 24,588.60

- S&P 40 Latin America closed +0.69% at 2,207.79

- U.S. 10-year Treasury is down 2 bps to 4.77%

- E-mini S&P 500 futures are up 0.16% to 5,891.50

- E-mini Nasdaq-100 futures are up 0.22% to 20,965.25

- E-mini Dow Jones Industrial Average Index futures are up 0.2% at 42,836.00

Bitcoin Stats:

- BTC Dominance: 58.21

- Ethereum to bitcoin ratio: 0.033

- Hashrate (seven-day moving average): 790 EH/s

- Hashprice (spot): $55.2

- Total Fees: 6.54 BTC/

- CME Futures Open Interest: 177,355 BTC

- BTC priced in gold: 36.1 oz

- BTC vs gold market cap: 10.26%

Technical Analysis

- The above chart shows privacy-focused cryptocurrency’s weekly price changes in a candlestick pattern since late 2020.

- XMR recently broke out of a prolonged consolidation/basing pattern and has validated the same with the bullish re-test of the breakout point.

- Now, the market may unleash the energy built during consolidation, taking prices higher to resistance at $289, the April 2022 high.

Crypto Equities

- MicroStrategy (MSTR): closed on Tuesday at $342.17 (+4.19%), down 0.51% at $340.44 in pre-market.

- Coinbase Global (COIN): closed at $255.37 (+1.66%), down 0.17% at $254.93 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$26.6 (+2.15%)

- MARA Holdings (MARA): closed at $17.36 (+0.99%), unchanged in pre-market.

- Riot Platforms (RIOT): closed at $12.24 (+3.99%), down 0.25% at $12.21 in pre-market.

- Core Scientific (CORZ): closed at $13.91 (+2.2%), up 1.51% at $14.12 in pre-market.

- CleanSpark (CLSK): closed at $10.35 (+1.57%), down 0.39% at $10.31 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.07 (+3.83%).

- Semler Scientific (SMLR): closed at $54.93 (+4.23%), up 0.31% at $55.10 in pre-market.

- Exodus Movement (EXOD): closed at $33.07 (-1.52%), down 1.66% at $32.52 in pre-market.

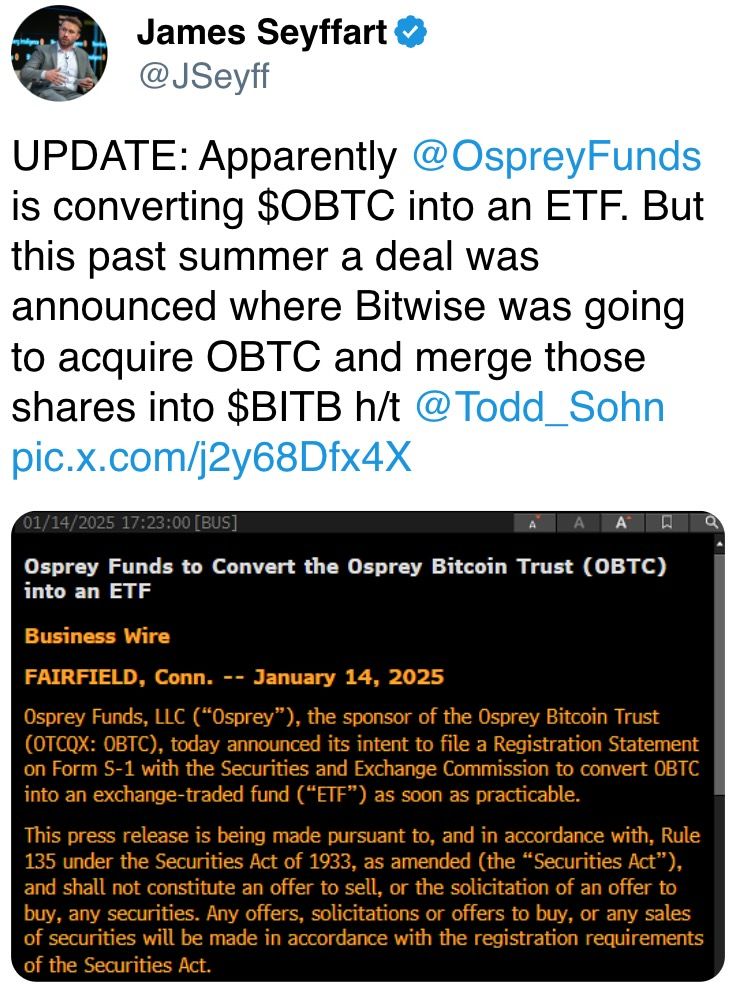

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$209.8 million

- Cumulative net flows: $35.71 billion

- Total BTC holdings ~ 1.131 million.

