What to know:

As someone who has navigated the tumultuous seas of the cryptocurrency market for years now, I must say that the recent market swoon has been a rollercoaster ride to remember. It’s not every day you see your life savings plummet by 50% in a matter of days!

By Omkar Godbole (All times ET unless indicated otherwise)

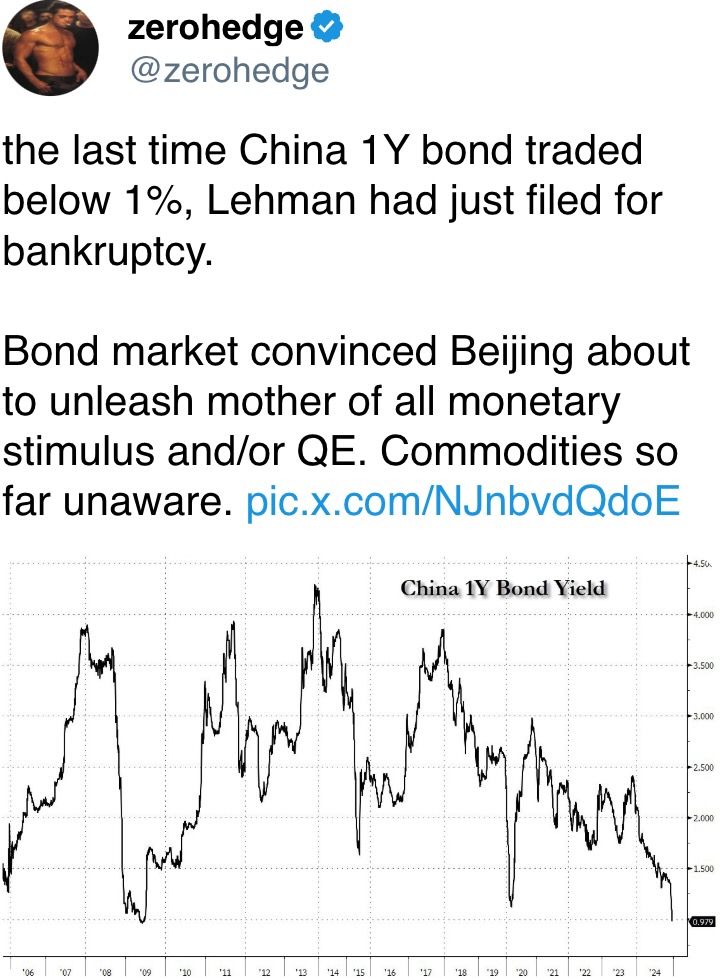

Recently, we’ve been closely monitoring developments in the Far East, and today’s updates from the Chinese bond market underscore this focus. Specifically, China’s one-year government bond yield dipped below 1% for the first time since the Financial Crisis of 2008, contributing to a continuing yearly decline. Moreover, the benchmark 10-year yield fell to 1.7%.

What does this mean for risky investments such as Bitcoin, which dropped significantly last night? There are two main reasons to be hopeful. Firstly, the persistent decrease in yields indicates that China might need to implement more robust stimulus policies than those implemented earlier this year.

Jeroen Blokland, head of the Blokland Smart Multi-Asset Fund, summarized it this way: “China’s economic struggles are likely to persist, leading their government to follow a common path for mature economies: increasing public spending, tolerating larger budget deficits and debt, and lowering interest rates close to zero.

Additionally, this event in China adds complexity. It prompts us to ponder the concern expressed by Federal Reserve Chairman Jerome Powell about interest rates, which caused bitcoin’s price to drop from around $105,000 to $95,000.

As a researcher, I am observing that China, often referred to as the world’s factory, is grappling with an increasingly severe bout of deflation. This prolonged downturn in prices, last seen in the late 1990s, could potentially impact key economic indicators such as Producer Price Index (PPI) and Consumer Price Index (CPI), not just within China but also globally, including in significant trading partners like the U.S.

Earlier this year, BNP Paribas pointed out that China’s economic activity has played a role in reducing the main inflation rate in both the Eurozone and the United States by approximately 0.1% and 0.5% for core goods inflation.

As a crypto investor, I ponder over the implications of Powell’s statements about persistent inflation. It seems his apprehensions could potentially be misplaced, leading me to wonder if he will indeed adhere strictly to the two rate cuts he hinted at for 2025 as suggested on Wednesday. Some analysts predict there might be more adjustments in store.

