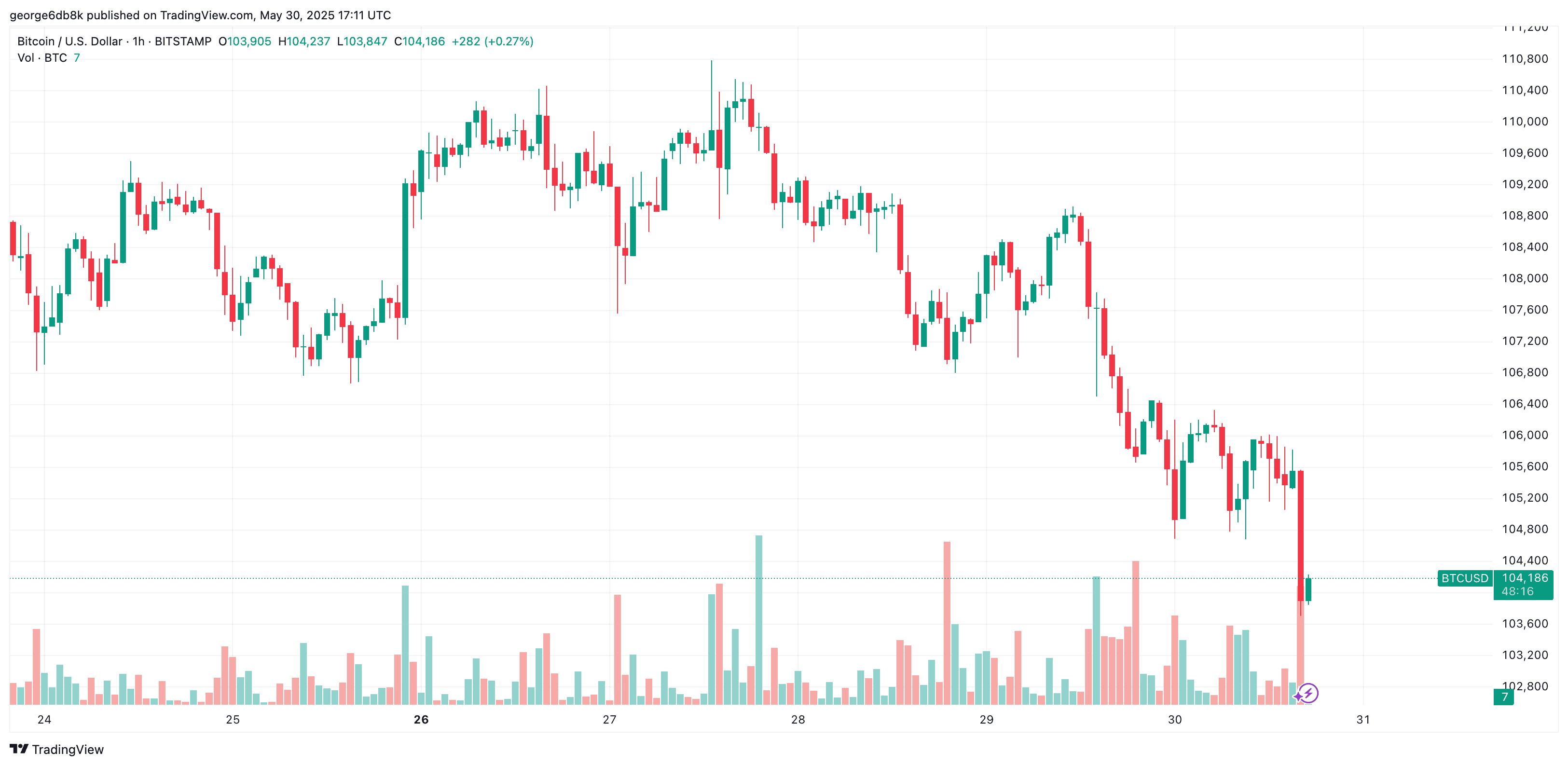

In a most theatrical display, Bitcoin has plummeted to a staggering low of approximately $103,700, as if it were a tragic hero in a Russian novel, grappling with the weight of its own existence over the past few hours.

As I pen these words, the digital currency has managed a slight recovery, now hovering around $104,100. This minor resurgence has led to a total liquidation across the derivatives market that would make even the most stoic of investors weep—around $844 million, according to the ever-reliable Coinglass.

In the last hour alone, the liquidated Bitcoin positions have surpassed a staggering $226 million, with a jaw-dropping $220 million of that being longs. One might wonder if these investors were simply playing a game of high-stakes poker, only to find themselves holding nothing but air.

Meanwhile, the broader stock markets are not faring much better, as the S&P 500, Nasdaq, and the Small Cap 2000 all tumble downwards by more than 1%. The DJI, in a fit of modesty, has only dipped by 0.6%. It seems the entire financial world is caught in a dance of despair.

This dramatic drop coincides with escalating tensions between the US and China, as if the universe itself conspired to add a touch of geopolitical drama to our financial woes. Donald Trump, in a flourish of rhetoric, declared that China has “violated” the agreement, promising retaliation in a manner reminiscent of a character from a Dostoevsky novel, full of bravado yet lacking in substance. The markets, ever the anxious participants, brace themselves for the impending storm.

In response, China has urged the US to “immediately correct its erroneous actions,” as if a simple correction could mend the rift. They call for an end to discriminatory restrictions, hoping to uphold the fragile consensus reached at the high-level talks in Geneva. Ah, the irony of diplomacy in the face of financial chaos!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- All Songs in Superman’s Soundtrack Listed

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

2025-05-30 20:23