What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

Yesterday, I pointed out that the trend in the S&P 500 options market was indicating caution towards risky assets. Now, it appears that this cautious sentiment has become a reality, as risky assets like Bitcoin are currently under pressure.

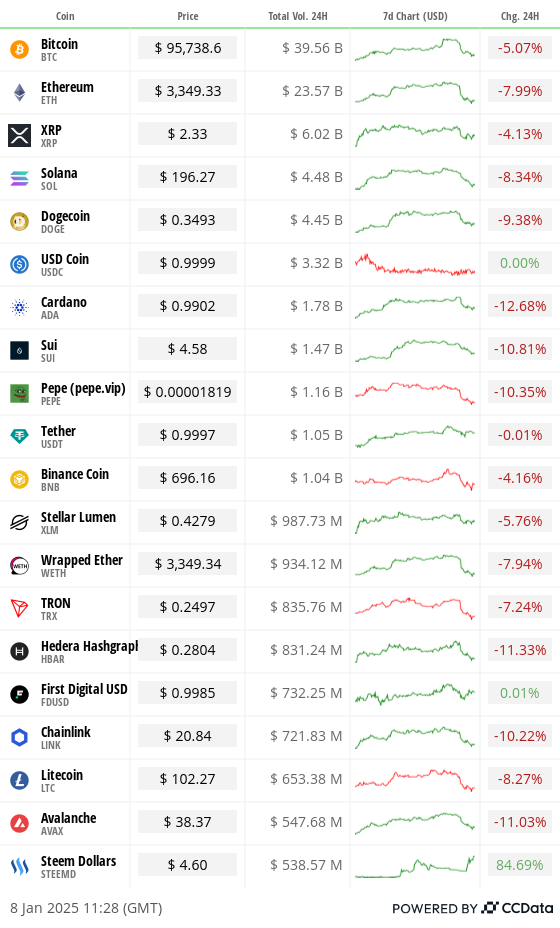

In the world of altcoins, there’s been a more significant shift in mood compared to Bitcoin, as Ethereum (ETH), Cardano (ADA) and DeFi coins have suffered greater losses, approximately 5%, compared to Bitcoin’s 24-hour decline. The optimism surrounding the “alt season” was high after ether, the altcoin leader, outperformed Bitcoin since December 2020.

The enthusiasm appears to be dwindling rapidly, but here’s where things get intriguing: The relationship between the prices of ETH (Ether) and BTC (Bitcoin) futures over various maturities, known as the Ethereum-to-Bitcoin forward term structure, has moved into a state called backwardation, as per data monitored by crypto financial platform BloFin.

In simpler terms, it suggests that certain brilliant analysts in the derivatives sector predict that Ethereum (ETH) and other alternative coins might not perform as well in the near future. Unfortunately, this may dampen the excitement surrounding the popular belief about the bright future of these alternative coins.

it only implies that things might not deteriorate further.

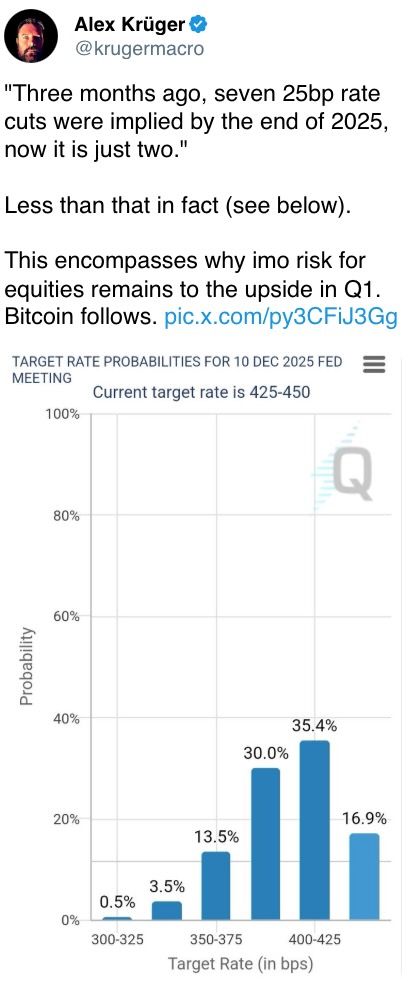

Regarding interest rates, it seems that traders aren’t overly optimistic about a potential Federal Reserve rate reduction in March, as the likelihood is less than 50%. This doesn’t provide much reassurance. According to the CME’s FedWatch tool, another rate cut might not occur before June.