According to Dan Tapiero, CEO and CIO of 10T Holdings, the fears regarding inflation are unwarranted. In fact, U.S. interest rates remain excessively high, and an increase in liquidity is imminent, which could lead to a rise in Bitcoin’s value. These remarks were made on X, and they seem to hint at China’s decreasing bond yields.

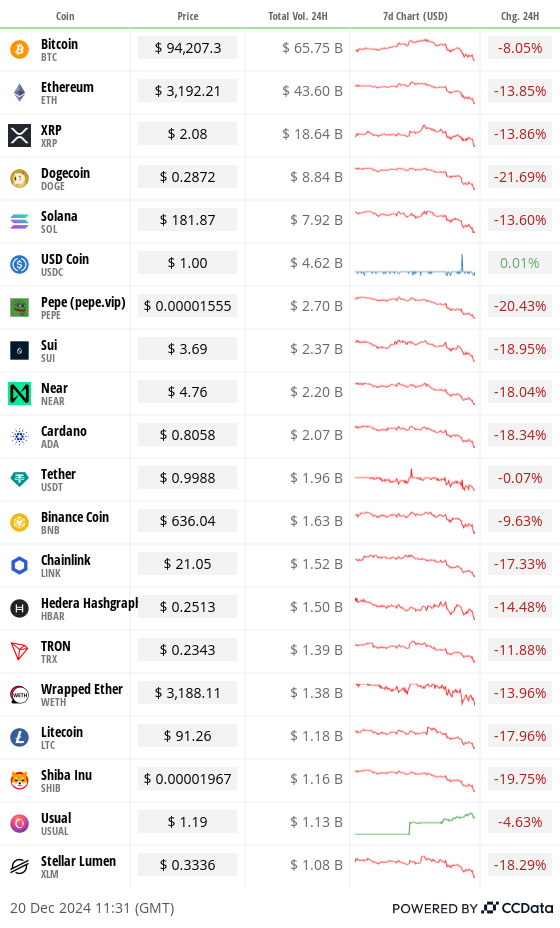

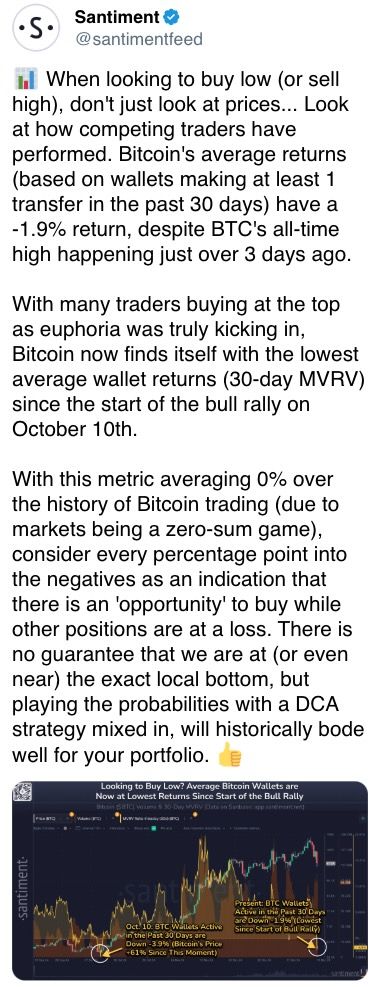

Currently, the markets aren’t favoring a bullish perspective as Bitcoin has fallen below $95,000, Ethereum has dipped to around $3,200, and all the top 100 cryptocurrencies are showing losses. Additionally, futures linked to the S&P 500 are declining by 0.5%, suggesting a downward opening and an ongoing risk-off trend following the Fed’s announcement.

If the Federal Reserve’s favored inflation indicator, the Core Personal Consumption Expenditures (PCE), shows a higher-than-anticipated increase today, it could potentially intensify sentiment. This might lead financial markets to assume that another interest rate reduction will not occur this year, leaving only one potential cut for 2025. Keep a close eye!

Token Events

- Token Launches

Token Talk

By Shaurya Malwa

Fartcoin (FART) just touched $1 billion.

The scatologically named AI agent token jumped over $1.1 billion in market cap early Friday even as the broader market saw a second-straight day of losses, becoming one of the few tokens in the green.

