Bittensor has shattered previous boundaries, pushing the number of subnets to a dizzying high. Once a humble network, now it dazzles like a circus performer—fingers crossed for a $1,000 TAO balloon by 2025. The ecosystem buzzes with optimism, while investors clutch their pearls and hope it’s not just a mirage in a desert of crypto chaos.

But what’s all this fuss about these *subnets*, you ask? Well, imagine tiny islands of chaos where developers, miners, and validators debate, train, and fight for dominance—in the name of decentralized AI, of course. Each subnet specializes in something lofty: natural language processing, data analysis, or AI content creation—because why settle for one task when you can irritate the internet with your endless AI chatter?

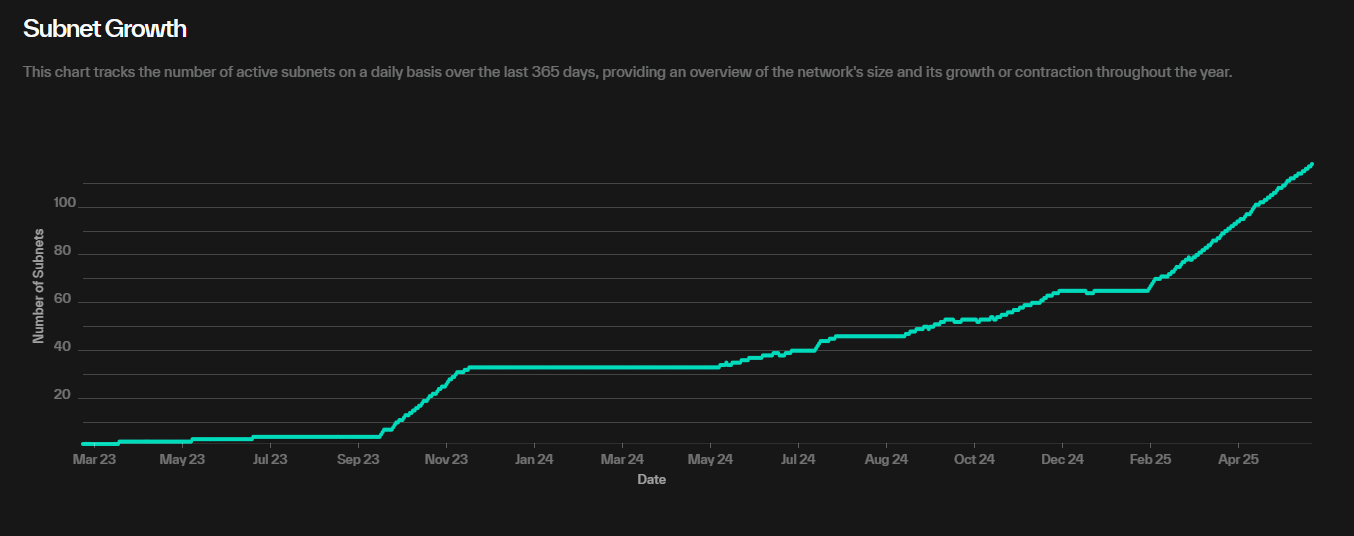

These subnets operate under an “incentive model,” meaning miners and validators get TAO tokens for their tireless (and often thankless) efforts. With 118 subnets, the ecosystem’s grown so wild that it’s practically a decentralized AI version of the Tower of Babel—just with more crypto and fewer languages.

This expansion isn’t just a feat of engineering; it’s a parade of overconfidence, promising more projects, more participants, and—hopefully—less chaos. But hey, with great diversification comes the great headache of keeping everything running smoothly without the whole mess collapsing into digital entropy.

BitGo Partners with Yuma to Drive Institutional TAO Staking

Meanwhile, the big players—those who juice the system with serious money—have stepped in. BitGo, the digital asset giant, joined forces with Yuma, one of Bittensor’s star validators, to offer TAO staking for institutional investors. Because nothing says “trust us” like handing your crypto to a validator with a fancy name.

This alliance is a slap in the face to traditional finance, making wealthy funds feel like they’re investing in the future—while secretly praying it’s not just a balloon waiting to pop. Over 6 million TAO are now staked—more than 70% of the circulating supply—so basically, everyone’s putting their chips in the decentralized AI poker game. 🃏

The Yuma Consensus 3 upgrade, announced loudly in early June, brought improvements to reward distribution and fraud detection—because what’s a network without some digital police? These changes aim to ensure the ‘good guys’ get their fair share, or at least that’s the story we’re told.

The Million-Dollar Question: Can TAO Hit $1,000?

Optimists, like the analyst Decode, believe Bittensor could blast past $1,000 by 2025. Using mystical Elliott Wave Theory, they see TAO as the next crypto messiah—soar high and sprinkle fairy dust on investors’ dreams.

“You will see a similar structure and bullish setup on many other altcoins, but few are as strong as TAO, imo,” Decode declared with the certainty of a prophet in a digital temple.

But don’t break out the champagne just yet. The market cap of AI tokens has fallen faster than a skydiver without a parachute—down over 50%, from $69 billion at the end of last year to a meager $31 billion today. So while TAO’s dreams are big, reality remains stubbornly grounded in skepticism.

Despite the glitter and promises, many investors are hesitant—stuck between the hope of riches and the fear of losing what little they have. Like a bad joke that keeps getting told at every crypto meeting, everyone’s waiting for the punchline that never comes.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- Which Is the Best Version of Final Fantasy IX in 2025? Switch, PC, PS5, Xbox, Mobile and More Compared

2025-06-06 16:18