🚨 Can Dogecoin Reach $0.19? 🚨

- DOGE has surged by 7.3% over the past 24 hours, because, of course, it has.

- Dogecoin buyers are returning to the market, because who wouldn’t want to buy a coin that’s been on a downward trend?

It appears that Dogecoin buyers have made a strong comeback, because they’ve returned to buy the dip. This buying spree has played a vital role in driving DOGE prices higher, because, well, that’s what happens when people buy things.

In fact, as of this writing, Dogecoin was trading at $0.174, which is a 7.30% increase in the 24-hour timeframe. Because, you know, math.

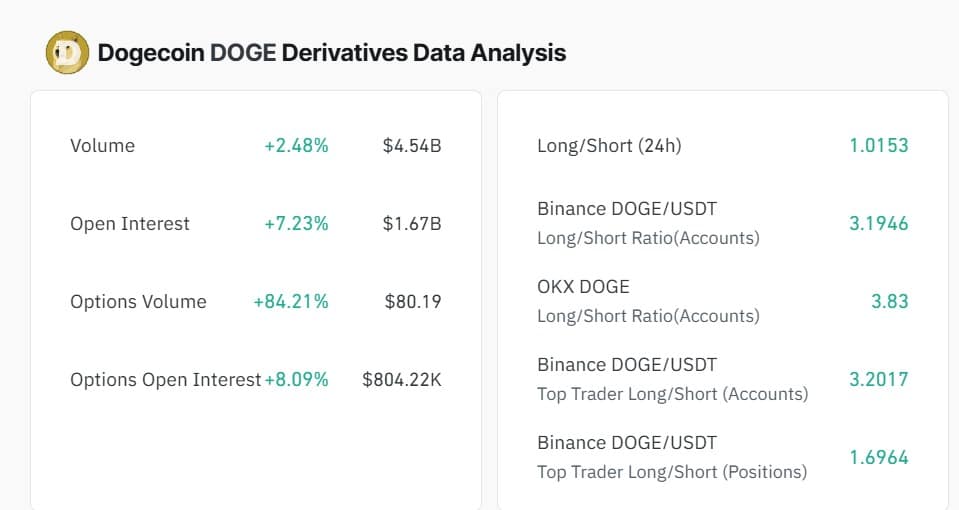

During the same period, Dogecoin’s derivatives experienced significant growth, because people are getting excited. Options volume increased by 84.21%, while Options Open Interest (OI) rose by 8% to $804k. Because, you know, people are placing bets.

Additionally, the memecoin’s trading volume surged by 22%, reaching $1.22 billion, and OI climbed 7.23% to $1.67 billion. Because, well, people are buying and selling.

Before these gains, Dogecoin had been on a downward trend, declining by 5.45% weekly and 15.5% monthly. The question remains whether Dogecoin can maintain this momentum and reach higher resistance levels, because, you know, it’s a coin.

Can Dogecoin maintain its recent gains?

AMBCrypto’s analysis indicates a surge in demand for Dogecoin as buyers re-enter the market, because, of course, they do.

