Circle’s IPO filing has sent shockwaves through the financial world, with analysts raising eyebrows over its financial health, distribution costs, and sky-high valuation. 🎪

While the move is hailed as a step toward mainstream financial integration, the skeptics are already sharpening their knives, questioning the company’s long-term survival. 🗡️

Analysts Spot Trouble in Circle’s Financial Funhouse

On April 1, BeInCrypto revealed that Circle had filed for an IPO, planning to list its Class A common stock on the NYSE under the ticker “CRCL.” 🎰

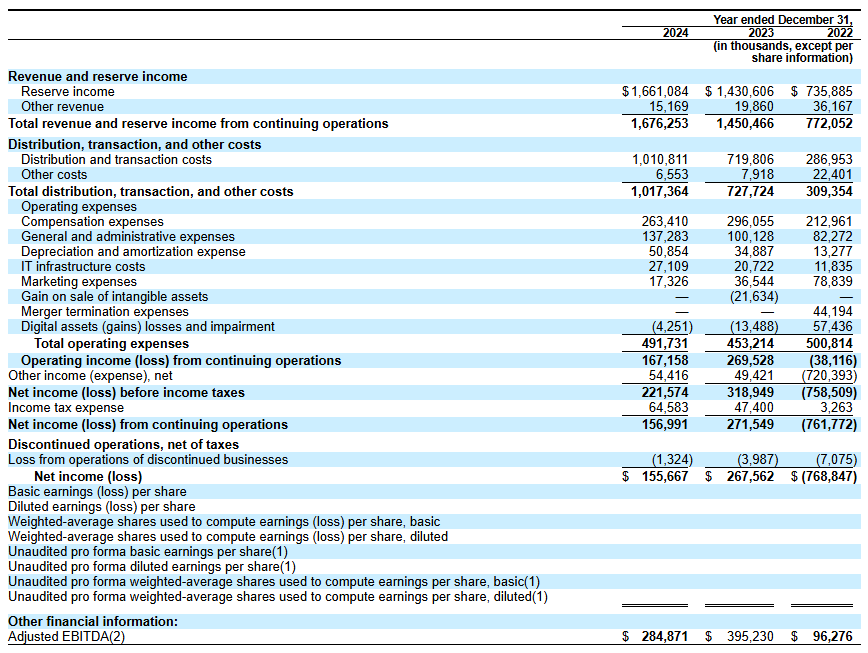

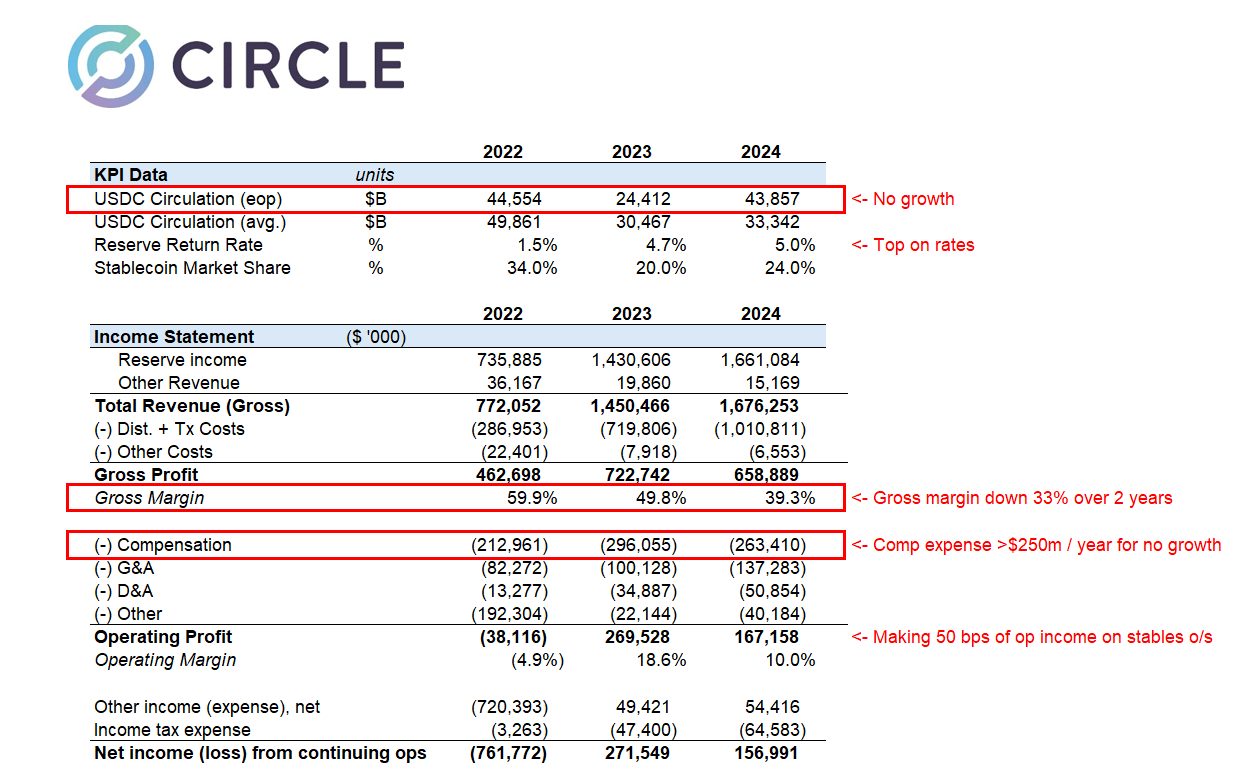

Circle’s IPO filing boasts a revenue of $1.67 billion in 2024, a significant jump from previous years. But, as always, the devil is in the details. 😈

Matthew Sigel, Head of Digital Assets Research at VanEck, noted a 16% year-over-year revenue increase. However, EBITDA plummeted by 29%, and net income took a nosedive of 42%. 📉

Sigel attributed this financial freefall to four key factors: rapid expansion, service discontinuations, restructuring costs, and legal settlements. 🏗️

“Costs related to restructuring, legal settlements, and acquisition-related expenses also played a role in the decline in EBITDA and net income, despite overall revenue growth,” Sigel added.

He also highlighted Circle’s skyrocketing distribution and transaction costs, driven by hefty fees paid to partners like Coinbase and Binance. 💸

A post by Farside Investors on X (formerly Twitter) further exposed these expenses, revealing that Circle spent over $1 billion on distribution and transaction costs in 2024. 🐦

“In 2024, the company spent over $1 billion on ‘distribution and transaction costs,’ probably much higher than Tether as a % of revenue,” the post read.

This has led to speculation that Circle is burning through cash to maintain its market share in the cutthroat stablecoin sector. 🔥

Farside Investors also pointed out that Circle recorded a staggering $720 million loss in 2022, a year marked by the collapses of FTX and Three Arrows Capital (3AC). 💥

