For days now, Bitcoin has been playing the role of the hapless protagonist in a Shakespearean tragedy, tumbling headlong into the abyss with a gusto that would put even the most dramatic thespians to shame. Dropping just shy of $92,000, it appears that the market’s current temperament resembles that of a tantrum-throwing toddler-stubborn, unpredictable, and entirely uncooperative. 💸🙃

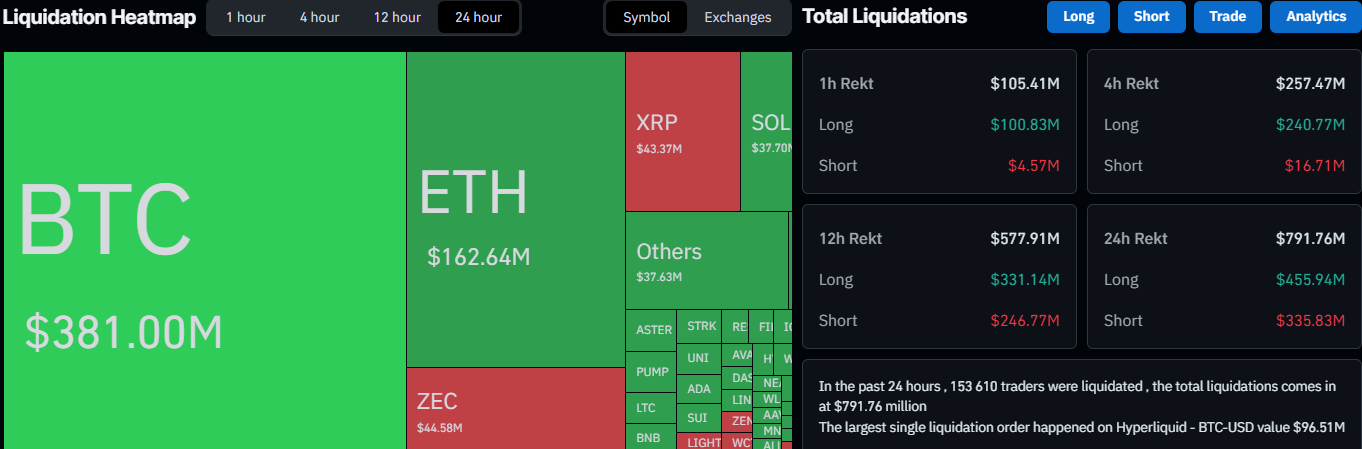

Meanwhile, Ethereum, that once noble contender with lofty ambitions, has also bowed to the merciless tide, slipping below the all-important $3,000 threshold. Traders, riding the leverage rollercoaster, are now crying into their digital beer as liquidations skyrocket-an eye-watering $800 million to be precise. One can only marvel at the spectacle of so many fortunes evaporating in a single afternoon, like a magician’s last trick-only without the applause. 🎩💥

Just last week, Bitcoin was cavorting happily above $100,000-dotting the charts like a starlet. Then, as if on cue, it had a sudden, rude rejection, careening downward in a manner that would make even the most seasoned sailor seasick. Now, it languishes in the mid-$90,000s, the lowest since April, marking seven months of despair. And all this without a villain in sight-no pandemics, no global crises, just the simple, humbling truth: traders leveraged themselves into oblivion because they fancied themselves invincible. 🤦♂️📉

This episode is particularly piquant because, unlike before, there’s no clear external catastrophe to blame. Instead, the culprits are those cheeky traders-those daredevils who over-leveraged as if the market were a free-for-all amusement park. The Kobeissi Letter analysts label this as a bona fide new bear market-an unkind mental image, but perhaps deserved.

And in this global sell-off, Ethereum isn’t spared the fun. Dropping beneath $3,000, it’s now down over 15% weekly and more than 22% in a month, while its smaller cousins-XRP and SOL-also suffered. The leverage used by these traders has been a spectacularly reckless act, with over 150,000 losing everything in a daily clothes-burning ritual. The liquidation total? Nearly $800 million-enough to buy several islands, if you’re feeling particularly extravagant. 🏝️💸

The pièce de résistance of destruction was a single order on Hyperliquid-a gargantuan $96.51 million vanished into thin air, demonstrating once again that when the market whispers “save yourselves,” most traders seem to have misunderstood and instead decided to interpret it as “double down.” Truly, the spectacle continues to astound in its audacity.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- Every Death In The Night Agent Season 3 Explained

- How to Repair the Bronze Gate in Starsand Island

2025-11-17 22:49