What Aster’s Burning and Building! Is $1 Near? 🤔🔥

One must ask, with an eyebrow raised, “What be the future for this daring token in the year of our Lord 2026?” Courage, curiosity! Let us delve into the finest plans and fiery burnings! 🔥

One must ask, with an eyebrow raised, “What be the future for this daring token in the year of our Lord 2026?” Courage, curiosity! Let us delve into the finest plans and fiery burnings! 🔥

Bitcoin’s four-year rhythm, Neuner argues, is about as real as a troll’s promise to share its bridge. 🌉 In a brisk 17-minute romp through Crypto Insider, he dismantles the industry’s favorite myth with the precision of a dwarf with a grudge. 🔨

Table of Contents

With GTreasury now fully integrated, Ripple is positioning itself as more than a blockchain company-it’s a financial wizard, or at least a very expensive party trick. GTreasury’s corporate clients will be able to use Ripple’s digital asset infrastructure directly through the systems they already rely on. This setup allows real-time settlements and on-demand liquidity without requiring companies to manage crypto wallets or understand complex blockchain processes. 🧙♂️✨

Ah, zee Bitcoin! Once again, it dances under the ominous shadow of the yen carry-trade, as we approach the grand spectacle of the 9-10 December FOMC meeting and the likely hawkish pirouette of the Bank of Japan on December 18-19. Truly, a déjà vu of last summer’s tragic comedy, when Tokyo’s policy shift sent risk assets-including our beloved crypto-spiraling into chaos.🎭

Meanwhile, the US government is once again showering us with economic data. Surprise! It’s a bit gloomy, which, apparently, is great news for those hoping for a rate cut from the Federal Reserve next week. Now, the odds of a 0.25% rate cut on Dec. 10? A whopping 87%, according to CME futures. So, yeah, the Fed might just toss us a bone.

Bitcoin Dynamics Are Currently Looking Similar To Early 2022 Bear Market

The Federal Reserve’s dovish stance (that’s fancy talk for “we’re chill for now”) might make riskier assets more tempting than a slice of cake at a diet convention. More capital could flow into crypto, especially Bitcoin-but whether this hype can push us to new heights, or if it’s just a clever mirage, remains a thrilling mystery. 🍰🤷♂️

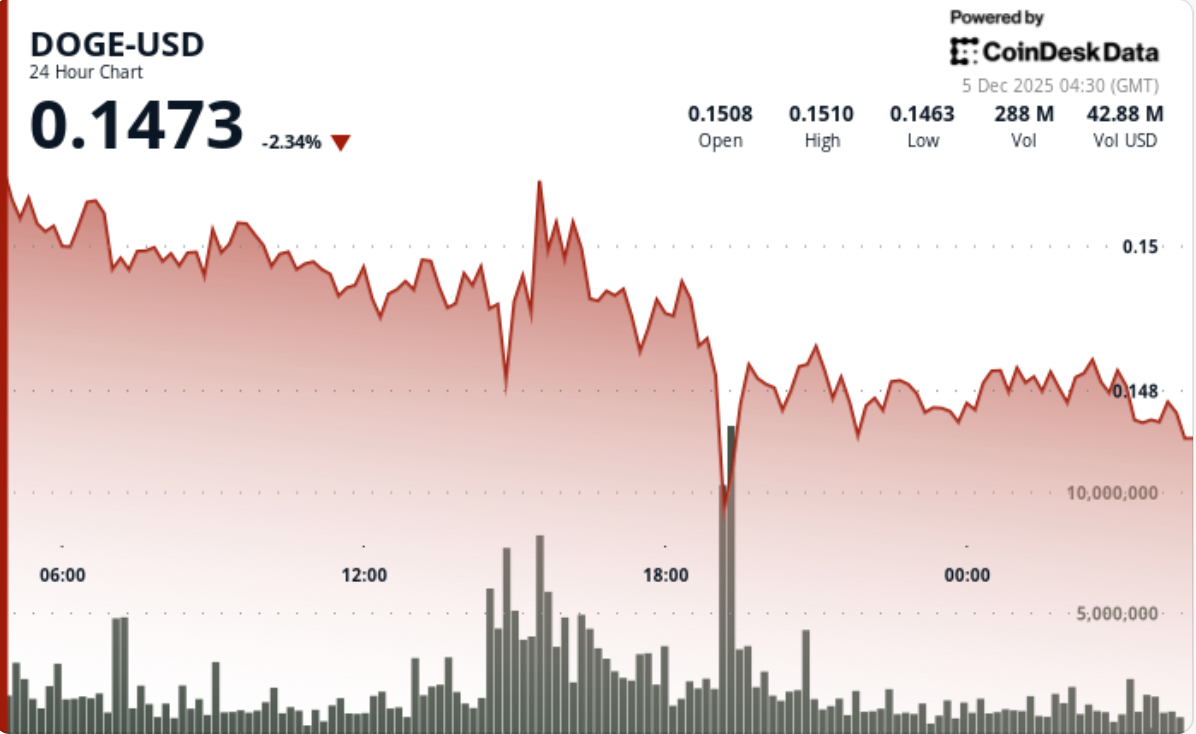

The meme coin, once a darling of the internet, now breaks technical levels with the grace of a drunk at a ballet. 🩰🍷 Institutional-sized trades ruled Wednesday’s session, their cold logic drowning out ETF filing buzz. 📊🚀

Europol, those delightful continental crime-busters, announced on Dec. 4 that they’ve wrapped up a multi-year sting operation with more twists than a pretzel factory. The agency declared, with all the gravitas of a Shakespearean actor forgetting their lines: “We’ve dismantled a network so shady, it needed SPF 100 sunscreen. Over €700 million laundered? More like over €700 million floundered!” 🌞🧼