What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

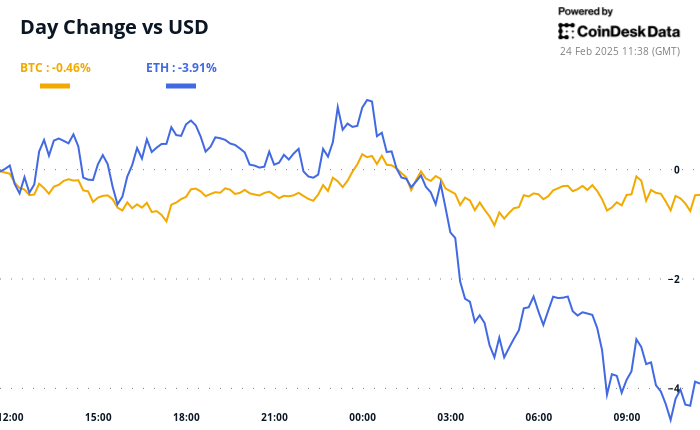

Ah, Bitcoin and ether, those two titans of the digital realm, remain ensconced in their recent trading ranges, as if they were pondering the meaning of existence two days post the $1.5 billion heist of Bybit, a veritable colossus among cryptocurrency exchanges. One might wonder, do they feel the weight of their own worth?

Perpetual funding rates, those fickle indicators, are positive, suggesting a bias towards long positions, as if traders are whispering sweet nothings to the rising prices. Bitcoin options on Deribit, with their bullish inclinations, seem to dance across all time frames, while ether, poor ether, languishes under a cloud of downside bias, a fate it has endured long before the hack. How tragic! 😢

Meanwhile, Volmex Finance’s 30-day bitcoin implied volatility index has plummeted to an annualized 48.45%, the lowest since July, as if the market has taken a deep breath. Ether’s implied volatility, however, has reversed its minor weekend spike, a tale of two cryptocurrencies, each with its own narrative of despair and hope.

In this calm, a sign of market maturity, QCP Capital proclaims, “The price action underscores the growing maturity of the crypto landscape since the FTX collapse in 2022.” Indeed, every crisis has its lessons, and the crypto world seems to be learning, albeit slowly. One can only chuckle at the irony of it all! 😂

Bybit, in a show of resilience, has managed over $6 billion in withdrawals post-hack, filling the void in its ETH reserves. A commendable feat, or merely a band-aid on a gaping wound?

As Mena Theodorou, co-founder of Coinstash, observes, all eyes are now on Solana’s SOL, as Franklin Templeton, that behemoth of asset management, has submitted a spot SOL ETF proposal to the SEC. The anticipation is palpable, with 11.2 million SOL from the FTX estate set to unlock on March 1, a potential harbinger of market volatility. How delightful! 🎉

In a curious twist, President Donald Trump’s decision to audit gold reserves at Fort Knox has stirred the crypto community. “If the gold supply turns out to be lower than expected,” muses Theodorou, “it could reinforce Bitcoin’s case as digital gold.” Ah, the irony of gold and Bitcoin vying for supremacy! 🥇

In traditional markets, the yen continues its ascent against the U.S. dollar, a reminder for risk asset bulls to tread carefully. Stay alert, dear traders!

- Day 2 of 8: ETHDenver 2025 (Denver)

- Feb. 24: RWA London Summit 2025

- Feb. 25: HederaCon 2025 (Denver)

- March 2-3: Crypto Expo Europe (Bucharest, Romania)

- March 8: Bitcoin Alive (Sydney, Australia)

Token Talk

By Francisco Rodrigues

- The audacious perpetrators of the $1.5 billion Bybit hack have turned to the Solana-based token launchpad Pump.fun, attempting to launder their ill-gotten gains. How quaint!

- Pump.fun, in a fit of vigilance, linked a token called “QinShinhuang (500000)” to the hacker(s) after a 60 SOL transfer, only to remove it from its front end. A valiant effort, indeed!

- Meanwhile, Pump.fun is poised to launch its own automated market maker (AMM), a potential blow to the popular Solana-based decentralized exchange Raydium. The drama unfolds! 🎭

Derivatives Positioning

- SOL put options expiring this Friday on Deribit trade at a premium of 7 vol points to calls, reflecting strong downside fears. The market is a fickle mistress!

- Ether options continue to show concerns of downside risk

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- How to use a Modifier in Wuthering Waves

- Basketball Zero Boombox & Music ID Codes – Roblox

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-02-24 15:23