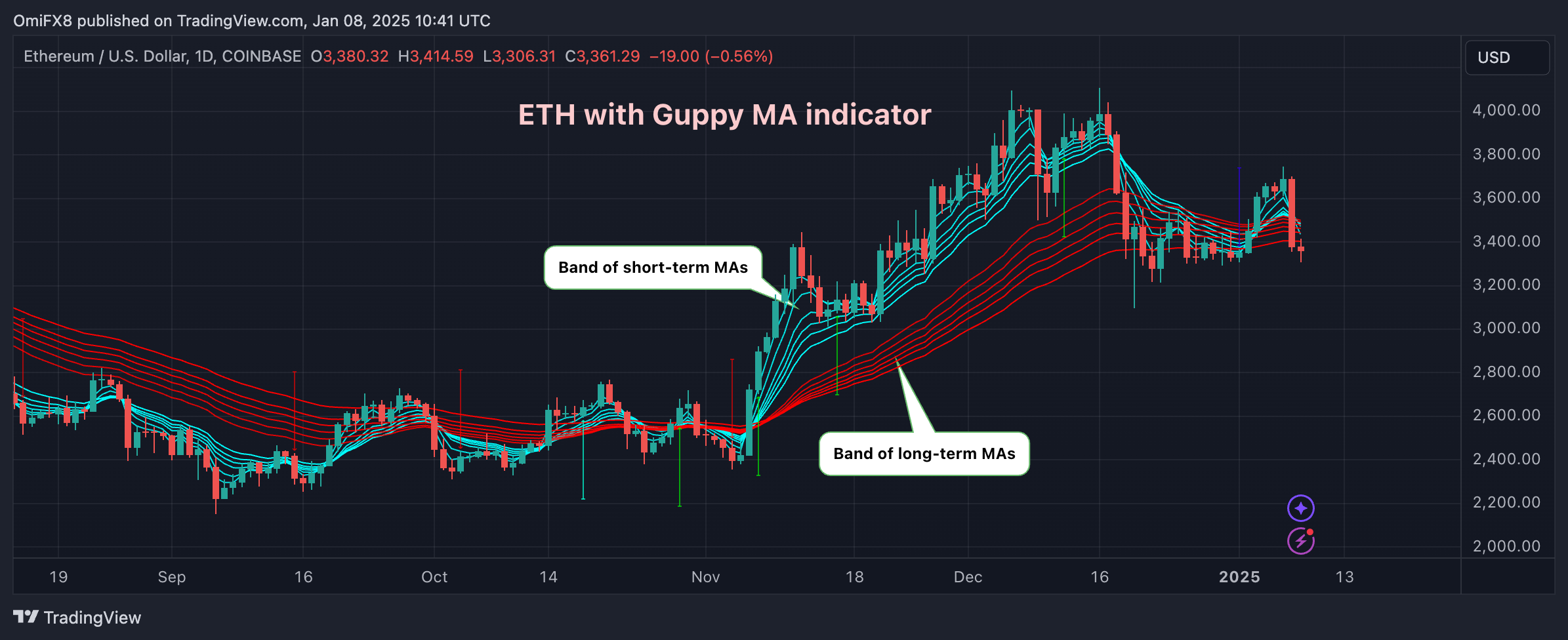

This analysis suggests that Ethereum, frequently described as an ‘internet bond,’ may soon display a bearish trend due to its staking rewards resembling fixed income. Notably, a significant technical analysis tool, the “Guppy Multiple Moving Average Indicator,” is on the verge of indicating a bearish signal for Ethereum (take a look at the Technical Analysis section).

The current events are taking place amidst growing worries about U.S. inflation and its impact on market rate fluctuations. On Wednesday, data was disclosed showing an uptick in U.S. service sector growth in December, with prices reaching their peak since the year 2023.

The disclosure of minutes from the December meeting on Wednesday, suggesting fewer anticipated interest rate reductions, might contribute to a more cautious market atmosphere and bolster the U.S. dollar. Furthermore, we can anticipate some responses to the ADP payrolls report, although this data may not always align precisely with the official payroll figures, which will be released on Friday.

Make sure you jot down the date on your planner. A notable talk by Chris Waller from the Federal Reserve is coming up, and it could provide insights into whether his views align with those of his peers about potential inflated inflation rates. Keep a close eye out!

What to Watch

- Crypto

- Jan. 8: Bybit terminates withdrawal and custody services to nationals or residents of the French Territories.

- Jan. 8: Xterio (XTER) to create and distribute new tokens in token generation event.

