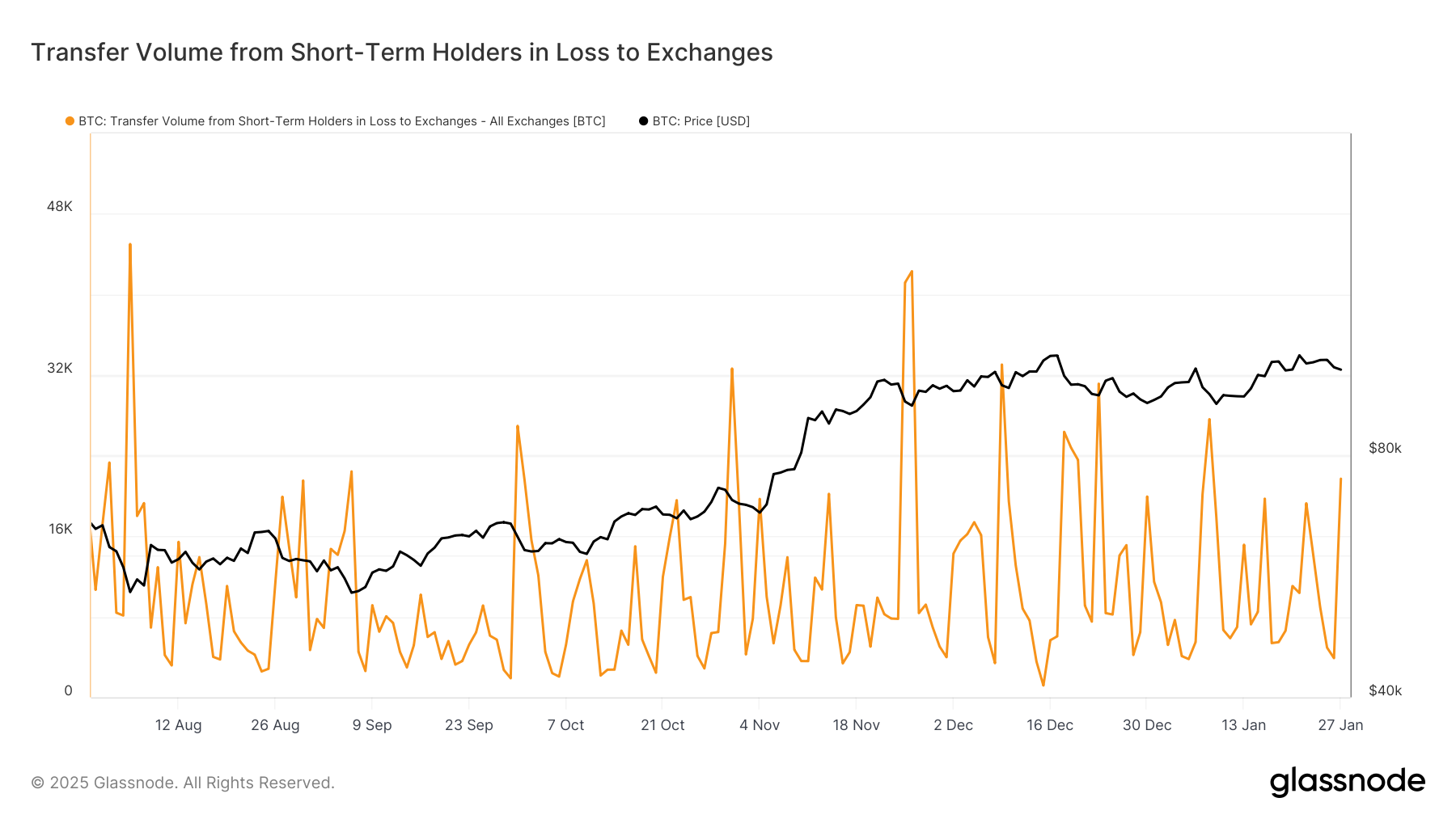

Ah, Monday. The day when Bitcoin decided to take a nosedive, and short-term holders decided they’d had enough. 🚀💥 Glassnode, the ever-watchful eye of the crypto world, noted that these fleeting souls—those who’ve held BTC for less than 155 days—sent over 21,000 BTC ($2.2 billion) to exchanges, all at a loss. Because why not lose money in style? 💸

This mass exodus was the second-largest this month, a clear sign that those who bought near the $108,000 peak earlier this year were spooked by the sudden plunge back into the five-digit realm. 🕷️📉 And who can blame them? When the price swings like a pendulum, even the bravest of traders might reconsider their life choices.

