What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

Investment assets are seeing a decrease in value due to the strong performance of the U.S. dollar index and Treasury bond yields following the impressive nonfarm payrolls report on Friday, and the Palisades Fires potentially impacting the insurance industry and certain property and casualty (P&C) companies.

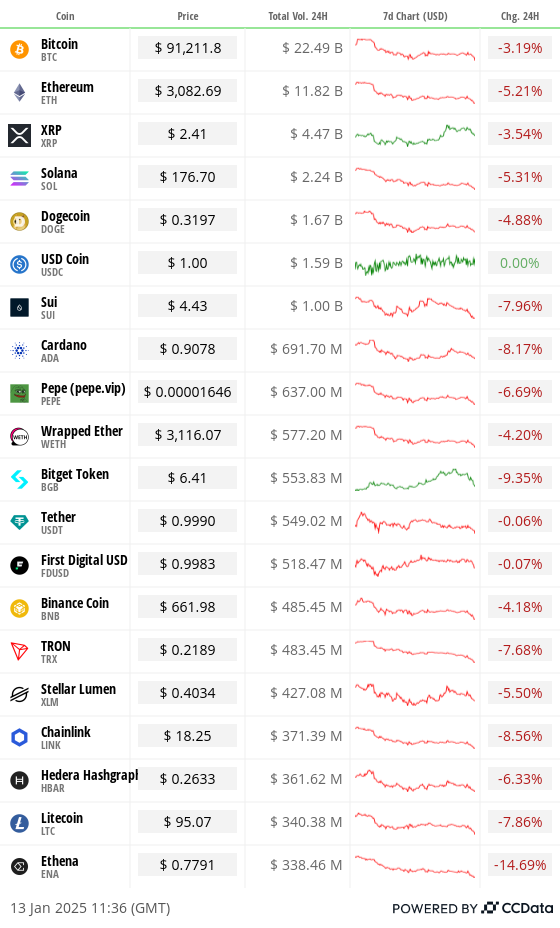

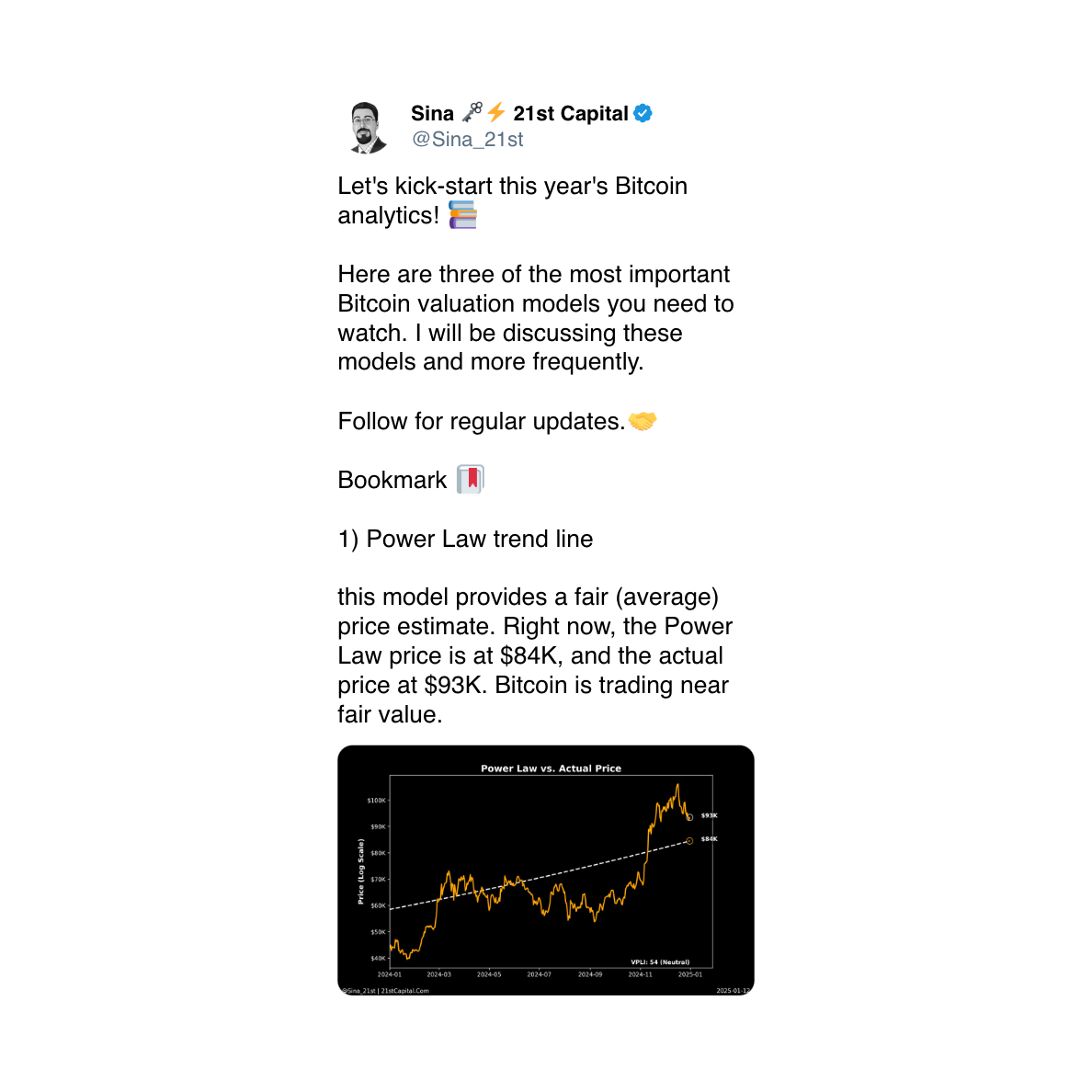

1) Bitcoin (BTC) has fallen by 2%, currently being traded within the significant support levels of $90,000 and $93,000. Other cryptocurrencies are experiencing larger decreases as expected. Ethereum (ETH) has reached its lowest point since December 21st, and the overall bearish sentiment is impacting XRP‘s technical bullish prospects (refer to TA section). There have been indications that whales might have amassed XRP over the weekend through Upbit in South Korea. Artificial Intelligence (AI) coins are the worst-performing sector over the past 24 hours. In traditional markets, futures related to the S&P 500 suggest a negative opening, while there’s continued volatility downside in the British pound and emerging market currencies.

