Predicting the Network’s Future: A Bayesian Approach

![The study demonstrates that a self-sustained Bayesian predictor frequently achieves performance comparable to, and occasionally surpasses, an in-sample dcGM reconstruction, as evidenced by metric-specific improvements calculated using both [latex] \text{ARE}_k [/latex] and [latex] \text{MRE}_k [/latex] for certain metrics, and a different formulation for others-including [latex] \langle\text{TPR}\rangle [/latex], [latex] \langle\text{PPV}\rangle [/latex], [latex] \langle\text{TNR}\rangle [/latex], and [latex] \langle\text{ACC}\rangle [/latex]-where values exceeding zero indicate superior Bayesian predictor performance.](https://arxiv.org/html/2602.21869v1/x14.png)

A new framework uses Bayesian inference to reconstruct network topology and forecast future connections from limited initial data.

![The study demonstrates that a self-sustained Bayesian predictor frequently achieves performance comparable to, and occasionally surpasses, an in-sample dcGM reconstruction, as evidenced by metric-specific improvements calculated using both [latex] \text{ARE}_k [/latex] and [latex] \text{MRE}_k [/latex] for certain metrics, and a different formulation for others-including [latex] \langle\text{TPR}\rangle [/latex], [latex] \langle\text{PPV}\rangle [/latex], [latex] \langle\text{TNR}\rangle [/latex], and [latex] \langle\text{ACC}\rangle [/latex]-where values exceeding zero indicate superior Bayesian predictor performance.](https://arxiv.org/html/2602.21869v1/x14.png)

A new framework uses Bayesian inference to reconstruct network topology and forecast future connections from limited initial data.

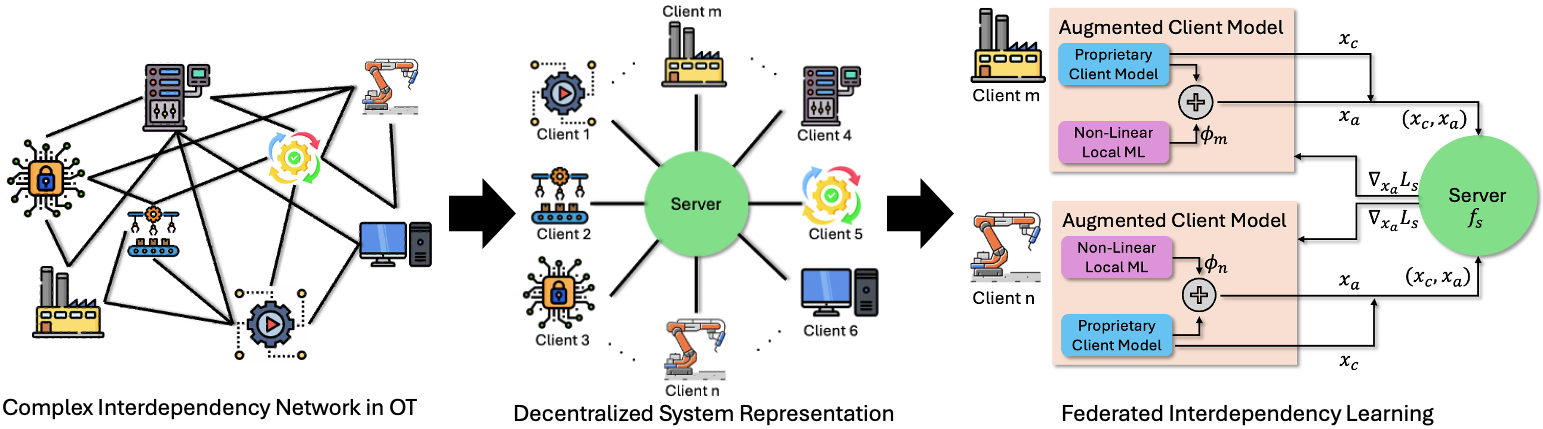

A new federated learning framework enables identifying the origins of anomalies in industrial control systems without compromising data privacy or requiring model changes.

![The study demonstrates that predictive scoring for fraud scenarios-considering both actionability and information access-exhibits variance dependent on the decomposition method employed, with observed scores averaged across diverse models, actor types, and jailbreaking techniques, and quantified by [latex]94\%[/latex] credible intervals to reflect inherent uncertainty.](https://arxiv.org/html/2602.21831v1/x4.png)

Researchers have developed a systematic method for evaluating how readily artificial intelligence can be exploited to assist in fraudulent activities and cybercrime.

A new approach leverages the power of artificial intelligence to efficiently and accurately predict crop yields, enabling proactive climate risk assessment and improved agricultural planning.

![The iterative refinement of a gravitational wave model, initiated with data from GWTC-3 and augmented by observations from O4a, demonstrates a convergence-measured by the smoothing parameter [latex] \hat{k} [/latex]-towards a stable posterior distribution, as evidenced by the alignment of log-likelihood estimators [latex] \ln \hat{\mathcal{L}} [/latex] and variance [latex] \mathcal{V} [/latex] obtained through nested sampling, variational approximation, and Pareto-smoothed importance sampling, ultimately indicating the model’s capacity to assimilate new information without abandoning its foundational principles-a precarious balance mirroring the fate of any theory approaching the event horizon.](https://arxiv.org/html/2602.20277v1/x1.png)

Researchers are leveraging neural networks to refine our understanding of black hole and neutron star populations as more gravitational wave detections come online.

