What to know:

- Bitcoin has been wobbling around the $96,000 mark like a drunken squirrel, but CryptoQuant analysts are waving red flags, suggesting it might just tumble down to $86,000.

- With BTC demand, network activity, and liquidity moving slower than a tortoise on a lazy day, prices could be in for a bumpy ride, they say.

- Bob Loukas, the oracle of crypto, claims the sentiment reset is nearly complete, as BTC enters the final stretch of its weekly cycle—whatever that means!

Bitcoin (BTC) made a valiant leap back from a Tuesday dip to $93,000, but alas, the specter of downside pressure looms like a bad smell in a crowded room, threatening to drag it down to $86,000. The report suggests that waning demand, a faltering blockchain, and a distinct lack of liquidity are all conspiring against our dear BTC.

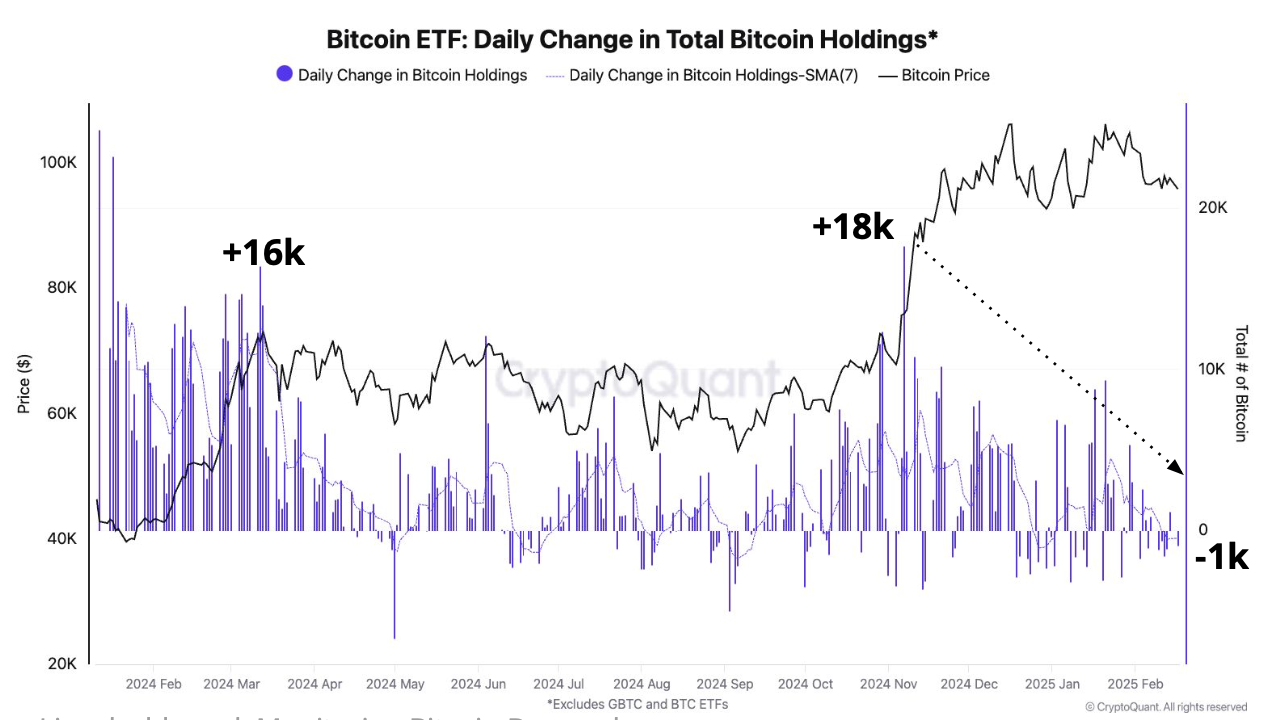

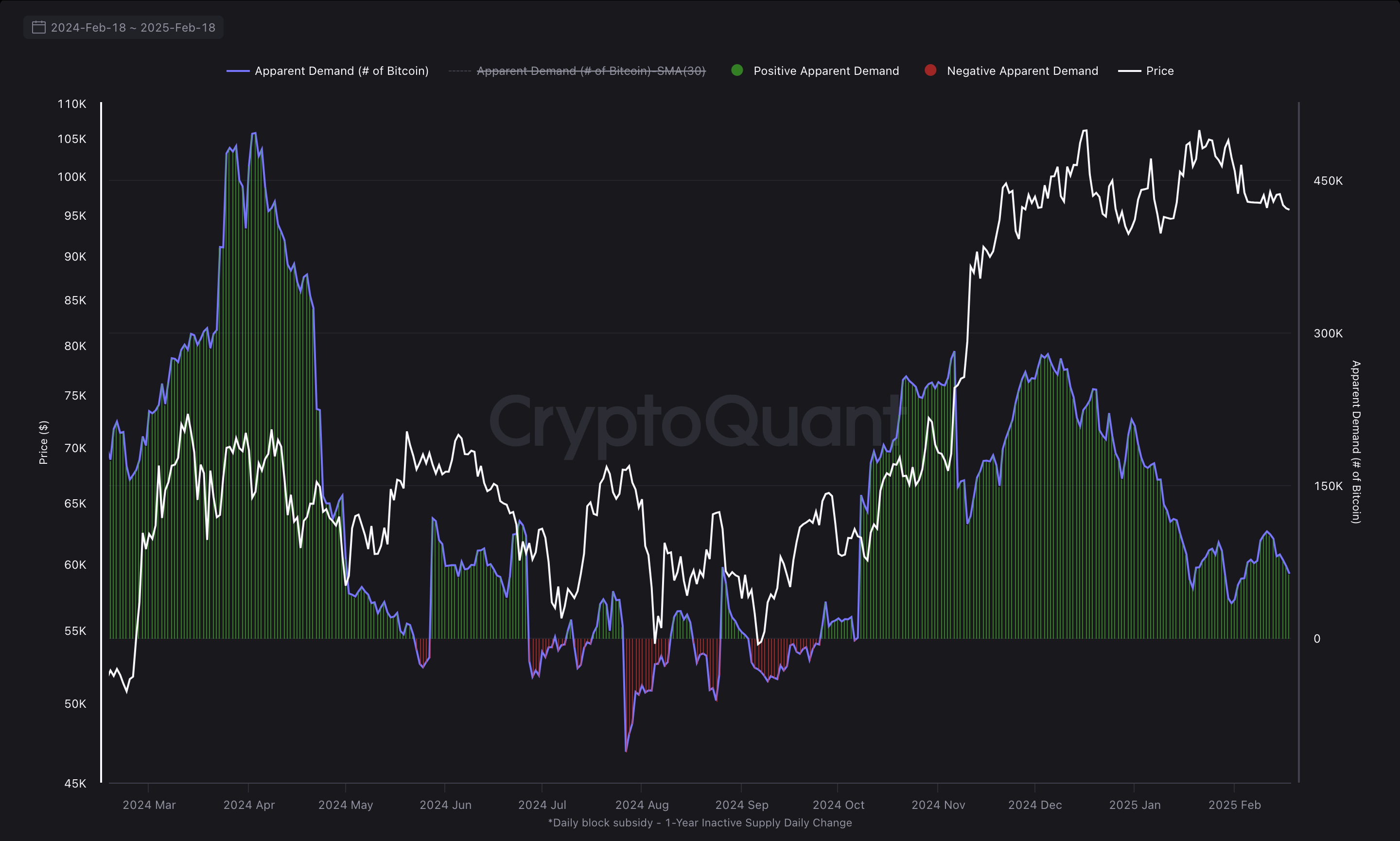

Once upon a time, in late 2024, demand for bitcoin surged like a caffeinated rabbit after Trump’s election win, but now it’s retreating faster than a cat in a dog park. CryptoQuant data reveals that demand growth has plummeted to a mere 70,000 BTC from a dizzying peak of 279,000 BTC on December 4. Inflows to spot BTC exchange-traded funds (ETFs) have vanished like socks in a dryer, leaving behind regular net outflows over the past two weeks after a brief flirtation with 18,000 BTC in daily purchases.

Meanwhile, CryptoQuant’s Inter-exchange Flow Pulse, which sounds like a fancy medical device, indicates weakness with BTC transfers to Coinbase—our trusty gauge of U.S. spot demand—dropping below its 90-day moving average. It’s like watching a balloon slowly deflate.