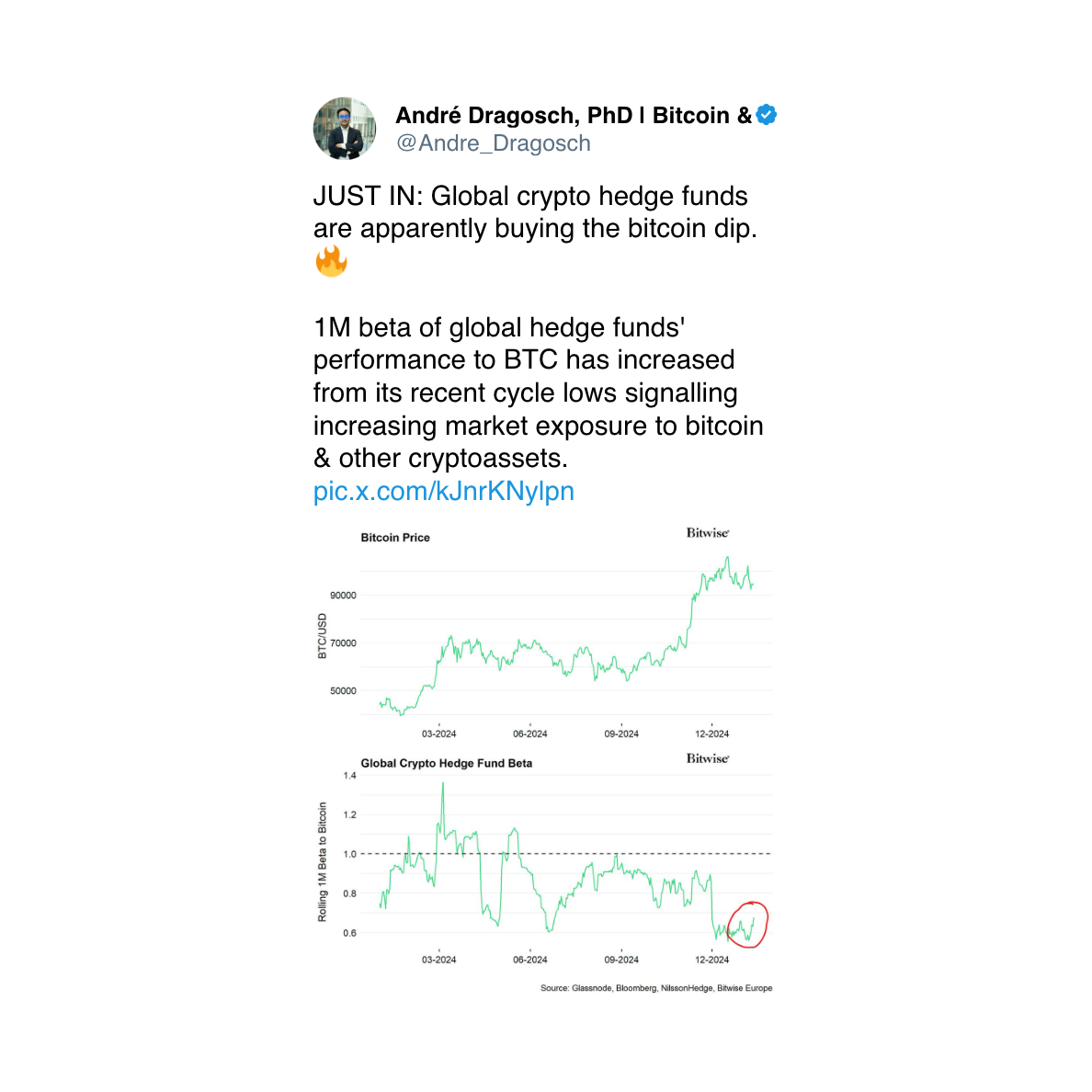

Despite the general caution in the market, Michael Saylor hinted at a possible future bitcoin buy from MicroStrategy, as he provided an update on their bitcoin acquisition tracker. If it were to alleviate the negative market sentiment, that would be another matter. As Valentin Fournier, analyst at BRN, stated, MicroStrategy’s recent $100 million purchase on Monday had minimal overall impact on the market, but underscores the company’s continuous interest in bitcoin.

Under similar circumstances, it seems the likelihood of Bitcoin dropping below its key support level could increase significantly. This is due to certain financial institutions predicting that the Federal Reserve’s rate-cutting phase has ended, and Bank of America even hinting at the possibility of an interest rate rise in the future. According to various analysts, the general expectation is that the price will initially dip to around $70,000, followed by another bullish surge.

