- Bitcoin has been dancing a merry jig in the derivatives markets, but the spot markets? Not so much.

- With liquidation levels piling up at $100k and below, it seems prices might just take a nosedive.

Ah, Bitcoin [BTC], that elusive creature of the digital realm, reached a staggering height of $111,980 on Binance on the 22nd of May. It was reported that the Open Interest (OI) reached a record high of $74 billion, which is a number so large it could make a dragon blush. The influx of capital into the derivatives market recently has been like a stampede of bullish conviction, charging through the fields of speculation.

However, lurking beneath the surface, a multitude of liquidations have gathered like a storm cloud under the $100k level. This could very well pull prices southwards, as if they were drawn by the siren call of liquidity. Should traders be preparing for a short-term pullback? Well, that’s the million-dollar question, or perhaps the hundred-thousand-dollar one! 🤔

According to the wise sages at Coinalyze, the OI trend has flattened out after BTC reached its new all-time high. The Funding Rate was positively exuberant, but in the last 24 hours, it has decided to take a little nap and fallen to neutral levels. How delightful!

Traders, brace yourselves for a short-term pullback!

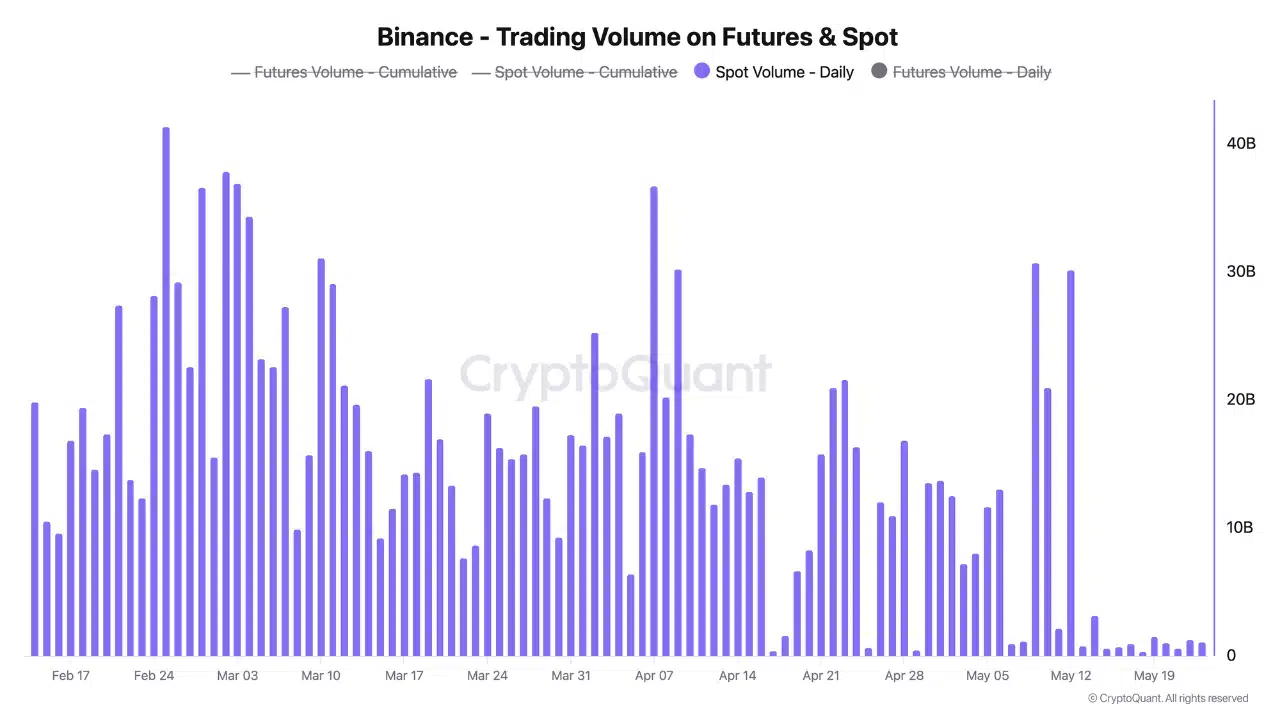

In a post on CryptoQuant Insights, the user known as Darkfost (a name that inspires confidence, doesn’t it?) pointed out that spot demand is dwindling faster than a magician’s rabbit. The futures trading volume, however, is still going strong, showcasing a high level of speculative interest. Yet, the drop in spot volume as Bitcoin embarked on its price discovery phase was a bit of a letdown, like finding out the cake is a lie.

The lack of spot demand suggests that investors are being as cautious as a cat on a hot tin roof when it comes to buying BTC above the $94k-$96k area. This region served as a formidable resistance earlier in May before the price broke out to nearly touch the $112k mark, which is a bit like trying to reach the top shelf without a ladder.

A rally led by the derivatives market could be at risk of heightened volatility and deeper pullbacks, which sounds like a thrilling rollercoaster ride, but without the safety harness.

Now, if we zoom out to cover the price action of the past six months, the 1-day chart of Bitcoin reveals a possible range formation (in white, for those who enjoy a bit of color). Two paths lie ahead in the coming weeks: a sustained uptrend, or a reset to $100k or even $93k. Decisions, decisions!

When ranges form, price action within the range tends to induce liquidation levels to build up around the extremes, much like a crowd gathering for a particularly juicy gossip. The retracement to $77.5k in March and the subsequent recovery saw short liquidations build up at $99.6k, $108k, and $113k. The first two levels have been swept away like crumbs from a banquet table. The dwindling spot demand suggests a market reset is possible, and $113k might be as unreachable as a unicorn in a traffic jam.

The 3-month chart highlights the build-up of liquidation levels at $100k and $92k as the next potential targets. Depending on the profit-taking activity and whether the bulls can find their feet again (or perhaps their hooves), Bitcoin might just cede $106k to the bears once more. And we all know how bears can be when they don’t get their way!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-05-26 03:38