Ah, the crypto market! A whirlwind of chaos and opportunity, where the tides of global liquidity have surged to unprecedented heights in April 2025. Gold, that glittering relic, has shattered the $3,200 barrier, while Bitcoin, poor thing, lingers 30% below its former glory. What a tale of two metals!

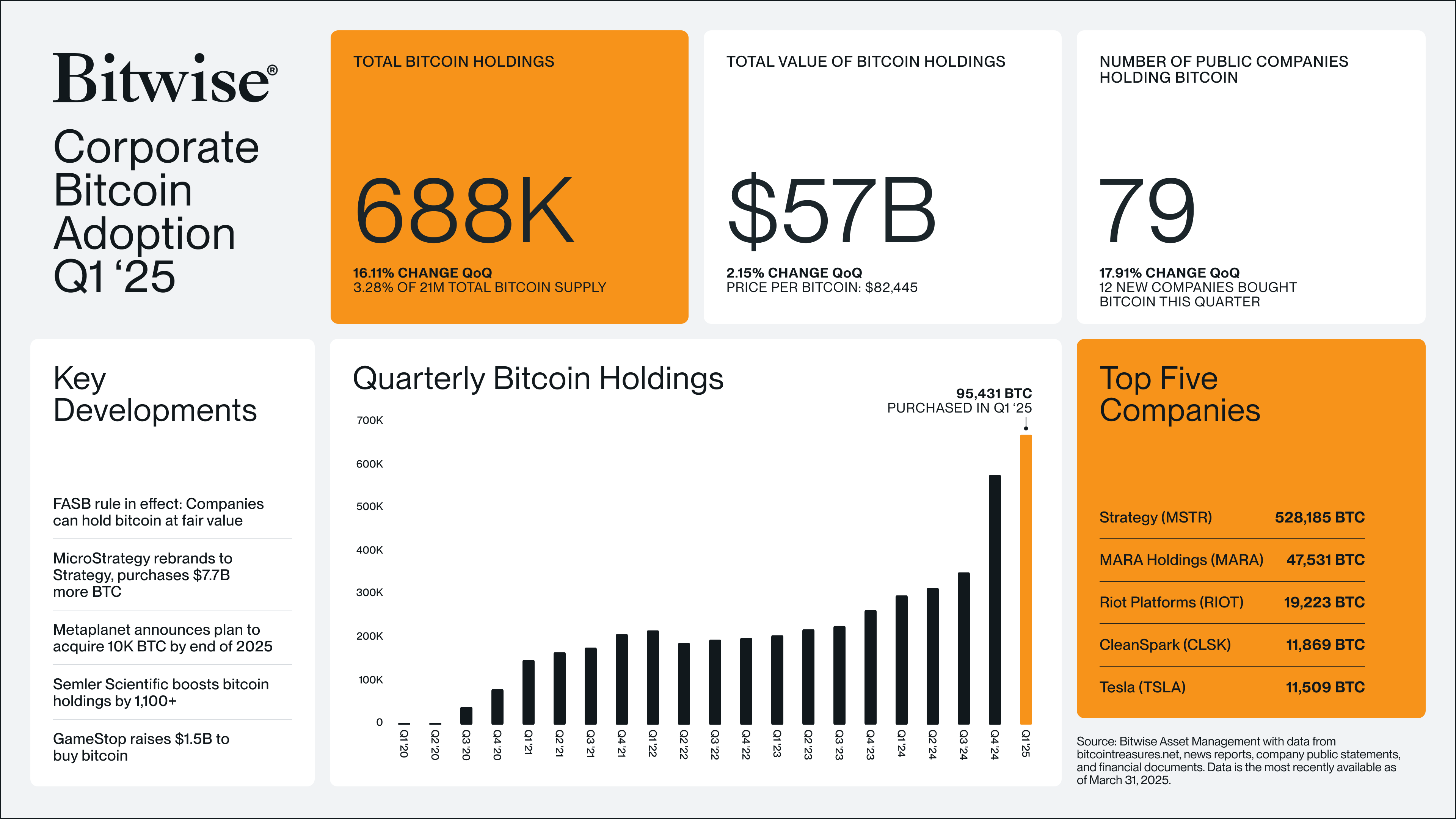

In this grand theater of finance, analysts are squinting through their glasses, trying to decipher the cryptic relationship between Bitcoin and gold. Fresh data reveals a corporate stampede towards Bitcoin, with record-breaking purchases in the first quarter of 2025. Who knew corporations had such a taste for digital gold?