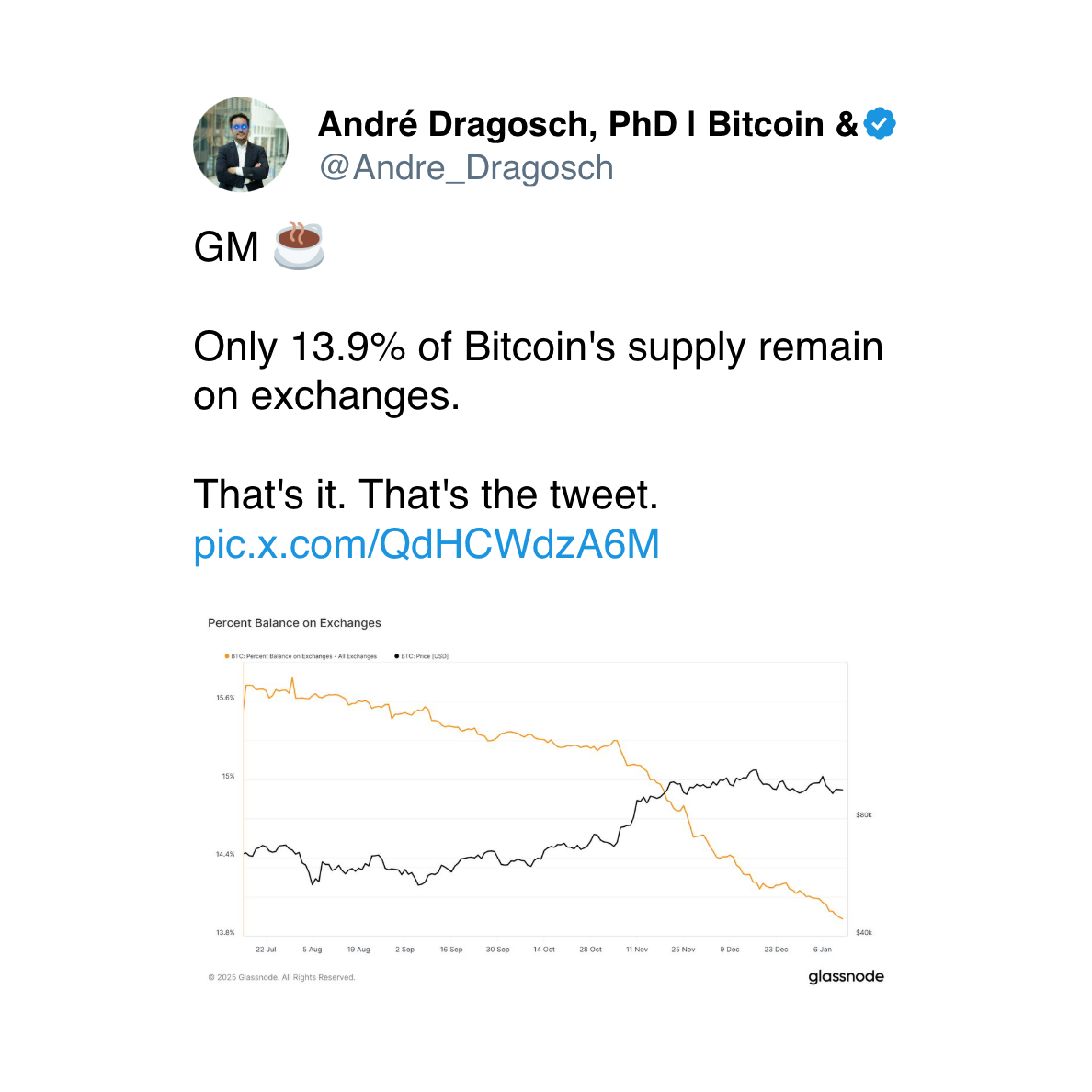

As a researcher, I’ve been monitoring the 30-day moving average of the difference in Bitcoin prices between Coinbase and Binance, which historically tends to indicate significant price peaks. Interestingly, this differential has recently dropped to its lowest point since at least 2019, suggesting a potential decrease in domestic demand for Bitcoin.

In the upcoming weeks, attention in the cryptocurrency market may center around President-elect Donald Trump’s inauguration on January 20th and the ongoing distribution of claims with FTX, as suggested by Coinbase Institutional.

What to Watch

- Crypto

- Jan. 13: Solayer (LAYER) “Season 1” airdrop snapshot for staking participants, liquidity providers, and partner ecosystem users.

- Jan. 15: Derive (DRV) to create and distribute new tokens in token generation event.

- Jan. 15: Mintlayer version 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling native BTC cross-chain swaps.

- Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is set to start on Binance, featuring pairs like S/USDT, S/BTC, and S/BNB.

- Jan. 17: Primary listing of SOLV, the native token of Solv Protocol.

- Macro

- Jan. 13, 2:00 p.m.: The U.S. Department of the Treasury releases December 2024’s Monthly Treasury Statement report. Monthly budget deficit Est. $62B vs. Prev. $367B.

- Jan. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s PPI data.

- PPI MoM Est. 0.3% vs. Prev. 0.4%.

- Core PPI MoM Est. 0.3% vs. Prev. 0.2%.

- Core PPI YoY Est. 3.7% vs. Prev. 3.4%.

- PPI YoY Est. 3.4% vs. Prev. 3%.

- Jan. 14, 8:55 a.m.: U.S. Redbook YoY for the week ending on Jan. 11. Prev. 6.8%.

- Jan. 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Consumer Price Index Summary.

- Core Inflation Rate MoM Est. 0.2% vs. Prev. 0.3%.

- Core Inflation Rate YoY Est. 3.3% vs. Prev. 3.3%.

- Inflation Rate MoM Est. 0.3% vs. Prev. 0.3%.

- Inflation Rate YoY Est. 2.8% vs. Prev. 2.7%.

- Jan. 16, 2:00 a.m.: The U.K.’s Office for National Statistics November 2024’s GDP estimate.

- GDP MoM Est. 0.2% vs. Prev. -0.1%.

- GDP YoY Prev. 1.3%.

- Jan. 16, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ending on Jan. 11. Initial Jobless Claims Est. 214K vs. Prev. 201K.

