What to know:

- In a twist worthy of a Dostoevskian plot, BlackRock’s ownership of Strategy has crept up to a tantalizing 5%, as revealed in the latest 13-G filing. Who knew finance could be so thrilling? 🎢

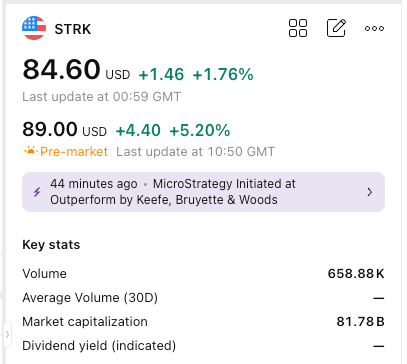

- Strategy’s perpetual preferred stock is strutting its stuff, up 5% in pre-market trading. It seems the stock market is having a good hair day! 💁♂️

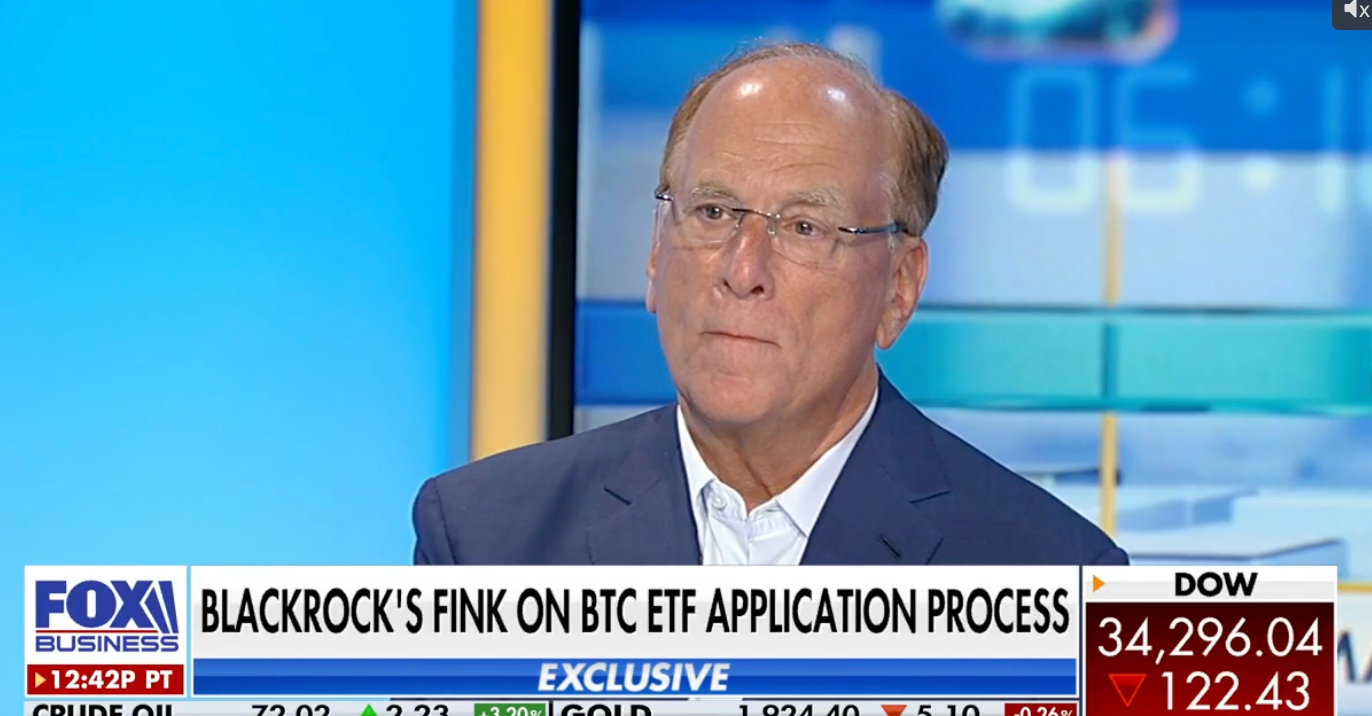

In a recent Schedule 13G filing, BlackRock (BLK) has unveiled its newfound affection for Strategy (MSTR), now clutching a hefty 5% of the company—approximately 11.2 million shares. This marks a 0.91% increase from its previous 4.09% ownership as of September 30, 2024, according to the ever-reliable oracle, Yahoo Finance. 📈

Ah, the Schedule 13G—a document that sounds like a secret code but is merely a formality for investors who acquire more than 5% of a publicly traded company’s stock without the intention of staging a coup. Institutional investors must file within 45 days after year-end or within 10 days if they decide to go all-in and exceed 10%. Talk about a ticking clock! ⏰

Since BlackRock’s filing date was December 31, 2024, the firm had until February 14 to spill the beans. A Valentine’s Day gift for the stock market, perhaps? 💌

In related news, Strategy’s perpetual preferred stock (STRK) made its grand debut on the Nasdaq on Thursday. According to TradingView, STRK closed the day up 2% with over 650,000 shares traded. It seems this stock is on a roll, now up 5% pre-market. Who knew stocks could be so popular? 🎉

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-02-07 14:52