The surge of FART (Financial Asset Risky Tokens) isn’t just about economic factors; it’s also deeply rooted in human psychology. In an investment landscape where traditional, solid investments are struggling, FART has emerged as a symbol of the absurd, representing a playful resistance against the dismal financial predictions that dominate the headlines.

This platform enables users to post memes or jokes on similar topics, with the chance to receive tokens as reward. It has a distinctive trading system that makes a digital fart noise every time a transaction takes place.

Individuals are putting their money into something not just because of the potential usefulness or innovative technology, but for the instant gratification and camaraderie that comes with it – like sharing a laugh over a token whose very name can lighten up the weight of the day.

While humor might play a role, it’s not the only aspect at hand. This token belongs to the burgeoning field of AI agent cryptocurrencies, which assert that their AI-driven characters can execute tasks on blockchain systems independently, all while being associated with a meme-inspired brand.

Derivatives Positioning

- The BTC one-month basis has pulled back to 10% on the CME while the three-month basis has dropped to around 12% on offshore exchanges. ETH futures display similar behavior.

- Most major tokens are showing negative perpetual cumulative volume deltas for the past 24 hours, a sign of net selling pressure. DOGE has seen the most intense selling.

- Front-end BTC and ETH show a strong put bias, but calls expiring on Jan. 31 and beyond continue to trade at a premium.

- Block trades in options leaned slightly bearish, with large transactions involving a standalone long position in the $75K put expiring on Jan. 31.

- Someone sold a large amount of ETH $3K put.

Market Movements:

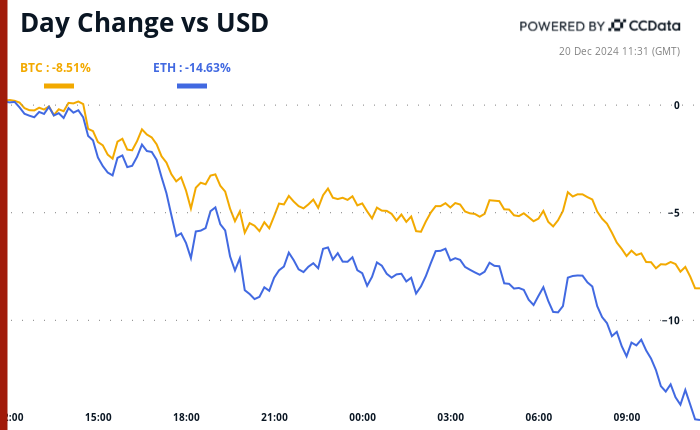

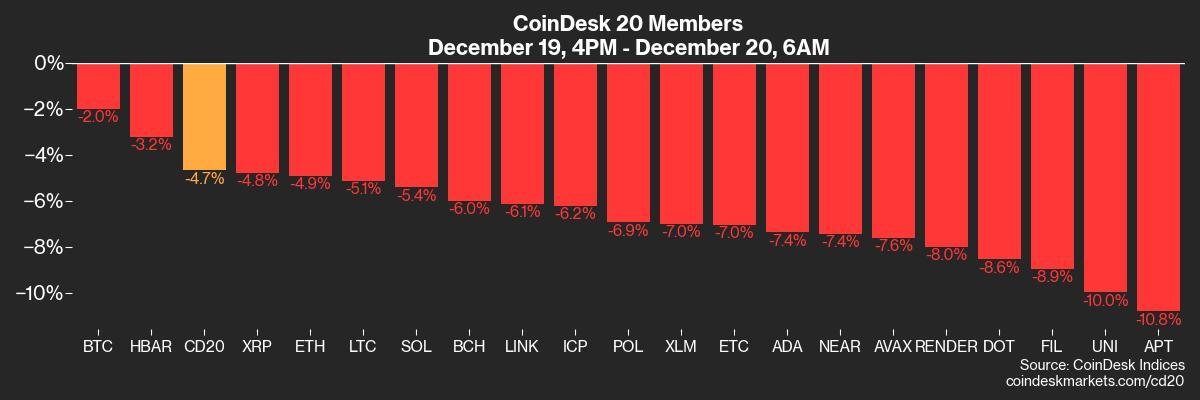

- BTC is down 2.55% from 4 p.m. ET Thursday to $94,947.95 (24hrs: -7.92%)

- ETH is down 5.41% at $3,232.19 (24hrs: -14.06%)