- Jan. 17, 5:00 a.m.: Eurostat releases December 2024’s Eurozone inflation data.

- Inflation Rate MoM Final Est. 0.4% vs Prev. -0.3%.

- Core Inflation Rate YoY Final Est. 2.7% vs. Prev. 2.7%.

- Inflation Rate YoY Final Est. 2.4% vs. Prev. 2.2%.

Token Events

- Governance votes & calls

- Aave community propose adjusting borrow rate for its GHO stablecoin from 10.50% to 9.00%.

- Aavegotchi DAO has an active vote on modifying ETH sell ladder parameters due to “significant underperformance” by ETH.

- Jan. 14: Mantra community call with its co-founder

- Unlocks

- Token Launches

- No major token launches scheduled today.

- Jan. 15: Derive (DRV) will launch, with 5% of supply going to sENA stakers.

Jan. 16: Solayer (LAYER) to host token sale followed by five months of points farming. - Jan. 17: Solv Protocol (SOLV) to be listed on Binance.

Token Talk

By Oliver Knight

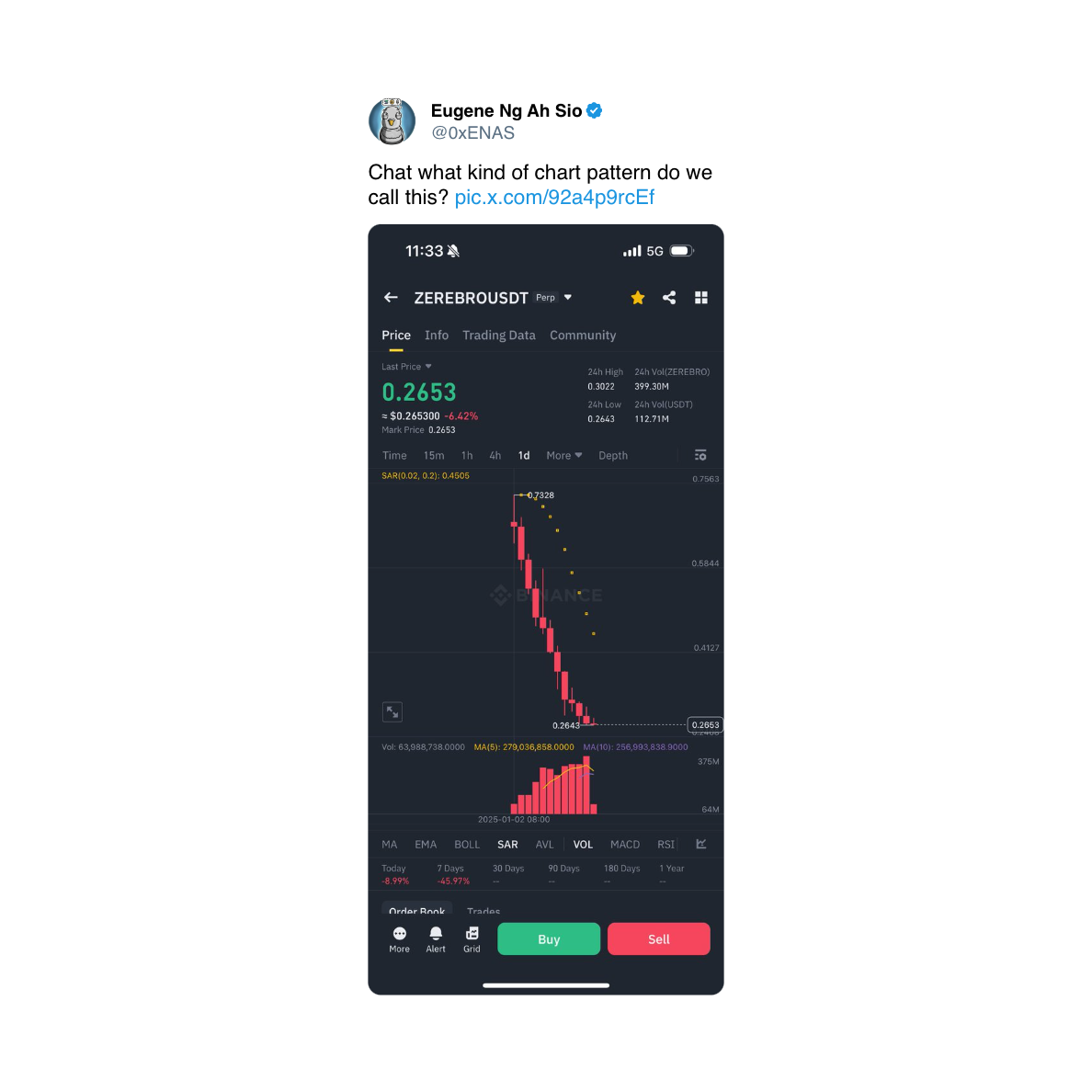

- AI agent tokens have suffered a deep correction, with ai16z now trading at $1.02, down more than 60% from its record high set on Jan. 2. Virtual Protocol’s native token (VIRTUAL) has slumped a further 16% over the past 24-hours to compound its recent downtrend, it is now trading at $2.40 after surging to $5.04 on Jan. 2.

- NFT project Azuki has announced the launch of ANIME, a Japanese cartoon-themed token that will distribute 50.5% of the token’s supply to the Azuki community. Azuki employees and advisors will receive 15.62% of supply bound by a vesting schedule.

