CZ’s Crypto Wisdom: Buy Fear, Sell Greed? 🤡🤑

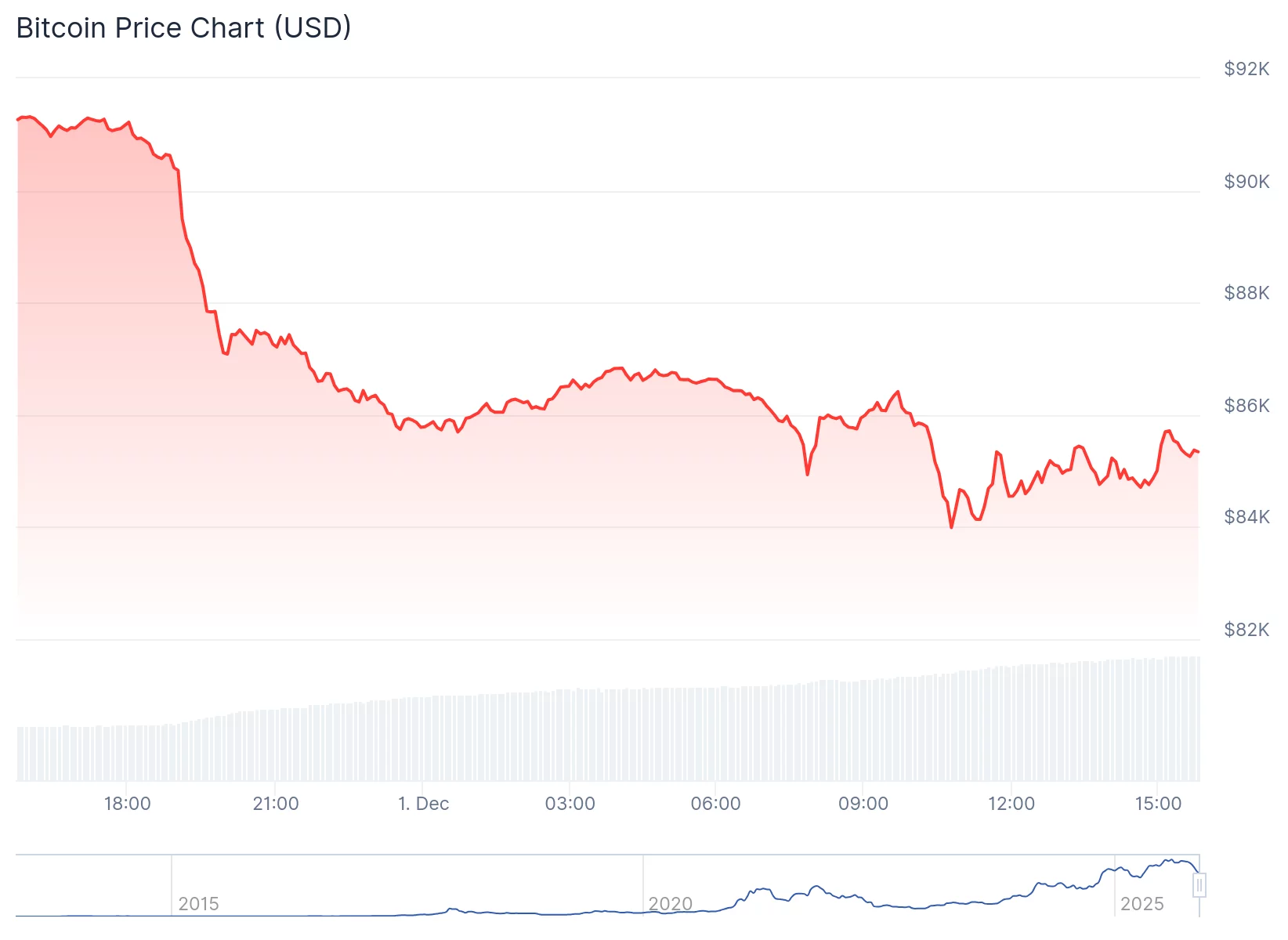

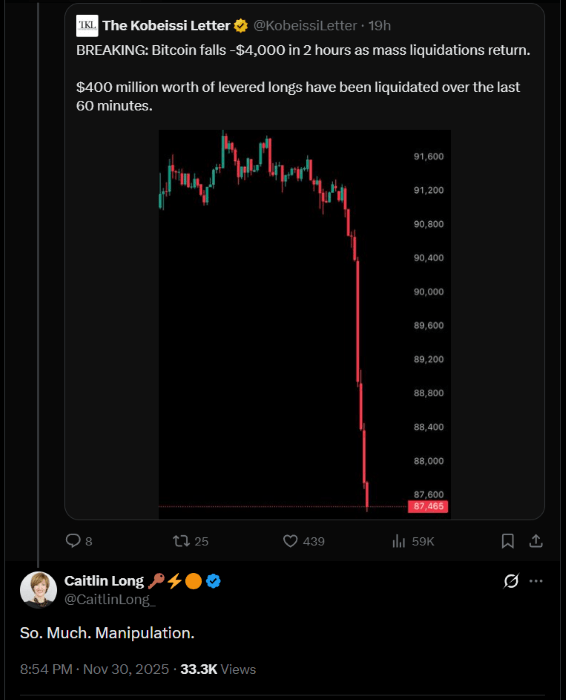

In a weekend missive on X, Zhao-the man, the myth, the CZ-proclaimed that the true fortunes in Bitcoin (CRYPTO: BTC) are forged by selling when the market froths like a cappuccino and buying when the masses are panic-refreshing their portfolios with the fervor of a doomed gambler. 🎰