What Bitcoin’s Ties to Gold and Liquidity Signal for Its Price

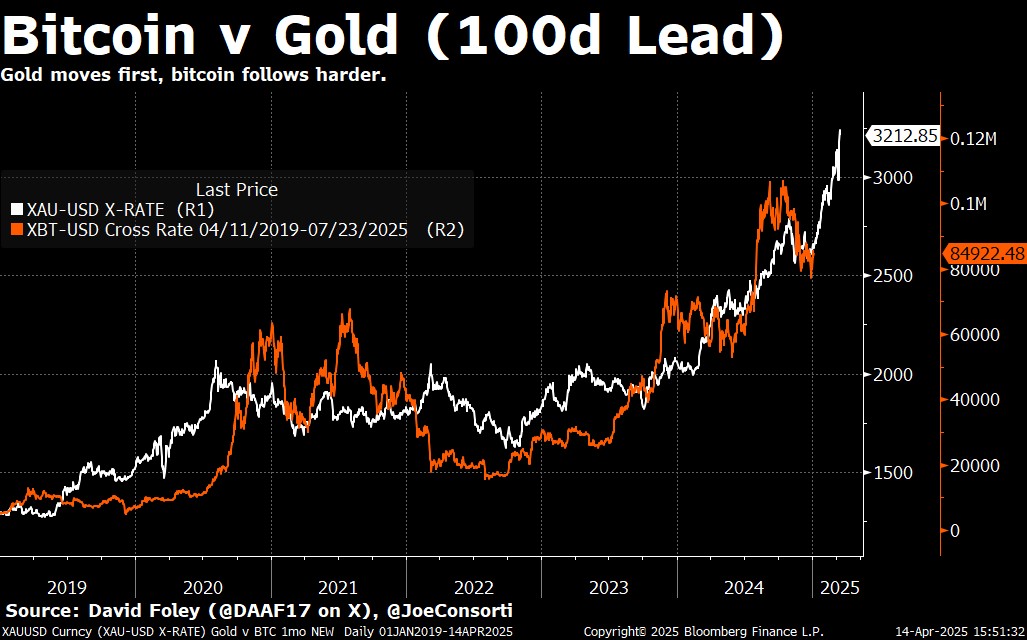

According to the wise Joe Consorti, Head of Growth at Theya, Bitcoin is like a loyal dog, trailing behind gold with a delay of 100 to 150 days. A chart shared by Consorti on X, courtesy of Bloomberg, paints this picture from 2019 to April 14, 2025. It’s like watching a slow-motion race!

The chart, a masterpiece of financial art, shows gold (XAU/USD) in white and Bitcoin (XBT/USD) in orange. It reveals that gold usually takes the lead during upswings, but Bitcoin, oh sweet Bitcoin, often makes a more dramatic entrance afterward—especially when global liquidity is on the rise. Talk about a dramatic flair!

“When the printer roars to life, gold sniffs it out first, then Bitcoin follows harder,” Consorti quipped, probably while sipping a fine whiskey.

This 100-to-150-day lag is not just a number; it’s a beacon of hope! It suggests Bitcoin might be gearing up for a spectacular leap within the next 3 to 4 months. And with global liquidity surging, who wouldn’t want to hop on this rollercoaster?