- Ethena’s ENA token has dropped by 11.4% over the past 24-hours as funding rates for ETH, which Ethena’s business model relies on, is beginning to fall into neutral territory. Ethena still offers a yield of 11% on its stablecoin although it’s unclear how long that rate is sustainable if funding rates continue to fall.

- Ether whales have begun offloading ETH at a loss with one trader selling 10,070 ETH for $33 million at a $1 million loss, the wallet still holds $45 million, on-chain data reported by Lookonchain shows.

Derivatives Positioning

- Perpetual funding rates for TRX, AVAX, SUI and TON have flipped negative, indicating a bearish shift in positioning.

- Front-end risk reversals show a strong bias for BTC and ETH protective put options in line with the risk-off sentiment in markets. Screen traders have bought puts at $92K, $90K and $87K in BTC.

- There is notable negative dealer gamma in the range of $90K and $93K, which means these entities might trade in the market’s direction to hedge book, bolstering the move. A similar dynamic exists between $3.2K and $3,450. in the ETH market.

- BTC and ETH DVOLs, measuring 30-day expected price swings, remain in the familiar ranges for the month.

Market Movements:

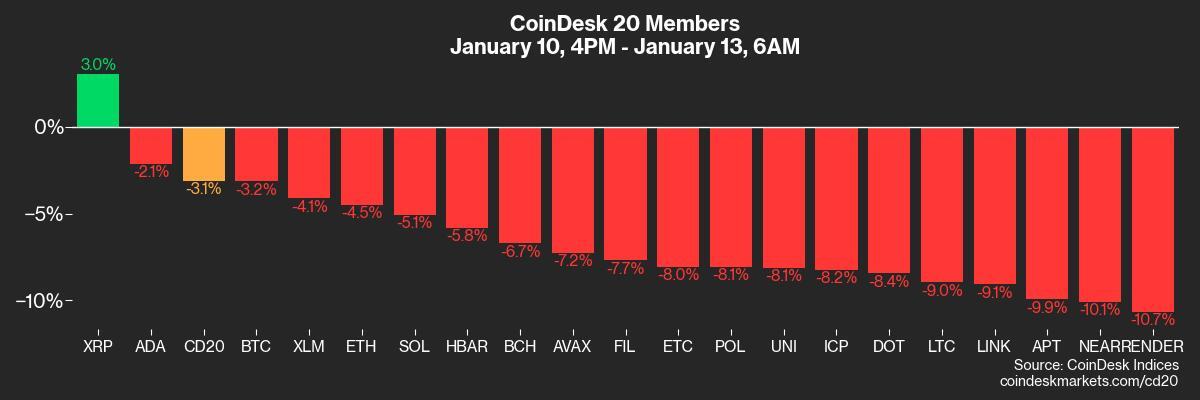

- BTC is down 3.12% from 4 p.m. ET Friday to $91,392.04 (24hrs: -2.67%)

- ETH is down 4.78% at $3,109.45 (24hrs: -4.05%)

- CoinDesk 20 is down 2.15% to 3,310.23 (24hrs: -3.08%)

