What to know:

By James Van Straten (All times ET unless indicated otherwise)

In the wake of Wednesday’s inflation figures that could make a grown man weep, all eyes are now glued to the produce price report due at 8:30 a.m. 🍅📈

Analysts, those brave souls, expect the year-over-year PPI to come in at 3.2%, a slight dip from December’s 3.3%. Month-on-month, we’re looking at a rise to 0.3% from 0.2%. Core PPI, which is like the plain yogurt of inflation—stripped of all the fun stuff—might show underlying inflationary pressure, accelerating to 0.3% from a thrilling 0% in December. From January last year, it’s seen easing to 3.3%. Who knew numbers could be so dramatic?

Hotter-than-expected data could signal that monetary policy is as loose as a pair of old sweatpants, potentially delaying or even eliminating Fed rate cuts this year, much to President Trump’s chagrin. A more restrictive Fed is likely to be bearish for risk assets. On the flip side, softer inflation data could weaken the dollar and lower treasury yields while giving risk-assets a much-needed hug. 🤗

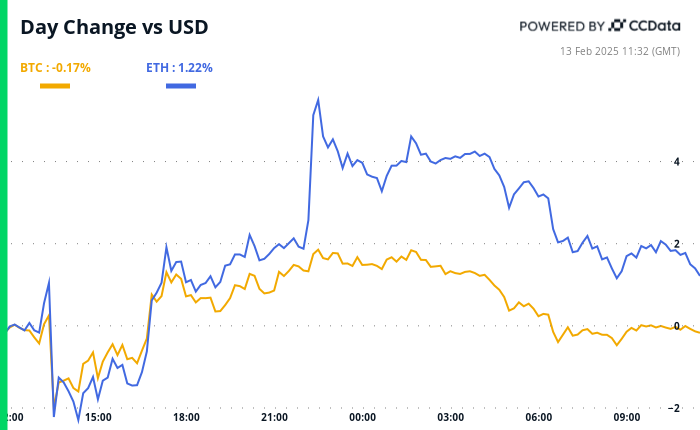

After the CPI data, markets were as volatile as a cat on a hot tin roof. 🐱🔥

Treasury yields surged to 4.6% before retreating slightly, like a shy turtle. The Dollar Index (DXY) mirrored this movement, spiking to 108.5 before pulling back below 108. Talk about a dramatic entrance!

Despite the initial sell-off, major asset classes rebounded, with bitcoin (BTC), U.S. equities, and gold finishing the session in the green. It’s like they all decided to wear their best outfits for the party! 🎉

Also on the agenda, Coinbase (COIN) reports fourth-quarter earnings after the market closes. Following Robinhood’s strong results, expectations are high, and a positive report could provide a boost to the cryptocurrency market. Stay Alert! 🚨

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 2 of 2: Frankfurt Digital Finance (FDF) 2025

- Day 1 of 2: The 4th Edition of NFT Paris.

- Feb. 18-20: Consensus Hong Kong

- Feb. 19: Sui Connect: Hong Kong

- Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

- Feb. 24: RWA London Summit 2025

- Feb. 25: HederaCon 2025 (Denver)

Derivatives Positioning

- Funding rates in perpetual futures tied to SOL, TRS, TRON, and DOT remain negative, indicating a bias for shorts, data from Coinglass and Velo Data show. Shorts, the unsung heroes of the market!

- Annualized funding rates in BTC and ETH hover near 5%.

- Most major coins, excluding BNB, have seen negative open-interest-adjusted cumulative volume deltas, a sign of net selling pressure, which raises a question mark on the sustainability of Wednesday’s post-U.S. CPI recovery. 🧐

- BTC and ETH options skews are positive across the board, reflecting a bull bias. 🐂

- Flows, however, have been muted, with some demand for out-of-the-money higher strike ETH calls, according to data sources Deribit and Paradigm.

Market Movements:

- BTC is down 1.

Read More

- Best Crosshair Codes for Fragpunk

- Monster Hunter Wilds Character Design Codes – Ultimate Collection

- Enigma Of Sepia Tier List & Reroll Guide

- Hollow Era Private Server Codes [RELEASE]

- Wuthering Waves: How to Unlock the Reyes Ruins

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Ultimate Tales of Wind Radiant Rebirth Tier List

- Best Crossbow Build in Kingdom Come Deliverance 2

- Best Jotunnslayer Hordes of Hel Character Builds

- Skull and Bones Timed Out: Players Frustrated by PSN Issues

2025-02-13 15:19