TL;DR

- Bitcoin surged from below $90K to briefly surpass $100K, driven by bullish momentum and CPI data. Analysts predict further gains, with some expecting a new all-time high and an “euphoria phase” for the market.

- Positive exchange netflows and an RSI above 70 suggest potential selling pressure and overbought conditions, signaling a possible short-term correction.

New ATH Incoming?

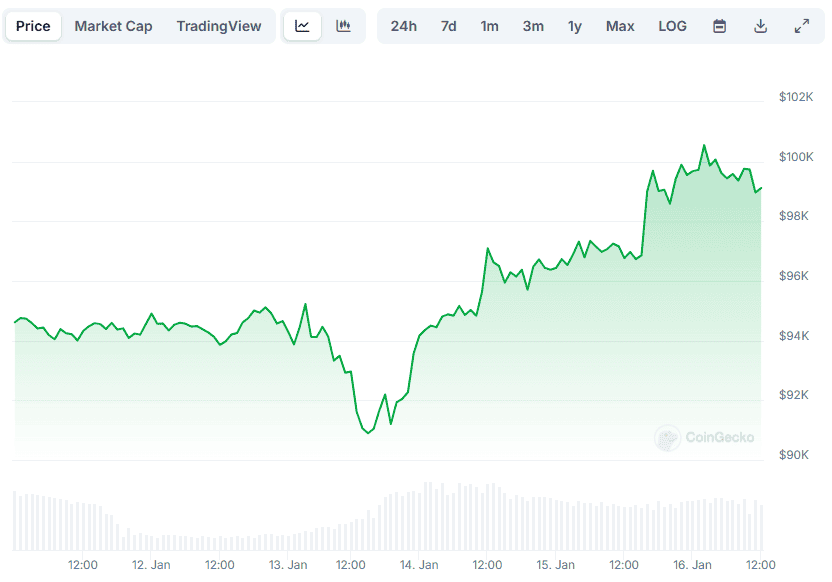

Bitcoin (BTC) demonstrated its characteristic volatility over the past few days. Over the weekend, it was trading around $94,000 to $95,000, but when the market bears emerged at the start of the work week, they drove down its value for the first time since November last year, below $90,000.

Initially, it seemed like a drastic drop, but it proved to be temporary as the price began experiencing rapid increases in the subsequent days. On January 15, BTC experienced a significant surge, crossing $98,000, following the latest CPI data announcement by the US Labor Department. The bullish sentiment persisted, with BTC briefly breaking through $100,000 on January 16. However, in the following hours, BTC slightly retreated and is currently valued around $98,000 (as per CoinGecko’s data).

Analysts are abound in Crypto X, who have observed the strong price recovery and anticipate even greater growth in the coming weeks. Captain Faibik foresees a new record high by the end of January, while JAVON MARKS predicts a significant breakout.

In the second instance, they pointed out a distinct “price spike pattern” on the chart, asserting that when this occurred previously, Bitcoin surged more than 70% within approximately a month.

Mikybull Crypto also offered their input. The analyst posited that exceeding the resistance level approximately at $99,000 might trigger “the excitement and exuberance” phase in the market psychology.

“This is the phase where everything pumps, especially alts,” they added.

A Potential Correction?

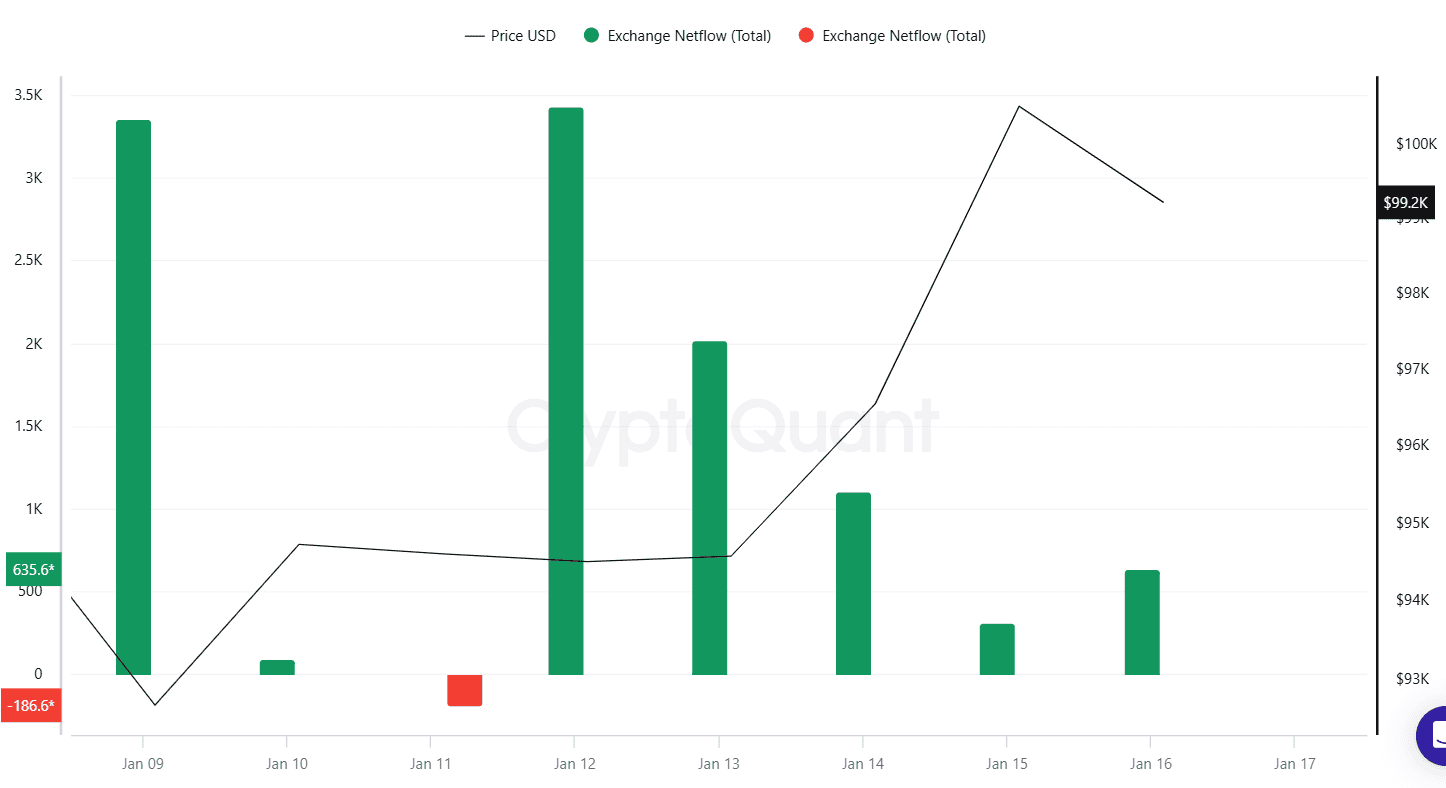

Despite optimistic forecasts, certain indicators suggest that the leading cryptocurrency might temporarily lose momentum. As per CryptoQuant, Bitcoin’s exchange netflow has predominantly been positive over the past week. This could imply a transition from self-custody methods to centralized trading platforms, which may be perceived as bearish because it boosts immediate selling pressure.

An additional point to consider is Bitcoin’s Relative Strength Index (RSI), which recently exceeded 70 on January 16. This elevated level typically indicates that the asset could be overbought, potentially leading to a potential correction or pullback.

On the contrary, any readings below 30 could be interpreted as a bullish sign.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-16 18:15