In distant Brazil, amidst samba and soccer, a curious thing has happened: Hashdex, with a solemn nod from Genial Investimentos, has conjured an ETF known simply as XRPH11. This mystical vessel invites investors to sip the sweet elixir of XRP without the tedious bother of handling the actual tokens—how very convenient!

The fund, guided by the Nasdaq XRP Reference Price Index (imagine a compass in the wild crypto jungle), pledges to commit at least 95% of its treasures to XRP or its kin. Samir Kerbage, a man of great seriousness and title, declared, “XRPH11 is for the sophisticated—the ones who dabble in crypto not for fun, but with cold, institutional calculation.” Ah, sophistication: the seasoning that spices the cryptic broth.

Thus, Brazil, that land of eternal carnival, strides boldly where others hesitate. Offering regulated keys to Ripple’s kingdom via the B3 stock exchange, it sets itself apart as a pioneer while others… well, sniff the dust.

Brazil Sprints, America Limps

On one side, Brazil, proud and unbothered by red tape. On the other, the United States—home turf of Ripple Labs and a regulatory circus still spinning its endless show, refusing to let XRP ETFs enter the ring. Despite valiant attempts by Grayscale, Franklin Templeton, and assorted dreamers, the SEC hides behind bureaucratic curtains, saying, “Not yet.”

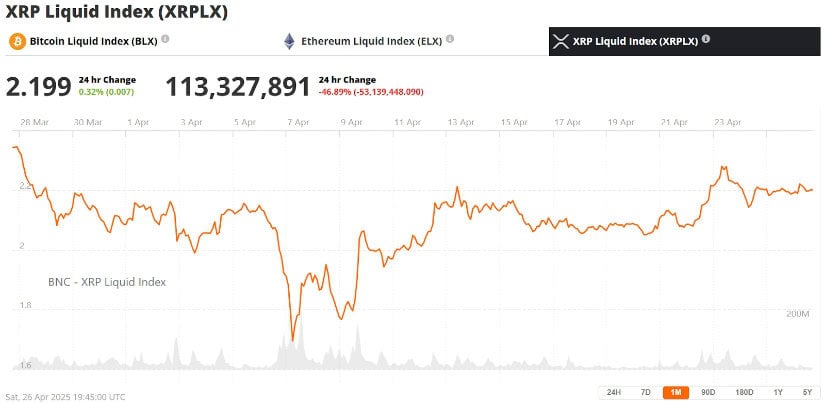

//bravenewcoin.com/wp-content/uploads/2025/04/Bnc-Apr-27-86.jpg” alt=”Graph suggesting XRP price trends”/>

Local sages and international wizards alike muse that Ripple’s ledger is evolving, partnerships blossom, and the infrastructure for swift payments grows stronger—an enchantment that could well propel XRP’s value into an entirely new stratosphere.

The Brazilian Marvel: XRPH11 and Why It Matters

Approved by Brazil’s watchful CVM, the XRPH11 ETF is a beacon for those weary of crypto’s Wild West. Intended for the discerning investor—those who prefer their fortunes wrapped in regulatory paperwork rather than chaos—the fund boasts daily transparency and cautious caretakers ensuring every token sleeps safely under Genial Bank’s watchful eye.

Silvio Pegado, Ripple’s emissary to Latin lands, lauds Brazil’s vision, mentioning XRP’s swiftness and efficiency as the perfect dance partner for this new financial ballet. A 0.7% management fee and a gentle 0.1% custody fee provide the seasoning—just enough to keep investors alert but not wincing.

Ripple in America: Lawsuits and Waiting Games

The Ripple saga in the U.S. courts led to a $50 million settlement from a $125 million penalty—less a defeat, more a grudging tip of the hat. Yet the SEC’s shadow still lingers, debating XRP’s very nature and who should watch over the markets. The old guard, Gary Gensler, was no friend to altcoin ETFs, fearing mischief; the new sheriff, Paul Atkins, brings more crypto-friendly vibes, stirring hope that the regulatory fog may lift.

Looking Forward: Institutional Hunger and Market Waves

To the tune of bustling trading floors and eager whispers, XRPH11’s debut revealed a thirst for regulated XRP exposure. JPMorgan’s crystal ball sees a combined $14 billion flowing into XRP and Solana ETFs within a year—either a brave prophecy or a bid to brighten a gloomy corridor.

Meanwhile, alliances are forged—a partnership with Bank of America here, a ledger upgrade there—each move adds a note to XRP’s symphony of hope. As the lawsuit dust settles and global markets nod approvingly, XRP may yet become the harbinger of a new era in the grand bazaar of digital money.

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- Death Stranding 2 Review – Tied Up

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

2025-04-26 23:27