What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

As we move through 2025, it’s clear that Bitcoin and the S&P 500 are taking different paths so far.

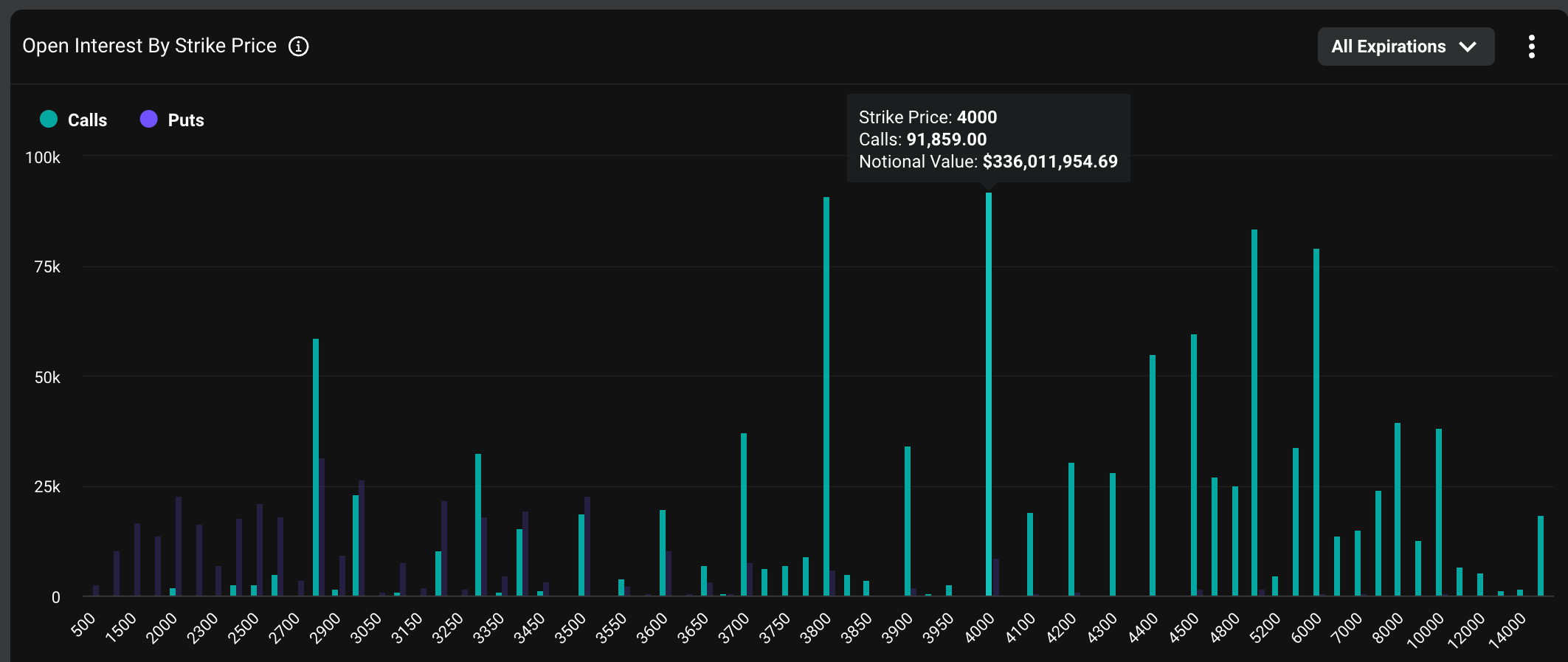

Bitcoin aims to establish a strong position above $100,000, and its options listed on Deribit suggest a positive outlook. On the other hand, the S&P 500 has traditionally served as a guide for risk-on/risk-off signals for assets like Bitcoin.

As per Cboe’s data analysis, there is currently a higher perceived risk of downturns (downside risk) in the SPX market compared to what was observed a year prior.

Investors may be adopting a cautious approach towards stocks, given speculation that President-elect Donald Trump’s inauguration on January 20th could trigger a “sell-the-news” reaction. With optimism about corporate and economic reforms under Trump’s presidency leading to increased risk-taking in financial markets over the past two months, it is possible that investors are looking to secure their profits before any potential market adjustments occur.

As a researcher, I’ve been closely analyzing market trends and I must say, there appear to be some inconsistencies in the data we’re seeing. Given the prolonged period of economic optimism across various sectors that we’ve experienced over nearly three months, I believe there’s a significant possibility that Trump’s inauguration later this month could serve as a ‘sell the news’ event. This is merely an observation and not a definitive prediction.

