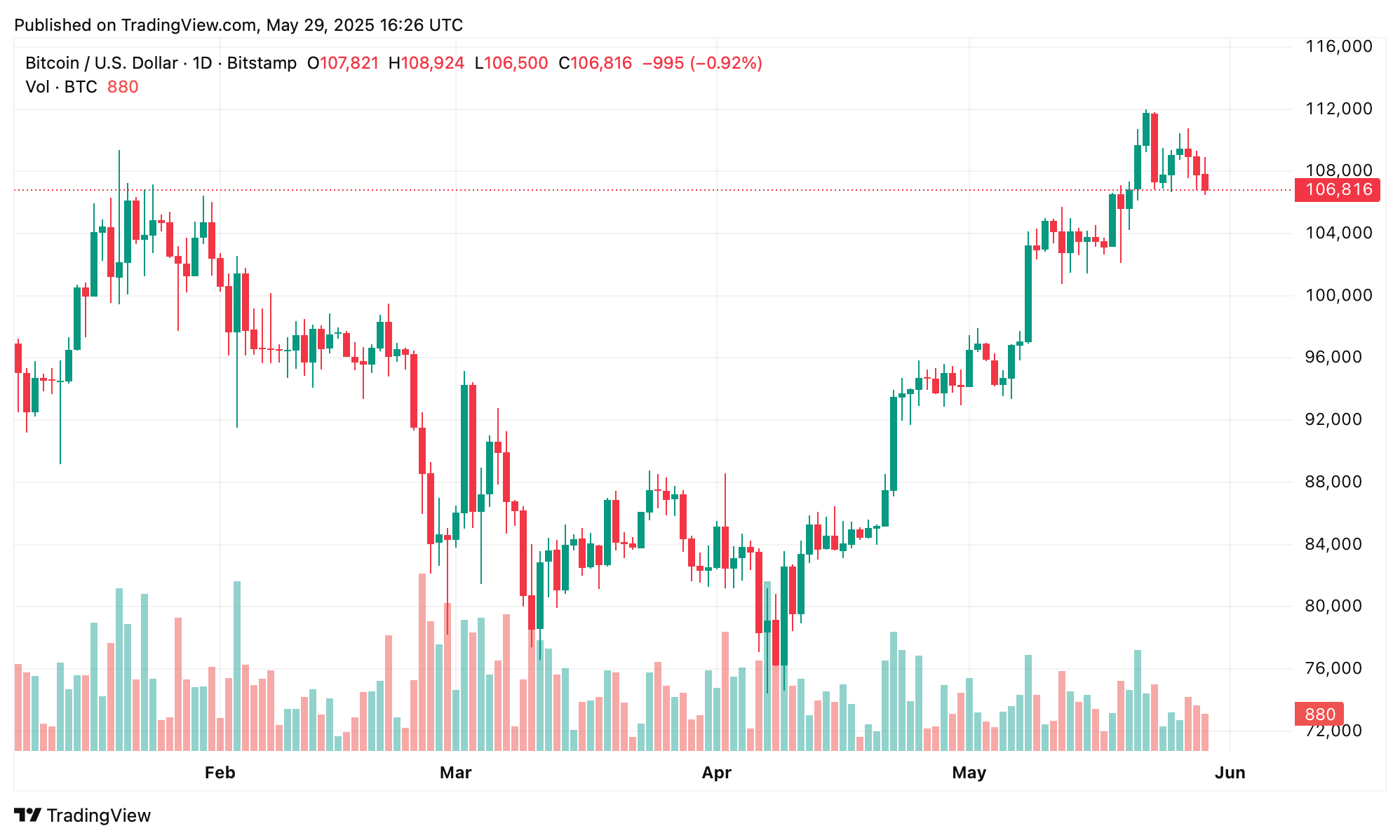

So, Bitcoin has decided to take a breather at $112,000, and experts are scratching their heads, attributing this latest price tango to technical consolidation and some macroeconomic mumbo jumbo, rather than a full-blown panic attack. Who knew digital currency could be so dramatic? 🎢

Experts: Bitcoin Correction Healthy, Macro Data Key to Breakout

Ruslan Lienkha, the Chief of Markets at Youhodler, is here to tell us that the recent net distribution by large holders is just a healthy correction within Bitcoin’s cozy $90,000–$110,000 consolidation zone. “This area is saturated with market orders, suggesting strong trading interest and potential support,” he said, probably while sipping a latte and pretending to be a financial guru.

Lienkha expects Bitcoin to keep its medium-term relationship with U.S. tech stocks, which is like saying a cat and a dog can be friends—until they can’t. He warns that this bond could weaken over time or during those delightful macro disruptions where Bitcoin’s hedge attributes might just flex their muscles. And Ethereum? Well, it’s got strong fundamentals but is still waiting for its prom date—institutional adoption—to show up.

Nic Puckrin, founder of Coin Bureau, pointed out that Bitcoin’s reaction to news of blocked Trump tariffs was about as lively as a sloth on a Sunday. “Bitcoin doesn’t care about tariffs – it cares about the Fed,” Puckrin stated, probably while rolling his eyes. He noted that market expectations for 2024 rate cuts have plummeted below 20%, which means Bitcoin is in desperate need of some new catalysts to get its groove back.

“While Bitcoin isn’t surging, the U.S. market is set to open higher, judging by the S&P 500 futures. It’s likely that Bitcoin front-ran stocks over the last couple of weeks, fueled by sovereign risk fears. Now, crypto investors have turned their attention to monetary policy, and it’s not looking good,” Puckrin said in a note sent to TopMob, probably while shaking his head in disbelief.

James Toledano, COO of Unity Wallet, chimed in, saying Bitcoin’s rally has already priced in bullish catalysts like institutional inflows and geopolitical uncertainty. “I see it as a stabilization and not a stall,” he noted, pointing to high open interest and neutral funding rates, as if he were reading tea leaves. He warned of potential volatility ahead of key economic releases, including PCE inflation data and jobless claims—because who doesn’t love a little uncertainty?

Toledano added that Nvidia’s record earnings could support Bitcoin via tech-rally correlation, but cautioned that signs of slowing AI demand might spook risk assets. “The combination of potentially soft inflation, a cooling labor market, and positive tech earnings… could create a supportive environment,” he said, though hotter-than-expected inflation could pressure prices, like a bad date that just won’t leave.

So, here we are, waiting with bated breath for clearer signals from macroeconomic data and policy developments to determine Bitcoin’s next significant move. It’s like watching a soap opera, but with more numbers and fewer dramatic pauses. 🍿

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- KPop Demon Hunters: Real Ages Revealed?!

- Basketball Zero Boombox & Music ID Codes – Roblox

- Lottery apologizes after thousands mistakenly told they won millions

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- Umamusume: Pretty Derby Support Card Tier List [Release]

2025-05-29 20:32