- Jan. 9, 1:00 a.m.: Cronos (CRO) zkEVM mainnet upgrades to ZKsync’s latest release.

- Jan. 12, 10:30 p.m.: Binance will halt Fantom token (FTM) deposits and withdrawals and delist all FTM trading pairs. FTM tokens will be swapped for S tokens at a 1:1 ratio.

- Jan. 15: Derive (DRV) token generation event.

- Jan. 15: Mintlayer version 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling native BTC cross-chain swaps.

- Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is set to start on Binance, featuring pairs like S/USDT, S/BTC, and S/BNB.

- Macro

- Jan. 8, 8:30 a.m.: Fed Governor Christopher J. Waller is giving a speech, “Economic Outlook,” at the Lectures of the Governor Event, in Paris, France. Livestream link.

- Jan. 8, 2:00 p.m.: The Fed releases the minutes of the Dec. 17-18 Federal Open Market Committee (FOMC) meeting.

- Jan. 9, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 4. Initial Jobless Claims Est. 210K vs. Prev. 211K.

- Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

- Nonfarm payrolls Est. 160K vs. Prev. 227K.

- Unemployment rate Est. 4.2% vs Prev. 4.2%.

- Jan. 10, 10:00 a.m.: The University of Michigan releases January’s Michigan Consumer Sentiment (Preliminary). Est. 74.5 vs. Prev. 74.0.

Token Events

- Governance votes & calls

- No major events scheduled.

- Unlocks

- Jan. 8: Flare to unlock 1.61% of its circulating supply, worth $43.78 million.

- Jan. 8: Optimism to unlock 0.33% of its OP circulating supply, worth $8.1 million.

- Jan. 11: Aptos to unlock 1.13% of its APT circulating supply, worth $104.73 million.

- Jan. 12: Axie Infinity to unlock 1.45% of its circulating supply, worth $14.08 million.

- Token Launches

- Jan. 10: Lava Network (LAVA) to be listed on KuCoin and Bybit at 5 a.m.

- Jan. 10: Bybit to delist FTM (FTM) at 5 a.m..

Token Talk

By Shaurya Malwa

Crypto gaming projects are onboarding AI Agents amid the hype.

In a recent announcement, Illuvium, a gaming franchise built on Ethereum, revealed plans to incorporate the artificial intelligence (AI) technology from Virtuals Protocol into its three games: Overworld, Arena, and Zero. This integration aims to boost the actions of non-player characters (NPCs) within these games.

Notably, Virtuals Protocol is renowned for its AI agent, AiXBT, which utilizes the G.A.M.E framework to develop more lively and interactive NPCs. This enhancement will positively impact questing, storytelling, and player-NPC interactions.

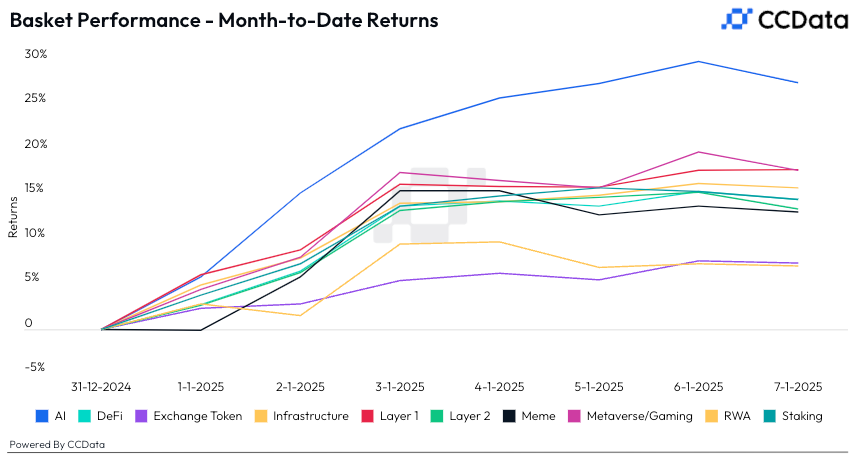

In recent months, the sector focusing on AI agents has seen unprecedented growth in the crypto world, outperforming gains made by bitcoin, memecoins, and decentralized finance tokens in December.

Virtuals Protocol leads the market in terms of AI Agent creation tools, enabling users to create their own AI agent, program it, and even float a token associated with it on open markets.

Games that utilize cryptocurrency and blockchain have been thought of as promising growth areas for some time, but they haven’t yet achieved widespread success in a practical sense. Artificial Intelligence enthusiasts, though, believe this technology could lead to more interactive, entertaining games with intelligent non-player characters (NPCs), better player retention, and even the management of in-game assets or strategies to provide passive income for players and holders.

