What to know:

As someone who has been closely observing and participating in the ever-evolving world of cryptocurrencies for years now, I find myself constantly amazed by the pace at which this sector is growing. Today’s report is particularly intriguing, with Bitcoin breaking new ground while the 10-year Treasury note seems to be challenging its own boundaries.

By Omkar Godbole (All times ET unless indicated otherwise)

If you had been eagerly anticipating a peaceful Christmas without your computer, hoping that Bitcoin would gradually increase in value as the year drew to a close, I’m afraid those expectations have been shattered. It seems that the Federal Reserve has put an end to those plans.

Initially, remarks by Chair Jerome Powell indicating that the central bank may not be involved in President-elect Donald Trump’s proposed bitcoin reserve have left traders seeking such a move feeling uncertain. They might choose to wait and see before making any moves, which could lead to a decrease in market activity until Trump assumes office on January 20th. This could weaken the demand side of the market until then.

The second issue at hand pertains to projected interest rates. Federal officials predict that there will be only two instances of rate increases in the year 2025. They believe that the standard lending rate could decline to approximately 3.9% within a year from its current range of 4.25% – 4.5%. This represents an adjustment of 0.5 percentage points upward compared to an earlier prediction of 3.40%.

As a crypto investor, I’ve been contemplating on the potential impact of recent economic data on the current market trends. If this data suggests persistent inflation and a robust labor market, there could be swift skepticism about reducing interest rates below 4%. This scenario has sparked apprehensions among analysts like ING that long-term interest rates, such as the 10-year yield, might be undervalued due to being too low.

