In a most alarming turn of events, the latest report from our esteemed firm raises a veritable cornucopia of red flags regarding the sustainability of the current rally, casting a rather cautious pall over ETH’s trajectory. One might say it’s akin to a grand soirée where the guests are all too aware that the host has forgotten to pay the caterer.

Rally Fueled by Hype, Not Fundamentals

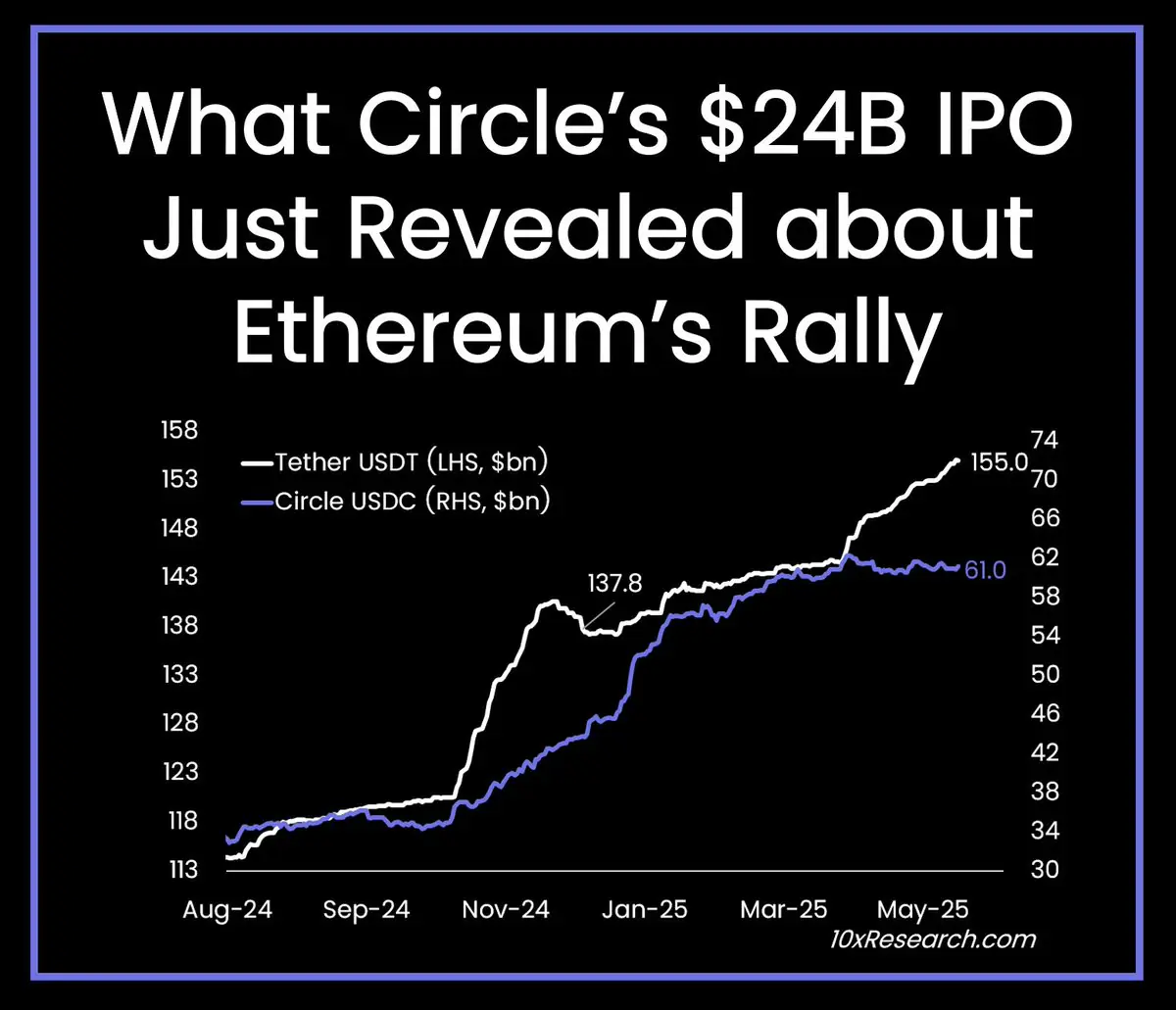

According to the ever-astute 10x Research, Ethereum’s price has soared with all the grace of a drunken peacock at a garden party. Yet, the underlying fundamentals are as flimsy as a paper umbrella in a monsoon. They attribute this meteoric rise to a rather alarming buildup in leverage and the aggressive posturing of derivatives traders, rather than any semblance of organic demand or protocol growth. Who knew that speculation could be so fashionable?

The firm notes that while Bitcoin has gallantly breached the $106,000 resistance zone, its breakout is about as robust as a wet noodle. The situation is even more pronounced in Ethereum, where the rally has been inflated by gamma hedging linked to call options and speculative flows—certainly not the kind of long-term investor conviction one would hope for. It’s like watching a house of cards being built in a wind tunnel.

Circle’s IPO: Catalyst or Distraction?

is this the dawn of a new bull leg, or merely a prelude to a rather embarrassing reversal? One can only hope the market isn’t wearing its best trousers for a mere mirage.

A Smarter Play Emerges

Amidst the cacophony, 10x Research has unearthed one emerging pair trade that they believe is rooted in fundamentals rather than the usual hype. While they’ve chosen to keep the specifics under wraps, the implication is clear: a shift towards selective, thesis-driven strategies over broad speculative exposure. A wise move, indeed, as leverage continues to rise and headline-driven rallies take center stage.

As the market dances to the tune of excitement rather than evidence, 10x Research urges caution: “This market is being driven more by excitement than evidence.” A sentiment that could very well apply to many aspects of life, wouldn’t you agree? 🎩

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- Umamusume: Pretty Derby Support Card Tier List [Release]

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

2025-06-12 11:56