- CoinDesk 20 is down 5.14% to 3,196.80 (24hrs: -13.12%)

- Ether staking yield is up 7 bps to 3.19%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is down 0.25% at 108.14

- Gold is up 1.11% at $2,621.1/oz

- Silver is up 0.65% to $29.28/oz

- Nikkei 225 closed -0.29% at 38,701.90

- Hang Seng closed -0.16% at 19,720.70

- FTSE is down 1.05% at 8,020.42

- Euro Stoxx 50 is down 1.36% at 4,812.53

- DJIA closed on Thursday unchanged at 42,342.24

- S&P 500 closed unchanged at 5,867.08

- Nasdaq closed -0.1% at 19,372.77

- S&P/TSX Composite Index closed -0.58% at 24,413.90

- S&P 40 Latin America closed +0.40% at 2,187.98

- U.S. 10-year Treasury is down 0.03% at 4.54%

- E-mini S&P 500 futures are down 0.79% to 5,822.25

- E-mini Nasdaq-100 futures are unchanged at 21,112.25

- E-mini Dow Jones Industrial Average Index futures are down 0.53% at 42,134.00

Bitcoin Stats:

- BTC Dominance: 59.21 (24hrs: +0.58%)

- Ethereum to bitcoin ratio: 0.034 (24hrs: -1.37%)

- Hashrate (seven-day moving average): 785 EH/s

- Hashprice (spot): $62.5

- Total Fees: $2.3 million

- CME Futures Open Interest: 211,885 BTC

- BTC priced in gold: 36.3 oz

- BTC vs gold market cap: 10.34%

- Bitcoin sitting in over-the-counter desk balances: 409,300 BTC

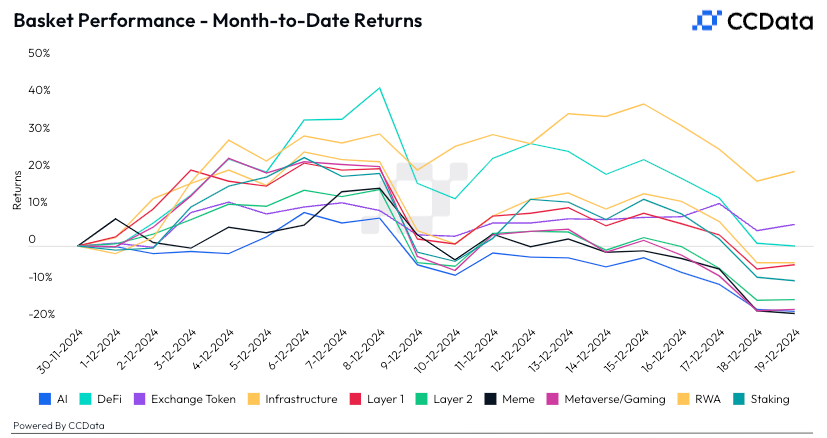

Basket Performance

Technical Analysis

- BTC is fast approaching the lower end of the recent expanding channel pattern.

- A UTC close below the support line could entice more chart-driven sellers to the market, potentially leading to a deeper drop to $80,000, a level widely watched after the U.S. election.

Crypto Equities

- MicroStrategy (MSTR): closed on Thursday at $326.46 (-6.63%), down 5.35% at $309.00 in pre-market.

- Coinbase Global (COIN): closed at $273.92 (-2.12%), down 5.65% at $258.43

in pre-market. - Galaxy Digital Holdings (GLXY): closed at C$24.75 (-5.93%)

- MARA Holdings (MARA): closed at $20.37 (-5.74%), down 4.52% at $19.41 in pre-market.

- Riot Platforms (RIOT): closed at $11.19 (-6.36%), down 4.2% at $10.72 in pre-market.

- Core Scientific (CORZ): closed at $14.48 (+0.21%), down 4.42% at $13.84 in pre-market.

- CleanSpark (CLSK): closed at $10.91 (-3.62%), down 3.94% at $10.48 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.45 (-5.56%), down 2.66% at $23.80 in pre-market.

- Semler Scientific (SMLR): closed at $61.34 (-5.66%), down 4.22% at $58.75 in pre-market.

- Exodus Movement (EXOD): closed at $50.95 (-4.05%), unchanged in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$671.9 million

- Cumulative net flows: $36.310 billion

- Total BTC holdings ~ 1.142 million.