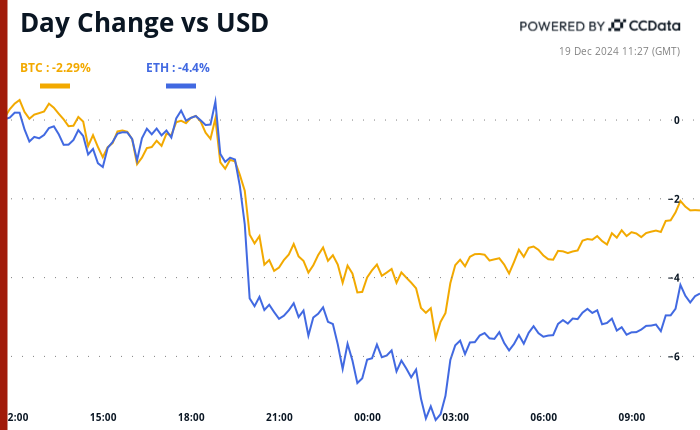

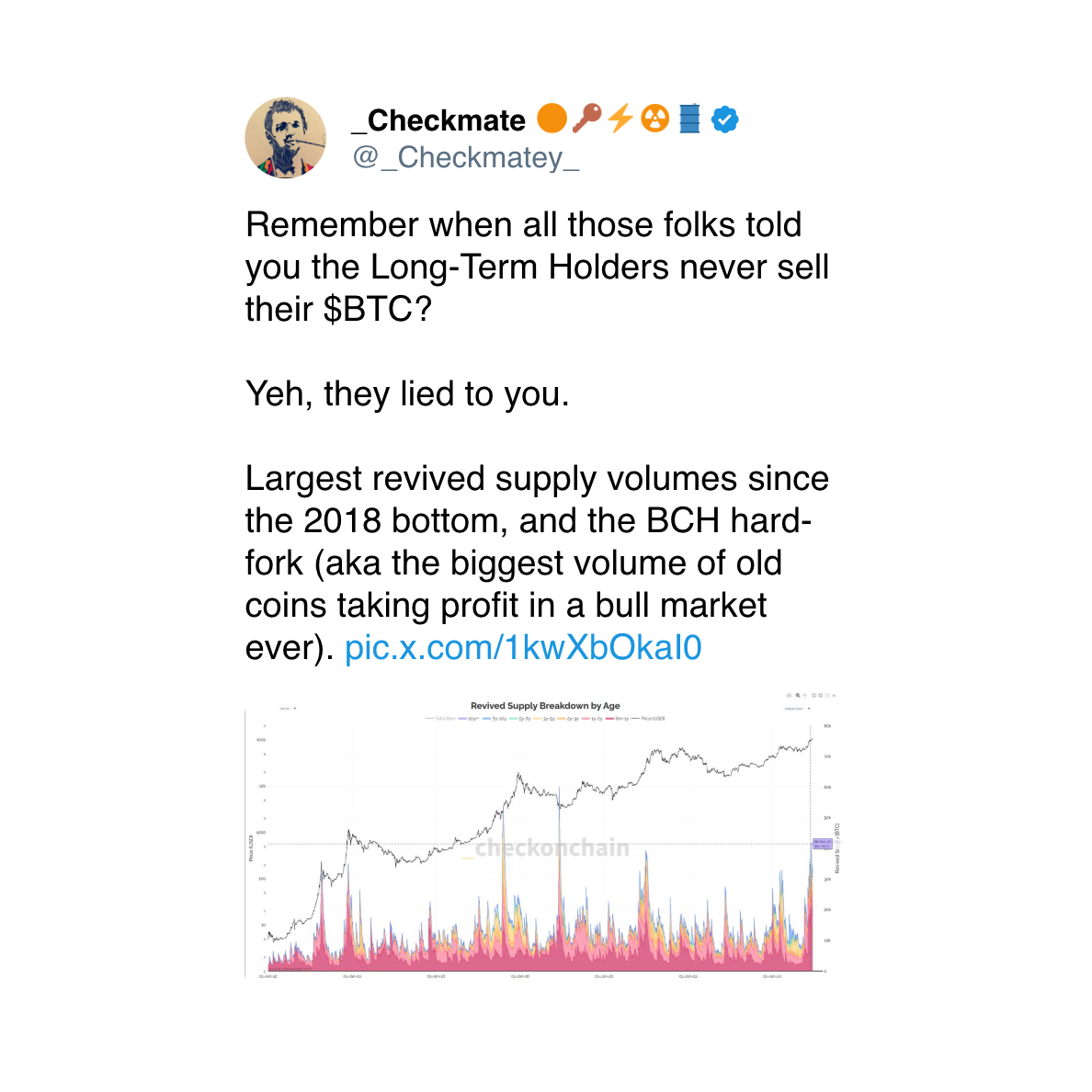

It’s worth noting that after a 14-month slide, the 10-year yield has suddenly increased, mirroring bitcoin’s surge from $30,000 to over $100,000. If this upward trend in yields continues, it could boost existing market strength and potentially initiate a broader decline in risk assets, such as Bitcoin. Last night, Bitcoin dropped below $100,000, causing a ripple effect that also affected other market sectors.

1) The surge in yield rates presents unique challenges for ether, which is frequently referred to as a “digital bond,” offering an annualized staking return of approximately 3%. This trend diminishes the argument for a prolonged increase in the ETH–BTC exchange rate. Furthermore, the persistent dip in riskier assets such as the Australian and New Zealand dollars, along with other emerging market currencies, partly due to concerns about China’s economy, suggests prudence.

Even though significant declines of around 20% or higher often occur during cryptocurrency market uptrends, the general perspective continues to be optimistic.

In the future, we can expect increased market fluctuations due to the anticipation of Donald Trump’s presidency. While there might be some temporary chaos, the overall forecast for Bitcoin and Ether in the long run is positive, according to analyst Valentin Fournier from BRN.

Amidst economic uncertainty, traders might find safety in high-return cryptocurrencies such as Ethena’s USDe, which provides approximately 12% returns. Anonymous analyst OxJeff proposes that these market dips could be ideal moments to invest in digital tokens tied to AI-driven blockchain systems. Noteworthy options to keep an eye on include AI16Z, ZEREBRO, VIRTUAL, MODE, and DOLOS. Keep your eyes open!

Token Events

- Governance votes & calls

- Lido floats Aragon Vote 182, including proposed limits, treasury swaps (Lido Stonks) limit, and reward address change. The vote is live.

- Airdrops

Token Talk

By Shaurya Malwa

Memecoins and AI tokens lead Binance users’ trading activity.

2025 is anticipated to see AI tokens shining brightly, as approximately one-quarter (24%) of respondents in a survey involving 27,000 Binance users foresee them driving market growth the following year. Memecoins are not too far off, with about 19% expecting their increase next year. Currently, these tokens are amusing, popular, and among the most held crypto assets, owned by 16% of Binance users – a figure that surpasses even Bitcoin at 14%.

The study revealed that approximately 45% of participants were fresh entrants, having entered the market in 2024 and admitting they were still navigating the market. Around 40% have been active for between one to five years. The majority aren’t heavily invested in crypto, as 44% of respondents reported having less than 10% of their funds allocated to it. While not many are risking their entire farm on crypto, a significant number trade regularly, with nearly a third engaging in daily trading activities.

