What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

2025’s opening act shares a familiar melody. It isn’t merely the digits: Bitcoin‘s 8% rise since late December, but also the sequence of events, or the news, resonates as well-known.

It seems that the key point is emphasized by JPMorgan, indicating that the market factors responsible for pushing bitcoin and gold to record highs in the previous year remain active.

As a researcher, I am affirming that the practice of debasement trading appears to be persistent, given the growing significance of gold and Bitcoin within investment portfolios. This was outlined in a recent communication from an investment bank.

Investors may opt for a tactic known as “hedging against depreciation,” which involves purchasing assets that safeguard their value during periods when the strength of traditional currencies and government bonds weakens due to inflation or changes in monetary policies.

In 2020, the maneuver that devalued currency caused bitcoin to surge past $100,000 and gold over $2,600, a level it’s nearing again now. This rise was sparked by heightened geopolitical tension, ongoing worries about inflation, currency degradation in developed economies, concerns of fiat currency devaluation in developing markets, and a move away from the U.S. dollar. Additionally, President-elect Donald Trump’s favorable views towards cryptocurrencies contributed to this trend. As a result, there was a historic influx of $78 billion into the digital assets market, as reported by JPMorgan.

A dissonant note in the financial market is caused by rising bond interest rates and a robust US dollar, which are fueled by economic confidence and decreasing predictions of Federal Reserve rate cuts. This could restrict short-term growth opportunities. However, this Friday’s nonfarm payroll report serves as a crucial assessment for the hawkish Fed narrative, with forecasts predicting 154,000 job additions in December.

It’s worth noting the unusual events involving Bitcoin-owning firm MicroStrategy (MSTR). The chatter on social media is especially noteworthy, focusing on brokers decreasing their involvement with the company. This move coincides with increased demands for higher margins, causing some unease due to possible market turbulence ahead.

People are talking about strange things happening with Bitcoin-holding business MicroStrategy (MSTR) on social media. Brokers are reducing their dealings with the company and asking for more money upfront, which could mean trouble in the future because of potential market volatility.

Crypto economist Ben Lilly proposes that the increase in ether coins locked within the DeFi protocol Ethena could be responsible for keeping ether’s price low. This is because Ethena employs a strategy to short ETH futures as part of a delta-neutral hedge, aiming to maintain the $1 peg of its stablecoin, USDe. Despite a 10% surge in the first six days of the year, ether’s price remains significantly lower than its all-time high.

Lilly stated on X that it appears there’s a trend in the market moving towards having delta-neutral exposure with Ethereum (ETH), instead of holding it as collateral for potential price increases. This shift could potentially limit Ethereum’s upward price movement due to Ethena.