Might the chosen route foster a rise in the acceptance and appraisal of gaming tokens? Only time will reveal the answer during the upcoming months.

Derivatives Positioning

- Most large-cap tokens, excluding BTC and BCH, have experienced a decline in futures open interest alongside their spot prices. This suggests that the price drop was led by unwinding of longs and not necessarily fresh shorts.

- The annualized one-month basis in ETH CME futures has dropped to a two-month low of 8.22%. BTC’s basis has dropped to 6.79%, denting the appeal of cash and carry trades.

- Front-end BTC and ETH options skews show a decline in call bias, suggesting that short-term bullish sentiment is diminishing. Options expiring in February and beyond maintain a bullish bias.

- Options flows, however, have been mixed for BTC, with demand for downside protection in ETH.

Market Movements:

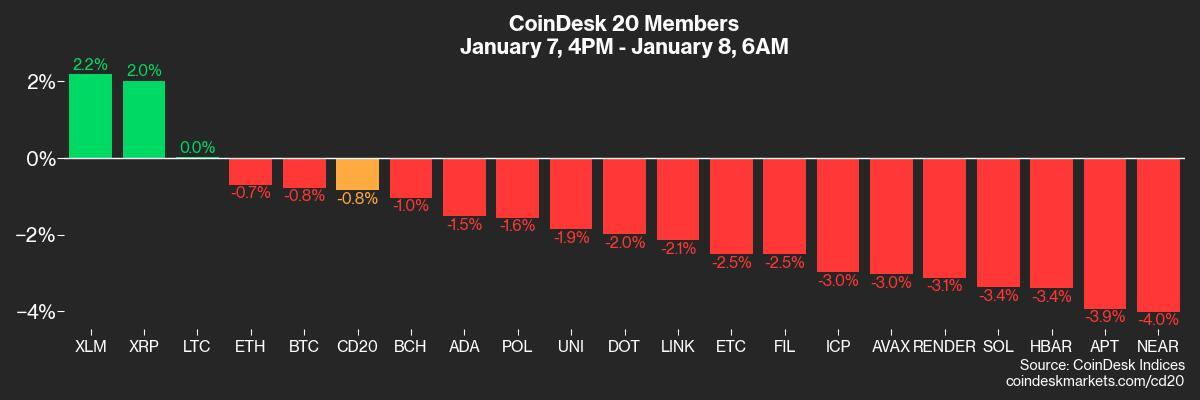

- BTC is down 1.9% from 4 p.m. ET Tuesday to $94,688.17 (24hrs: -5.83%)

- ETH is down 1.96% at $3,327.97 (24hrs: -8.57%)

- CoinDesk 20 is down 0.79% to 3,442.47 (24hrs: -7.1%)

- Ether staking yield is down 6 bps to 3.14%

- BTC funding rate is at 0.03% (10.95% annualized) on Binance

- DXY is up 0.34% at 108.91

- Gold is up 0.41% at $2667.5/oz

- Silver is up 1.25% to $30.83/oz

- Nikkei 225 closed -0.26% at 39,981.06

- Hang Seng closed -0.86% at 19,279.84

- FTSE is up 0.22% at 8,263.76

- Euro Stoxx 50 is up 0.36% at 5,029.83

- DJIA closed -0.42% to 42,528.36

- S&P 500 closed -1.11% at 5,909.03

- Nasdaq closed -1.89% at 19,489.68

- S&P/TSX Composite Index closed +0.18% at 25,635.73

- S&P 40 Latin America closed -0.28%% at 24,929.9

- U.S. 10-year Treasury is unchanged at 4.69%

- E-mini S&P 500 futures are up 0.33% to 5,973.75

- E-mini Nasdaq-100 futures are up 0.37% to 21,438.25

- E-mini Dow Jones Industrial Average Index futures are up 0.31% at 42,936.00

Bitcoin Stats:

- BTC Dominance: 57.95

- Ethereum to bitcoin ratio: 0.035

- Hashrate (seven-day moving average): 796 EH/s

- Hashprice (spot): $58.2

- Total Fees: 7.3 BTC/ $724,162

- CME Futures Open Interest:

- BTC priced in gold: 36.0 0z

- BTC vs gold market cap: 10.24%

Basket Performance

Technical Analysis

- The chart shows ether’s price and the guppy multiple moving averages (GMMA) indicator, which combines two groups of moving averages (MAs) with different periods to gauge trend strength and changes.