While there’s no denying that the crypto industry can be exciting, a significant number of participants are hoping for a shift towards more maturity and practicality in the coming year. Approximately 19% of the respondents predict tighter cryptocurrency regulations within the next 12 months, while 16% expect increased involvement from traditional financial institutions and institutional investors. Furthermore, 17% are optimistic about the broader use of blockchain technology in practical, real-world scenarios.

Derivatives Positioning

- The panic from the overnight sell-off has faded, and BTC and ETH calls expiring on Dec. 27 and beyond are back to trading at a premium relative to puts. However, the overall bias is still considerably weaker than it was earlier this month.

- A large put spread involving strikes $3.7K and $3.4K has been lifted

- Perpetual futures open interest has dropped in most major coins, including ETH, in the last 24 hours, a sign the decline has been led by the unwinding of bullish bets rather than fresh longs. BTC’s open interest has increased 3% in 24 hours, with cumulative volume delta indicating dominance of sellers.

Market Movements:

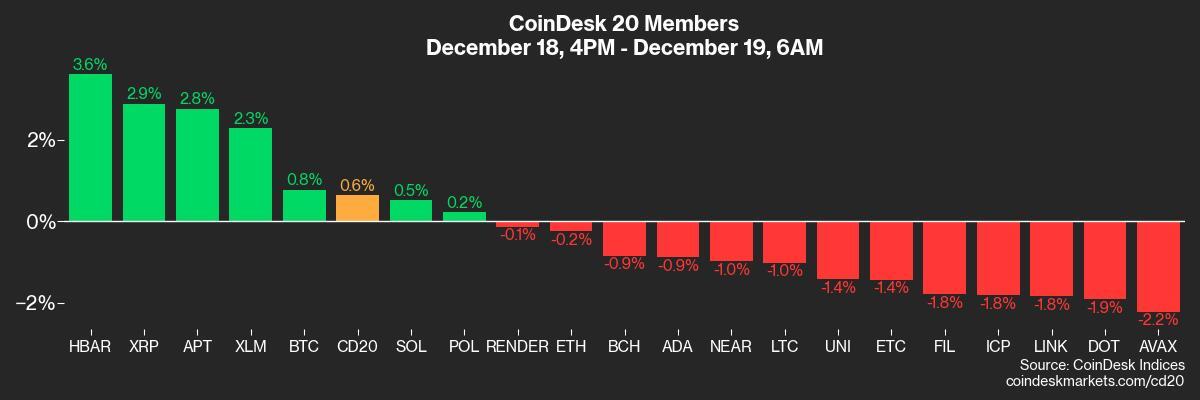

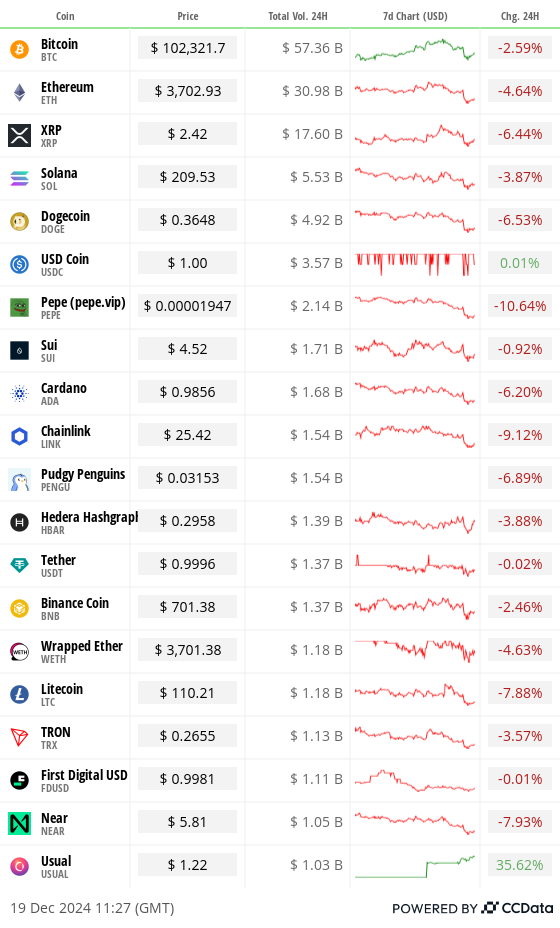

- BTC is up 1.5% from 4 p.m. ET Wednesday to $102,532.08 (24hrs: -2.59%%)

- ETH is up 0.49% at $3,711.07 (24hrs: -4.64%)

- CoinDesk 20 is up 1% to 3,683.74 (24hrs: -4.39%)

- Ether staking yield is down 6 bps to 3.12%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is down 0.11% at 107.91

