Bitcoin and Ether ETFs are Making It Rain—Fiat Beware!

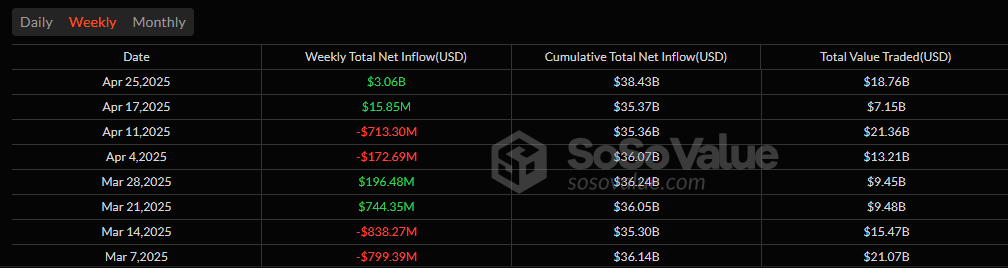

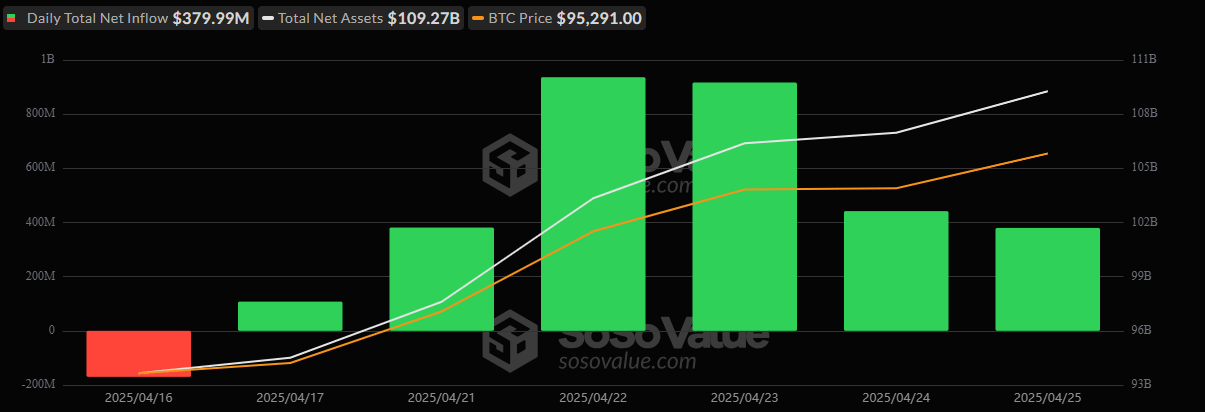

Despite what your grandma says about “putting money under the mattress,” crypto investors kept their hats on and their wallets open. On Friday, April 25, bitcoin and ether ETFs wrapped the week like they were auditioning for a Vegas magic show—poof! $379.99 million appeared out of thin air (or maybe thin wallets) in bitcoin ETFs alone.