On this fateful Friday, the 28th of February, a staggering 58,000 Bitcoin options contracts, valued at a not-so-humble $4.7 billion, are set to expire. One might wonder, is this the moment of reckoning or merely a blip on the radar?

This week’s expiry is not just any ordinary event; it is the end of the month, a time when the market often holds its breath. Yet, the impact on the spot markets is expected to be as minimal as a whisper in a storm, already battered by the tempest of US President Trump’s trade war. Ah, the irony of it all! 😅

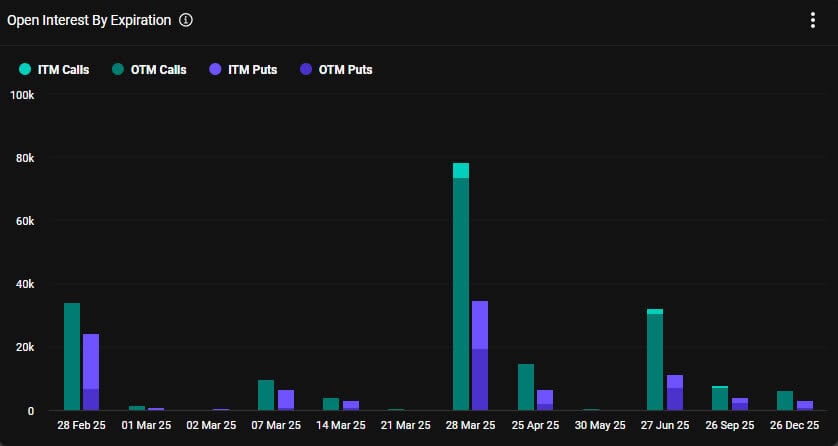

Bitcoin Options Expiry

In this grand theater of finance, the put/call ratio stands at 0.71, indicating a slight preference for call contracts. It seems traders are still clinging to hope, albeit with a hint of desperation. The open interest, that elusive beast, remains highest at the $120,000 strike price, a staggering $1.5 billion, as reported by Deribit. Who knew hope could be so expensive?

Meanwhile, $1 billion in open interest lurks at the $100,000 and $110,000 strike prices, while bearish sentiment creeps in like a thief in the night, with $800,000 at the $80,000 mark—the very ground we tread upon. The crypto derivatives provider Greeks Live has declared their stance as “predominantly bearish.” Oh, how the mighty have fallen!

“There’s significant concern about continued downside, with many members discussing the rapid 17% decline over three days and debating whether recent selling is controlled or indicative of a broader market shift.”

Technical analysis, that fickle friend, warns that if the price dips below the 2024 volume weighted average price (VWAP) bands, we might as well pack our bags for a trip to $77,000 or even $72,000. What a delightful journey that would be!

In a parallel universe, 526,000 Ethereum contracts are also expiring today, valued at $1.14 billion, with a put/call ratio of 0.52. This brings the combined crypto options expiry to a staggering $5.8 billion. Truly, a number to make one weep! 😭

Crypto Markets Tank

As the clock ticks towards the weekend, the market rout continues, with total capitalization plummeting another 6% to $2.76 trillion. It seems we have fallen through the long-term support like a child through a hole in the fence, possibly returning to the dark days of October.

Bitcoin has taken a nosedive of 5%, landing at $80,200 during the Asian trading hours. In just a week, it has lost 18%, and its correction has deepened to a staggering 25% from its all-time highs. The last time BTC was below $80,000 was on November 10. How the tables have turned!

Meanwhile, Ethereum has plunged 8%, reaching its lowest level in over a year at $2,150, with weekly losses amounting to a jaw-dropping 22%. The altcoins, too, are not spared, drowning in a sea of red, all bleeding out in unison. What a sight to behold! 😂

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- You Won’t Believe Denzel Washington Starred in a Forgotten ‘Die Hard’ Sequel

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

2025-02-28 10:22