- Gold is unchanged at $2,638.3/oz

- Silver is down 1.12% to $30.07/oz

- Nikkei 225 closed -0.69% at 38,813.58

- Hang Seng closed -0.56% at 19,752.51

- FTSE is down 1.37% at 8,086.92

- Euro Stoxx 50 is down 1.69% at 4,873.36

- DJIA closed on Wednesday -2.58% to 42,326.87

- S&P 500 closed -2.95% at 5,872.16

- Nasdaq closed -3.56% at 19,392.69

- S&P/TSX Composite Index closed -2.24% at 24,557.00

- S&P 40 Latin America closed -4.44% at 2,179.31

- U.S. 10-year Treasury was is up 0.02% at 4.54%

- E-mini S&P 500 futures are up 0.43% to 5,897.5

- E-mini Nasdaq-100 futures are up 1.66% to 21,570.75

- E-mini Dow Jones Industrial Average Index futures are down 0.39% at 42,486.00

Bitcoin Stats:

- BTC Dominance: 58.33% (24hrs: +0.14%)

- Ethereum to bitcoin ratio: 0.036 (24hrs: -0.14%)

- Hashrate (seven-day moving average): 784 EH/s

- Hashprice (spot): $60.55

- Total Fees: $1.4M

- CME Futures Open Interest: 212,620 BTC

- BTC priced in gold: 38.7 oz

- BTC vs gold market cap: 11.02%

- Bitcoin sitting in over-the-counter desk balances: 409,600 BTC

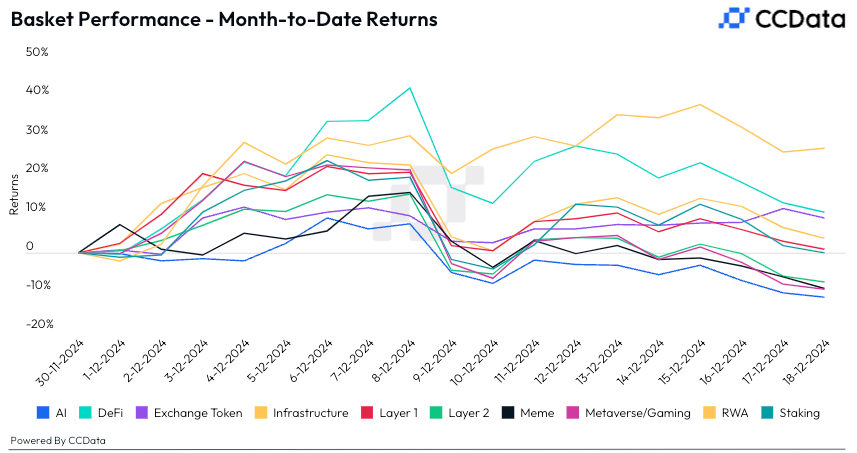

Basket Performance

Technical Analysis

- BTC’s daily chart shows the broader outlook remains constructive despite Wednesday’s drop, as 50-, 100- and 200-day simple moving averages remain stacked one above the other, trending north.

- The confluence of the 50-day SMA and Dec. 5’s swing low between $90,000 and $91,500 is the key area to watch out in case the pullback deepens.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $349.64 (-9.52%), up 4.95% at $366.95 in pre-market.

- Coinbase Global (COIN): closed at $279.86 (-10.2%), up 3.42% at $289.44 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$26.31 (-8.23%)

- MARA Holdings (MARA): closed at $21.61 (-12.15%), up 3.66% at $22.40 in pre-market.

- Riot Platforms (RIOT): closed at $11.95 (-14.46%), up 3.93% at $12.42 in pre-market.

- Core Scientific (CORZ): closed at $14.45 (-9.86%), up 1.87% at $14.72 in pre-market.

- CleanSpark (CLSK): closed at $11.32 (-8.41%), up 4.95% at $11.88 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.89 (-10.85%), up 6.14% at $27.48 in pre-market.

- Semler Scientific (SMLR): closed at $65.02 (-12.99%), up 7.64% at $69.99 in pre-market.

- Exodus Movement (EXOD): closed at $53.10 (+36.3%), unchanged in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $275.3 million

- Cumulative net inflows: $36.98 billion

- Total BTC holdings ~ 1.141 million.

Spot ETH ETFs

- Daily net inflow: $2.5 million

- Cumulative net inflows: $2.46 billion

- Total ETH holdings ~ 3.563 million.

Overnight Flows

Chart of the Day

- The yield on the U.S. 10-year Treasury note looks to have broken out above a 14-month channel.

- More gains might weigh over risk assets.

In the Ether

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-19 15:21