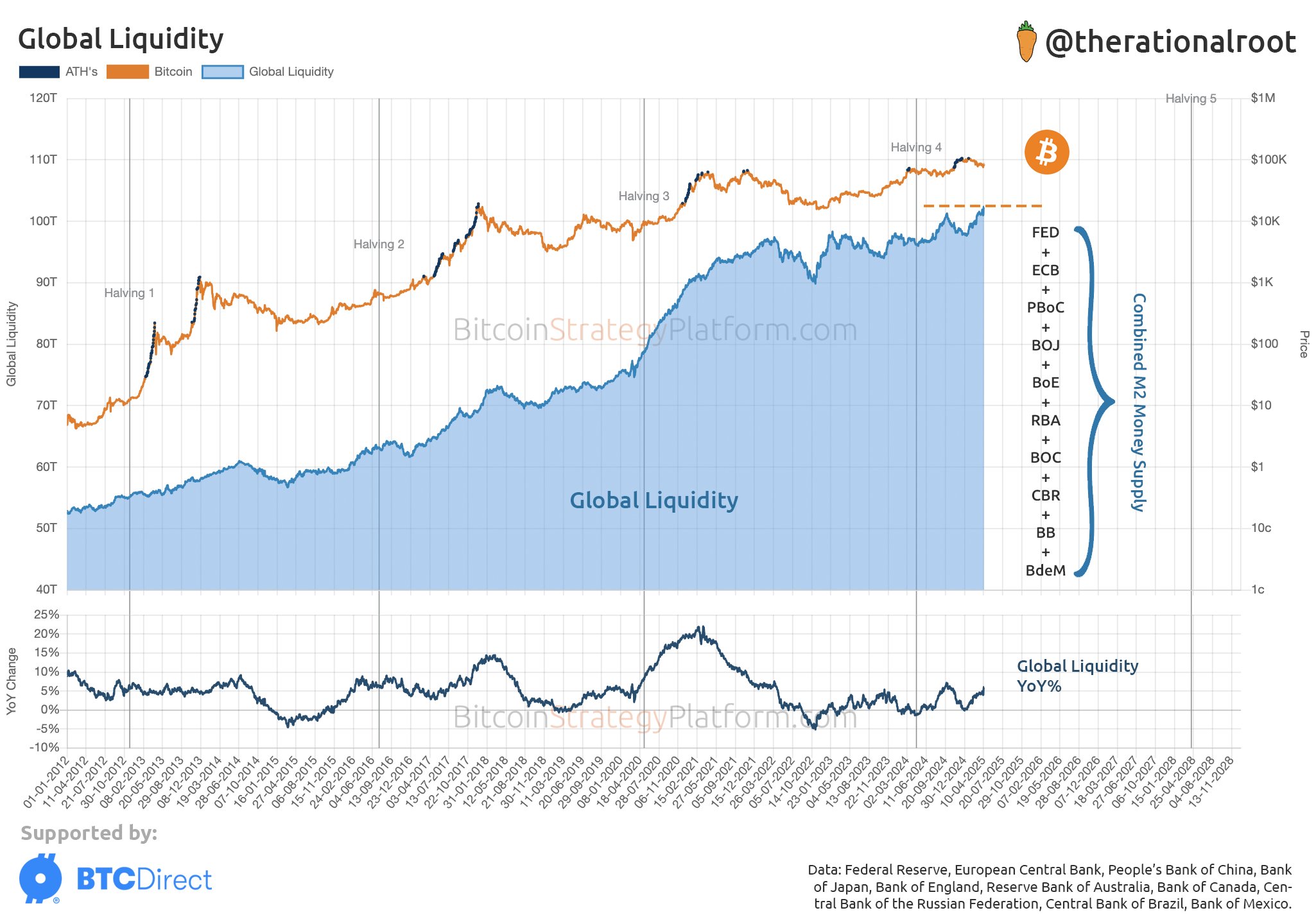

According to the ever-astute analyst Root, the M2 money supply from major central banks—including the US Federal Reserve, European Central Bank (ECB), People’s Bank of China (PBoC), and others—has hit a record high as of April 2025. It’s raining cash, hallelujah!

This sharp rise indicates more cash flowing through the global economy, like a river of greenbacks. 💵

Historically, Bitcoin bull markets have danced in sync with major increases in global liquidity, as more money in the system nudges investors toward riskier assets like Bitcoin. It’s like a financial tango!

