You Won’t Believe What Ripple Did at $2.4 – Next Stop: Plunge-ville?

By Shayan (but you didn’t hear it from me 😉)

By Shayan (but you didn’t hear it from me 😉)

By tea-time, Bitcoin strutted past $97,000 (nearly 30% above its April basement price), while investors everywhere collectively flung caution to the wind and started buying digital gold like Easter eggs. The Crypto Fear and Greed Index burst up to 55—a sure sign everyone’s either greedy or just desperately optimistic. Meanwhile, American stocks partied with the Dow Jones and Nasdaq 100 both leaping 350 points—clearly, even the stock market fancied some spring gymnastics. But why is everyone so jumpy? Let’s break it down with three delectable, Dahl-esque reasons Bitcoin could skip all the way to $100,000 shiny coins or even higher in May.

Dogecoin is doing its best Mario Kart impression and has double-jumped in price over two weeks. Analysts are suddenly less bored. 🚀

The distinguished Mathew Sigel, of VanEck fame and unruffled tie, put Circle’s true worth nearer $4 to $6 billion, which, much like the exchange rate at a dodgy Mallorca kiosk, depends heavily on who’s asking. Neither party has had the decency to confirm or deny—one would think they’re running for Parliament!

What’s that looming beneath the floorboards? Crypto analyst TehThomas, armed with clairvoyant charts and the patience of a Moscow librarian, finds the collective gaze fixated on resistance at $95,400–$95,800 – a range so frequently visited by Bitcoin that it’s begun charging rent. Like cats startled by their own reflection, the bulls seem content to bask just below this level, their courage sapped and their dreams of $100,000 interrupted by spectral bearish laughter.

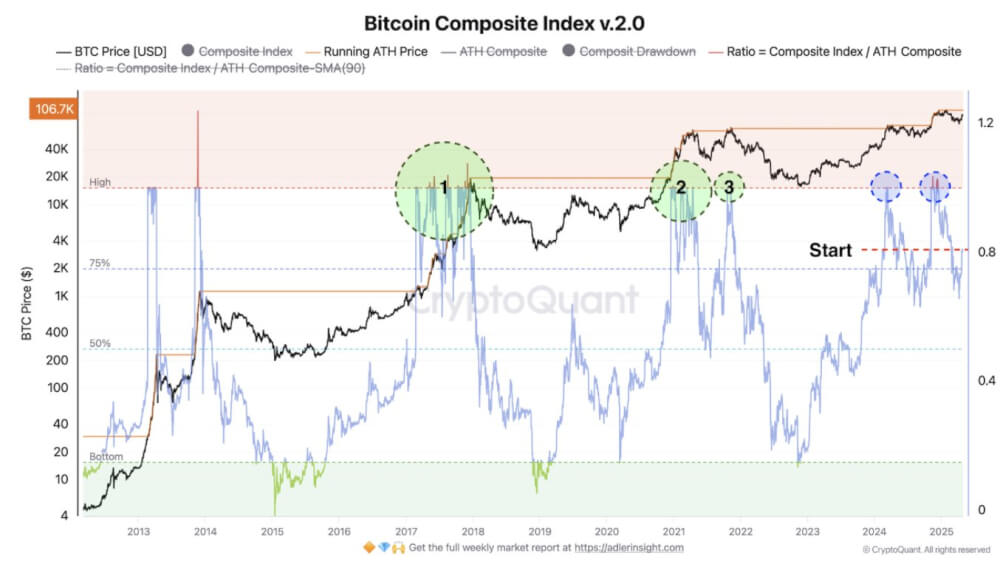

In this scenario, if the ratio breaks above 1.0 and sticks around like an uninvited guest at a party, we might witness a new wave of buying. It’s like 2017 and 2021 all over again! Picture this: Bitcoin shooting up to $175,000, driven by the unshakable faith of those who believe in it—and possibly some cycled-up momentum. Is it real? Probably. Could it happen? Absolutely. Will it happen? Well, that’s the million-dollar question, isn’t it?

Over in the windblown city of Abu Dhabi, MGX, never one to be outdone, has been tossing headlines like horseshoes—a real shindig since it dumped some cash into Binance, the crypto saloon where the serious traders gather. (Even the bartenders use blockchain.) Now Eric, with the swagger of a man who’s never misplaced his private key, announced that USD1 is hitching a ride over to the Tron (TRX) ecosystem. Folks, that means USD1 will be drifting through more blockchains than lost dreams in the Mojave.

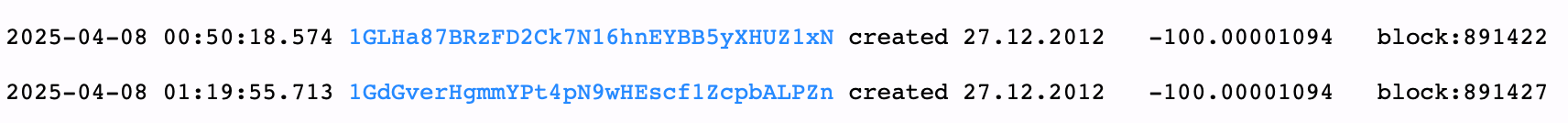

Some poor soul—perhaps a gambler, perhaps a philosopher entering the fourth stage of basement existentialism—has taken it upon himself to violate not one but two Casascius bitcoin bars, disemboweling 100 BTC from each, approximately $19.2 million total, which probably sounds like a joke to anyone already in finance. These bars, the bastard offspring of Mike Caldwell (a man who must be haunted by the ghosts of spent wallets), were part of an elite class: bars minted in denominations so high they could only be appreciated by those who know the taste of bitter poverty… or sublime boredom. Series 1 (S1) alone once boasted 57 such bars: a mere seven remain unmolested—clearly, humans prefer peeling things even more than bananas.

The analysts (the ones who didn’t lose their shirts in NFTs) say Bitcoin’s doing a nice comeback act. It dipped from $73,000-$74,000—frankly, who hasn’t dipped a little now and then?—and now it’s powering up, climbing over resistance like it’s sneaking into a Catskills casino after 9 PM.

On the first of May, while lesser mortals were celebrating spring or, at most, international labor, Eric unspooled the thrilling tale of being “canceled” by the allegedly modern financial system. “We became the most canceled people in the world,” he asserted, stirring the bonfire of self-pity with a poker forged from the finest American politics. It was, in short, a tragedy so deep not even the greatest family fortune could alleviate it—until cryptocurrency waltzed in, of course, wearing a top hat and a monocle.