Stablecoin growth, the rocket fuel for crypto market rallies, has also hit the brakes. Although the total stablecoin market cap recently crossed the $200 billion mark, the pace of expansion has slowed to a crawl. The 60-day average change in USDT’s market capitalization has nosedived by over 90% since mid-December, plummeting from over $20 billion to a paltry $1.5 billion. This slowdown suggests that fresh capital is as rare as a unicorn in a traffic jam.

Muted blockchain activity on the Bitcoin network is flashing warning signs like a disco ball at a retirement home. CryptoQuant analysts report that Bitcoin’s network activity has slumped to its lowest level in a year, down 17% from its November 2024 peak and dipping below its 365-day moving average for the first time since July 2021—when China decided BTC mining was a no-go. Fewer transactions mean declining investor engagement and waning speculative interest, which is about as exciting as watching paint dry.

BTC may bottom soon

After hitting a new record of $109,000 in January, fueled by optimism around Donald Trump becoming president (again, apparently), BTC has been struggling to hold its ground, languishing in a narrow range above $90,000. Meanwhile, the broader crypto market has been battered by controversial memecoin launches, with the likes of TRUMP memecoin and LIBRA burning through speculative capital like a bonfire at a barbecue.

Bob Loukas, the crypto sage, notes that the sentiment reset is almost complete as bitcoin enters the final stretch of its weekly cycle. BTC could find a bottom in the near future, but it might just break below the $90,000 range-low in the process. It’s

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- How to use a Modifier in Wuthering Waves

- Basketball Zero Boombox & Music ID Codes – Roblox

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-02-19 22:01