What to know:

- The White House crypto summit could trigger heightened trading activity, or at least a good gossip session.

- Rumors suggest Trump may announce a strategic BTC reserve, or perhaps just a new hairstyle.

- Options markets indicate potential volatility in BTC, ETH, and SOL post-summit, which is just a fancy way of saying “hold onto your hats!”

If you plan to disconnect from trading screens this weekend, think twice—unless you enjoy the thrill of missing out on potential chaos. Analysis from the digital assets trading firm STS Digital suggests that Friday’s White House crypto summit could lead to heightened activity, or at least a few raised eyebrows.

U.S. President Donald Trump, who promised a strategic crypto reserve in the lead-up to the November election (because why not?), will host top players from the industry, including Coinbase, Chainlink, and Exodus. It’s like a party, but with more spreadsheets and fewer snacks.

The latest rumor suggests that at the summit, Trump may announce the creation of a strategic bitcoin (BTC) reserve, which is a fancy way of saying he might just throw some coins into a jar and call it a day. This is a shift away from the Sunday disclosure that hinted at a basket of altcoins like XRP, Cardano‘s ADA, and Solana (SOL), along with BTC and ether (ETH) as the core—because who doesn’t love a good basket?

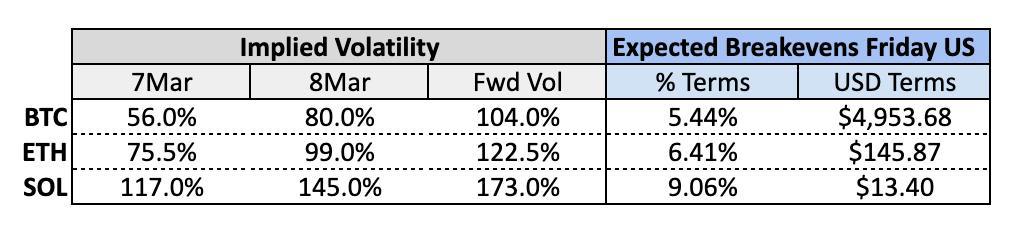

The pricing of BTC, ETH, and SOL options on Deribit suggests traders are bracing for a volatile weekend in the aftermath of the summit. It’s like preparing for a rollercoaster ride, but without the safety harness.

“Options markets are showing the nerves (and illiquidity) going into the weekend and the raft of potentials,” said Jeff Anderson, head of Asia at STS Digital, who clearly enjoys a good metaphor. “The Friday vs Saturday IV [implied volatility] Spread is nearly 25 vols wide across the board with Friday expiries missing the expected variance.” In layman’s terms: it’s going to be a bumpy ride.

Implied volatility, a metric derived from the pricing of options, indicates how much traders expect the asset’s price to fluctuate over a specific period. Options are derivative contracts that give the purchaser the right to buy or sell the underlying asset at a predetermined price at a later date—like a promise, but with more numbers and less sincerity.

Early Thursday, bitcoin options expiring Friday suggested an annualized implied volatility of 56%, while those expiring on Saturday traded at 80% volatility. The 24-point gap indicates expectations for increased price turbulence following Friday’s summit. In other words, expect the unexpected, or just expect to be disappointed—your choice!

A similar pattern was seen in ether and solana options, which are just as unpredictable as a cat on a hot tin roof.

The table shows implied and forward volatilities for BTC, ETH, and SOL and straddle breakevens (expected price swings). It’s like a math problem, but with more drama.

Forward volatility is calculated by comparing the implied volatility of options with different maturities and indicates the expected volatility over the period between the two specified expiration dates, in this case, Friday and Saturday. It’s all very scientific, or at least it sounds that way.

The 105% BTC forward volatility translates to a 5.5% price movement expected between Friday 08:00 UTC and Saturday 08:00 UTC. (Deribit options expire at 08:00 UTC, which is just a fancy way of saying “set your alarms, folks!”)

In other words, BTC could swing nearly $5K in either direction following the summit. ETH and SOL volatilities are pricing a move of $135 and $13, respectively. It’s like a game of financial limbo—how low can you go?

Per Anderson, expectations for large volatility often end up in disappointment. “

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- How to use a Modifier in Wuthering Waves

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-03-06 11:24