“The gross creation and redemption numbers are a lot higher than we would have thought for USDC. Gross creations in a year are many multiples higher than the outstanding balance,” Farside Investors remarked.

Analyst Omar chimed in, questioning Circle’s $5 billion valuation. 🤔

“Nothing to love in the Circle IPO filing and no idea how it prices at $5 billion,” he questioned.

He highlighted concerns over gross margins, high distribution costs, and the looming threat of US market deregulation. 🌪️

Omar also noted that Circle spends $250 million annually on compensation and $140 million on general and administrative costs, raising eyebrows over its financial efficiency. 💼

“32x ’24 earnings for a business that just lost its mini-monopoly and facing several headwinds is expensive when growth structurally challenged,” Omar said.

Ultimately, Omar concluded that the IPO filing was a desperate bid for liquidity before the market turns sour. 🍋

Meanwhile, Wyatt Lonergan, General Partner at VanEck, outlined four potential scenarios for Circle’s IPO. In the base case, Circle capitalizes on the stablecoin narrative and secures key partnerships. 🚀

In a bear case, Lonergan speculated that poor market conditions might lead to a Coinbase buyout. 🐻

“Circle IPOs, the market continues to tank, Circle stock goes with it. Poor business fundamentals cited. Coinbase swoops in to buy at a discount to the IPO price. USDC is all theirs at long last. Coinbase acquires Circle for something close to the IPO price, and they never go public,” Lonergan claimed.

Lastly, he envisioned a scenario where Ripple bids up Circle’s valuation to $15 to $20 billion and acquires the company. 🤑

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- MrBeast Becomes the Youngest Self-Made Billionaire in History

- How to use a Modifier in Wuthering Waves

- Lucky Offense Tier List & Reroll Guide

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- EA FC 25 LaLiga TOTS: Release Date LEAKED! + Predictions!

- ATHENA: Blood Twins Hero Tier List (May 2025)

- Honkai: Star Rail – Embracing the Legend of Fat Fuck in All Its Glory!

2025-04-02 08:57