What to know:

- Cryptos were sizably lower across the board on Monday.

- Above $100,000 earlier in the day, bitcoin retreated to the low $96,000 area by late in the U.S. session.

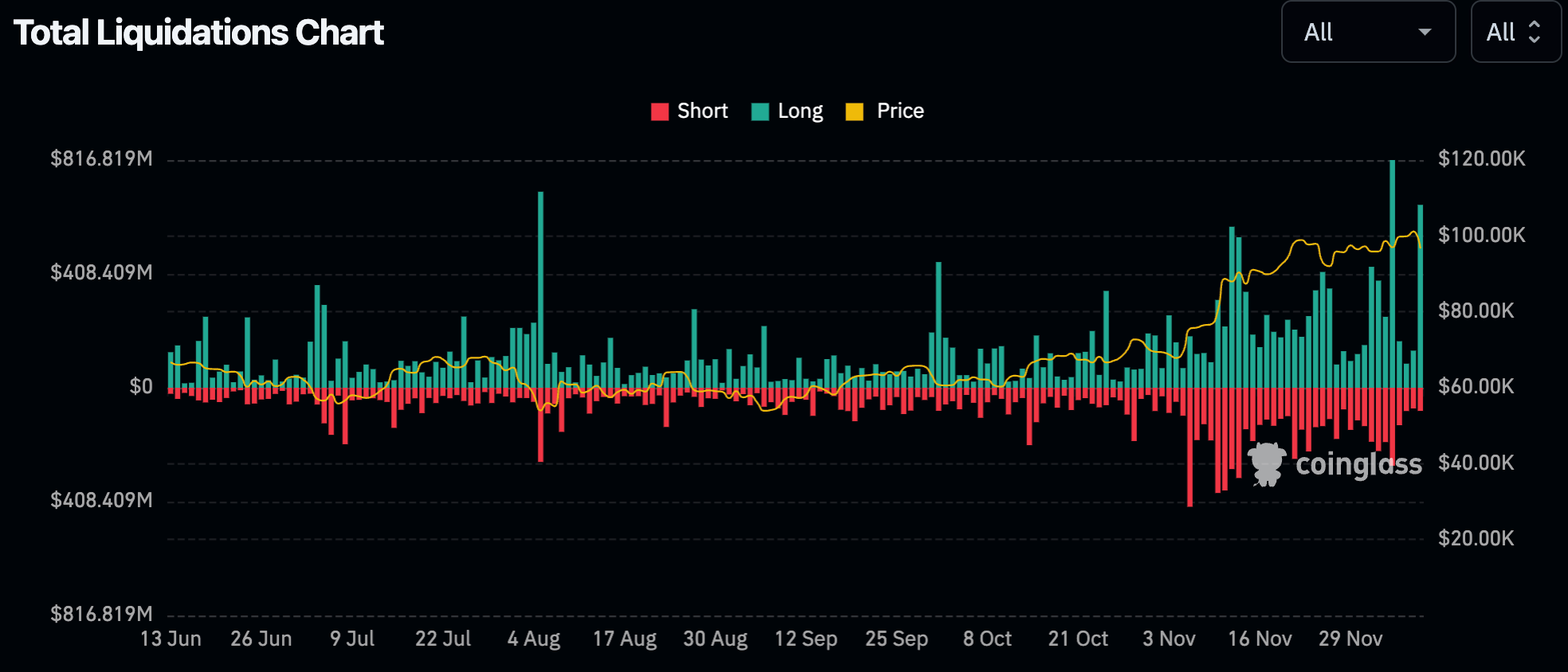

- The move sparked $750 million in liquidations of leverage derivative positions.

As a seasoned crypto investor with battle-tested nerves and a portfolio that has weathered numerous market storms, I find myself standing steadfast amidst the current crypto market turbulence. The recent dip, reminiscent of the wild west, is just another chapter in this exciting journey.

Over the weekend, a gradual decline occurred in the cryptocurrency market, which picked up speed during the American evening hours on Monday, resulting in a significant drop across most of the crypto sector.

currently, bitcoin (BTC) has retreated and is now hovering slightly above $95,000, representing a decrease of approximately 5% within the last 24 hours. Meanwhile, ether (ETH) has dropped by 10%, with its price settling at $3,590.

Over the specified period, the comprehensive CoinDesk 20 Index dropped by over 8%, primarily due to substantial declines – approximately 20% each – in the prices of Cardano (ADA), Avalanche (AVAX), and XRP (XRP).

Approximately $750 million in leveraged derivative positions related to all digital assets were closed down over the past day, according to CoinGlass data, with most of these being optimistic wagers. This recent liquidation comes close to matching the scale of the August 5th crash and is slightly less than the dramatic price drop on last Thursday when Bitcoin fell from around $100,000 to $90,000.

10x Research noted in a recent report that there might be a slowdown in the cryptocurrency market’s momentum, as evidenced by decreasing trading volumes on exchanges and significant selling from long-term investors looking to cash in their profits.

10x Research founder Markus Thielen notes that this period might just be a temporary strengthening stage before the bull market resumes. Yet, traders should now closely monitor the performance of their investments, since during this phase not all assets will keep rising.

To successfully move through this market, traders are advised to avoid the less robust areas and instead concentrate on their main, strongly believed investments.

Traders in the options market are increasingly preparing for a price range, rather than a significant increase, in the markets until the end of the year. They’re cashing in on their earlier optimistic predictions and could be extending their positions into early next year, according to a report published by digital asset hedge fund QCP this morning. The authors added that while they still hold a long-term bullish view, the current price is expected to fluctuate within a range for the rest of the holiday season.

Read More

- Why Sona is the Most Misunderstood Champion in League of Legends

- SUI PREDICTION. SUI cryptocurrency

- Square Enix Boss Would “Love” A Final Fantasy 7 Movie, But Don’t Get Your Hopes Up Just Yet

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- House Of The Dead 2: Remake Gets Gruesome Trailer And Release Window

- US Blacklists Tencent Over Alleged Ties With Chinese Military

- Leaks Suggest Blade is Coming to Marvel Rivals Soon

- Why Fortnite’s Most Underrated Skin Deserves More Love

- „It’s almost like spoofing it.” NCIS is a parody of CSI? Michael Weatherly knows why the TV series is viewed this way in many countries

- FIFA Team of the Year Voting: Fans Share Their Hot Takes!

2024-12-10 00:29