The question arises: What impact might BTC experience next? Given that the anticipation of regulatory certainty under Trump has propelled Bitcoin’s price from $70,000 to over $100,000 in merely two months, a broader market sell-off on Jan. 20 could weaken the dollar index and bond yields, possibly boosting BTC.

Currently, there are multiple reasons bolstering Bitcoin. For example, around $400 billion in liquidity that was withdrawn from the system during the last fortnight of 2024 might be reintroduced, potentially boosting asset prices as suggested by the LondonCryptoClub newsletter. Furthermore, a portion of capital influx from China may end up being invested in cryptocurrencies.

On Coinbase, Bitcoin is currently being bought at a higher price compared to other exchanges, indicating increased demand from the U.S., and there’s an expectation that miners will reduce their supply for sale.

As a crypto investor, I’ve been keeping an eye on the Net Unrealized Profit and Loss (NUPL) for miners, and it’s looking quite promising. The NUPL is currently hanging around 0.5, indicating that miners are in a robust position, holding onto significant unrealized profits. This suggests they seem content to keep their Bitcoin at this moment, according to the analysts at Bitfinex who shared this insight with CoinDesk.

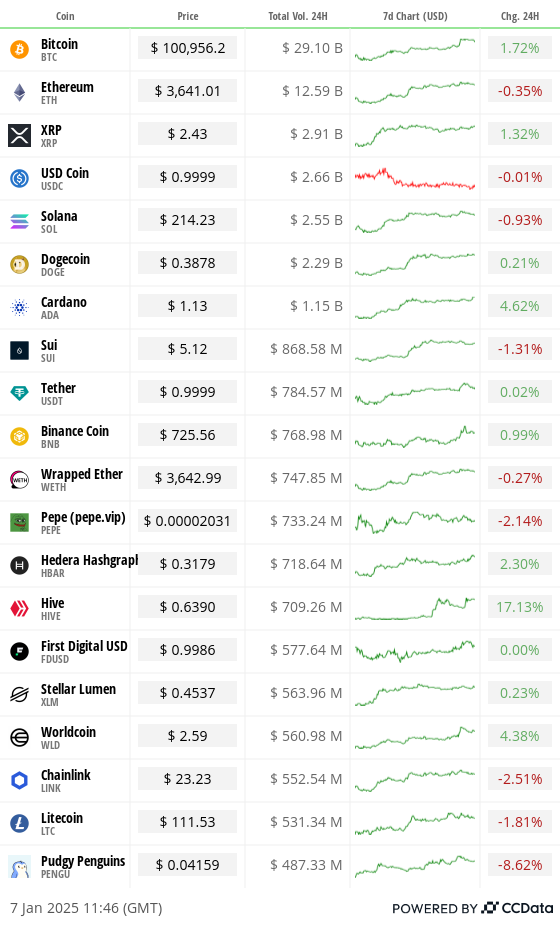

In the larger financial world, some investors are experimenting with options for Ether (ETH) that could potentially pay off if its price reaches $11,000 by December 2025. However, at this moment, Ether is being traded below $4,000. Interestingly, over 70 of the top 100 cryptocurrencies by value were showing gains within a 24-hour period as we speak. If you’re looking for further signs of optimism in the market, here it is.

Pay attention to the ongoing turmoil in the global bond market, as it is rapidly expanding beyond U.S. borders. Today, Japanese 10-year bond yields reached a 13-year peak, and the British 30-year bond yield is nearing levels not seen since the late 1990s. This trend could potentially drain strength from risky investments, so stay vigilant!

The bond market crisis is spreading globally, with Japanese and British bonds reaching their highest yields in years. Keep an eye on this, as it may affect the performance of riskier investments like stocks. Stay alert!

What to Watch

- Crypto

- Jan. 7: Dusk (DUSK) mainnet launch.

- Jan. 8: Bybit terminates withdrawal and custody services to nationals or residents of the French Territories.

- Jan. 8: Xterio (XTER) to create and distribute new tokens in token generation event.

- Jan. 9, 1:00 a.m.: Cronos (CRO) zkEVM mainnet upgrades to ZKsync’s latest release.

- Jan. 12, 10:30 p.m.: Binance will halt Fantom token (FTM) deposits and withdrawals and delist all FTM trading pairs. FTM tokens will be swapped for S tokens at a 1:1 ratio.

Jan. 15: Derive (DRV) token generation event. - Jan. 15: Mintlayer version 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling native BTC cross-chain swaps.

- Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is set to start on Binance, featuring pairs like S/USDT, S/BTC, and S/BNB.

