What to know:

- NYSE-listed Genius Group increased its bitcoin treasury to $35 million.

- Nasdaq-listed Ming Shing bought BTC worth $47 million.

Bitcoin (BTC) adoption by U.S.-listed public companies continues in full steam.

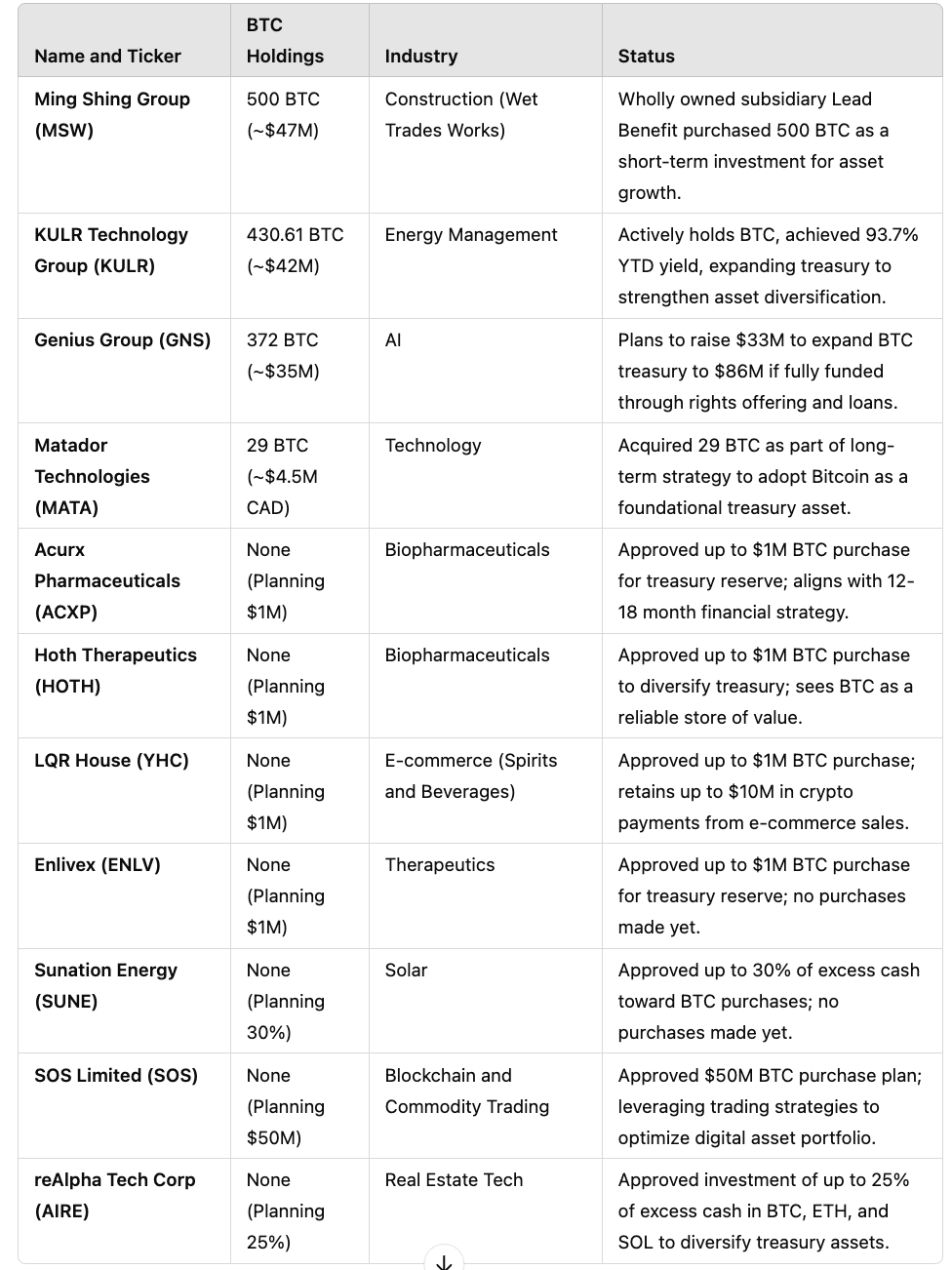

The most recent acquisition is from Genius Group (GNS), a company listed on the New York Stock Exchange. On January 10th, GNS revealed that they had boosted their bitcoin holdings to $35 million, surpassing their earlier goal of $120 million set for a later date. In doing so, they purchased 372 Bitcoins at an average price of approximately $94,047 per Bitcoin. This move was first disclosed on November 12th when they announced their “Bitcoin-focused” strategy.

On Tuesday, it was disclosed that GNS was offering rights for shareholders to acquire additional shares at reduced costs. If completely subscribed, this offering could yield $33 million. GNS’s founder and chief executive, Roger Hamilton, plans to participate in the offering and purchase 500,000 shares himself.

As an analyst, I’m sharing that our company is actively seeking loan financing to amass Bitcoin holdings. On Tuesday, our GNS shares experienced a 7% increase in value by the market close.

In addition to GNS, the Ming Shing Group, a publicly traded company on Nasdaq and a provider of services in the wet trades sector, recently acquired 500 Bitcoins at an average cost of approximately $94,375 per Bitcoin. The value of MSW’s shares has increased by 43% so far this year.

As an analyst, I’m excitedly observing the escalating trend of Bitcoin treasury adoption. Recently, four publicly-traded companies have openly declared their purchases of Bitcoin, while seven more have revealed their strategic plans – all without any acquisition in sight.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-15 13:19