Ah, the Pi Network’s native token, PI, has taken a rather dramatic plunge of 22% over the past week, now languishing at a seven-day low of a mere $0.61. One can only imagine the collective gasp of its investors! 😅

This double-digit decline is a delightful reflection of the growing bearish sentiment surrounding the token, perfectly timed with a broader contraction in the crypto market. Who knew that the crypto world could be so fickle?

PI’s Outlook Worsens as Bearish Trend Deepens

The global cryptocurrency market capitalization has dropped by over 5% in the past week, shedding a staggering $170 billion. It seems the market is on a diet, and unfortunately, it’s not the healthy kind. This widespread pullback has shaken investor confidence, triggering a fresh wave of PI selloffs. How charming!

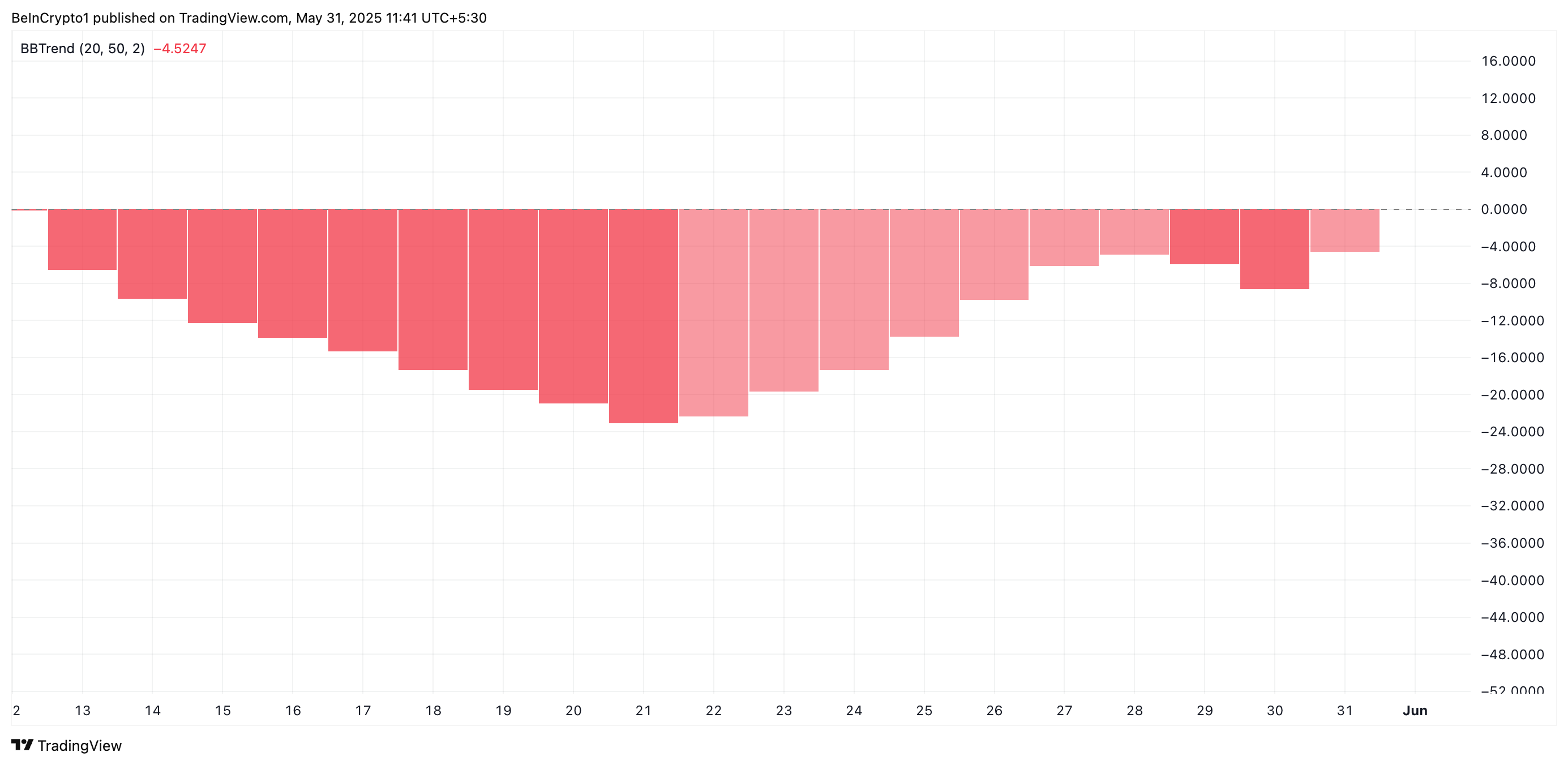

The strengthening sell-side pressure is evident in PI’s BBTrend indicator, which has continued to print red histogram bars—an unmistakable signal of mounting bearish momentum. As of this writing, the indicator sits at a rather dismal -4.52. Oh, the humanity!

The BBTrend measures the strength and direction of a trend based on the expansion and contraction of Bollinger Bands. When BBTrend values are positive, it typically signals a strong uptrend, while negative values indicate increasing bearish momentum. Quite the rollercoaster, isn’t it?

PI’s persistent negative BBTrend suggests that its price consistently closes near the lower Bollinger Band. This trend indicates sustained selling activity and hints at the potential for a prolonged price decline. How delightful!