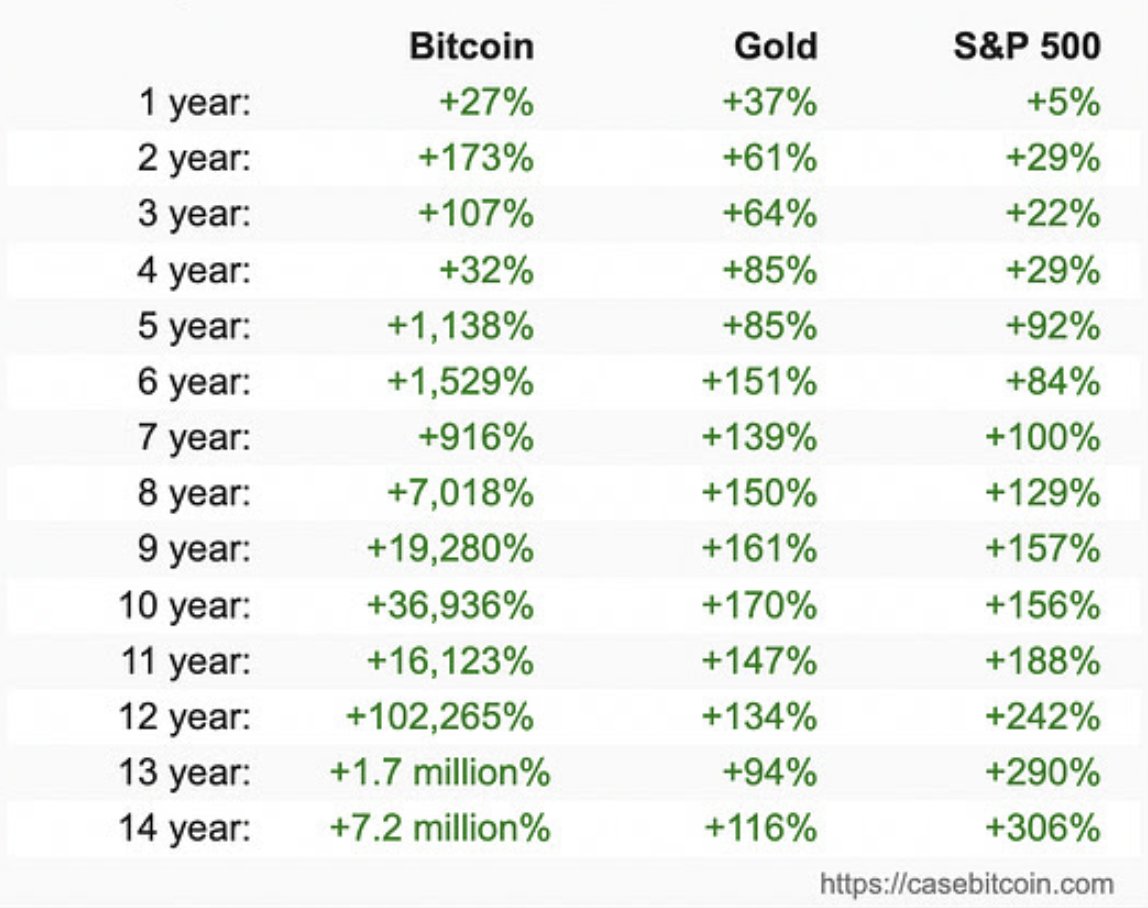

Why Bitcoin Might Outperform Gold and Stocks

Matt Hougan, the Chief Investment Officer at Bitwise Invest, boldly claims that Bitcoin is not just outpacing gold but is also leaving the S&P 500 in the dust over the long haul. This suggests that Bitcoin is becoming a more attractive investment option, despite its wild price swings. Who needs stability when you have excitement?

Data backs this up! A recent Bitwise report reveals that corporations gobbled up over 95,400 BTC in Q1—about 0.5% of all Bitcoin in circulation. That’s the largest quarter for corporate accumulation on record. Talk about a corporate feeding frenzy!

“People want to own Bitcoin. Corporations do too. 95,000 BTC purchased in Q1,” declared Bitwise CEO Hunter Horsley, probably while counting his own Bitcoin stash.

With corporate demand skyrocketing and Bitcoin flexing its muscles against traditional assets, the stage is set for a major rally in summer 2025—driven by peak global liquidity and Bitcoin’s historical tendency to follow gold’s lead. Buckle up, folks! 🎢

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- How to watch the South Park Donald Trump PSA free online

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

2025-04-15 11:26