What to know:

- It appears that Mr. Trump, in a most unexpected turn of events, has chosen to delay the tariffs on auto parts from our dear neighbors, Canada and Mexico. This, coupled with Germany’s rather generous inclination to ease debt limits and China’s audacious increase in its budget deficit, has led to a delightful rise in risk markets this fine Wednesday.

- In a most splendid display of financial acumen, Bitcoin has ascended above the lofty heights of $90,000, whilst its companions, bitcoin cash (BCH), Chainlink’s LINK, and Aptos’ APT, have also enjoyed double-digit percentage gains. How charming! 💰

- Meanwhile, the U.S. dollar index has plummeted to its lowest level since the early days of November, which, one might argue, has provided a rather fortuitous boost to crypto prices.

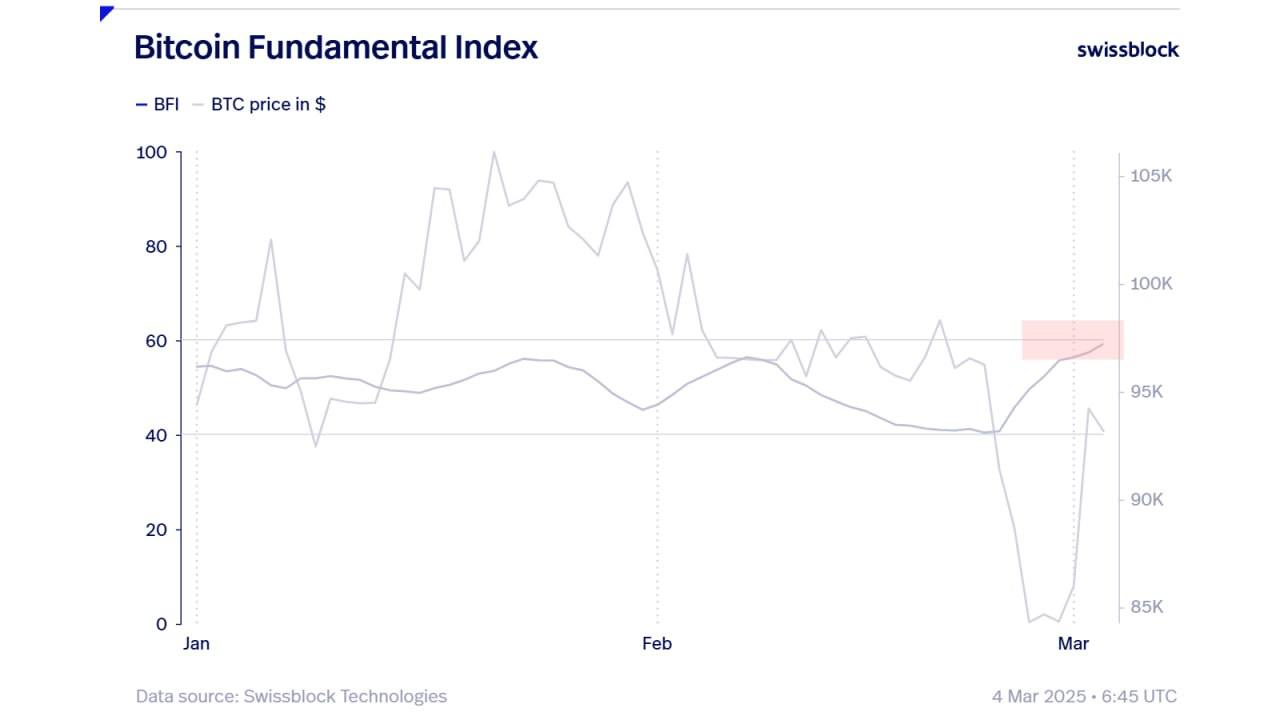

- Despite a recent dalliance with decline, the esteemed Swissblock’s Bitcoin Fundamental Index suggests that the fundamentals are shifting into a bullish quadrant, indicating that a bear market is, dare I say, unlikely. 🐻

In the latest whirlwind of headlines this week, Mr. Trump’s tariff delay has alleviated the anxieties of investors, with Bitcoin (BTC) gallantly leading the crypto market to new heights.

The U.S. government, in a rather hasty decision, confirmed the postponement of tariffs on auto parts from Canada and Mexico by a mere month, just one day after their enactment. Germany’s benevolent plan to ease debt limits for infrastructure spending, alongside China’s audacious budgetary maneuvers, has also contributed to the resurgence of risk markets.

BTC has triumphantly climbed just above $90,000 on this news, marking a 3.7% increase over the past 24 hours. Almost all assets in the broad-market CoinDesk 20 Index have advanced, with bitcoin cash (BCH), Chainlink’s LINK, and Aptos’ (APT) reveling in double-digit gains. How delightful! 🎈

The tech-focused Nasdaq and the broad-market S&P 500 have also experienced a rise of 1.2% and 1.5%, respectively, during the afternoon hours of this session. Crypto-related stocks have similarly ascended from their earlier week lows, with the crypto exchange Coinbase (COIN) up by 3.5%, while the largest corporate bitcoin holder, Strategy, has gained nearly 10%. Quite the spectacle! 📈

Trade tensions and geopolitical risks have recently taken center stage, casting a shadow over investor sentiment and pressuring risk assets such as U.S. stocks and digital assets. A most dramatic affair!

Historically, such episodes of risk aversion have prompted investors to seek refuge in the U.S. dollar, thereby exerting downward pressure on crypto assets, as noted by the astute Joel Kruger, market strategist at LMAX Group. However, this time, the U.S. dollar index (DXY) has cratered to its weakest level since early November, having fallen more than 5% from its mid-January peak. How curious! 🤔

“With Fed rate expectations shifting back to pricing more rate cuts than less in 2025, and with Bitcoin poised to shine as a store of value asset, we believe there are ample reasons to expect Bitcoin to be well supported on dips,” Kruger remarked sagely.

Crypto analytics firm Swissblock has observed that despite the tumultuous price fluctuations of recent days, their Bitcoin Fundamental Index, which measures the overall health of the network, has held up remarkably well. A testament to resilience!

“Bitcoin’s fundamentals are on the verge of shifting into the bullish quadrant, with sustained improvements in liquidity and network growth,” the analysts at Swissblock proclaimed in a Telegram broadcast. “This strength suggests that BTC is unlikely to be driven into a bear market.” How reassuring! 🐂

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-03-06 00:34