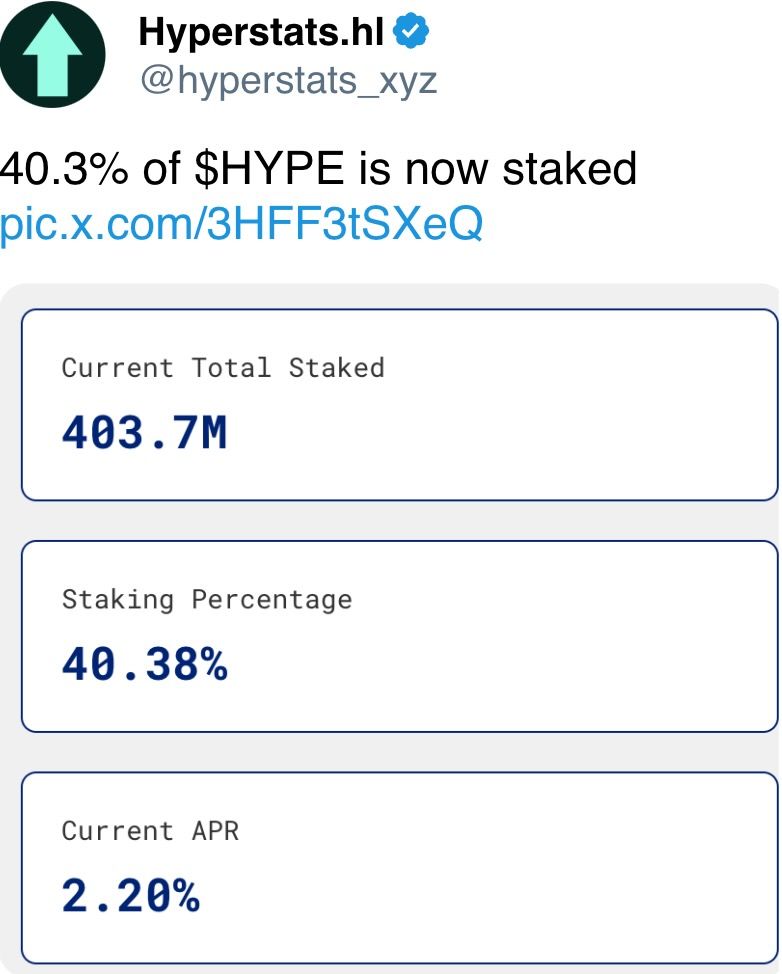

Ethena unveils intentions for iUSDe, a variant tailored for institutional investors aiming to invest in yield-generating USDe without engaging directly with tokens. On the other hand, the foremost on-chain perpetual DEX exchange, Hyperliquid, has added SOLV, the token indigenous to the Bitcoin staking protocol Solv Protocol, to its platform. There’s chatter about large investors interested in acquiring the HYPE token. Keep a watchful eye.

What to Watch

- Crypto

- Jan. 6: Decentralized exchange Uniswap’s layer-2 blockchain, Unichain, starts its transition to mainnet.

- Jan. 6: Binance is delisting DAR (rebranding).

- Jan. 6: SONIC primary listing.

- Jan. 7: Dusk (DUSK) mainnet launch.

- Jan. 8: Bybit terminates withdrawal and custody services to nationals or residents of the French Territories.

- Jan. 8: Xterio (XTER) token generation event.

Jan. 9, 1:00 a.m.: Cronos (CRO) zkEVM mainnet upgrades to ZKsync’s latest release. - Jan. 12, 10:30 p.m.: Binance will halt Fantom token (FTM) deposits and withdrawals and delist all FTM trading pairs. FTM tokens will be swapped for S tokens at a 1:1 ratio.

Jan. 15: Derive (DRV) token generation event. - Jan. 15: Mintlayer version 1.0.0 release. The mainnet is undergoing an upgrade that introduces Atomic Swaps, enabling native BTC cross-chain swaps.

- Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is set to start on Binance, featuring pairs like S/USDT, S/BTC, and S/BNB.

- Macro

- Jan. 6, 9:15 a.m.: Fed Governor Lisa D. Cook gives a speech, “Economic Outlook and Financial Stability,” at the Seventh Conference on Law and Macroeconomics, Ann Arbor, Michigan. Livestream link.

- Jan. 6, 9:45 a.m.: S&P Global releases U.S. December 2024 PMI final.

- Composite PMI Est. 56.6 vs. Prev. 54.9.

- Services PMI Est. 58.5 vs. Prev. 56.1.

- Jan. 7, 5:00 a.m.: Eurostat releases November 2024’s eurozone unemployment statistics and December 2024’s eurozone inflation data (flash).

- Core Inflation Rate YoY Est. 2.7% vs. Prev. 2.7%.

- Inflation Rate YoY Est. 2.4% vs. Prev. 2.2%.

- Unemployment Rate Est. 6.4% vs. Prev. 6.3%.

- Jan. 7, 8:55 a.m.: U.S. Redbook YoY for the week ended Jan. 4. Prev. 7.1%.

- Jan. 7, 10:00 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November 2024’s Job Openings and Labor Turnover Summary (JOLTS) report.

- Job openings Est. 7.65M vs. Prev. 7.744M.

- Job quits Prev. 3.326M.

- Jan. 8, 8:30 a.m.: Fed Governor Christopher J. Waller is giving a speech, “Economic Outlook,” at the Lectures of the Governor Event, Paris, France. Livestream link.

- Jan. 8, 2:00 p.m.: The Fed releases the minutes of the Dec. 17-18 Federal Open Market Committee (FOMC) meeting.

- Jan. 9, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 4. Initial Jobless Claims Est. 210K vs. Prev. 211K.

- Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

- Nonfarm payrolls Est. 160K vs. Prev. 227K.

- Unemployment rate Est. 4.2% vs Prev. 4.2%.

- Jan. 10, 10:00 a.m.: The University of Michigan releases January’s Michigan Consumer Sentiment (Preliminary). Est. 74.5 vs. Prev. 74.0.

Token Events

- Governance votes & calls

- Cartesi to hold first governance call of 2025 at 8 a.m.

