What to know:

- A divergence between bitcoin and the S&P 500 began following the election of Donald Trump, but the two asset classes have recently begun moving more in tandem.

- While macro factors like the interest rate outlook may have held back stocks over the past two months, a more favorable political outlook and things like declining exchange balances have boosted bitcoin, said one analyst.

- The renewed correlation of late could pose a short-term risk for bitcoin.

Ever since the unexpected victory of Donald Trump in the November 5 U.S. presidential election, I’ve noticed a significant surge in Bitcoin (BTC). To be precise, it has risen by approximately 47%, which is quite impressive when compared to the S&P 500’s more modest 4% growth.

As a crypto investor, I can’t help but notice the favorable stance the incoming president has taken towards Bitcoin and cryptocurrencies. Additionally, it’s significant to keep an eye on the Republican majority in both the Senate and House of Representatives, as any legislation that could impact the crypto sector will likely originate from these bodies.

Andre Dragosch, Bitwise’s European Research Head, discussed with CoinDesk exclusive insights into additional elements influencing the disparity between Bitcoin and stock market performance.

Dragosch expressed his perspective on Bitcoin versus the S&P 500: He believes that the Federal Reserve’s aggressive interest rate cut in December has had a negative impact on the stock market. Specifically, he mentioned that the Fed has revised its planned interest rate cuts for 2025 to just two cuts, which is less than what was previously signaled and also less than what traditional financial markets anticipated.

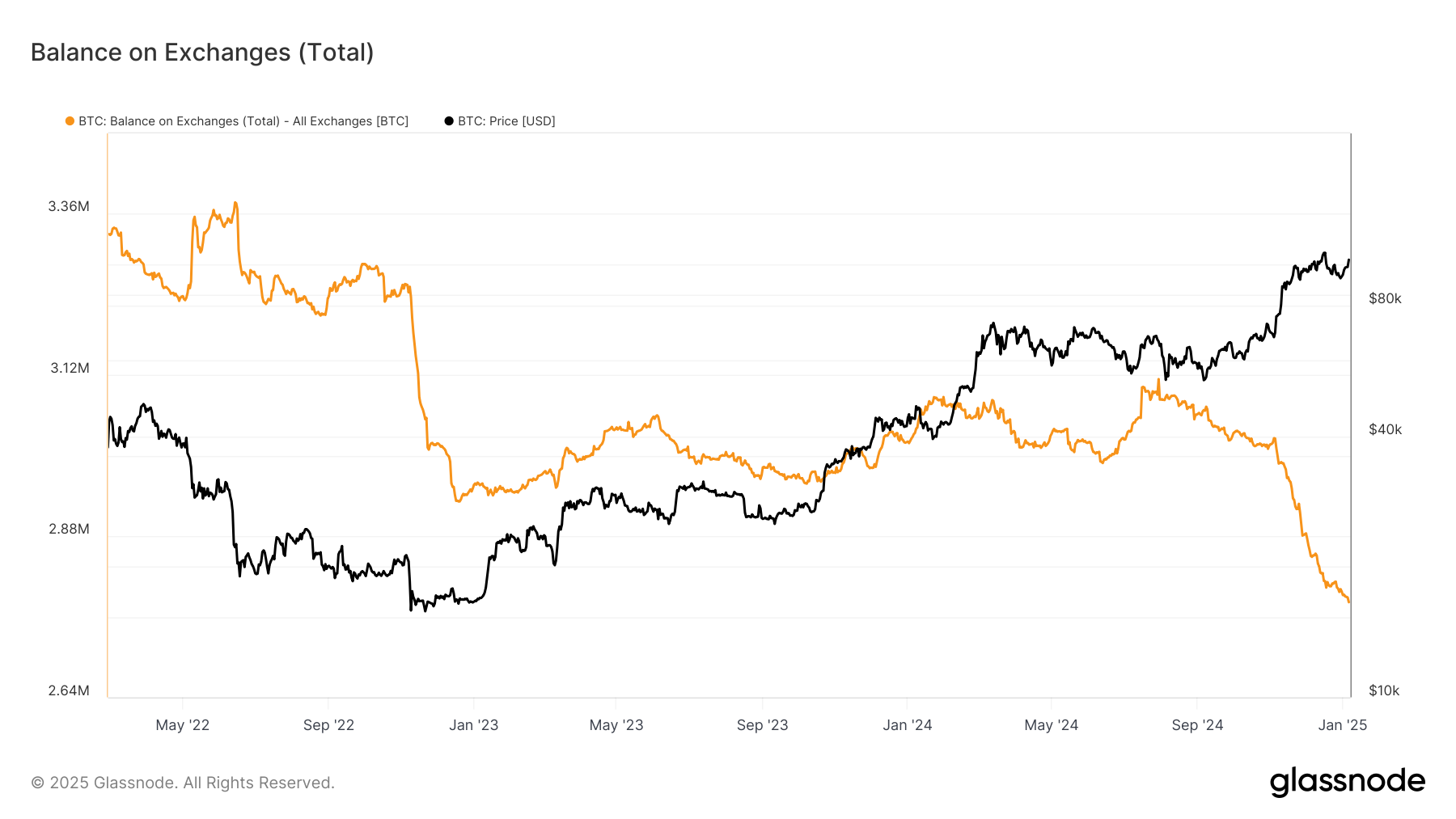

Concurrently, the DXY index, which compares the strength of the U.S. dollar against a group of significant currencies, has risen by 5%. This increase on risk assets may usually result in a decline for bitcoin; however, Dragosch notes that it has managed to remain resilient due to various factors, one being the ongoing scarcity of bitcoins available on exchanges. “Bitcoin balances on exchanges have continued to decrease even with profit-taking,” he added.

Recently, I’ve noticed a striking similarity between the movements of Bitcoin and the S&P 500. Over the past 20 days, their correlation has reached a high of 0.88, indicating that they are almost mirror images of each other. In simpler terms, when one rises, the other tends to follow suit, with only minor differences. This close relationship between these two distinct entities is quite intriguing.

According to Dragosch, the positive impact from on-chain factors is expected to continue until mid-2025, but a worsening economic outlook could potentially create short-term challenges for Bitcoin. This risk is amplified because Bitcoin’s relationship with the S&P 500 remains fairly strong.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

- DAG PREDICTION. DAG cryptocurrency

2025-01-07 19:26