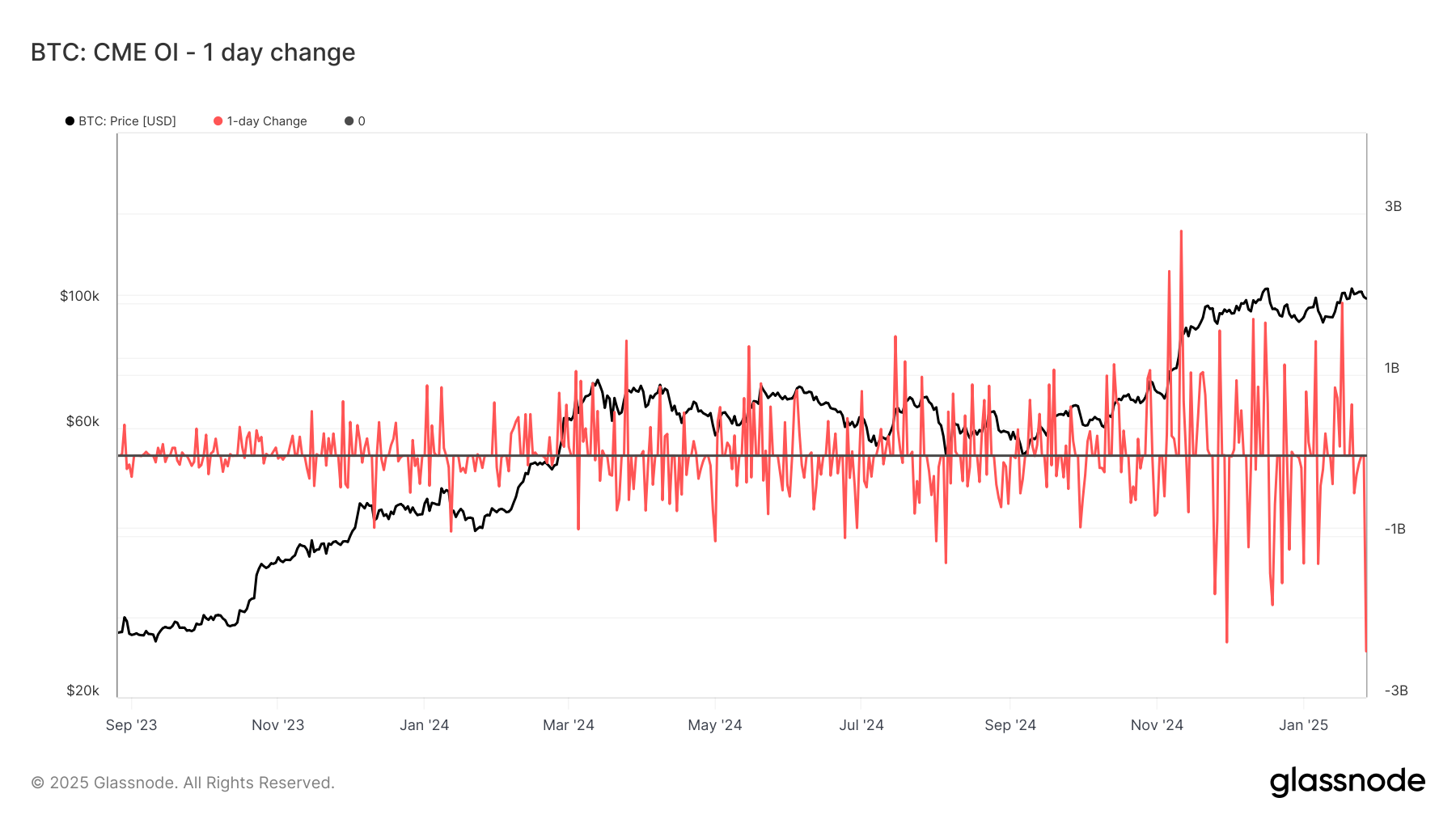

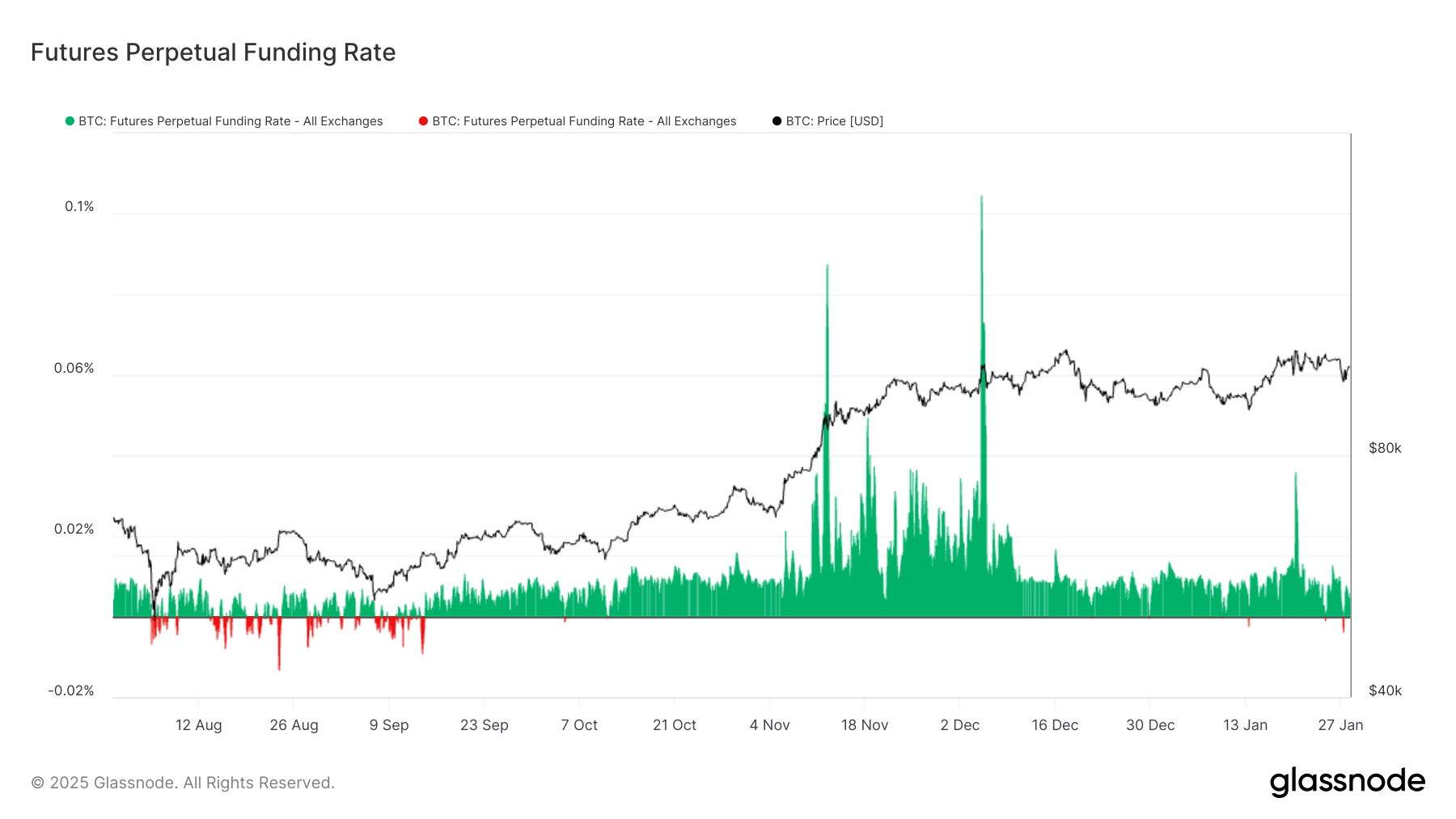

Meanwhile, the Chicago Mercantile Exchange (CME) wasn’t spared from the chaos. Open interest (OI) took a record-breaking hit, dropping a whopping $2.4 billion (17,000 BTC). 📉💼 Institutional activity? More like institutional panic. And let’s not forget Nvidia, the chipmaker darling, which also saw a double-digit slide. 🖥️📉 Because when Bitcoin sneezes, the whole tech sector catches a cold.

But wait, there’s more! U.S.-listed Bitcoin ETFs experienced their first outflows since mid-January, with a staggering $457.6 million fleeing the scene. 🏃♂️💨 A similar exodus occurred on Jan. 13, proving that history loves to repeat itself, especially when it comes to financial drama.

And just when you thought the plot couldn’t thicken, along came DeepSeek, a Chinese startup that decided to challenge U.S. dominance in AI and technology. 🤖🇨🇳 Because nothing says “market turmoil” like a tech rivalry between global superpowers. BTC, ever the drama queen, fell below $98,000 as if to say, “Hold my beer.” 🍺

So, what’s the takeaway? When Bitcoin stumbles, the world watches. And when it falls, it takes a little piece of everyone’s sanity with it. 🌍💔 But hey, at least we’ve got memes, sarcasm, and the occasional AI uprising to keep us entertained. 🎭🤖

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-28 13:53