Crypto Chaos: When Bitcoin and Altcoins Play Hard to Get

Ever feel like your investment strategy is starring in a cosmic version of “Pin the Tail on the Donkey”? Welcome to the crypto market, where sentiment swings faster than a caffeinated squirrel on a pogo stick. The Fear & Greed Index’s latest reading is 55—neither wildly optimistic nor overwhelmingly terrified, just a comfy, middle-of-the-road sort of “meh.” Last week, we had “Greed” at 65, which basically means folks were rubbing their hands together with all the subtlety of a kid in a candy store. Now, they’re just slightly more cautious, as if they just remembered they forgot to turn off the stove. 🔥

Meanwhile, the grand event of the day: Bitcoin’s ETF approval. Think of it as a shiny new toy that suddenly made everyone act like overexcited puppies—except these puppies had billion-dollar ambitions. Bitcoin decided to rally, causing a dramatic $190 million short liquidation wave—probably because some traders bet against it and how do you say, “Oops”? But wait! The altcoins, being the drama queens of the crypto world, were dealt a far crueler blow: over a billion dollars in long positions liquidated, which is roughly the equivalent of a very expensive piñata party gone wrong. 🎉

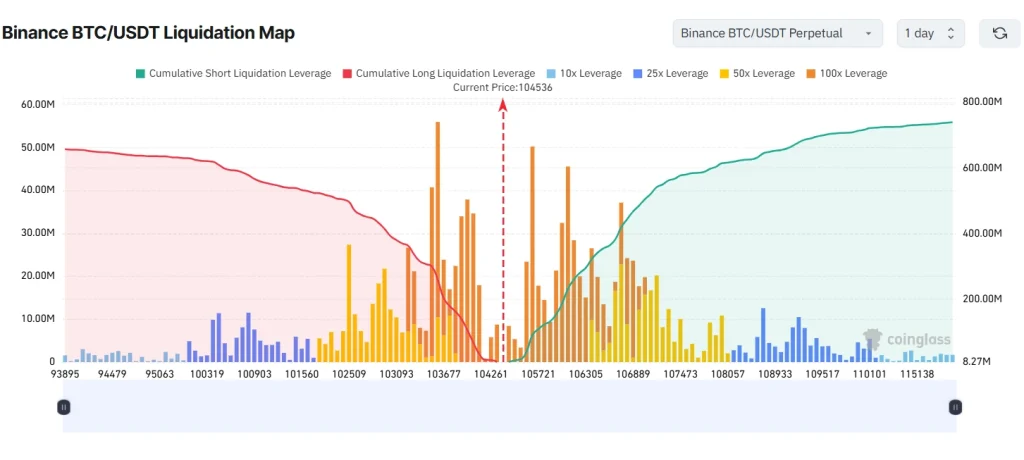

Liquidation Map and Sentiment Trends

Bitcoin’s steady climb has a tendency to send short sellers running for cover—think of them as that one friend who bets against the house and ends up eating their hat as BTC crosses the $100k mark, driven by institutional momentum (or as I like to call it, “Wall Street’s caffeine rush”).

Meanwhile, altcoins are busy doing their best impression of a deflating balloon—long leveraged positions wiped out, hopes dashed on the rocks of reality. Since December 2024, these whiplash-worthy swings have only gotten crazier, making traders look more like contestants on a chaos-themed game show than savvy investors. The Fear & Greed Index’s moods reflect this; when it was in the “Extreme Greed” zone earlier this year, altcoin traders were busy dreaming of riches—only to wake up and find their hopes liquidated faster than you can say “buyer’s remorse”. Now that the mood has cooled to a more ‘meh,’ Bitcoin’s taking a breather while altcoins continue their own version of a liquidation limbo dance. 💃

Curious about where Ethereum is headed? Check out our crystal-ball prediction for ETH through 2025 and beyond—because nothing beats a good gamble when the entire crypto universe feels like it’s starring in a particularly confusing soap opera.

FAQs

What does a Fear & Greed Index of 55 indicate?

It’s the market’s version of “I’m okay, you’re okay”—balanced between cautious and optimistic, like a tightrope walker with a safety net.

Why are altcoins seeing more long liquidations than BTC?

Because traders thought altcoins would moon after the ETF approval. Turns out, their dreams were more fragile than a soap bubble, and the resulting burst was spectacular.

How can traders use this data?

By keeping an eye on sentiment and liquidation trends, observant traders can avoid being the market’s next unwitting victim—like buying tickets to a rollercoaster only to find it’s currently in “loop-de-loop of doom” mode.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to watch the South Park Donald Trump PSA free online

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- 50 Goal Sound ID Codes for Blue Lock Rivals

2025-06-05 11:39