![Grade 2 features prominently in the model’s epistemic profile - as indicated by [latex]\mathbb{E}[C\_{k}\mid y{=}i][/latex] and [latex]\mathbb{E}[C\_{k}/\sum\_{j}C\_{j}\mid y{=}i][/latex] - suggesting that moderate difficulty examples are the primary source of confusion for the system.](https://arxiv.org/html/2602.21160v1/figures/diagnostic_epistemic_profiles.png)

New research breaks down how uncertainty affects the accurate reconstruction of historical clothing, specifically focusing on the challenges presented by bodices.

A new AI agent streamlines the complex process of evaluating how new power sources affect grid stability and reliability.

A new deep learning approach uses intracardiac echocardiography video to automatically identify where dangerous heart rhythm disturbances begin.

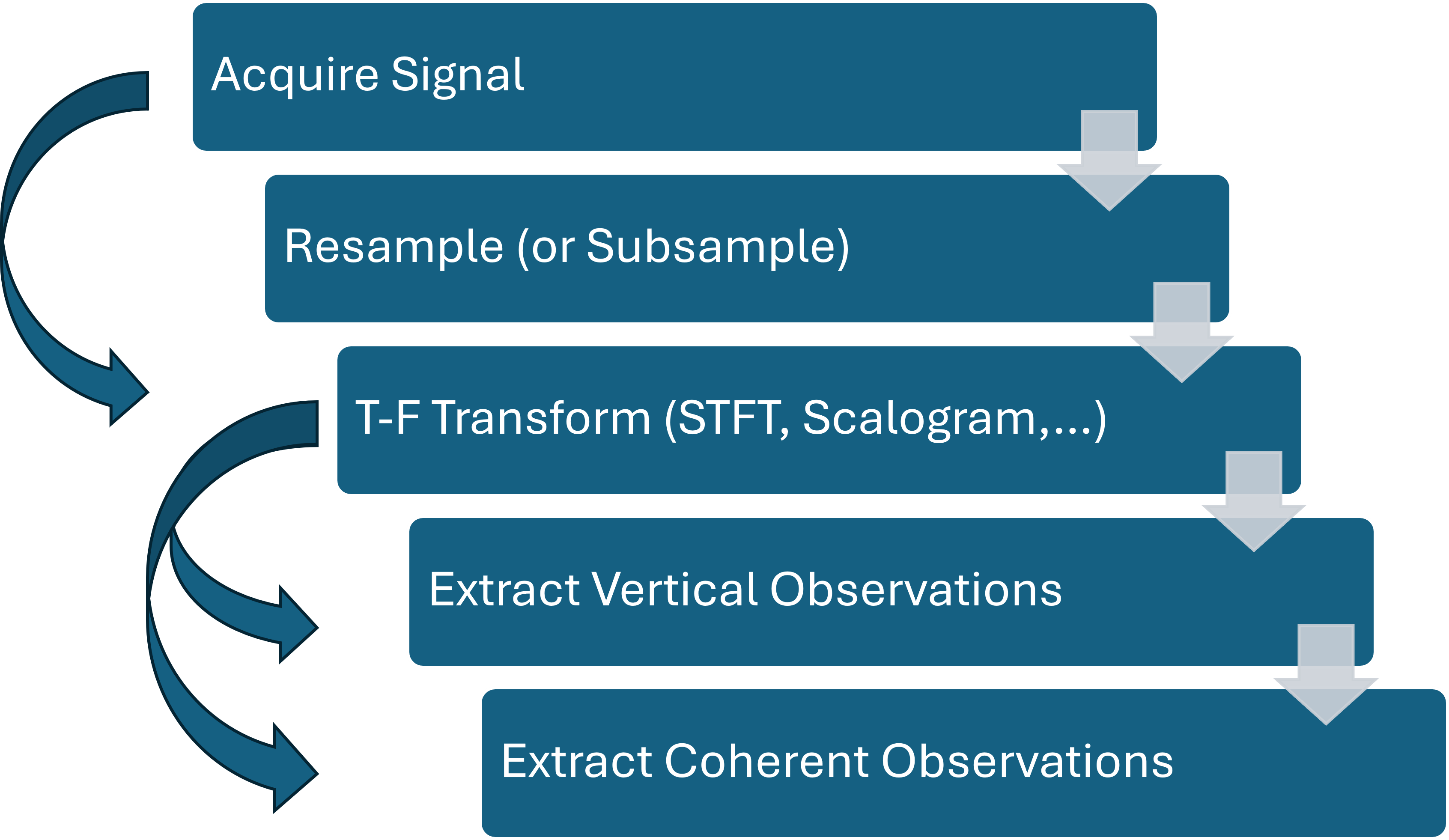

A new self-supervised learning pipeline automatically identifies and labels transient events within spectrograms, offering a powerful tool for analyzing everything from fusion plasmas to animal vocalizations.

![The study maps tasks according to a static regime defined by the cost of automation - proportional to task index [latex] c_A(i) = i/K_C [/latex] - and the cost of verification, determined by a function of feedback time [latex] c_H(i) = w\,t_{fb}(i)/S_{nm} [/latex], thus revealing the inherent relationship between these economic factors in task assignment.](https://arxiv.org/html/2602.20946v1/fig1_static_regime_map_v3.png)

The future of economic growth may hinge not on what artificial intelligence can do, but on our ability to reliably verify its actions.