- Macro

- Jan. 7, 8:55 a.m.: U.S. Redbook YoY for the week ended Jan. 4. Prev. 7.1%.

- Jan. 7, 10:00 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November 2024’s Job Openings and Labor Turnover Summary (JOLTS) report.

- Job openings Est. 7.65M vs. Prev. 7.744M.

- Job quits Prev. 3.326M.

- Jan. 8, 8:30 a.m.: Fed Governor Christopher J. Waller is giving a speech, “Economic Outlook,” at the Lectures of the Governor Event, Paris, France. Livestream link.

- Jan. 8, 2:00 p.m.: The Fed releases the minutes of the Dec. 17-18 Federal Open Market Committee (FOMC) meeting.

- Jan. 9, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 4. Initial Jobless Claims Est. 210K vs. Prev. 211K.

- Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

- Nonfarm payrolls Est. 160K vs. Prev. 227K.

- Unemployment rate Est. 4.2% vs Prev. 4.2%.

- Jan. 10, 10:00 a.m.: The University of Michigan releases January’s Michigan Consumer Sentiment (Preliminary). Est. 74.5 vs. Prev. 74.0.

Token Talk

According to on-chain data, Vitalik Buterin, one of the co-founders of Ethereum, has donated a collection of meme tokens that were given to him by different communities for charitable purposes.

For the past two days, Buterin has offloaded memecoins with a lower profile, totaling approximately $940,900, and exchanged them for the USDC stablecoin and ether. The NEIRO, ESTEE, MARVIN, EBULL, MSTR, and TERMINUS tokens accounted for at least $57,000 in USDC, while other tokens were sold for around $40,000 or less.

Approximately $916,000 was transferred to a multi-signature wallet, which appears to be linked with the charitable organization Kanro, as reported by SpotOnChain.

Communities frequently give tokens to Buterin primarily to increase their visibility and make use of his significant impact within the cryptocurrency sector.

Additionally, it’s worth noting that Vitalik Buterin’s philanthropic efforts are significant. Often, communities send tokens with the hope that Buterin will donate them, thus inadvertently contributing to charitable causes. In fact, as recently as October, Buterin announced his intention to donate any received tokens to charity. However, it’s important to clarify that he doesn’t necessarily endorse this practice.

I’m fond of memecoins that automatically contribute a part of their tokens to charitable causes. For instance, ebull recently transferred a substantial amount to various organizations last month. In the same vein, whatever I receive gets donated to charity as well (thanks moodeng! The 10 billion from today will be directed towards anti-airborne-disease efforts).

— vitalik.eth (@VitalikButerin) October 7, 2024

He mentioned that anything that’s forwarded to him will also be donated to charity (thanks for suggesting that, moodeng!). He added that the 10B from today will go towards anti-airborne-disease technology. However, he expressed a preference if you could donate directly to charity instead. Perhaps even consider creating a Decentralized Autonomous Organization (DAO), allowing your community to be more actively involved in the decision-making and process.

Derivatives Positioning

- BTC and ETH basis on the CME are little changed around 10% and 13%, respectively, with open interest ticking up, but staying well short of record highs.

- The broader market perpetual funding rates remain in a range near an annualized 10%.

- BTC and ETH calls continue to trade pricier than puts, but the largest block trade for the day leaned bearish, involving a long position in the $100,000 put expiring Jan. 31 financed by selling the $90,000 put expiring in June.

Market Movements:

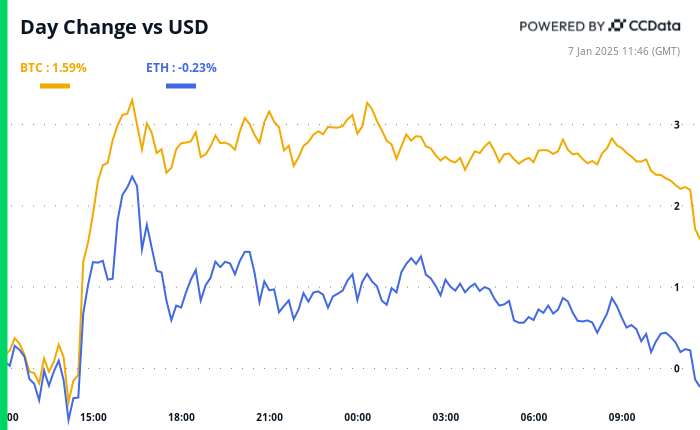

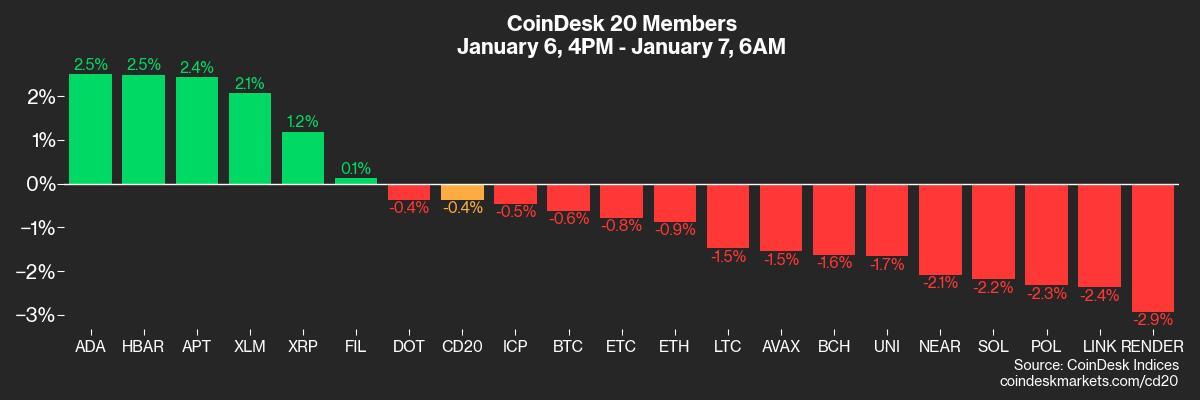

- BTC is down 0.23% from 4 p.m. ET Monday to $101,428.11 (24hrs: +2.72%)

- ETH is down 0.28% at $3,658.61 (24hrs: +0.62%)

- CoinDesk 20 is down 0.34% to 3,726.76 (24hrs: +1.95%)

- CESR Composite Ether Staking Rate is up 15 bps to 3.2%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is down 0.23% at 108.01

- Gold is up 0.63% at $2,655/oz

- Silver is up 1.58% to $30.82/oz

- Nikkei 225 closed +1.97% at 40,083.3

- Hang Seng closed -1.22% at 19,447.58

- FTSE is down 0.22% at 8,231.7

- Euro Stoxx 50 is up 0.45% to 5,009.08

- DJIA closed Monday unchanged at 42,706.56

- S&P 500 closed +0.55% at 5,975.38

- Nasdaq closed +1.24% at 19,864.98

- S&P/TSX Composite Index closed -0.29% at 24,999.8

- S&P 40 Latin America closed +2.13% at 2,199.88

- U.S. 10-year Treasury was up 2 bps at 4.618

- E-mini S&P 500 futures are up 0.1% to 6,026.5

- E-mini Nasdaq-100 futures are unchanged at 21,761.75

- E-mini Dow Jones Industrial Average Index futures are unchanged at 43,011

Bitcoin Stats:

- BTC Dominance: 57.55%

- Ethereum to bitcoin ratio: 0.036

- Hashrate (seven-day moving average): 792 EH/s

- Hashprice (spot): $59.4

- Total Fees: 6.6 BTC/ $665,000

- CME Futures Open Interest:495,641 BTC

- BTC priced in gold: 38.5 oz

- BTC vs gold market cap: 10.95%

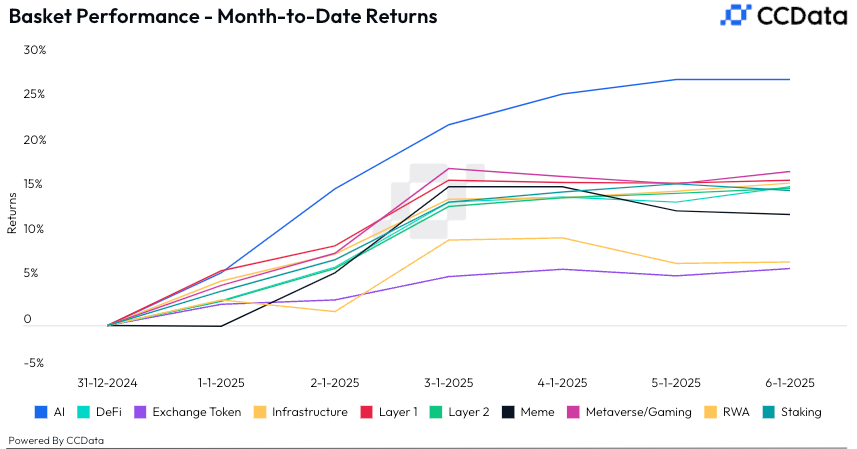

Basket Performance

Technical Analysis

- The rally in longer-duration bond yields shows no signs of stopping.