- The injective community passed a proposal in favor of decreasing the INJ supply as part of the INJ 3.0 upgrade.

Token Talk

In the last day, the parody token SPX6900 (SPX) climbed an additional 17%, reaching a market value of $1.5 billion. This growth extends a surge from the previous week, despite the overall market remaining relatively stable.

Initially intended as a humorous critique of the S&P 500 stock index, this token has now attracted a passionate group of followers who aspire to eventually reverse the market capitalization of the entire U.S. stock market, currently valued at approximately $44 trillion (as of Monday).

On the SPX6900 website, there’s a document, or what could be called a “blueprint,” that addresses a generation dealing with financial hardships. The token is presented as a means of rebooting or refreshing the traditional stock market system.

The call to action within the community, “cease dealing and embrace conviction instead,” has nurtured a steadfast group of individuals driven by their beliefs. This phrase promotes long-term investment over short-term speculation, cultivating a community of dedicated believers often referred to as those with “diamond hands.” This environment values trust in the project’s future prospects above immediate monetary rewards.

Derivatives Positioning

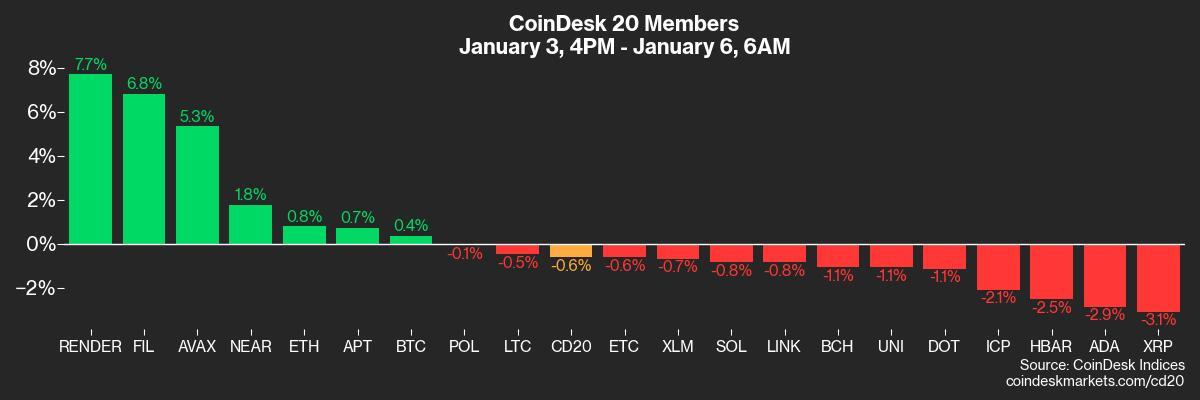

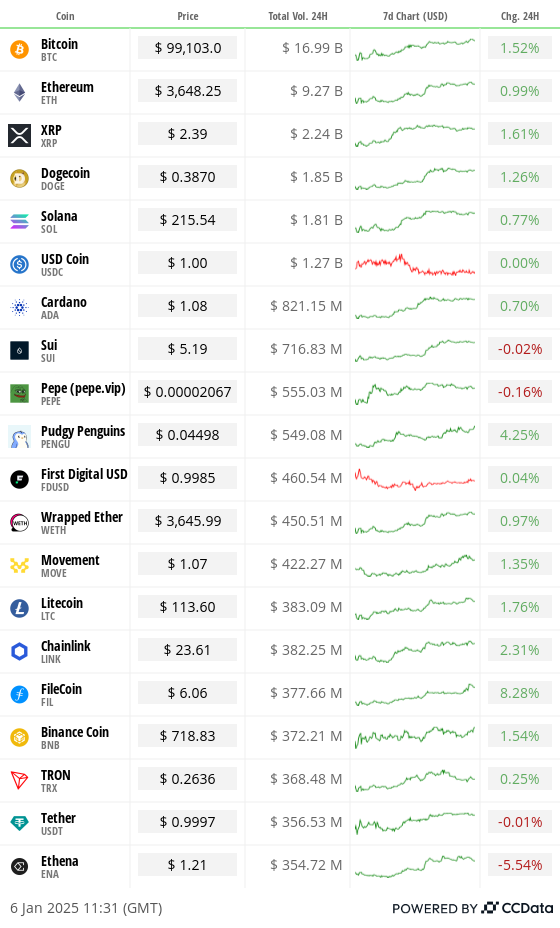

- Most large-cap tokens have seen price gains in the past 24 hours.

