Ah, Bitcoin, that enigmatic digital beast, continues to dance in the shadows of uncertainty, its price neither here nor there, as if it were a character in one of those absurdist plays where nothing ever happens. Analysts, those modern-day soothsayers, are busy scribbling their prophecies, and among them, Ali Martinez has emerged, pointing to two resistance zones like a magician revealing the secret to his trick. Could these be the keys to reigniting the crypto bull run? Or just another mirage in the desert of speculation?

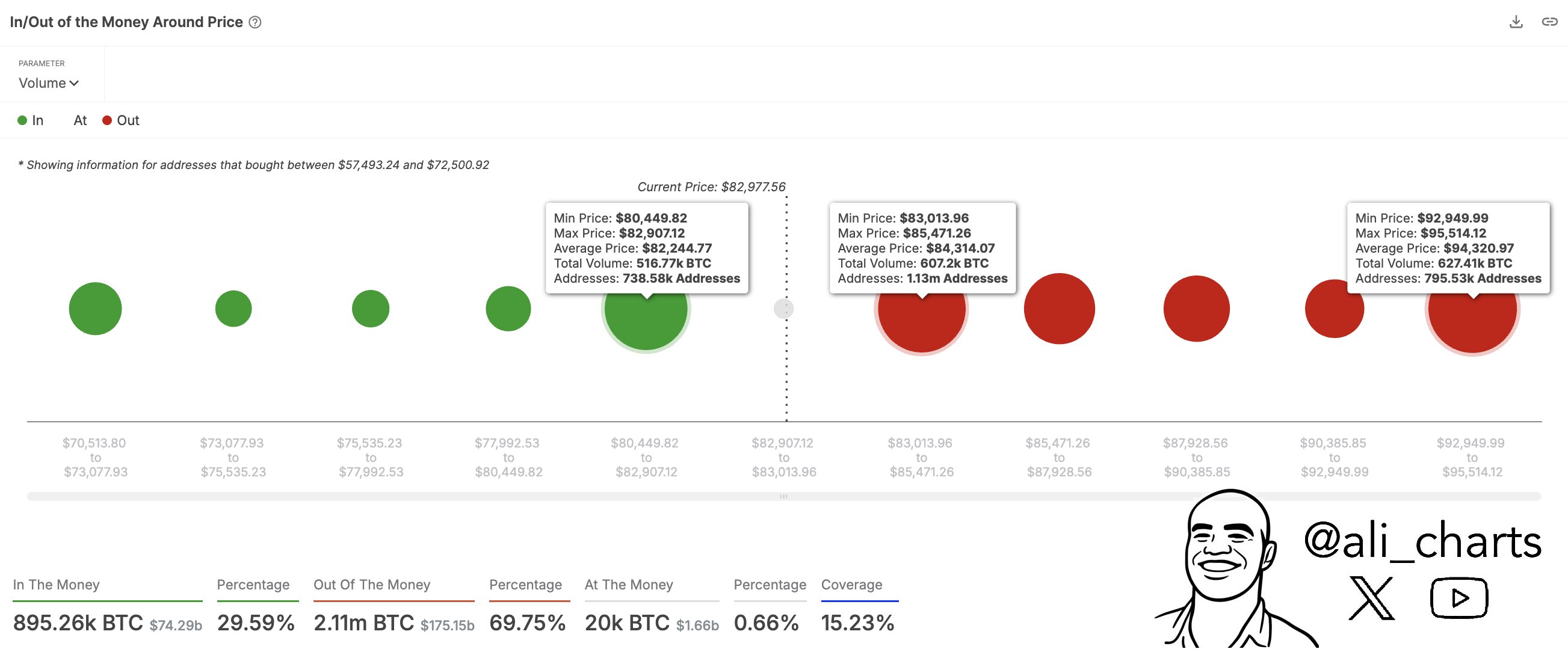

Over the past month, Bitcoin has been like a reluctant hero, struggling to break free from the shackles of $85,000 and $88,000, as if these numbers were cursed by some ancient financial deity. But Martinez, armed with on-chain data from IntoTheBlock, has identified two critical resistance zones: $85,470 and $92,950. The first, $85,470, is a fortress guarded by 1.13 million wallet addresses, which have traded a staggering 607,200 BTC within this range. If Bitcoin can breach this citadel, the next challenge awaits at $92,950, where 795,830 wallet addresses have traded 627,410 BTC. A lesser crowd, perhaps, but no less formidable.

If Bitcoin can conquer these two zones, Martinez suggests that the cryptocurrency could embark on a glorious bull rally, like a phoenix rising from the ashes. But beware! The $80,450 support zone looms below, a safety net woven by 738,580 wallet addresses that have traded 516,770 BTC. A fall below this level could spell disaster, turning the phoenix into a mere chicken.

In other news, Bitcoin network fees have plummeted by 57.3%, a sign that the digital gold rush may be losing its luster. Yet, Bitcoin’s price has only dipped by a mere 0.11%, as if it were shrugging off the decline with a nonchalant “meh.” Meanwhile, the broader crypto market has responded positively to the recent US tariff announcements, with Bitcoin rising by 2.2%. In contrast, the “Magnificent Seven” stocks have taken a beating, falling by an average of 12.18%. It seems that in this battle of the markets, Bitcoin is the last man standing, or at least the last one still smirking.

Read More

- Lucky Offense Tier List & Reroll Guide

- Indonesian Horror Smash ‘Pabrik Gula’ Haunts Local Box Office With $7 Million Haul Ahead of U.S. Release

- Best Crosshair Codes for Fragpunk

- League of Legends: The Spirit Blossom 2025 Splash Arts Unearthed and Unplugged!

- How To Find And Solve Every Overflowing Palette Puzzle In Avinoleum Of WuWa

- Unlock Every Room in Blue Prince: Your Ultimate Guide to the Mysterious Manor!

- Ultimate Half Sword Beginners Guide

- Russian Twitch Streamer Attacked in Tokyo as Japan Clamps Down on Influencer Behavior

- Unlock the Ultimate Barn Layout for Schedule 1: Maximize Your Empire!

- Madoka Magica Magia Exedra Tier List & Reroll Guide

2025-04-05 17:11