- The 30-year Treasury yield has topped the horizontal resistance from the April 2024 high.

- Should it hold at that level, the focus will shift to the 2023 high above 5%.

Crypto Equities

- MicroStrategy (MSTR): closed on Monday at $379.09 (+11.61%), unchanged in pre-market.

- Coinbase Global (COIN): closed at $287.76 (+6.32%), down 0.91% at $285.09 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$29.83 (+1.32%)

- MARA Holdings (MARA): closed at $20.55 (+4.63%), down 1.75% at $20.19 in pre-market.

- Riot Platforms (RIOT): closed at $12.89 (+4.46%), down 1.47% at $12.70 in pre-market.

- Core Scientific (CORZ): closed at $15.12 (-1.69%), down 0.13% at $15.10 in pre-market.

- CleanSpark (CLSK): closed at $11.43 (+5.83%), down 1.14% at $11.3 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $26.15 (+1.63%), down 0.96% at $25.90 in pre-market.

- Semler Scientific (SMLR): closed at $58.94 (-0.17%), down 1.49% at $58.06 in pre-market.

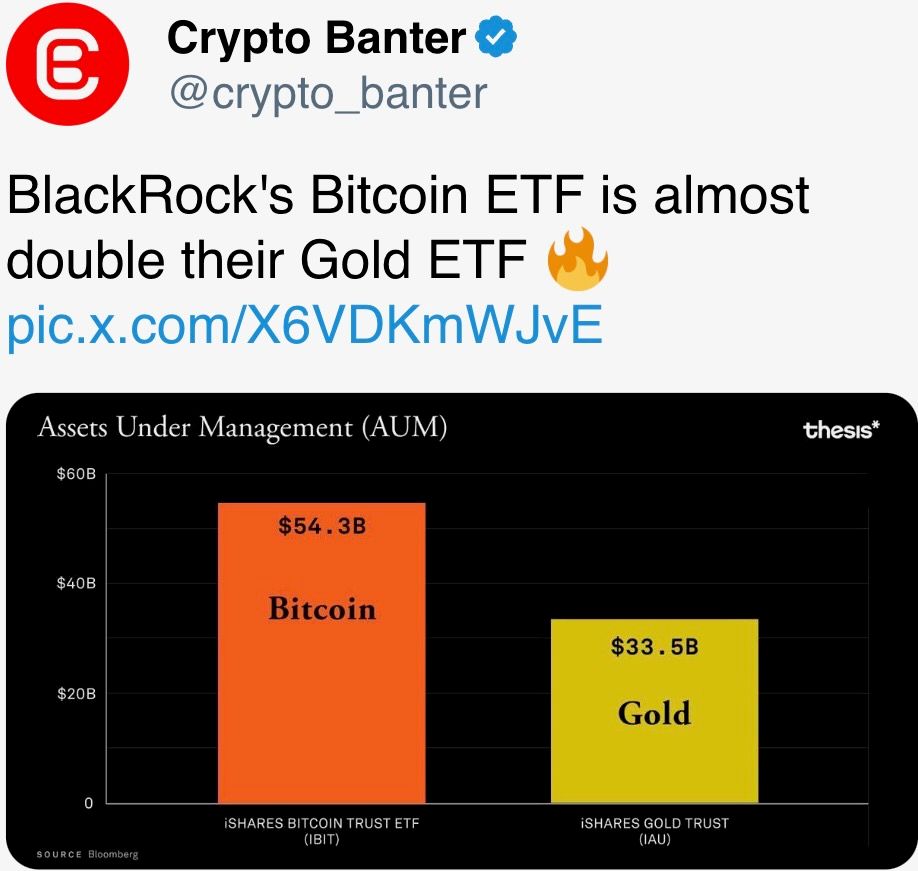

ETF Flows

Spot BTC ETFs:

- Daily net flow: $978.6 million

- Cumulative net flows: $36.89 billion

- Total BTC holdings ~ 1.134 million.

Spot ETH ETFs

- Daily net flow: $128.7 million

- Cumulative net flows: $2.77 billion

- Total ETH holdings ~ 3.618 million.

Overnight Flows

Chart of the Day

- The chart shows ether’s $4,000 call is now the most popular option on Deribit, with an open interest of $336 million.

- Also, note the activity in higher strike calls at $10,000 and $15,000.

In the Ether

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- DAG PREDICTION. DAG cryptocurrency

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2025-01-07 15:21