Ah, Bitcoin! The digital phoenix that rises from the ashes of investor despair, capturing the attention of the masses as it pirouettes through a critical phase of its price cycle. Our dear entrepreneur and crypto oracle, Lark Davis, recently graced us with his musings on whether this market is nearing its zenith or if it still has room to frolic in the fields of profit.

Bitcoin’s May Performance and Current Price Overview

May began with Bitcoin strutting its stuff at a modest $94,146, but oh, how it soared! By the 22nd, it had reached a dizzying height of $111,970, a staggering 18.66% increase in just three weeks. But wait! On May 23, the market decided to play coy, correcting itself by a mere 3.9%. Fear not, for the bullish momentum returned with a vengeance, pushing the price back up by over 1.5% the very next day. Talk about a rollercoaster ride! 🎢

As of now, Bitcoin lounges at around $108,789—just 2.8% shy of its all-time high. This steady price action is a testament to the ongoing investor interest and a market sentiment that is cautiously optimistic, like a cat eyeing a canary.

Insights from Lark Davis on Market Top Signals

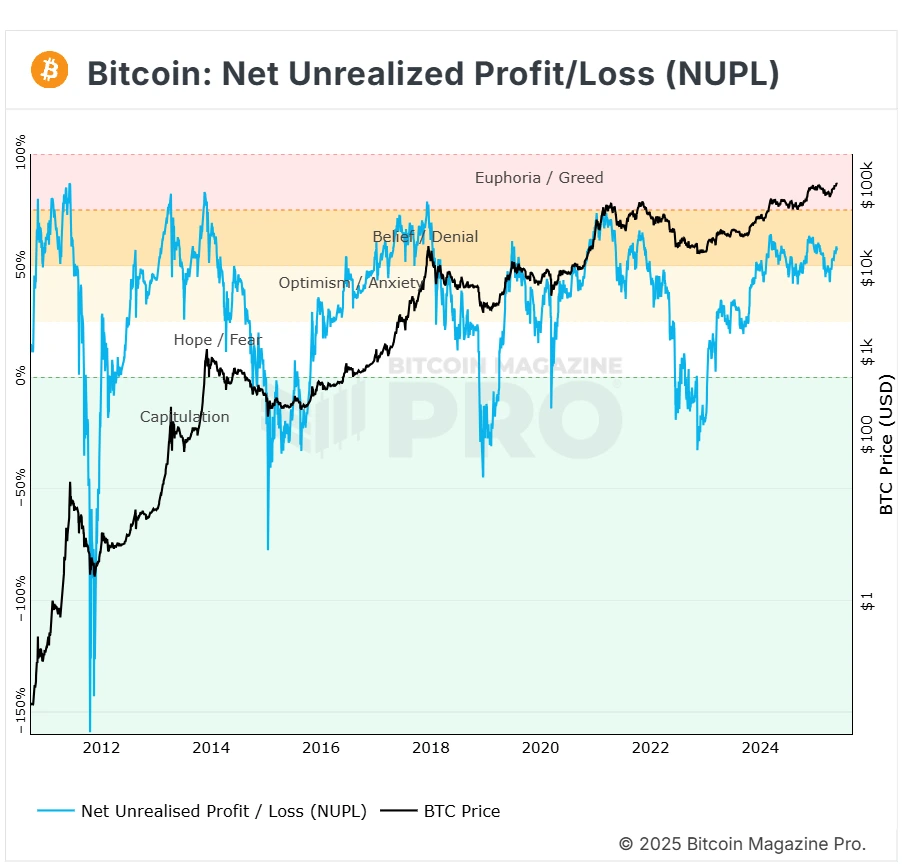

In a recent proclamation on X (formerly known as Twitter, the land of fleeting thoughts), Lark Davis dared to challenge the prevailing narrative that Bitcoin’s rally is at its end. He waved the Net Realised Profit and Loss (NPL) indicator like a flag of hope, suggesting that the market still holds significant upside potential. Who knew numbers could be so dramatic?

The NPL indicator, that fickle friend, tracks the average paper profit across Bitcoin holders. When it’s positively glowing, it often signals that many investors have realized profits, sometimes just before the market decides to take a nosedive. However, Davis pointed out that this indicator is not currently at peak levels, implying that widespread profit-taking has yet to occur. So, hold onto your hats, folks!

This analysis suggests that while Bitcoin has rallied significantly, many holders are still basking in profits but have not rushed to sell. A condition that could very well support further price appreciation. Who knew patience could be so profitable?

- Also Read:

- Robert Kiyosaki Warns of ‘Greater Depression’, Predicts Bitcoin to $1 Million

- ,

Understanding the Net Unrealised Profit/Loss Indicator

To clarify, the Net Unrealised Profit/Loss (NUPL) metric measures how much profit or loss investors hold on paper without having sold. A positive reading indicates collective profitability among holders, while a negative value points to unrealized losses. Simple, right? Or is it just a riddle wrapped in an enigma?

On May 5, the NUPL was at 52.78%. When Bitcoin reached its recent peak, the indicator rose to approximately 58.7%. These values, though elevated, have not yet reached the extreme levels historically associated with market tops. This aligns with Davis’s view that the rally may still have room to grow before a potential correction. So, keep your eyes peeled!

Balanced Perspective and Market Caution

While Lark Davis provides an optimistic take, it is crucial for investors to maintain a balanced perspective. Cryptocurrency markets are as volatile as a cat on a hot tin roof, subject to rapid changes based on external factors such as regulatory developments, macroeconomic conditions, and the whims of broader market sentiment.

Monitoring key technical indicators like the NPL and NUPL, alongside fundamental factors, can offer valuable insights for making informed investment decisions. Because, let’s face it, nobody wants to be the last one to leave the party when the music stops!

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more. Because who doesn’t want to be the smartest person in the room?

FAQs

What is the Net Realised Profit and Loss (NPL) indicator?

The NPL indicator tracks overall profit realized by Bitcoin holders; high positive values often signal potential market corrections. It’s like a warning light on your dashboard—ignore it at your own peril!

What does the Net Unrealised Profit/Loss (NUPL) show for Bitcoin?

NUPL indicates collective paper profits/losses. Bitcoin’s NUPL is elevated but not at historical extreme levels for a market top. So, it’s a bit like being on a rollercoaster—exciting but not quite at the peak yet!

Is it worth investing in Bitcoin right now?

Bitcoin is highly volatile. While current sentiment is cautiously optimistic, invest only what you can afford to lose and consider long-term goals. Remember, it’s not a sprint; it’s a marathon—unless you trip over your own feet!

How high can Bitcoin price go in 2025?

Bitcoin could reach $200,000 by year-end 2025, driven by ETF inflows and supply tightening, though predictions vary. Sources say it’s all about the crystal ball—good luck with that!

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Master the Pitch: Rematch Controls – Keyboard & Controller (Open Beta)

- Basketball Zero Boombox & Music ID Codes – Roblox

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

- How to use a Modifier in Wuthering Waves

2025-05-28 13:39