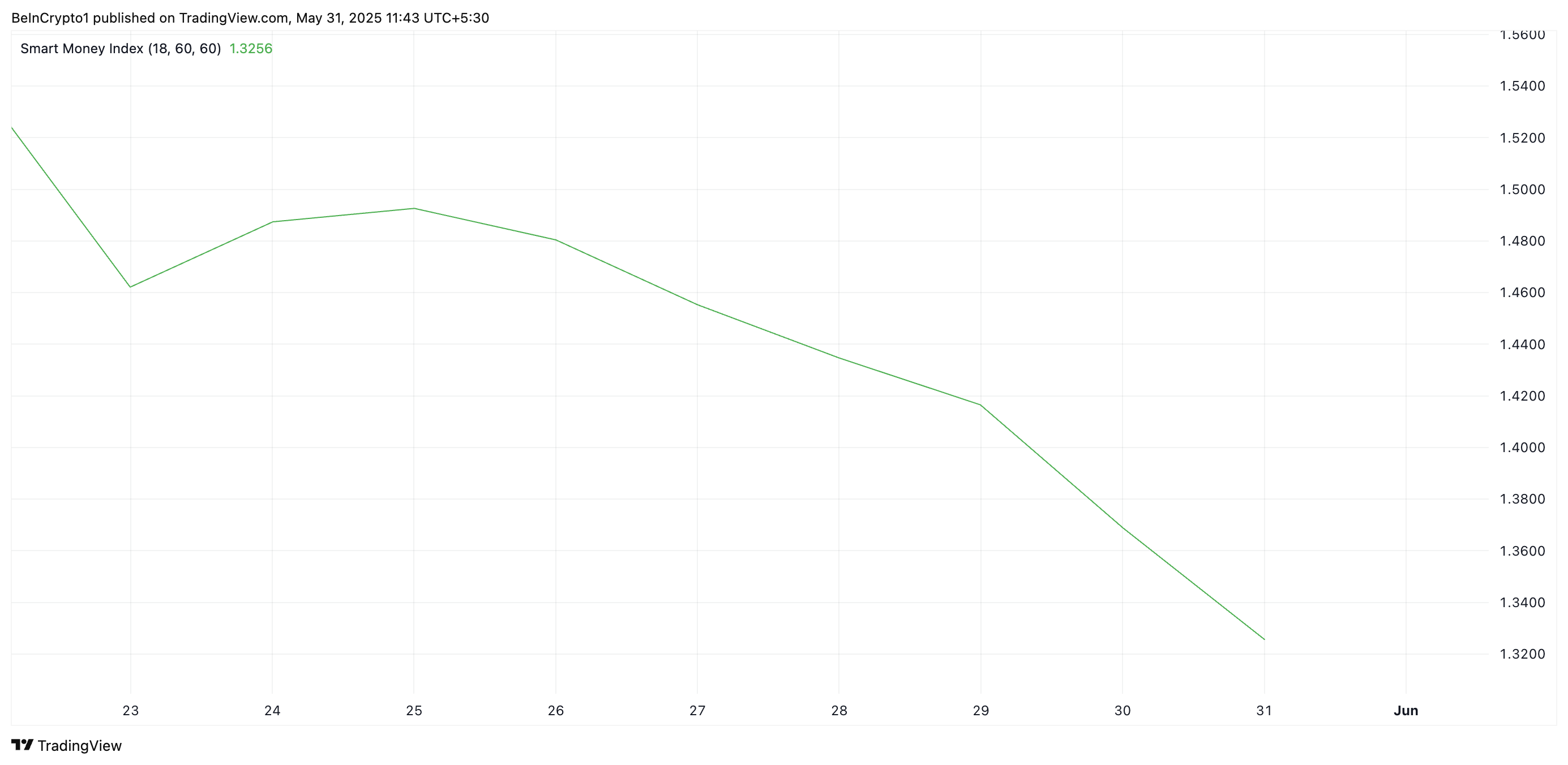

Moreover, PI’s Smart Money Index (SMI) has taken a nosedive over the past few days, signaling an exodus of “smart money” or institutional-grade investors. This is often considered a leading indicator of deeper price declines, as it suggests a distinct lack of confidence from these key investors. Bravo!

An asset’s SMI tracks the activity of institutional investors by analyzing market behavior during the first and last hours of trading. When it rises, these investors are increasing their buying activity, indicating the likelihood of an extended rally. Conversely, as with PI, when it falls, it indicates that institutional demand for the asset is weakening, signaling potential for further downside. How very insightful!

PI Teeters Near Key Support—Will Bulls Hold the Line at $0.55?

PI’s climbing selling activity suggests that the token could be vulnerable to further losses in the short term. If selloffs continue, the altcoin risks breaking below the critical support formed at $0.55. Will the bulls rise to the occasion, or will they simply take a leisurely stroll away?

If the bulls fail to defend this support floor, PI could revisit its all-time low of $0.40. How thrilling! 😬

However, a spike in new demand for the token could prevent this from happening. If the PI Network token buying pressure spikes, it could push its price to a dazzling $0.86. What a twist!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- All Songs in Superman’s Soundtrack Listed

2025-05-31 21:06