- The green band, representing short-term MAs, is about to cross below the red band of long-term MAs, confirming a bearish shift in momentum.

Crypto Equities

- MicroStrategy (MSTR): closed on Tuesday at $341.43 (-9.93%), down 0.77% at $338.61 in pre-market.

- Coinbase Global (COIN): closed at $264.33 (-8.14%), up 0.25% at $264.98 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$28.25 (-5.3%).

- MARA Holdings (MARA): closed at $19.07 (-7.2%), down 1.26% at $18.83 in pre-market.

- Riot Platforms (RIOT): closed at $12.41 (-3.72%), down 1.05% at $12.28 in pre-market.

- Core Scientific (CORZ): closed at $14.12 (-6.61%), up 0.85% at $14.24 in pre-market.

- CleanSpark (CLSK): closed at $10.71 (-6.3%), down 0.75% at $10.63 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.35 (-6.88%).

- Semler Scientific (SMLR): closed at $55.24 (-6.28%).

- Exodus Movement (EXOD): closed at $39.31 (-0.98%).

ETF Flows

Spot BTC ETFs:

- Daily net flow: $52.4 million

- Cumulative net flows: $36.94 billion

- Total BTC holdings ~ 1.138 million.

Spot ETH ETFs

- Daily net flow: -$86.8 million

- Cumulative net flows: $2.68 billion

- Total ETH holdings ~ 3.653 million.

Overnight Flows

Chart of the Day

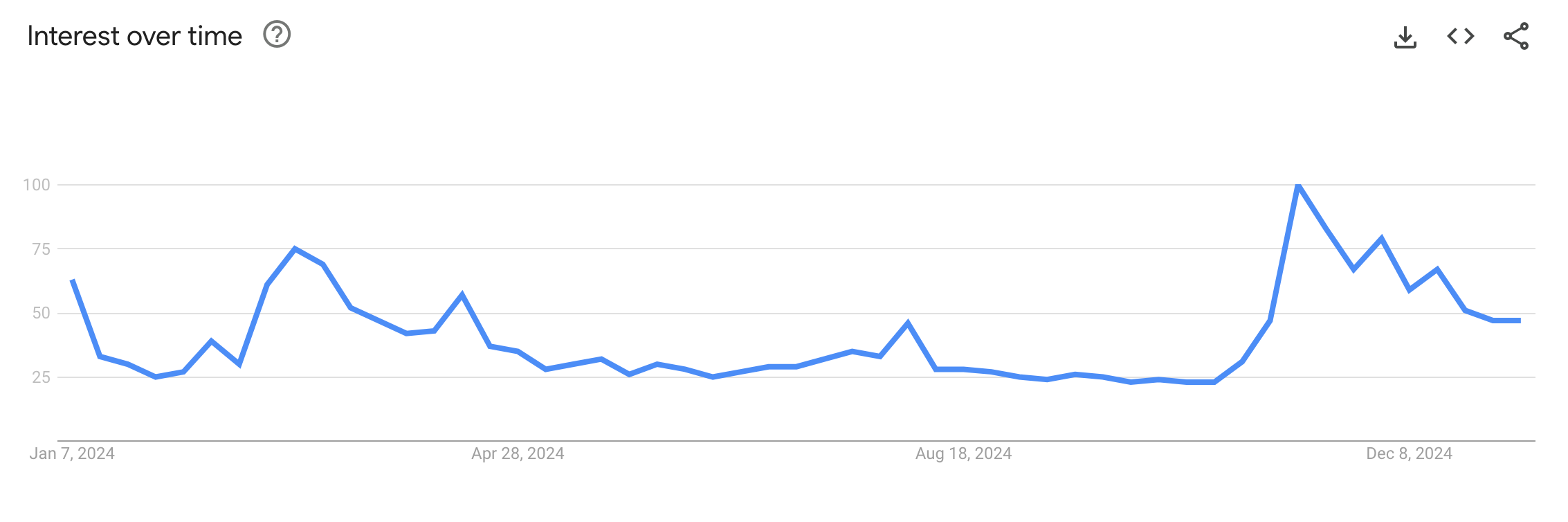

- Google Trends, used to measure retail interest in popular topics, currently reports a value of under 50 for the U.S.-wide search for ‘Bitcoin’ during the past 12 months.

- The sharp decline from the peak of value of 100 seen in November indicates the euphoria has fizzled out, leaving the market in a much healthier state.

In the Ether

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- DAG PREDICTION. DAG cryptocurrency

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2025-01-08 15:05