- Ether staking yield is down 16 bps to 2.97%

- BTC funding rate is at -0.0149% (-16.27% annualized) on Binance

- DXY is up 0.35% at 110.04

- Gold is down 0.13% at $2,705.00/oz

- Silver is down 0.84% to $30.83/oz

- Nikkei 225 closed -1.05% at 39,190.40

- Hang Seng closed -1% at 18,874.14

- FTSE is down 0.25% at 82,27.71

- Euro Stoxx 50 is up 0.92% at 4,931.47

- DJIA closed on Friday -1.63% to 41,938.45

- S&P 500 closed -1.54% at 5,827.04

- Nasdaq closed -1.63% at 19,161.63

- S&P/TSX Composite Index closed -1.22% at 24,767.70

- S&P 40 Latin America closed -1.31% at 2,181.96

- U.S. 10-year Treasury is up 2 bps at 4.79%

- E-mini S&P 500 futures are down 0.78% to 5,820.50

- E-mini Nasdaq-100 futures are down 1.18% to 20,767.25

- E-mini Dow Jones Industrial Average Index futures are down 0.48% at 42,022.00

Bitcoin Stats:

- BTC Dominance: 58.39

- Ethereum to bitcoin ratio: 0.033

- Hashrate (seven-day moving average): 775 EH/s

- Hashprice (spot): $54.6

- Total Fees: 4.89 BTC/ $462,582

- CME Futures Open Interest: 175,380 BTC

- BTC priced in gold: 34.5 oz

- BTC vs gold market cap: 9.82%

Technical Analysis

- XRP broke out of a descending triangle pattern Friday, signaling a resumption of the broader uptrend from early November lows.

- However, BTC’s macro-led risk-off action has pushed XRP back to the breakout point.

- Watch out for a potential move back inside the triangle, as failed breakouts are powerful bearish reversal signals.

Crypto Equities

- MicroStrategy (MSTR): closed on Friday at $327.91 (-1.14%), down 4.95% at $311.67 in pre-market.

- Coinbase Global (COIN): closed at $258.78 (-0.47%), down 4.42% at $247.34 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.07 (+0.82%)

- MARA Holdings (MARA): closed at $17.86 (-2.62%), down 4.59% at $17.04 in pre-market.

- Riot Platforms (RIOT): closed at $12.00 (-0.17%), down 5.25% at $11.37 in pre-market.

- Core Scientific (CORZ): closed unchanged at $14.04, down 3.49% at $13.55 in pre-market.

- CleanSpark (CLSK): closed unchanged at $10.09, down 5.05% at $9.58 in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.11 (-0.17%), down 4.41% at $22.09 in pre-market.

- Semler Scientific (SMLR): closed at $51.36 (+2.33%), down 7.03% at $47.75 in pre-market.

- Exodus Movement (EXOD): closed unchanged at $37.77, down 9.98% at $34.00 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: $-149.4 million

- Cumulative net flows: $36.22 billion

- Total BTC holdings ~ 1.137 million.

Spot ETH ETFs

- Daily net flow: $-68.5 million

- Cumulative net flows: $2.45 billion

- Total ETH holdings ~ 3.582 million.

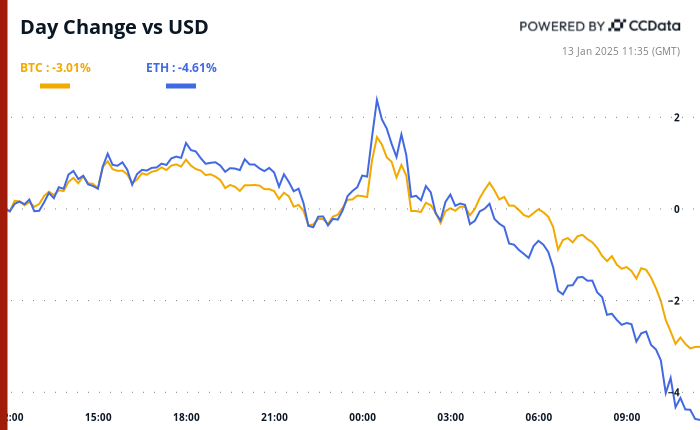

Overnight Flows

Chart of the Day

- The number of Bitcoin Runes minted daily has slipped to a record lows, averaging less than 10% of last year’s figures.

- Runes was a big hit among traders following the Bitcoin blockchain’s reward halving in April last year.

- Runes is similar to Ordinals, allows people to “etch” and mint tokens on-chain.

In the Ether

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-13 15:06