Spot ETH ETFs

- Daily net flow: -$39.4 million

- Cumulative net flows: $2.41 billion

- Total ETH holdings ~ 3.540 million.

Overnight Flows

Chart of the Day

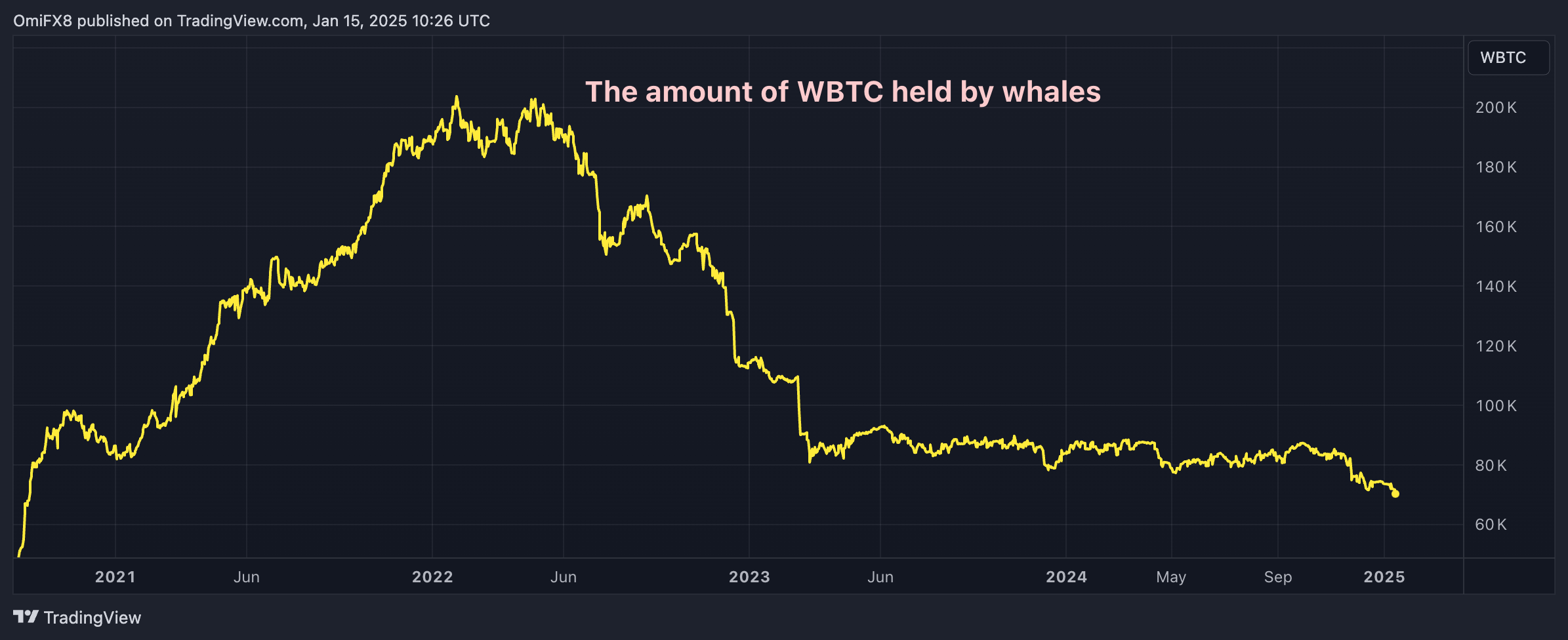

- Cryptocurrency whales continue to run down their holdings of wrapped bitcoin (WBTC), an Ethereum token intended to represent bitcoin on the Ethereum-based DeFi applications.

- The balance held by whales has dropped to 70.33K WBTC, the lowest in over four years.

In the Ether

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-15 15:14