Ah, Bitcoin, that fickle mistress of the digital age, has once again decided to dance upon the precipice of financial euphoria. With a flourish, she has broken free from her descending channel, like a caged bird suddenly remembering it has wings. The price, my dear reader, soars toward the heavens, flirting with the $122K-$124K mark, as if to say, “Behold, mortals, I am inevitable.” 🌟

Yet, in this grand ballet of greed and hope, the market, ever the pragmatist, whispers of a brief retreat. A pullback, they say, toward $114K-$118K, as if to catch its breath before the next mad dash upward. For what is life without a little drama? 🎭

Technical Analysis

By Shayan, the soothsayer of charts

The Daily Chart

Bitcoin, that relentless climber, has shattered the mid-range resistance with the grace of a bull in a china shop. The descending structure of September? A distant memory, like a forgotten lover. Now, it eyes the buy-side liquidity above $124K, as a cat eyes a particularly tempting saucer of cream. 🐱

The price, ever the tightrope walker, holds above $116K-$118K, with $112K-$114K as its safety net. Should it falter, this net awaits, ready to catch and propel it once more. The $124K-$125K region, where the next pool of liquidity lies, beckons like a siren. Yet, the momentum indicators, those wise old owls, caution of a corrective move, a moment to gather strength for the next leap. 🦉

The 4-Hour Chart

The recent surge from $108K, impulsive and unchecked, has left behind a trail of unmitigated interest zones. The breaker block at $115K-$117K and the Fibonacci retracement cluster between $114.4K and $113.1K now stand as the next rendezvous points for eager buyers. A controlled pullback here would be like a well-timed joke-just enough to build anticipation before the punchline. 🤣

Should the momentum persist, a sweep above $124K could precede a corrective phase, all in harmony with the broader bullish structure, provided the market holds above $111K-$112K. Ah, the delicate balance of it all! ⚖️

Sentiment Analysis

By Shayan, the interpreter of market moods

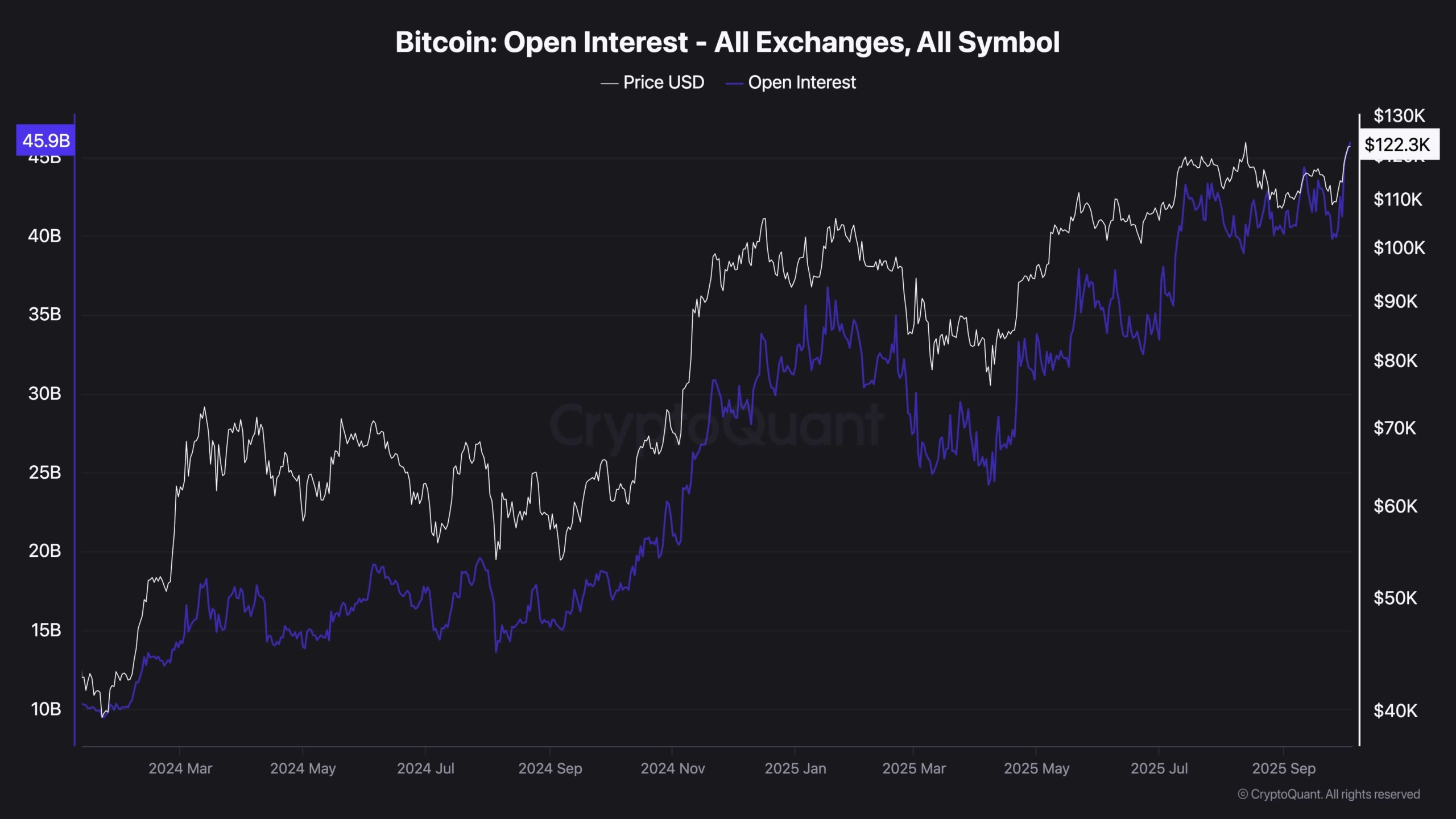

Open interest on Binance, that barometer of trader fervor, has reached a new zenith, surpassing even the August peak of $14.306B. This surge, my friends, coincides with Bitcoin’s ascent from $108K to $124K, as open interest swelled from $11.5B to $14.3B in mere weeks. A parallel rise, indeed, confirming that fresh inflows and new positions, not a short-covering squeeze, fuel this rally. 🌊

Yet, this expansion is a double-edged sword, as sharp as it is seductive. It amplifies upside moves as trapped shorts unwind, but it can just as swiftly trigger liquidation cascades should momentum stall. The market, ever fragile, teeters on the edge of euphoria and panic. If Bitcoin fails to extend its gains and consolidates while open interest remains high, a sharp flush looms, potentially dragging the price back to key demand zones before the bullish trend resumes. 🌀

In short, record-high open interest is both a testament to confidence and a harbinger of vulnerability. Traders, take heed: watch whether open interest continues to rise or begins to unwind, for this will determine if the next leg extends smoothly into $130K or if a leverage-driven shakeout interrupts the rally. 🧐

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- He Had One Night to Write the Music for Shane and Ilya’s First Time

- Gold Rate Forecast

- Brent Oil Forecast

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

2025-10-04 20:21