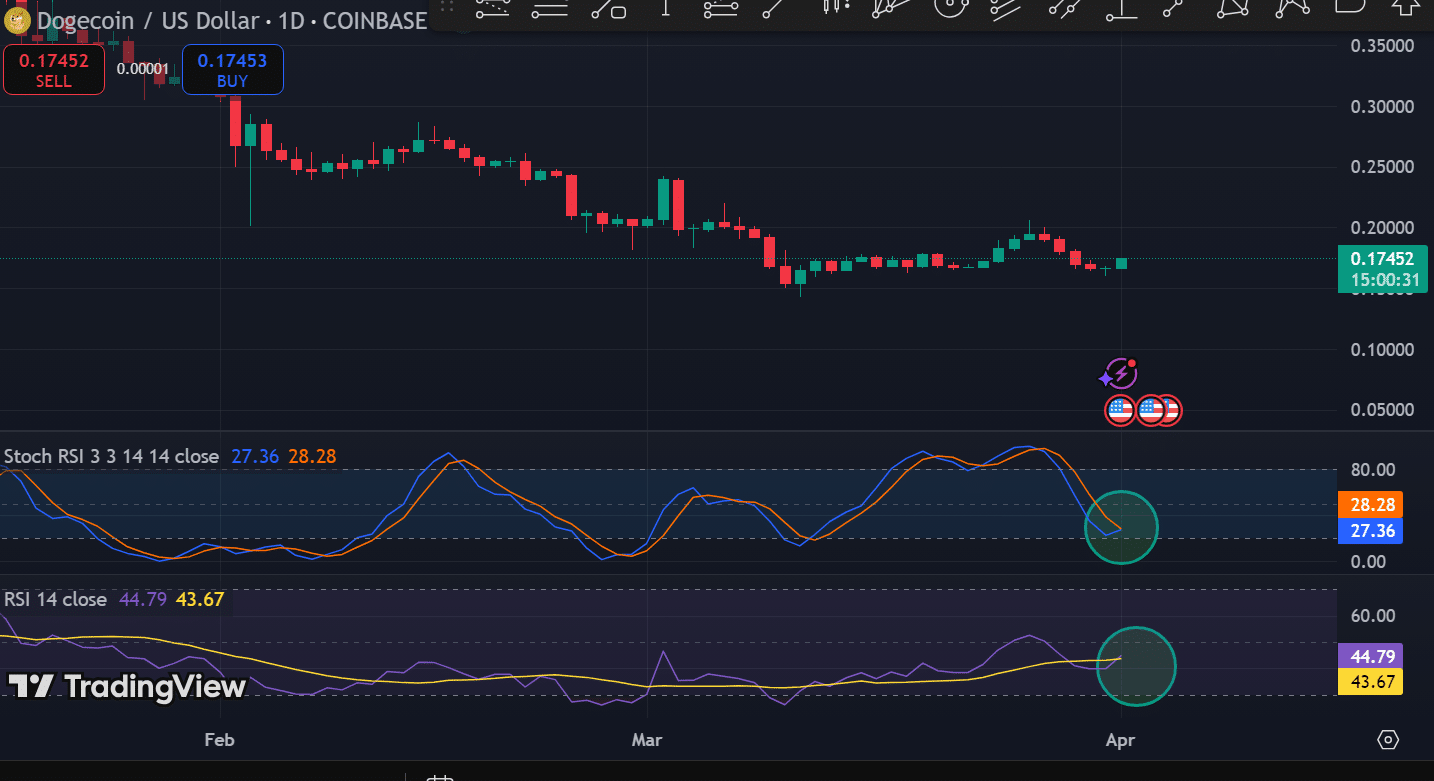

The memecoin’s price charts reveal a bullish crossover on its Relative Strength Index (RSI), which is just a fancy way of saying “buyers are in control.” This crossover supports the observation that buyers have regained control of the market, because, well, they have.

When the RSI rises and makes a bullish crossover, it signals that buyers are dominating the market, surpassing sellers in strength, because, you know, that’s what happens when buyers are in control.

The dominance of buyers is confirmed by the positive order imbalance, indicating more buy orders than sell orders, because, well, people are buying.

This market behavior showcases strong bullish sentiment, as investors see current rates as favorable for acquiring the asset, because, you know, they’re optimistic.

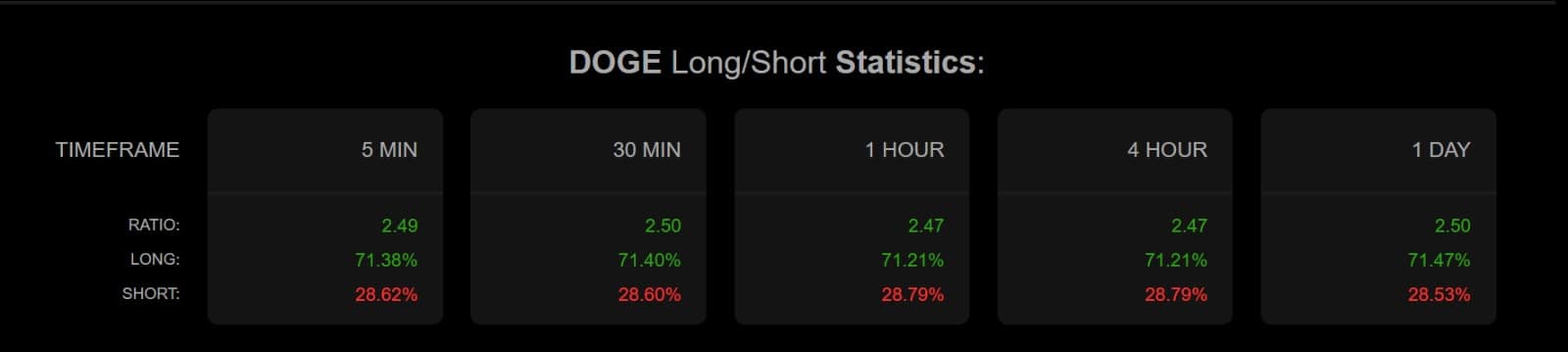

Finally, Dogecoin’s Long/Short Ratio indicates that these buyers are re-entering the market to take long positions, because, well, they’re buying.

When longs are dominant, it suggests that investors are bullish and anticipate prices to rise in the near term, because, you know, they’re optimistic.

In summary, Dogecoin is experiencing strong short-term demand, signaling a shift in market sentiment, because, well, people are buying.

The upward momentum appears to be building steadily, because, you know, it’s a coin.

If the Stoch RSI completes its upward move and makes a bullish flip, it will validate the RSI’s bullish crossover, because, well, math.

This confirmation would indicate a continuation of the uptrend, suggesting that Dogecoin can sustain its recent gains, because, you know, it’s a coin.

If this happens, DOGE is likely to reclaim the $0.18 level, which would strengthen its position for a push toward $0.19, because, well, it’s a coin.

However, if buyers’ bullish efforts falter and sellers begin to offload, a correction could bring DOGE’s price down to $0.168, because, well, that’s what happens when sellers sell.

Read More

- Lucky Offense Tier List & Reroll Guide

- Indonesian Horror Smash ‘Pabrik Gula’ Haunts Local Box Office With $7 Million Haul Ahead of U.S. Release

- Best Crosshair Codes for Fragpunk

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- League of Legends: The Spirit Blossom 2025 Splash Arts Unearthed and Unplugged!

- ‘Severance’ Renewed for Season 3 at Apple TV+

- Unlock All Avinoleum Treasure Spots in Wuthering Waves!

- How To Find And Solve Every Overflowing Palette Puzzle In Avinoleum Of WuWa

- Ultimate Half Sword Beginners Guide

- Skull and Bones Year 2 Showcase: Get Ready for Big Ships and Land Combat!

2025-04-02 01:17