What to know:

- Bitcoin is playing hard to get near $80,000 while the funding rate decides to take a vacation in the negatives.

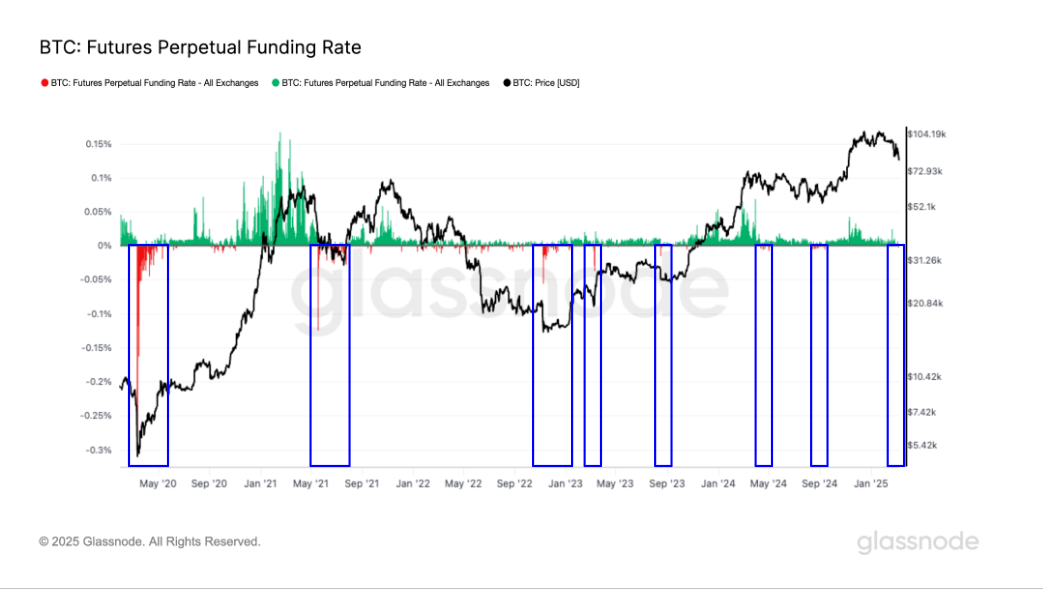

- Negative funding rates are like that friend who always shows up at the party just when you think it’s winding down—potentially marking a bottoming pattern in bitcoin.

Ah, the bitcoin (BTC) perpetual futures funding rate—fluctuating more than my mood on a Monday morning. As bitcoin hovers around the $80,000 mark, traders are left scratching their heads, wondering if they should buy a crystal ball or just consult their local fortune teller. After all, it recently lost its 200-day moving average, which is like losing your keys right before a road trip.

Now, let’s talk about the funding rate, which is set by exchanges for perpetual futures contracts. It’s the financial equivalent of a game of musical chairs: a positive rate means long positions are paying shorts, while a negative rate means shorts are paying longs. It’s all very confusing, much like trying to explain to your grandmother what a “blockchain” is.

In the last two weeks, this funding rate has been oscillating like a pendulum, indicating that traders are as indecisive as I am when choosing a restaurant. In bull markets, you’d expect the rate to stay positive, but recently it hit a negative -0.006%, which is like finding out your favorite ice cream shop has run out of your flavor—equivalent to an annualized rate of -2%, according to Glassnode data. So, grab your popcorn, folks; this show is just getting started!

Read More

- Best Crosshair Codes for Fragpunk

- Monster Hunter Wilds Character Design Codes – Ultimate Collection

- Enigma Of Sepia Tier List & Reroll Guide

- Hollow Era Private Server Codes [RELEASE]

- Wuthering Waves: How to Unlock the Reyes Ruins

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Ultimate Tales of Wind Radiant Rebirth Tier List

- Skull and Bones Timed Out: Players Frustrated by PSN Issues

- Best Jotunnslayer Hordes of Hel Character Builds

- Master Wuthering Waves: Conquer All Dream Patrol Trials in Penitent’s End for Epic Rewards!

2025-03-10 19:28