Spot ETH ETFs

- Daily net flow: -$60.5 million

- Cumulative net flows: $2.406 billion

- Total ETH holdings ~ 3.565 million.

Overnight Flows

Chart of the Day

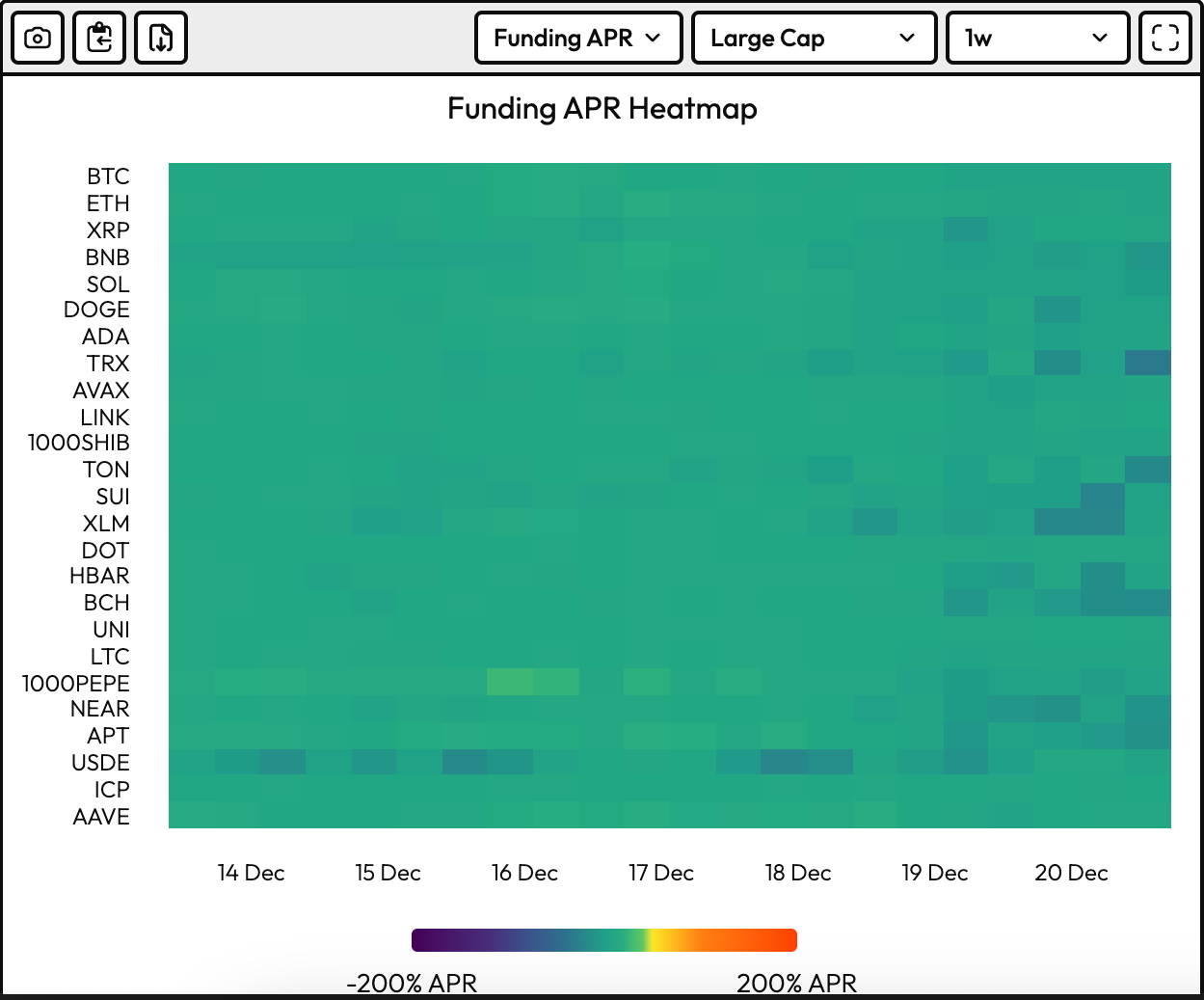

- The chart shows annualized perpetual funding rates for major cryptocurrencies have been reset to healthier levels below 10%.

- The market swoon has cleared out over-leveraged bets.

In the Ether

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-20 15:05