- The increases are accompanied by muted cumulative volume delta and limited growth in futures open interest, indicating a lack of strong buying pressure and raising concerns about the sustainability of these gains.

- The BTC options market shows renewed buying in calls at strikes $100,000 and $120,000, anticipating a rally to new lifetime highs.

- Dealers are net short gamma at the $100,000 strike, which means a breakout above that level could see them trade in the direction of the market to maintain their net exposure neutral. That could add to the upward momentum.

- Similar negative gamma is seen in ETH between $3,650 and $3,850 strikes.

- Traders have sold upside optionality in SOL.

Market Movements:

- BTC is up 0.78 % from 4 p.m. ET Friday to $99,034.53 (24hrs: +1.41%)

- ETH is up 0.97% at $3,647.09 (24hrs: +3.22%)

- CoinDesk 20 is down 0.29% to 3,659.91 (24hrs: +1.19%)

- Ether staking yield is down 11 bps to 3.05%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is down 0.57% at 108.33

- Gold is unchanged at $2,641.26/oz

- Silver is up 1.33% to $30.01/oz

- Nikkei 225 closed -1.47% at 39,307.05

- Hang Seng closed -0.36% at 19,688.29

- FTSE is up 0.12% at 8,233.81

- Euro Stoxx 50 is up 0.89% at 4,914.95

- DJIA closed on Friday +0.8% to 42,732.13

- S&P 500 closed +1.26% at 5,942.47

- Nasdaq closed +1.77% at 19,621.68

- S&P/TSX Composite Index closed +0.7% at 25,073.54

- S&P 40 Latin America closed -1.44% at 2,153.90

- U.S. 10-year Treasury is up 1 bp at 4.61%

- E-mini S&P 500 futures are up 0.51% to 6,020.00

- E-mini Nasdaq-100 futures are up 0.85% to 21,699.25

- E-mini Dow Jones Industrial Average Index futures are up 0.14% at 43,081

Bitcoin Stats:

- BTC Dominance: 57.25%

- Ethereum to bitcoin ratio: 0.0367

- Hashrate (seven-day moving average): 814 EH/s

- Hashprice (spot): $56.5

- Total Fees: 5.9 BTC / $579k

- CME Futures Open Interest: 170,345 BTC

- BTC priced in gold: 37.6 oz

- BTC vs gold market cap: 10.70%

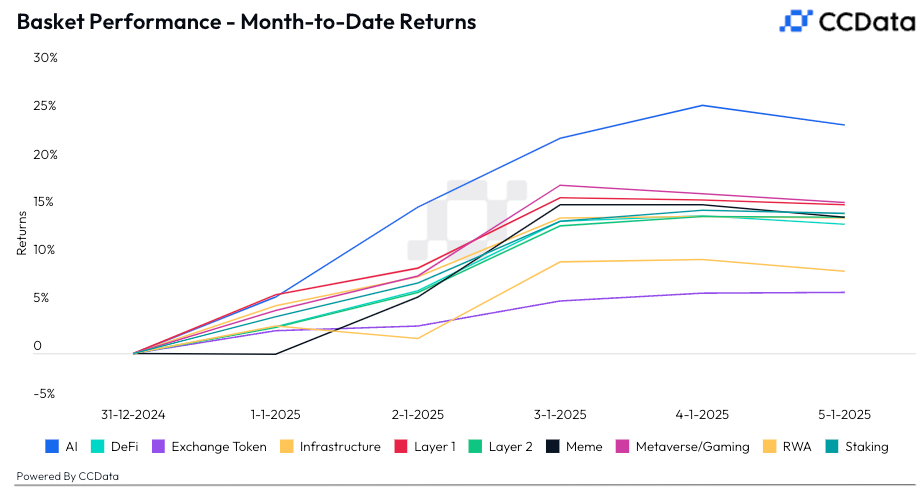

Basket Performance

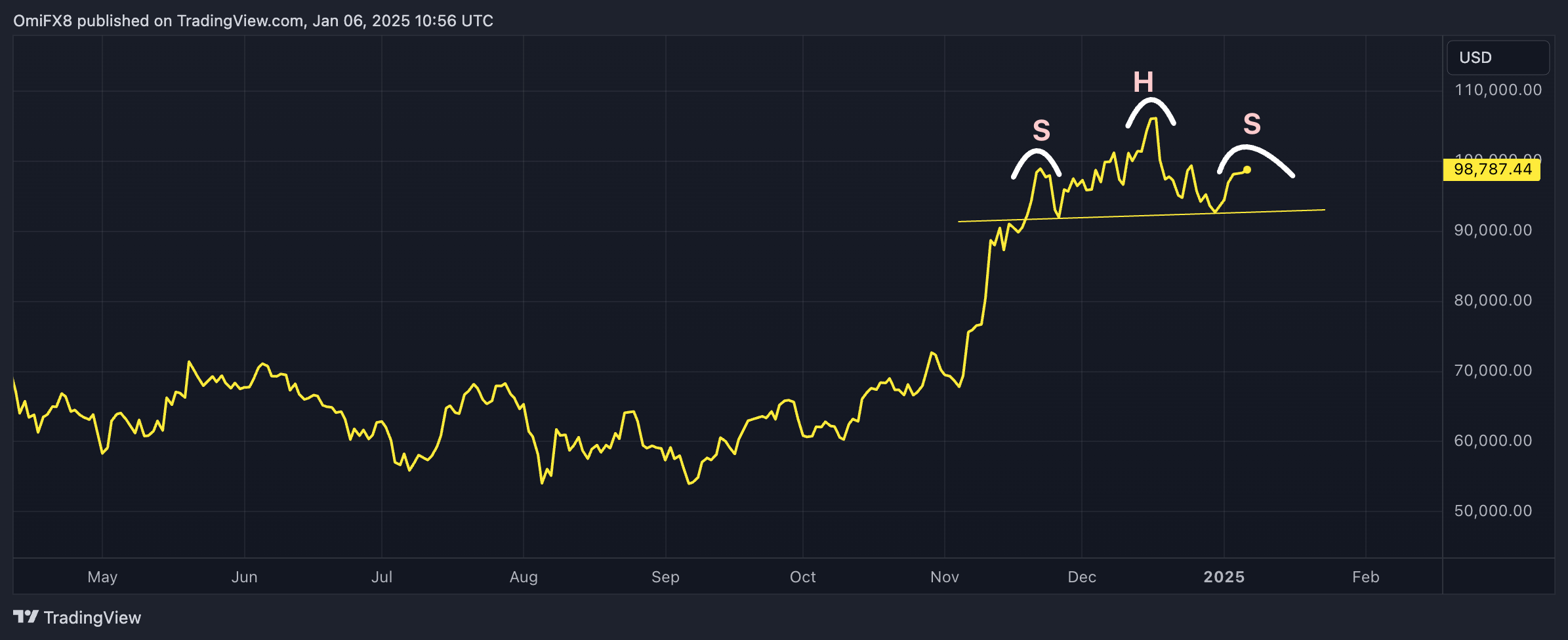

Technical Analysis

- Watch out for a potential head-and-shoulders topping pattern in bitcoin.

- A breakdown below the horizontal support line would confirm the pattern, opening doors for a deeper price slide.

- Recent price action has shown sellers are looking to reassert themselves.

Crypto Equities

- MicroStrategy (MSTR): closed on Friday at $339.66 (+13.22%), up 2.74% at $348.94 in pre-market.

- Coinbase Global (COIN): closed at $270.65 (+5.23%), up 2.73% at $278.05 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$29.44 (+13.36%)

- MARA Holdings (MARA): closed at $19.64 (+14.12%), up 2.24% at $20.08 in pre-market.

- Riot Platforms (RIOT): closed at $12.34 (+17.97%), up 2.51% at $12.65 in pre-market.

- Core Scientific (CORZ): closed at $15.38 (+6.22%), up 1.69% at $15.64 in pre-market.

- CleanSpark (CLSK): closed at $10.80 (+14.29%), up 2.87% at $11.11 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.73 (+10.91%).

- Semler Scientific (SMLR): closed at $59.04 (+8.13%).

ETF Flows

Spot BTC ETFs:

- Daily net flow: $908.1 million

- Cumulative net flows: $35.91 billion

- Total BTC holdings ~ 1.124 million.

Spot ETH ETFs

- Daily net flow: $58.9 million

- Cumulative net flows: $2.64 billion

- Total ETH holdings ~ 3.611 million.

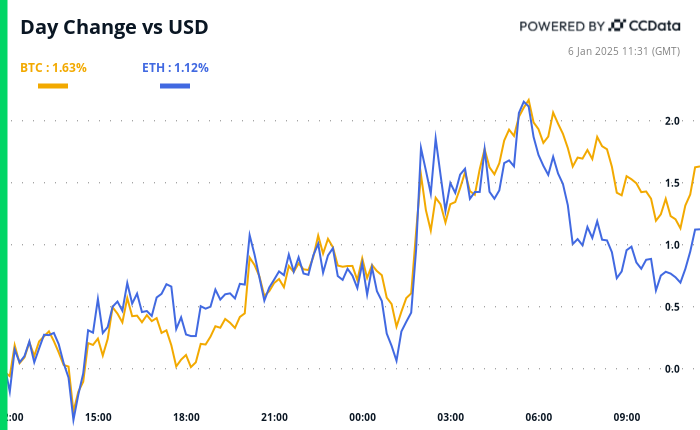

Overnight Flows

Chart of the Day

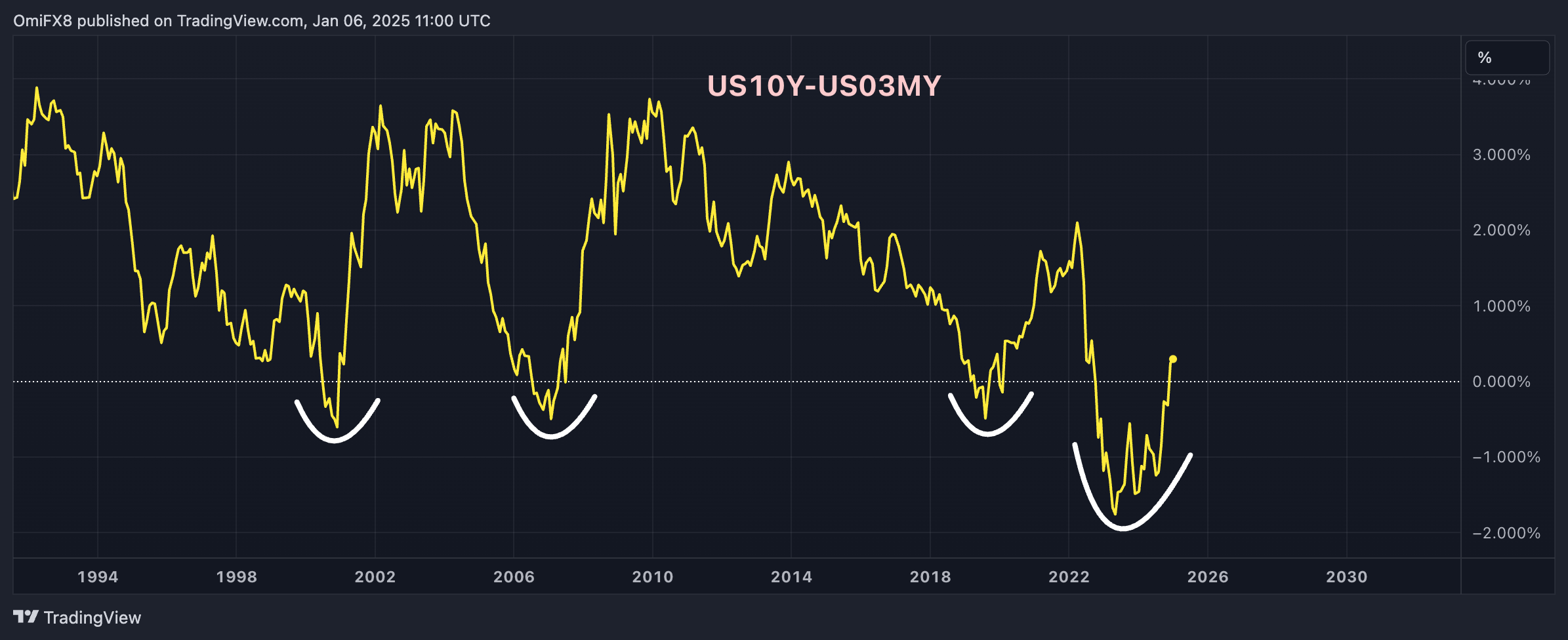

- The spread between yields on the U.S. 10-year note and the three-month bill has turned positive in a so-called normalization or de-inversion of the yield curve.

- Previous de-inversions have often signaled sharp economic downturns.

- This time may be different because the movement is led by a faster rise in the 10-year yield, representing economic optimism.

In the Ether

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-06 15:17